Insights and Observations

Economic, Public Policy, and Fed Developments

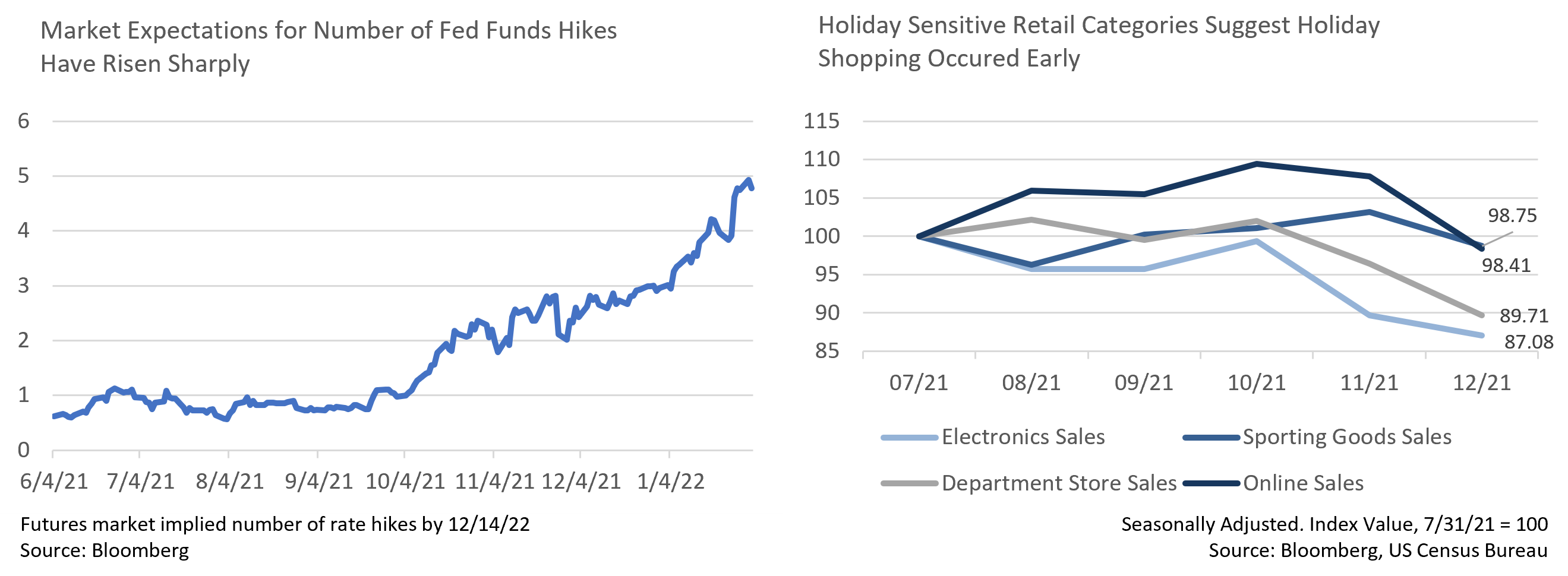

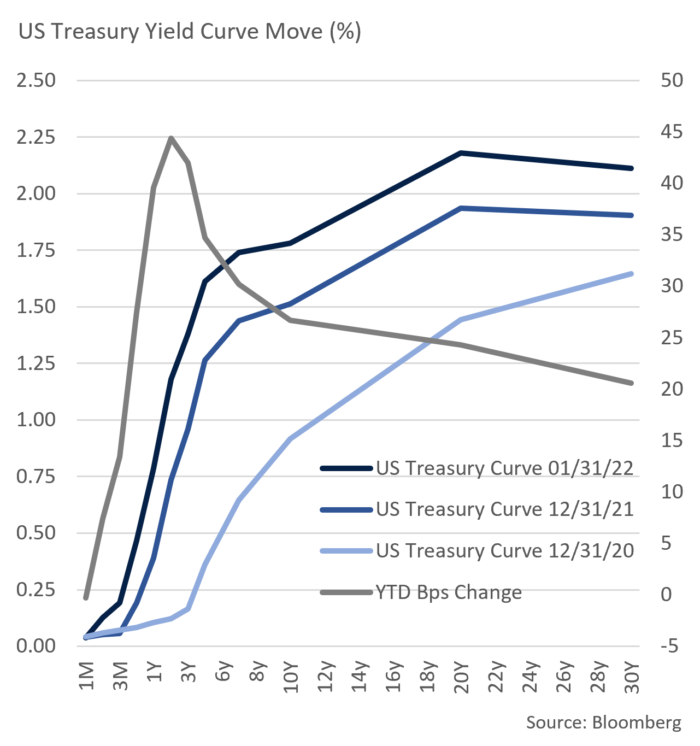

- Any hope for quiet markets at the start of 2022 was dashed in January. Equities traded off sharply as interest rates rose in an aggressive “bear flattener,” with 2Yr issues up 45 bps to 1.18% and 10Yr UST yields up 27 bps to 1.79%. These moves were largely driven by changing rate hike expectations. As recently as September the market had expected one Fed Funds rate increase, a consensus view that grew to three by year-end. Bloomberg’s interest rate probability monitor now shows nearly five hikes in 2022.

- We believe the Fed will lift rates off the lower bound with a 25bps hike in March. They have signaled as much, and the Fed has been very careful not to surprise the markets since at least the Taper Tantrum of 2013. However, the market has likely gotten ahead of itself by responding to current conditions rather than expectations and we feel that by the second half of the year the case for continuing beyond an initial few hikes will have weakened. The Fed’s reticence to commit to a rate hike schedule beyond March seems to be tacit recognition of that.

- First, inflation appears to be peaking. CPI hit a 40-year high in December but has shown signs of receding after the Delta-related surge that spurred the Fed into action, and while another Covid-related spike is hardly impossible, thus far manufacturing output seems to have held up relatively well. Year-over-year inflation readings will remain elevated for some time, but the monthly series should start moderating over the next several months regardless of Fed policy.

- A primary reason we expect inflation to slow is retail spending fell off a cliff in December. Surging spending earlier in Q4 had been widely interpreted as post-pandemic consumer demand, although we were more inclined to view these two months as front-loaded holiday shopping driven by supply chain concerns. December’s -1.8% nominal drop, with notable weakness in electronics, sporting goods, department stores, and online sales – all holiday-sensitive categories – provides a strong argument. With October and November’s surge appearing to borrow heavily from later months’ retail spending, early Q4 strength in consumer demand is unlikely to persist.

