Insights and Observations

Economic, Public Policy, and Fed Developments

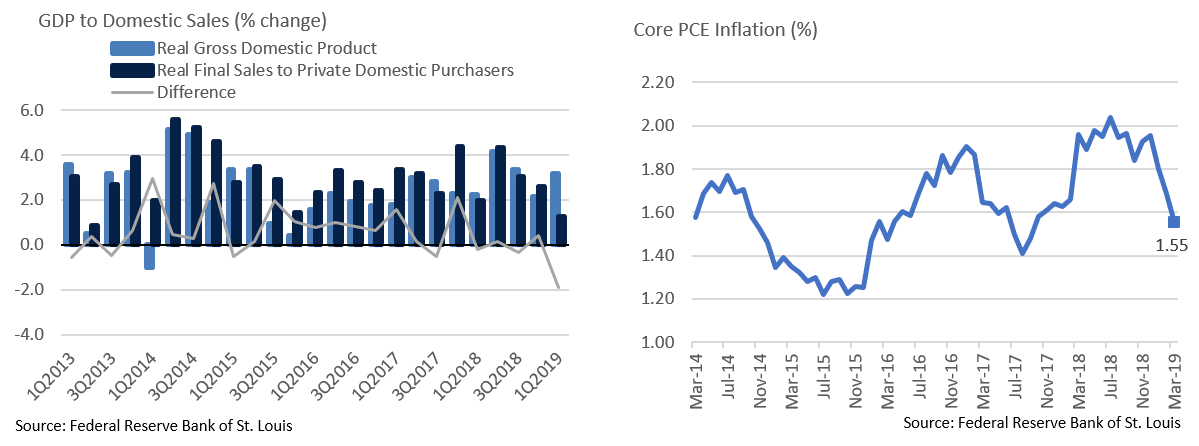

- After a soft January and February, March’s economic data demonstrated evidence of economic firming. The jobs report was unremarkable, but a welcome rebound after prior weakness, with average hourly earnings showing a modest increase. Inflation disappointed though, despite a Bureau of Labor Statistics report suggesting a monthly drop in real wages due to a 0.4% increase in CPI. The Fed’s preferred Core PCE index came in flat in March and was only up 1.55% year-over-year. This is flirting with the 1.5% threshold that the Fed has indicated might potentially warrant rate cuts. However, we feel that a sizable spike in productivity in April should give the Fed cover to remain patient unless inflation continues to weaken.

- While Q1 GDP growth of 3.2% handily beat estimates (the Bloomberg median was 2.3%), the report itself was not encouraging. Growth was primarily driven by an unexpected narrowing in the trade deficit, as well as an increase in inventories. Tariffs are likely behind both factors, as firms rushed to build inventory given supply-chain disruption risks ahead of what was then expected March 1st tariff increases. Underlying demand was weak – consumption expenditures increased 1.2% (durable goods expenditures fell 5.3%), while final sales to private domestic purchasers only increased 1.3%. Although these effects are likely to unwind in Q2, this was about as weak a GDP report as a 3.2% headline rate can be, and all else equal, we expect Q2 growth to decelerate to at or below the recent 2-2.5% trendline.

- At the start of May, Pres. Trump threatened to implement long-delayed tariff increases on China from 10% to 25%, spooking global markets and casting further doubt on the progress of negotiations; we remain bearish the likelihood of a substantial deal, and believe this uncertainty could continue to weigh on global trade and domestic growth.

- Herman Cain and Steven Moore both recently withdrew their nominations to the board of the Federal Reserve. Cain, a former pizza magnate and 2012 presidential candidate known for his short-lived 9-9-9 tax proposal, had drawn scrutiny for his role heading a pro-Trump super PAC and for the sexual harassment allegations that ended his presidential campaign. Moore, a Heritage Foundation fellow and early Trump supporter, had his candidacy falter due to tax and child support issues and published remarks in the early 2000s criticizing gender pay equality. While we consider both withdrawals to be a short term positive for Fed governance, longer term Trump’s decision to appoint two avowed loyalists in the first place is a disconcerting attack on the Fed’s independence, as is their nominations collapsing over personal issues rather than widely perceived lack of qualifications for the Fed board.

