Insights and Observations

Economic, Public Policy, and Fed Developments

- The growing “peak inflation” market consensus crashed into the “stalling growth” call in May, after Walmart and Target reported earnings misses, citing margin compression from consumers substituting lower cost items. These announcements spooked the market, and the yield curve reacted by beginning to dial back rate hike expectations for the second half of the year.

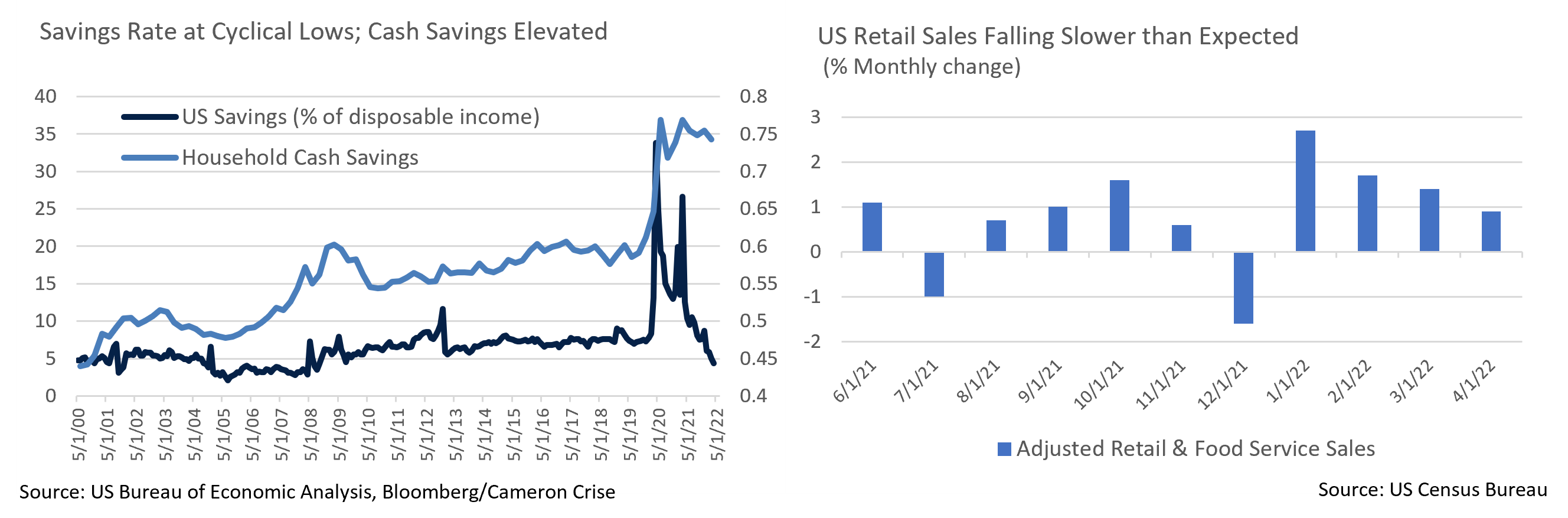

- Of note, aggregate retail sales have not actually slowed as much as these earnings reports suggest. The May headline growth rate fell short, +0.9% vs +1.0%, but March upwards revisions of +0.5% to +1.4% more than made up for the miss. Large revisions make it difficult to know how much trust to place in the data series, although consumers appear to still be spending despite falling inflation adjusted purchasing power.

- How this is being financed is another question. The savings rate fell to 4.4% in April, the lowest level since 2008, so the ability for consumers to spend out of current income is strained. Consumer total credit use rose by a record $52.4 billion with revolving credit up a record $31.4 billion over the month, suggesting that consumers may be turning to debt to finance spending. Household cash as % of GDP also remains abnormally high. While this is not broken out by income level, a large proportion is in checking accounts, which implies that low- and middle-income Americans (who tend to spend a greater proportion of their disposable income) may still be well capitalized. If cash holdings are a primary source of still-strong spending, the consumer may prove to be reasonably resilient.

