Insights and Observations

Economic, Public Policy, and Fed Developments

- As expected, the Federal Reserve hiked short term rates for the first time this cycle at their March meeting. The median dot plot was more hawkish than expected, showing seven hikes vs. the market’s expectation of six, although there is little cost to the Fed setting aggressive expectations. If, as we expect, growth slows into the second half, the Fed may have to choose between fighting inflation and supporting growth. If so, we believe growth will win out. We also note the surprising lack of media attention to the Fed’s balance sheet reduction plans and how this plays out has the potential to surprise the market.

- It bears reiterating in the context of the Fed’s inflation fight that at least three distinct factors explain its rise – a post-pandemic, stimulus fueled demand boom, ongoing Covid supply chain issues, and the Russian attack on Ukraine and resulting commodity supply shocks. Some of these the Fed can address with rate hikes, but others are largely out of their control.

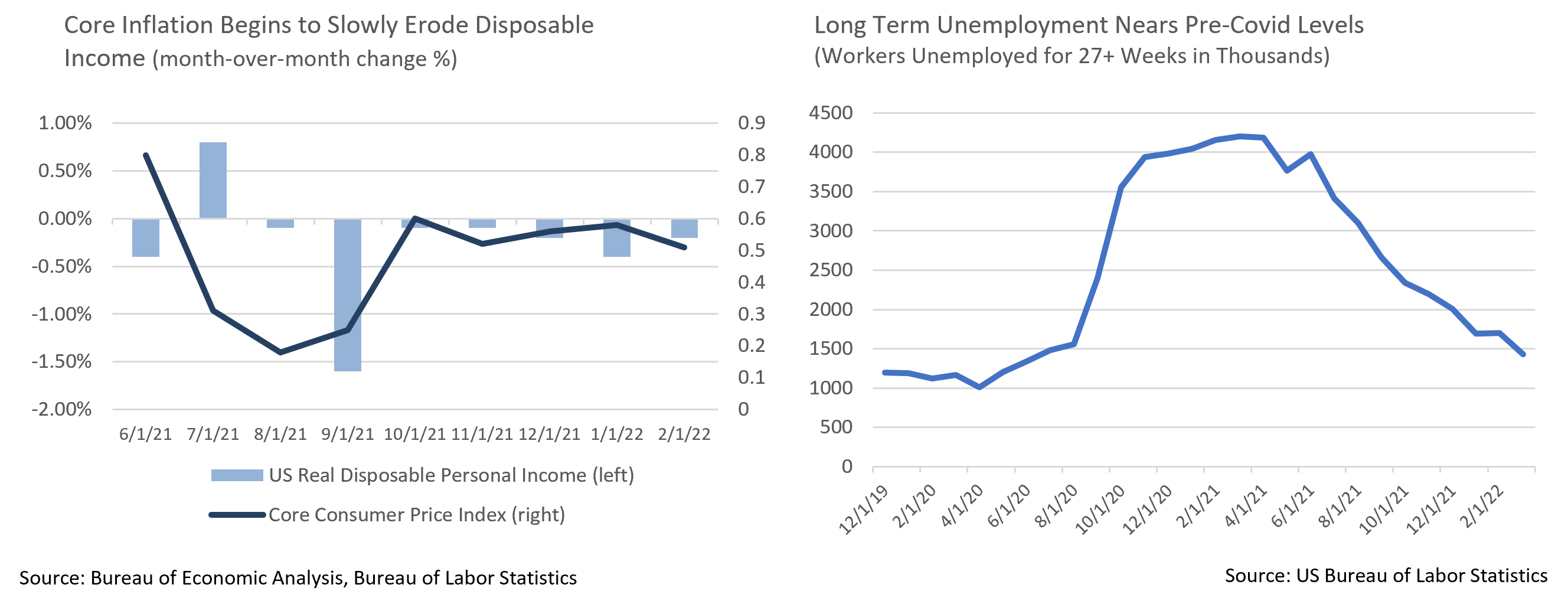

- March brought more evidence inflation had started to slow before full-scale war broke out in Ukraine. The monthly Core CPI series slowed to +0.51% and has been in a modest downtrend for some time. Core Goods Inflation, elevated after Omicron, decelerated from +1.0% to +0.4% month-over-month. Core PPI inflation also slowed to +0.2% in March, the lowest reading since November 2020, and while durable goods orders missed at -2.2% vs. -0.6% expectations, shipments improved at a monthly +0.5% pace. This offered an encouraging sign that supply chains are healing independently of normalizing demand.