- A source of near-term uncertainty removed from the markets in March was Brexit, as the EU agreed to extend the deadline to October 31st, while allowing the UK to leave in June if the House of Commons manages to pass a deal before that time. Nonetheless, the longer-term outlook is little changed. We find it hard to picture a deal that will pass British Parliament that the EU is simultaneously willing to accept and feel the most likely outcomes remain Theresa May’s “soft Brexit” withdrawal deal, the UK reversing its Article 50 EU withdrawal provision, or a hard Brexit, loosely in that order. Global markets are currently pricing in something along the lines of May’s previously rejected “soft Brexit” proposal, and would likely respond very favorably to no Brexit, whereas the UK crashing out of the EU without a deal risks shocking equity and currency markets.

Equity News & Notes

A Look at the Markets

- Market strength continued in April as stocks saw gains across the board. The S&P 500, up 18.25% through April 30th, is enjoying its best start in over 30 years. The Dow’s 14% YTD gain represents a pace not seen since 1999, while the Nasdaq’s 22% advance has not been matched since 1991. The rally was originally fueled by optimism of a trade deal with China and the Fed’s pivot to a more patient approach. This early momentum was subsequently reinforced by two new drivers: signs of global economic growth bottoming, and a better than expected Q1 earnings season.

- Q1 earnings continue to roll in, with roughly 75% of the S&P having reported as of May 6th. Of those companies, 75% have beaten analysts’ earnings expectations and 53% have beaten revenue estimates. More importantly, the blended earnings growth rate has improved to -0.8% from a -4.3% thanks to an above-average beat margin of +5.3%. Given the decent start to earnings season, investors have grown increasingly comfortable with 2020 estimates. Should 2020 S&P earnings achieve a low to mid $180 level, even an undemanding valuation multiple of 16.5x justifies an S&P 500 over 3,000 (vs. 2,932 as of May 6th close). We believe fears of an earnings recession have largely been mollified, thereby enhancing equity expectations.

- But alas, the trade saga continues, and as we write on May 6th, global markets are down sharply on weekend news that President Trump intends to increase Chinese tariffs to 25% at week’s end. How this plays out will certainly impact market sentiment, as YTD equity market strength factored in a reduction, not acceleration, of trade tensions.

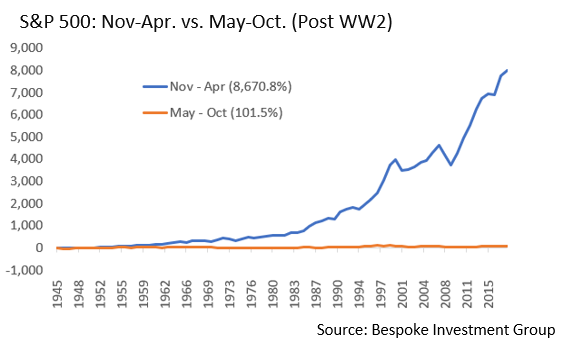

- Sell in May, Go Away? Given the historically strong start to 2019, many investors are revisiting the old market adage. Although there is data supporting the theory that the S&P performs much better from November through April than in the May to October period, we advise taking this with a grain of salt.

- It is important to note that the market hasn’t performed poorly during the May-October period, just much weaker than in the November to April timeframe. Furthermore, according to data from Pension Partners, had you sold at the end of April only to buy back at the end of October, you would’ve earned 6.0% annualized since World War II. Had you simply bought and held the entire time, your return jumps to 9.2% annualized over the same period. The power of positive compounding is tremendous if you let it work. In short, we feel staying invested in accordance with one’s risk-based asset allocation makes much more sense than trying to time markets.