- However, evidence of slowing growth was present in the Fed’s latest “beige book” survey of economic conditions. Most districts reported slight growth, with four reporting moderate growth, and four explicitly noting a slowdown since the last report. Labor remains a constraint, although coastal districts referenced possible hiring freezes in anticipation of growth slowdowns or other evidence of a softening in labor demand.

Equity News and Notes

A Look at the Markets

- Most US equity indexes ended the month of May little changed with the Dow returning +0.04%, the S&P 500 +0.01%, and the Russell 2000 flat. The exception was the tech-heavy Nasdaq which dropped -2.1%. Although many Technology stocks moved higher, the market-cap weighted sector was weighed down by mega caps such as Apple and Microsoft. Energy, Utilities and Financials led to the upside, while Real Estate and the Consumer sectors – Staples and Discretionary – lagged due to weakness in retailers.

- Don’t let these modest moves in the broader averages fool you; May was an extremely volatile month. The S&P 500 fell in each of the first three weeks extending its weekly losing streak to seven. A YTD intraday low (3,810) was hit on May 20th, briefly crossing the bear market threshold of -20% off its January all-time-high. The S&P followed with a strong rally (+6.6%) over the final week of May, enjoying its best week since November 2020. Volatility has been the norm, with the S&P 500 experiencing +/- 2% or more daily moves 8 out of 21 trading days in May. To put that in context, the Index has only averaged 16 +/-2% days annually since 1928.

- Investors are left grappling with the question of whether recent rally attempts merely reflect a short-term countertrend similar to late March, or if we are seeing something more sustainable. We remain cautious as several indicators normally associated with cycle reversing capitulation such as VIX over 40, a spike in the put/call ratio, or a surge in the percentage of stocks making new lows, are not yet evident. Fleeting acts of equity market support, such as short covering and month-end rebalancing, may have been evident during the final week of May.

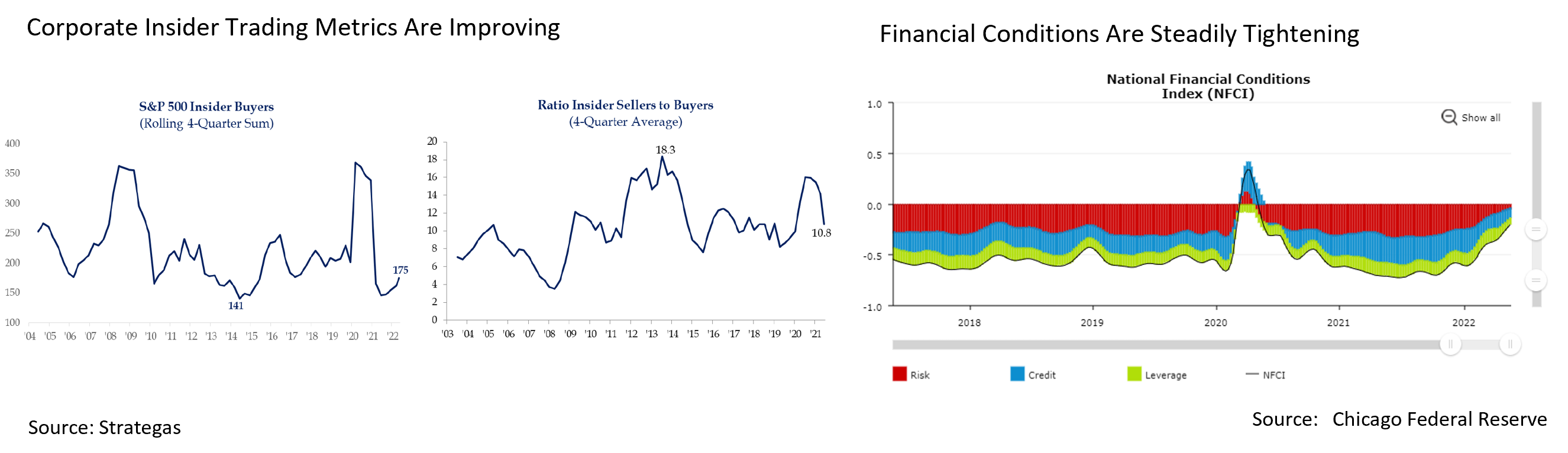

- Although the bulls have not had much to get excited about of late, a recent increase in corporate insider buying offers reason for optimism. More importantly, the ratio of sellers to buyers has fallen sharply. We find it reassuring to see insiders seeing value in their share prices but even more encouraging that selling appears to be subsiding. Other positive signs included three straight 80+% advancing-volume trading days and tightening credit spreads.