- Consumer spending, a sizable driver of recent inflation, also slowed. Retail sales missed by a tenth at +0.3%, and with a good part of the increase attributable to rising gas prices, the “control group” sales that are part of the GDP calculation actually fell -1.2%. The ability of consumers to spend is waning, and demand had begun to recalibrate to supply in March.

- The Bloomberg Q1 GDP consensus estimate due out at the end of April is expected to slow considerably to a weak annualized rate of +1.5%. We expect the underlying details to be stronger, as a buildup of inventories boosted Q4’s +6.9% figure, effectively borrowing headline growth from the following quarter. Q4’s Private Sales to Domestic Purchasers was a closer-to-trendline +1.7%, and a better indication of underlying demand. We believe the Final Sales number for Q1 will exceed the consensus GDP estimate.

- Two external risks to US economic growth also bear watching. China’s “zero Covid” policy is coming face-to-face with ongoing virus waves, most recently seen through rolling lockdowns in Shanghai. China had initially locked down the city of 26 million but reversed course after a backlash. Their containment strategy has worsened supply issues, most notably when tech hub Shenzhen, a city of nearly 18 million, was locked down on 3/14, impacting Foxconn, Tencent, and Huawei. Meanwhile, Russia’s threat to cut off oil exports to Europe would be a severe problem for Germany in particular, as they import a third of its oil and more than half its natural gas from Russia.

- April’s BLS jobs report was refreshingly boring. Employment was perhaps slightly stronger than expectations, with the prior upwards revisions and a modest (but not worrisome) upside surprise in wages, though we believe this report does nothing to change market expectations of a 0.50% Fed Funds hike in May. A series of strong reports during a tight labor market, and in particular sizable declines in long term unemployment and continued increases in participation rate, means that workers who had dropped out of the workforce are coming back. While inflation remains a risk, let’s not lose sight of the fact that this is a good thing, especially in a supply-constrained economy.

Equity News and Notes

A Look at the Markets

- US equity market averages rallied in March despite worries about the conflict in Ukraine and the Fed’s quest to fight inflation without tipping the economy into recession. The S&P 500 gained +3.7% to close the Q1 at -4.6%, the first quarterly loss since Q1 2020. The tech-heavy Nasdaq rallied +3.5% in March yet still posted a -9% quarterly return. Commodities (+25.5%) and Energy (+39%) were the only positive sectors YTD.

- After dropping into correction territory (>-10% from the most recent high) at the start of March, stocks proved resilient over the back half of the month. The S&P 500 gained 11% over just 11 trading days and regained its 50-day and 200-day moving averages. Investors are left questioning whether this is a classic “bear rally” or if a bottom has been put in. We expect the Index to remain rangebound between 4,200-4,600 for the next few months given lack of clarity on Ukraine, the Fed’s inflation fight, and the upcoming earnings season. A good deal of damage has occurred in pockets of the market that should take time to resolve. Even if a bottom has been established, reaching a fresh all-time high of 4,796 over the near term will likely prove quite challenging.

- When viewed through the lens of valuations, stocks have gone through a reset to start the year. Corporate profits are expected to expand at a +9.3% pace in 2022 and +9.7% in 2023, so earnings growth is not the problem. A sharp move higher in inflation and the interest rate outlook has impacted risk appetite, and the forward P/E multiple has contracted accordingly to 19.5x. While remaining above the 5-year average of 18.6x, it is now less demanding than year-end 2021’s 21.3x. Despite bond market turbulence, stock valuations remain compelling with an earnings yield (E/P) of 5.1% vs. the 10Yr UST trading at ~2.4%.