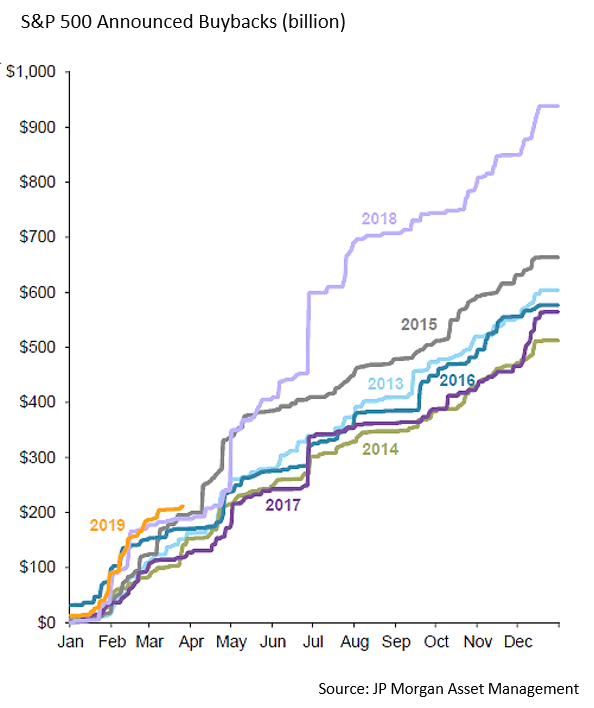

- Despite the year to date strength, healthy retail skepticism remains. According to Lipper Inc., US equity funds (mutual funds and ETFs) have experienced over $40 billion in YTD outflows through the week ending April 26th. That compares to nearly $79 billion of inflows into US bond funds. Who is buying all the stock that fund investors are selling? Corporations. According to a report by BofA Merrill Lynch, $270 billion of corporate buybacks were up 22% year-over-year in Q1. This buyback bonanza is likely to continue with earnings season winding down and blackout periods expiring. In fact, 2019 is on pace to break 2018’s record of nearly $1 trillion in buybacks.

From the Trading Desk

Municipal Markets

- The tax-exempt markets are enjoying a prolonged period of favorable supply-demand dynamics and tight credit spreads, with the 10Yr Muni/Treasury ratio reaching 74.4% as of the end of April, down from 84.8% as recently as year-end 2018 and low 90s averages over the prior decade. Municipals have been in high demand to a confluence of factors, none of which we see dissipating anytime soon.

- 2017’s tax reform imposed a $10,000 state and local tax (SALT) deduction limitation, fueling a surge in retail buying, particularly from high tax states. Municipal mutual funds have seen almost $30 billion of net flows YTD (1) and positive cash flow for 16 consecutive weeks. (2) Reversal of the SALT caps appears politically unpalatable given how integral tax reform is to the Trump Administration’s fortunes.

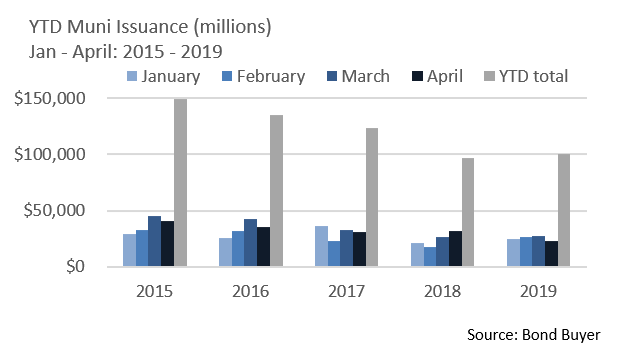

- Primary market supply continues to be constrained by restrictions on advance-refunded debt introduced in 2017’s tax reform. Citigroup has projected $385 billion of new issuance in 2019, a total now unlikely to be reached as it would require more than $8 billion to be issued each week through year-end. April’s $22.6 billion volume was the weakest YTD and was lower by 28% vs. the same month of 2018. (3)

- JPM recently projected $63 billion of net negative municipal issuance for 2019 at large, although the negative year-end total may end up being even larger. Sustained demand for tax-advantaged income, which shows no signs of ebbing, coupled with constrained supply, should keep muni/UST ratios in their current range. While today’s ratio seems low, the 10Yr ratio spent most of the 1990s in the 70s.