- We expect further volatility until such time as meaningful clarity is established relative to the market’s major headwinds: inflation, the war in Ukraine, global supply chain constraints, a slowing economy, and, most notably, how the Fed responds to these challenges. As discussed in our recent equity market brief, a major wildcard is the Fed’s ability to drive down inflation while avoiding overtightening and pushing the economy into recession. For now, we feel a near term recession is likely to be avoided, although the window for a soft-landing is narrowing.

- An item that gives us a glimpse into what the Fed may be targeting can be seen in the chart below from the Chicago Fed. The NFCI measures financial conditions and has an average value of 0. Positive readings indicate tighter than average financial conditions while negative values have been historically associated with looser than average conditions. The Fed has so far only raised Fed Funds by 0.75%, with balance sheet runoff commencing on June 1st. Nonetheless, they have been hawkish in their communications, and in response, the market has begun doing the Fed’s heavy lifting by pressuring mortgage rates, credit, and the US dollar. The market’s reaction has opened the door for a slowdown or pause in the Fed’s rate hike cycle later this year, a potential development that has arguably not been priced into recent equity market weakness. We believe Fed Fund rates will increase by another 0.50% in both June and July, as the Fed must regain its inflation fighting credibility.

- The labor market will be of great significance in evaluating the inflation and interest rate outlook in the months ahead. The Fed will want to see job openings (JOLTS) come down significantly without greatly impacting the unemployment rate, as this would offer evidence of an economic “soft-landing” that mitigates inflationary pressures without tipping the economy into recession. Should labor market pressures be reduced in such a manner, the Fed would be more inclined to dial back its monetary policy response, a scenario that would likely give risk assets a lift.

From the Trading Desk

Municipal Markets

- The past month saw a dramatic and welcome tightening of municipal bid-ask spreads, as it appears investors recognized the relative value of the asset class and became more eager to put money to work. Recently elevated tax-exempt yields have significantly changed the Municipal/UST yield relationship with 10Yr ratios exceeding 100% at times during May before municipal outperformance towards the end of the month brought ratios back into a 90% range. Anecdotally, our trade desk has seen new issue deals many times oversubscribed and quality secondary offerings trading very quickly.

- Despite such demand, the retail channels have continued to lag, with 21 consecutive weeks of net outflows, although the pace has slowed. Lipper Inc. reports YTD net municipal fund outflows of $59 billion, a data point that highlights what is now the second largest outflow cycle since fund flows began being recorded in 1992. Nonetheless, Lipper reported positive inflows into High Yield funds over the week ending June 1st, a development of note given that high yield has often been a leading fund flow indicator.