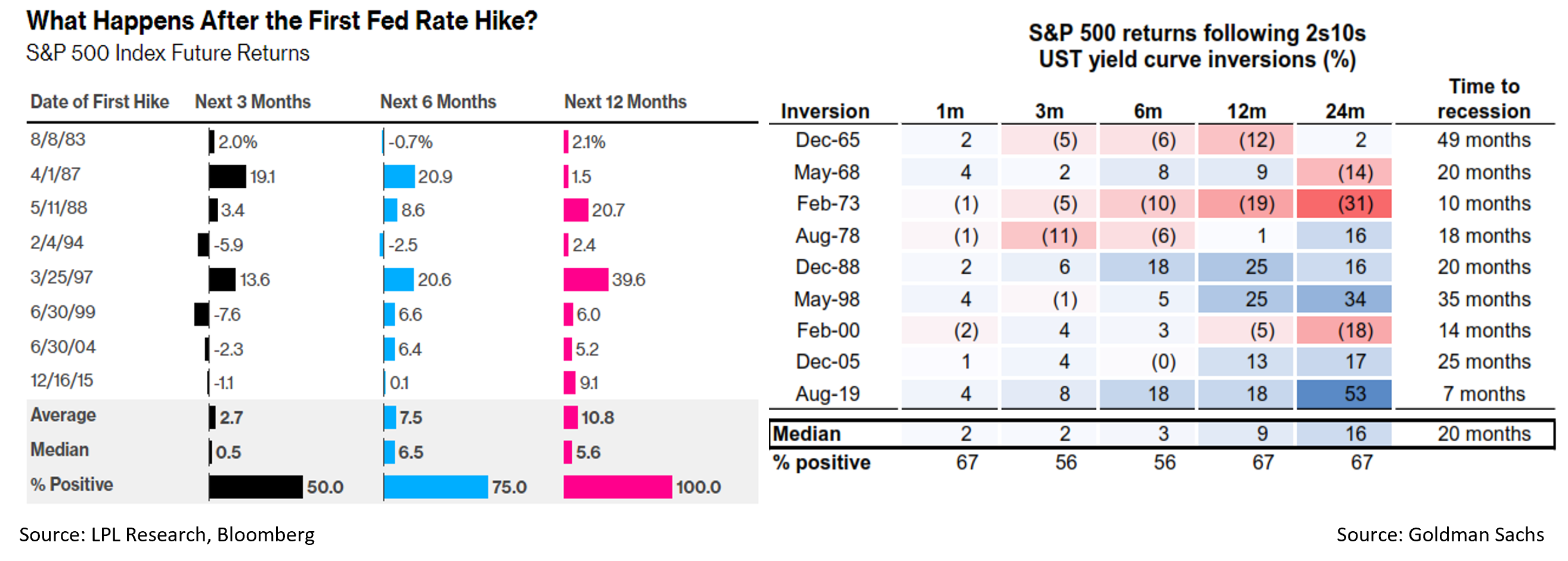

- The FOMC unanimously agreed in March to hike the Fed Funds rate by 0.25%, embarking on their first hiking cycle since 2015. With many wary that a rise in interest rates will end the bull market, it is important to recognize that the Fed typically initiates hikes into economic strength. History suggests that short-term volatility may follow although we note that the S&P 500 has been higher a year out over each of the past 8 hiking cycles. Stocks tend to struggle towards the end of a series of rate increases, not the beginning.

- The recent inversion of the yield curve and what it portends for the economy and stock market was a focal point of market angst late in Q1. The inversion of the 2-10Yr UST curve is one of the most reliable recession indicators, with the spread turning negative ahead of each of the most recent recessions. But that is an incomplete story. Interest rates are rising as the curve flattens (bear flattener) rather than falling. Typically, rates fall into a recession as traders seek shelter in USTs. Second, real rates (less inflation) have not inverted suggesting that much of what is driving the nominal rate curve are inflation expectations which are higher short-term and lower further out. Third, short term spreads have been a better recession indicator and the 3M/10Yr differential points to low odds of a recession in the next 12 months. Credit and CDS spreads also remain far from the stressed levels seen heading into other recessionary periods.

- We are not ignoring these concerns and agree that the odds of a recession have risen. The consumer and labor market bear close attention. Consumer confidence and real spending have weakened, although non-farm payroll data, often a recession indicator, has improved over the past six months and a strong labor report was revealed as the calendar moved into April. We will also be monitoring earnings season beginning in mid-April. Management teams will be sure to discuss inflation and, so far, persistent demand has enabled them to maintain margins while passing higher costs to the consumer. Time will tell…