- Adding to this picture, Q4’s +6.4% GDP print was strong at the headline, but nearly two-thirds of the gain was due to an increase in inventories. Final Sales to Domestic Purchasers, a good proxy for underlying demand, grew at a more mundane +1.9%. This is important for two reasons. First, a buildup in inventories cannot continue indefinitely, and growth should revert over time towards the level of private sales. Second, after an extended Covid-influenced inventory drawdown, replenishment is the strongest sign yet that the bottlenecks that have fueled inflation are easing.

- Nonetheless, risks remain. China’s “zero Covid” policy could lead to protracted shutdowns if the Omicron variant takes hold, reversing some of the supply bottleneck improvements. And the 709k in upwards revisions we were looking for in November and December employment finally came in January, and due to upwards revisions to the participation rate the unemployment rate increased to 4.0%. The economy is doing a much better job bringing back labor after the pandemic than it once appeared. However, we remain 1.9mm workers short of pre-pandemic peaks, and average hourly earnings surging at an annual +5.7% rate in January suggests there may be some near-term pain until the workforce fully recovers. This is still below inflation and appears impacted by an Omicron-shortened workweek, but certainly bears watching.

From the Trading Desk

Municipal Markets

- While the month of January is generally slow in the municipal market, this year was an exception with rates increasing about 50-60 bps across the curve. The municipal curve was slower to react to a highly likely Fed rate hike in March than the UST market, but it has now caught up. We see this development offering a better entry point for buyers deterred by persistently low yields.

- It is worth noting that while recent price action has impacted absolute yields, we have not seen material credit spread widening. Given the strength in credit fundamentals, we do not see a reason for that to change significantly anytime soon.

- In terms of relative value, the 10-Year AAA Muni/Treasury ratio spent all of 2021 in a 60-70% range yet ended the month significantly cheaper on a relative basis at 87.6%. This was primarily due to the move in municipals as USTs were largely flat.