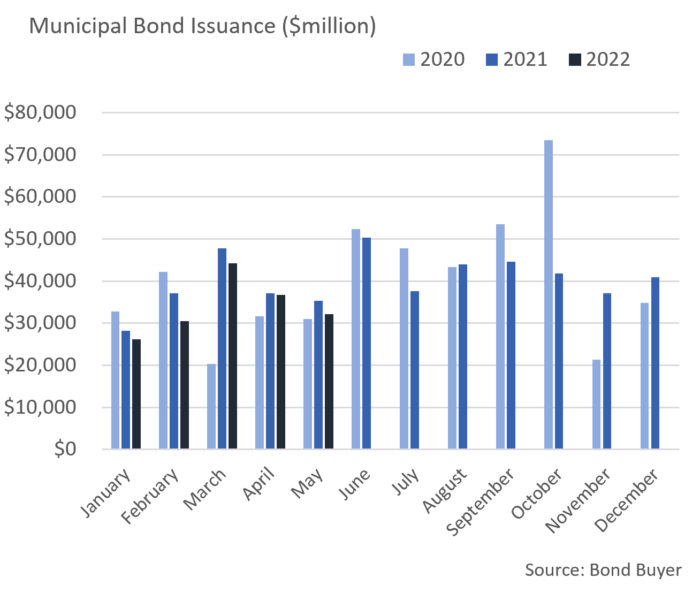

- According to The Bond Buyer, May issuance of $32.2 billion was about 9% lower than last May. YTD issuance of $169.7 billion also trails the prior by about 8.5%. Generally, lower net new market supply is supportive of municipal prices, although the recent slowdown in retail demand has played a meaningful role in this year’s softer technical dynamics. With net negative issuance expected over the summer months, and much higher yield levels in place than was the case in 2021, we anticipate late May’s firming in tax-exempt market pricing to be sustained.

Corporate Bond Markets

- Investment Grade credit spreads receded from YTD highs reached during the middle of May based largely on trading heavily influenced by technical factors. A lack of significant issuance to close out the second half of the month contributed to spread compression by hindering supply. Release of the Federal Reserve’s minutes on May 25th also had an influence, as a softer mood amongst Fed officials within a still hawkish message led to credit catching a bid. As these dynamics played out, the Bloomberg Barclays US Corporate Index saw OAS compress 13 bps to 130 bps after beginning the month at 143 bps.

- Despite fluctuation in investor sentiment and tightening financial conditions, corporate bond issuers that came to market towards the end of the month found strong investor reception to their deals and lower concessions than 2022’s overall average. That being said, $87 billion of new supply fell well short of $135 billion consensus expectations in May, despite issuance typically being heavy during that period. On a YTD basis, Investment Grade new issuance of roughly $645 billion is off 5% year-over-year, as equity market weakness and overall risk asset volatility are likely slowing the new issue calendar. Relative to credit spreads, this is a positive technical factor.

- The US Treasury curve was in a bear flattening mode most of the month with the front end rising significantly more than longer maturities. That was to be expected given the most recent rate hike. The 10Yr UST hit 3.12% (YTD high) at the close of the first week of May before subsequently dropping to 2.74% and closing the month at 2.84%. Our baseline estimate for the 10Yr UST over the remainder of the year lies in a range of 2.75% to 3.25%.

Financial Planning Perspectives

Roth IRAs: A Powerful Retirement Savings Option

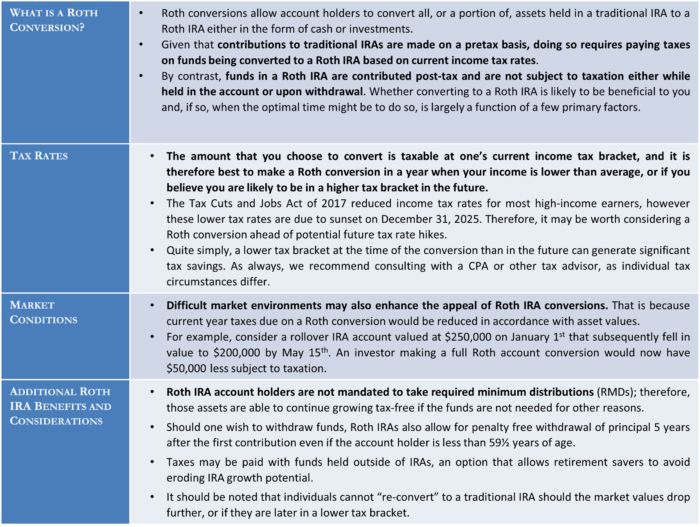

A challenging market environment such as we are currently experiencing has silver linings, including potential opportunities to garner long-term tax benefits by repositioning retirement investments. More specifically, let’s look at how recent market weakness can be used to your advantage through a Roth IRA conversion.

Sometimes, taking proactive steps today can pay considerable dividends tomorrow. We encourage clients who may be interested in Roth IRAs to contact your Portfolio Manager to discuss the merits of this retirement savings option.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]