From the Trading Desk

Municipal Markets

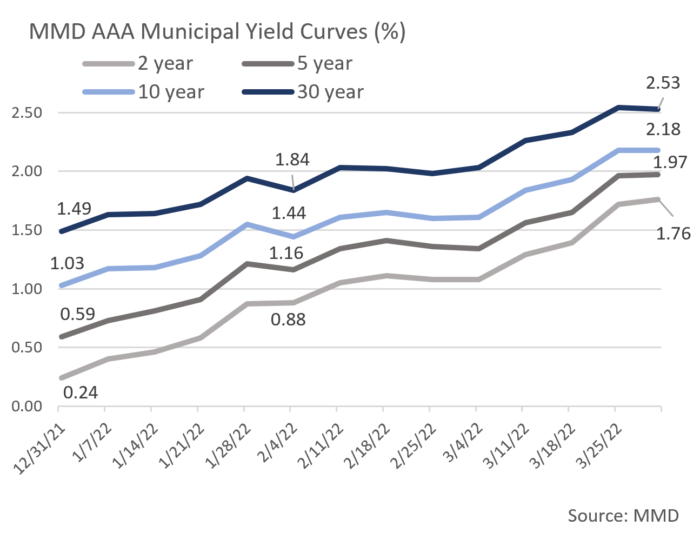

- March accelerated an already difficult quarter in the municipal market as a bear flattening trend continued. The 2Yr AAA curve reached 1.76%, while the 10Yr rose to 2.18%. As discussed in our recent commentary, we feel these levels are attractive on an absolute basis and relative to USTs.

- The 10-Year AAA Muni/UST ratio closed the quarter at 93% while the 2-Year ratio reached 75%. Both metrics are now above long-term averages, historically a positive sign for relative municipal performance.

- Short maturities have already priced in six to seven Fed Fund rate hikes, although we are in the camp that expects 0.50% in May and another 0.25% in July before Fed Fund increases may pause. With this in mind, we are emphasizing the “tails” of our 3 to 12-year buying range in the Intermediate strategy and reducing marginal buying among 5 to 8-year maturities.

- Investor sentiment reflects what has been one of the largest yield curve moves in many years. Fund outflows of $2 billion over the last week in March raised YTD outflows to $21.9 billion, more than half of which came from longer duration strategies. Deals are still coming to market though and are being reasonably well received. The first week in April brought with it a $13 billion calendar.

- Credit quality in the obligors we like remains very strong, and with yields now much more attractive we are finding compelling investment opportunities to reinvest income and new cash. Q1 performance reflects a broad market repricing, although today’s entry point is quite favorable, particularly for investors in high tax states.

Corporate Bond Markets

- During the last week in March, $33.3 billion of IG Corporate bond issuance blew through market consensus expectations. This has been a consistent trend over the last several weeks, leading to a total of $229.9 billion for the month. Historically, the primary market tends to be robust in March and this was certainly the case this year. Q1 concluded with the fourth highest monthly total on record, roughly $35 billion more than the $196 billion priced over the same period last year.

- The Fed’s deeply embedded hawkish tone has pushed front-end UST yields to levels not seen since the middle of 2019. Markets have already priced in 6 to 7 Fed Funds rate hikes with the 2Yr UST at 2.47% and the 3Yr UST at 2.63%. We see considerable value in shorter maturities and feel that the pace of Fed rate hikes is likely to slow in the second half of the year and fail to meet current expectations. By contrast, weakening economic expectations, pension and foreign buying have driven down the long bond to 2.43%.

- Lipper Inc. reported $15.7 billion of taxable fixed income fund outflows YTD through 3/28, as sentiment clouds in the face of economic, interest rate, and geopolitical concerns. High yield issues reflected this volatility, closing March with significant losses despite ending the quarter as the top performing US fixed income asset class.

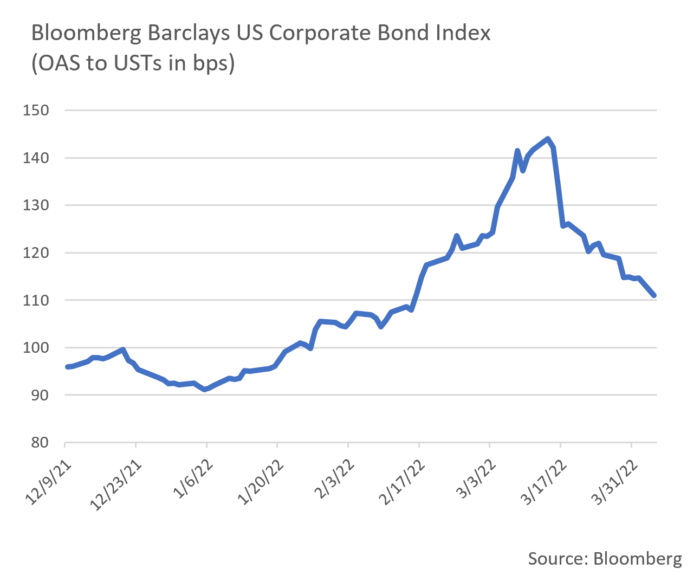

- While widening credit spreads garnered much attention early in March, the corporate markets found their footing later in the month. Spreads ultimately closed about 7bps tighter on the month as strong issuance met unexpectedly firm investor demand in a stabilizing geopolitical environment.