- Curve structure has flattened considerably as front-end yields drove the upward move. The differential between 2s and 10s declined to 66 bps, the lowest level since February of 2021, yet it is still elevated from the 57 bps recorded at the beginning of 2021.

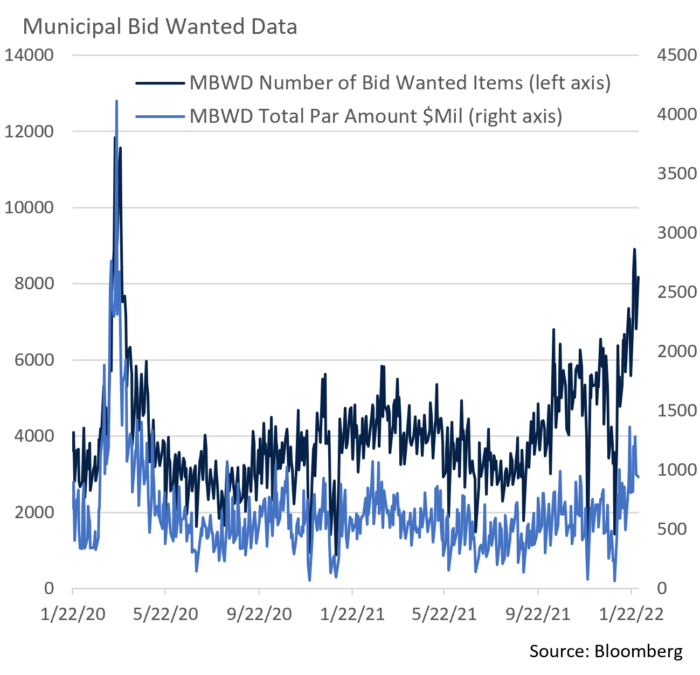

- The change in market dynamics has at least temporarily slowed fund flows. The last three weeks of January all saw net outflows for IG municipals and notably, secondary market supply has risen from $7B to $11.1B YTD. Municipal bond bid wanteds hit highs not seen since the pandemic spike of March 2020. In general, we see volatility of this nature as an opportunity given our flexible, active investment approach.

Corporate Bond Markets

- Price and spread volatility increased considerably in January across the investment grade credit markets as investors digested a more hawkish Fed and signs of “risk-off” sentiment returned after a long period of favorable markets. In this environment IG corporate issuance slowed considerably after a robust start. The $142B of new debt issued in January was near the average and secondary market trading waned. Not surprisingly, retail investors have pulled back a bit in response, with Lipper Inc. reporting net YTD taxable fixed income fund outflows of $8.8B.

- As is often the case, riskier corporate markets fared worse than higher grade credits with US high yield corporate spreads spiking to 345 bps over USTs vs. 87 for A rated credits. Corporate balance sheets and overall credit quality largely remain strong though, and the January move wider in our view reflects a general repricing of risk in the face of tighter monetary policy much more than corporate credit concerns.

- The UST curve flattened over the month with 2-10 spreads falling from 79 bps on January 3rd to a month-end level of 63 bps, due largely to a disproportionate increase in yields on the front end of the curve. We feel at least 50 bps of March Fed Funds increases have already been priced in with month-end 10Yr UST yields rising to 1.78% and the 1yr to 0.85%.