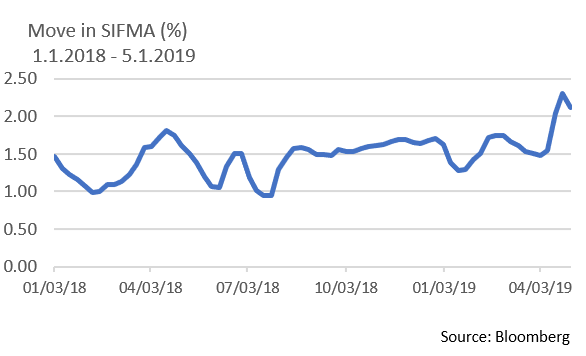

- The short-term tax-exempt markets have simultaneously been jolted by tax liability-driven selling of variable rate demand notes (VRDNs). VRDN inventories are currently high, pushing the SIFMA index yield sharply higher to 2.12% (as of 5/1/19). While tax season often causes a bump in SIFMA yields, this season’s change has been extreme. Given SIFMA’s jump, one needs to go out to 2033 to find equivalent AAA muni yields. Although we feel a SIFMA reversion is inevitable as demand from crossover buyers builds, for now, VRDNs may represent an attractive, high quality, short-term option for many investors looking at the shorter ends of the muni curve.

1. Credit Sights

2. Investment Company Institute

3. Bond Buyer, 4/30/19

Taxable Markets

- The Federal Reserve Bank theoretically has four ways of controlling monetary policy. The most talked about is the discount rate, or the rate the Fed charges on short-term lending. The others include buying and selling US debt in the open market, adjusting bank reserve requirements, and payment of interest on excess bank reserves held at the Fed. Lowering the discount rate or interest on excess reserves motivate banks to lend rather than hold Fed reserves. In recent years, banks have felt a need (due to Basel III and Dodd-Frank regulation) to maintain large amounts of high-quality excess reserves, including Treasuries, to meet liquidity requirements.

- Treasuries are not officially designated as “cash equivalents” and there has been talk at the Fed about changing the liquidity designation of Treasuries in the event of a “rapid liquidity event.” If that were to occur, the Fed could repurchase US Treasuries through a Repo Agreement. This would give banks an incentive to buy short treasuries as opposed to holding excess reserves or accessing the discount window when there is a need for cash. Should the Fed change policy in this manner, it would likely reduce excess reserves at the Fed and allow those monies to be invested in the marketplace. This would be expansionary and could push up rates, particularly in the currently flat 2 to 5-year portion of the Treasury yield curve.

Financial Planning Perspectives

Caps, Gowns and Financial Planning…Recommendations for Graduates and Their Families

With tax season thankfully behind us, many are now focusing attention on upcoming high school and college graduations. This is a wonderful time for graduates, with the world seemingly at their fingertips. But alas, with opportunity comes real world responsibility, and we recommend discussing several financial matters with college-bound children.

We all want to see our children and grandchildren thrive. One of the major stresses faced by today’s families involves the skyrocketing costs of college and potential burdens of student loan debt. There are, however, opportunities to mitigate these costs and debt burdens, most notably:

- Making tax-free annual gifts to children of up to $15,000 ($30,000 if gift splitting);

- Funding 529 plans for undergraduate, graduate or post-graduate studies

College students, being of the age of majority, need to begin contemplating their own healthcare and estate planning needs and should seriously consider (perhaps with the assistance of Mom and Dad) putting the following documents in place:

- Health Care Proxy and HIPPA Authorization;

- Durable Power of Attorney;

- Living Will; and

- Last Will & Testament

We urge parents to get ahead of these types of issues prior to the start of the Fall academic year. Proper financial planning and intrafamily communication can help create valuable peace of mind, while freeing your children up to focus on academics and, of course, all the many other rewarding aspects of collegiate life.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]