- With Investment Grade spreads about 20bps wider than they were at the start of the year, and factoring in what is now a steep spread curve, corporates currently offer considerably more relative value than they did at the end of 2021.

Financial Planning Perspectives

Clarifying the SECURE ACT

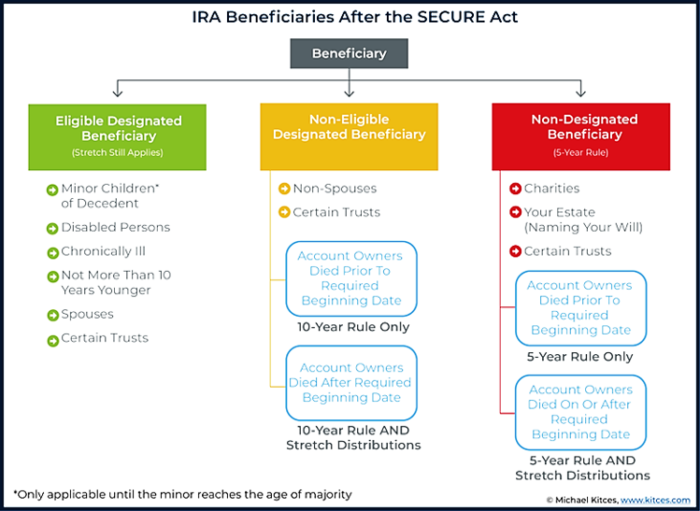

The IRS passed Proposed Regulations on February 23rd aimed at clearing up provisions in the December 2019 SECURE Act that were either ill-defined or open to interpretation. While the Regulations touch on many different retirement topics, the most significant in our view involves clarification of the 10-Year Rule. This provision essentially requires all Non-Eligible Designated Beneficiaries to “distribute the entirety of their inherited retirement accounts by the end of the tenth year after the decedent’s death.” The new Regulations intend to take this a step further by implementing a new rule for retirement accounts that had a decedent die on or after their Required Beginning Date. This step would require beneficiaries of these accounts to take annual Required Minimum Distributions (RMDs) during the 10-year period in addition to completing the 10-year distribution requirement. On the other hand, Non-Eligible Designated Beneficiaries of accounts where the decedent died before their Required Beginning Date would only be subject to the 10-Year Rule – there is no annual distribution requirement.

The Regulations also offer greater clarity concerning the difference between Eligible and Non-Eligible Designated Beneficiaries, a distinction that has considerable impact on how a retirement account’s assets are to be distributed. Eligible Beneficiaries include spouses and minor children of the decedent, as well as disabled individuals, persons who are chronically ill, or individuals not more than 10 years younger than the deceased individual. For these types of Beneficiaries, the existing “stretch” rules regarding distribution will continue to be enforced by the IRS. Non-Eligible Beneficiaries, on the other hand, include individuals that do not satisfy those requirements and would now be subject to the 10-Year Rule and a potential RMD requirement.

Retirement Accounts With Trust Beneficiaries

The Regulations contain important language regarding retirement accounts that elect trusts as a beneficiary of the account. An important change concerns See-Through Trusts. With this change, the IRS would relax its stance on post-death powers of appointment and give these trusts more favorable post-death distribution rules.

Additionally, the Regulations propose allowing the addition or removal of trust beneficiaries by September 30th of the year following the year of death without penalty. These changes are noteworthy in that they offer additional flexibility relative to beneficiaries and allow for the possibility of changes to trust language after a decedent passes away.

In summary, while somewhat arcane in nature, these Regulations offer useful clarification of the SECURE Act and provide new distribution schedules for certain types of retirement accounts. While the 10-Year Rule has already had a sizeable impact on retirement account beneficiaries, the Regulations would take the effect a step further with regards to Non-Eligible Designated Beneficiaries. Furthermore, the Regulations serve to relax certain IRS rules regarding distributions to trusts, allowing for additional post-death flexibility.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]