Public Sector Watch

Credit Comments

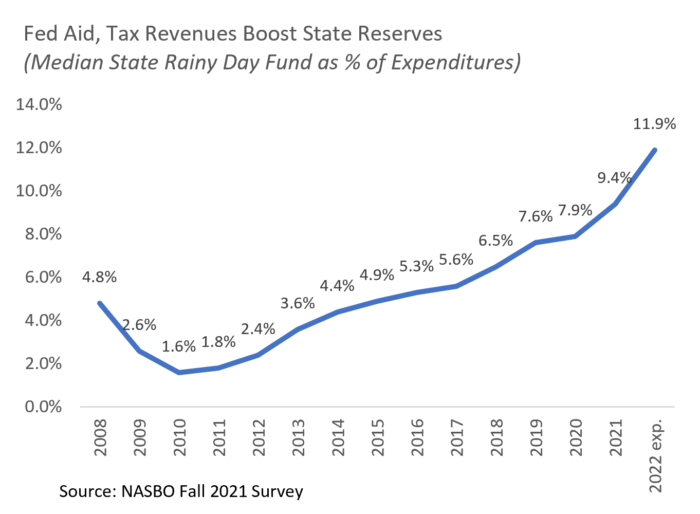

State Rainy Day Funds Soar

State Rainy Day Funds Soar

- As has been much chronicled, strong tax revenue collections, generous federal aid, and budget cuts at the outset of the pandemic have all led to rapidly strengthening state balance sheets. The median state rainy day fund as a percentage of expenses will soon exceed 10%.

- Budget flexibility is atypically high, an envious development likely to lead to considerable debate about FY 2023 budget priorities. Tax cuts, increased spending, supplemental pension fund contributions, and debt paydown are all on the table in many states.

- Political considerations are also never far away with more than 30 gubernatorial elections slated to take place in November 2022. This suggests that the above-mentioned tax cuts and/or increased spending plans are likely as campaign promises translate into policy outcomes.

Puerto Rico’s Bankruptcy Nears Conclusion

- Puerto Rico is one step closer to resolving its nearly five-year bankruptcy after Judge Swain approved a restructuring plan that would reduce about $33B of outstanding debt, including $22B of bonds. The plan follows years of negotiations with the financial oversight board, hedge funds, bond insurers, mutual funds, and labor groups.

- The restructuring is very significant given Puerto Rico’s $70B of pre-bankruptcy debt, a total amassed through years of deficit financing and excessive borrowing. Debt piled up at the same time the economy was struggling and migration accelerating, factors that pushed Puerto Rico into bankruptcy in 2017. As context, 2017 debt relative to GDP had reached 70% vs. a US state median of 2.2%.

- The restructuring plan for $18.8B of GO and Public Building Authority (PBA) debt offers bondholders a $7B cash payment and $7.4B of new bonds. They would also receive tradable securities known as contingent value instruments that pay out based on the amount that the Commonwealth’s sales tax revenue exceeds projections. The plan also forgives $3B of pension bonds.

- The overall recovery rate for GO and PBA bondholders ranges from high-60s to low-80s depending on the type of security held and when the debt was first sold. The exchange will likely take place in mid-March.

- The deal greatly benefits both bondholders, who enjoy a solid recovery rate, and Puerto Rico, which is gaining significant fiscal flexibility. Debt service costs are now projected to average $667M annually over the next ten years, down from $1.6B annually. The workout also establishes a reserve trust to help rebuild a significantly underfunded pension system which owes employees over $55B.

- While the workout is positive for municipal market sentiment, Puerto Rico still has considerable hurdles to overcome. Debt service costs have been slashed, yet fixed costs remain high due to $2.3B of annual retirement benefit expenses.

- The Commonwealth will need to continue making significant changes to its budget. While this deal offers a generous amount of time to adjust, Puerto Rico’s track record of budget difficulties and lack of financial transparency warrants skepticism. Appleton recognizes the positive developments and acknowledges efforts to improve the business environment and economy. However, Puerto Rico’s credit profile remains far short of the levels of stability and strength we seek from tax-exempt bond issuers.

Strategy Overview

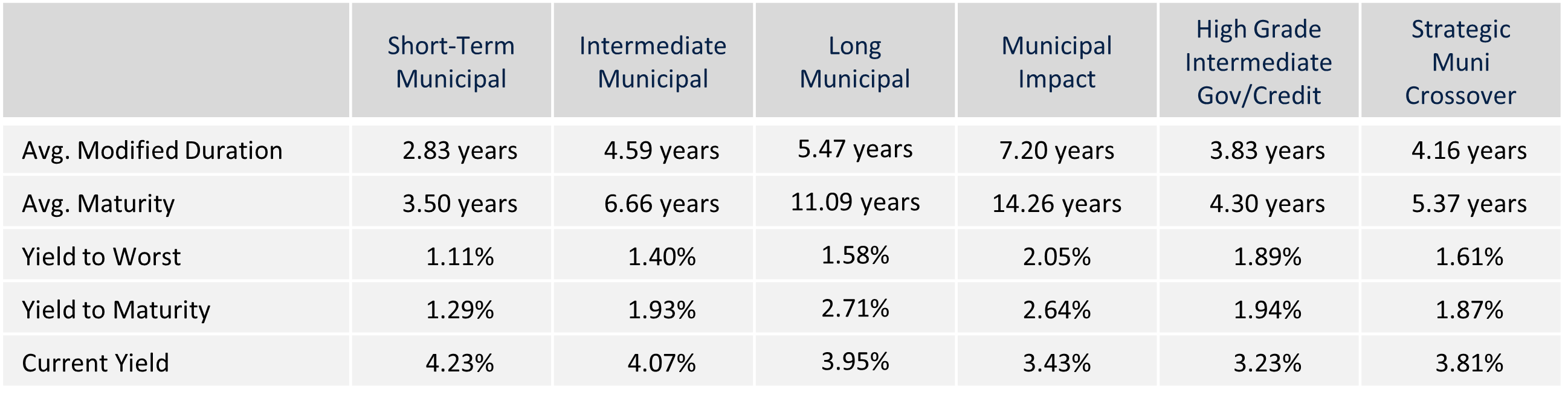

Composite Portfolio Positioning as of 1/31/22

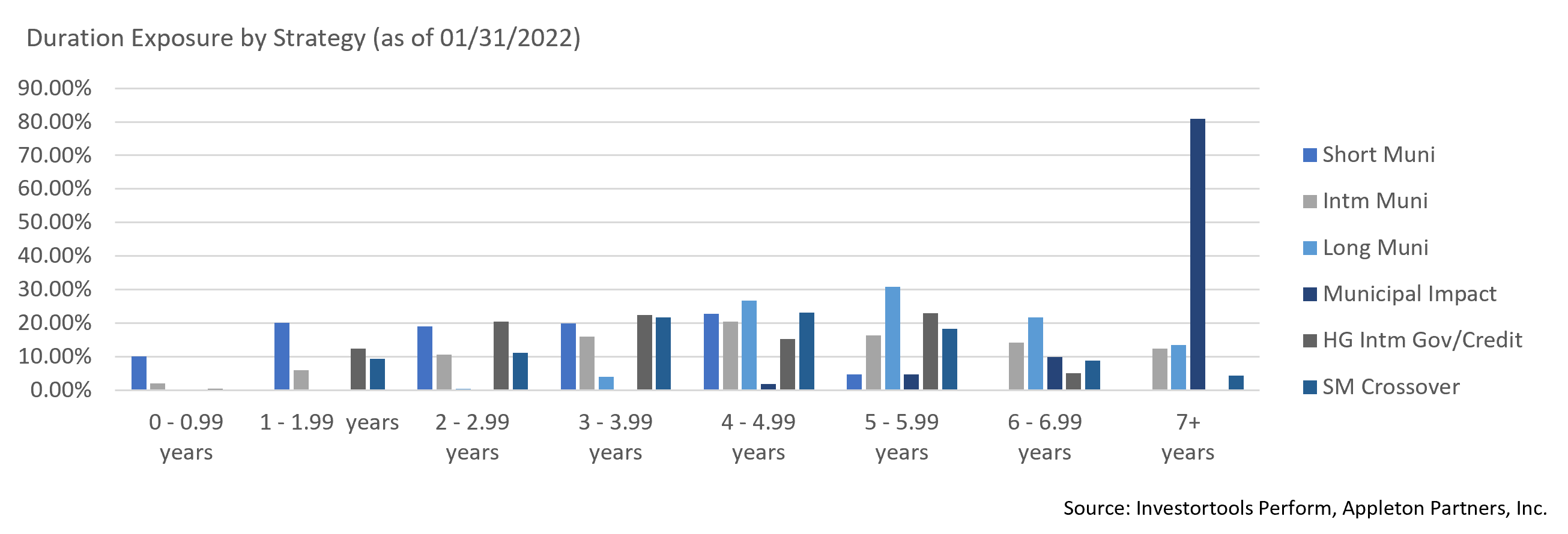

Duration Exposure by Strategy as of 1/31/22

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.