Insights and Observations

Economic, Public Policy, and Fed Developments

- Two November inflation reports shifted market expectations concerning Federal Reserve policy and the market is now pricing a “pivot.” We think this is wrong, for two reasons.

- First, an expected decrease in the pace of tightening to 50bps is not new; it has been telegraphed by the Fed for months and market expectations have not shifted materially from a deceleration to 50bps in December and 25bps by March. Recent Fed commentary (notably Chairman Powell’s Q&A after the last meeting) has shifted the focus from the pace of tightening, to how high they will ultimately hike and how long we should expect rates to stay there. In our view, Powell has implied that the market’s expectations on both fronts were too conservative.

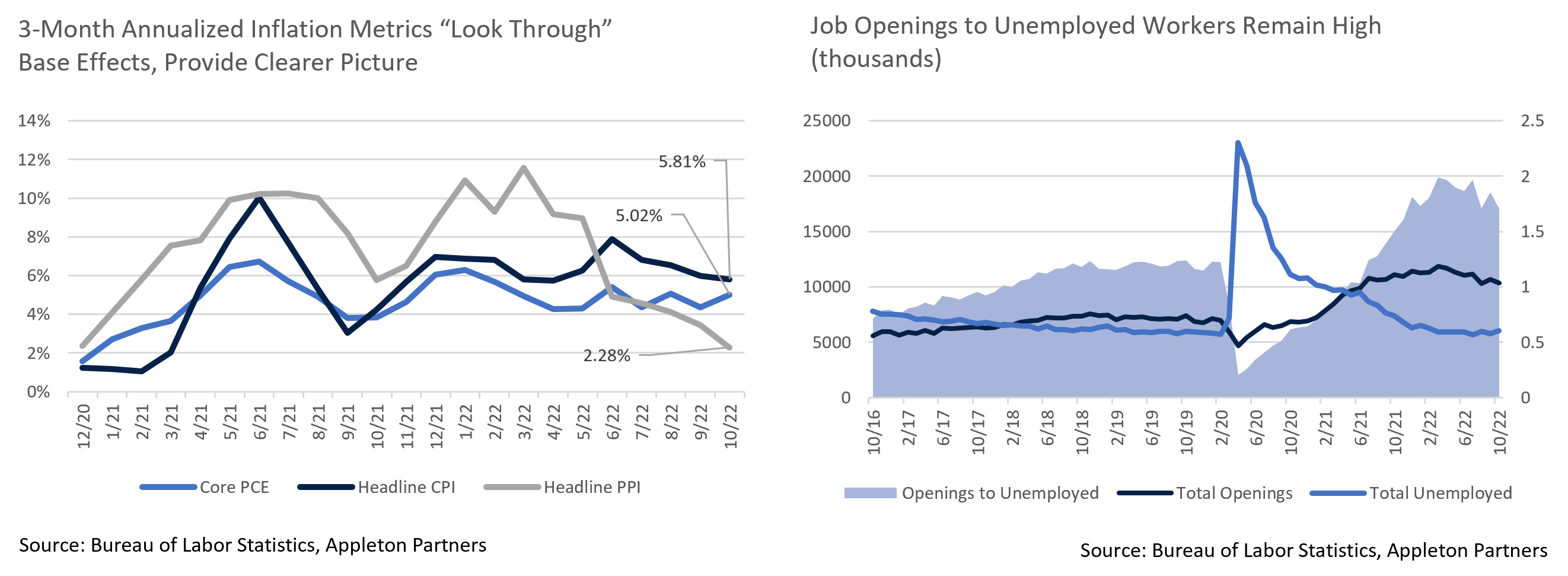

- Second, while pivot talk was fueled by CPI and PPI falling more than expected in October, annual improvements were driven by base effects. Although the monthly CPI change stayed the same at +0.4%, the annual rate of inflation dropped from +8.2% to +7.7% due to the anniversary of higher levels of inflation a year ago. The same applies to headline PPI which held steady at +0.2% month-over-month but dropped on an annual basis from +8.4% to +8.0%. Base effects were a big story last year when they were pushing inflation up, yet they are getting surprisingly little attention now. As before, we suggest looking at annualized 3-month rates to “look through” base effect noise, and this suggests consumer inflation remains fairly stable at +5-6%. By this measure, interest rates are not yet restrictive.

- The Fed is very likely to hike 50bps in December as they have made this policy course quite clear. However, when the Fed publishes their new “dot plot” in December, we expect it to show a terminal rate several hikes above the 4.75-5% range currently priced in, and for the first cut to not occur as early as fall 2023, as traders currently expect. This may lead to some repricing in the equity and bond markets, both of which have rallied on hopes for a slowing and then more rapid reversal of the Fed Funds rate path.

- Tightening does not yet appear to have discouraged the consumer as both retail sales and personal consumption expenditures have been much stronger than expected. On one hand, this is a positive for growth and increases the odds of a “soft landing,” but it complicates the Fed’s work as demand needs to weaken to adjust to supply shocks. Bloomberg estimates consumers still hold $1.2T in excess savings, and that it will take 12 months to spend down at current rates. Consumer spending will likely need to further soften before inflation can significantly fall, and this may take time.

- The labor market also remains robust. JOLTS data suggest job openings are starting to decline relative to job seekers, from nearly 2.0 openings per unemployed to 1.7 in October, though these are still very elevated rates. The November jobs report also came in unexpectedly strong at 263k vs. expectations of 200k, closely in line with the last three reports. With wages cheap relative to other production imports and many employers still short-staffed from the pandemic, hiring may continue for a time even as the economy slows. Labor market reports like these make it difficult for the Fed to conclude their policy tightening work is done.

- On the other hand, ISM manufacturing fell into contraction for the first time since May 2020, on the third straight deceleration in new orders. Inventories fell at their slowest rate since April 2020, which is concerning for retailers already worried about high inventories. We will be monitoring this economic indicator as the Fed balances data inputs in planning monetary policy.

Equity News and Notes

A Look at the Markets

- Stocks were higher in November as the S&P 500 advanced 5.4% to give the index its first back-to-back monthly gains since August of 2021. A resurgent Q4 return of +14.1% pared YTD losses to -13.1%. All eleven sectors were higher with leadership coming from Materials and Industrials. Energy was the laggard as crude oil dropped ~7%, continuing a recent trend as demand from China waned. Notably, we saw a decline in volatility as the VIX fell below 20, a key threshold, for the first time since mid-August.

- A potentially bullish development came through China seemingly loosening their strict “zero-Covid” stance by “optimizing” the policy. Significant steps towards a broader Chinese reopening would support global economic growth, while alleviating supply chain concerns that have aggravated inflationary pressures. “Zero-Covid” has become an acute political risk for China, and we caution that the path forward is uncertain.

- The Fed remained at the center of investor attention as they raised the Fed Funds rate by 0.75% for an unprecedented 4th straight time. However, several data points came in over the course of November that led investors to believe smaller increases may be forthcoming. Several inflation readings, including the CPI, PPI, PCE (lowest since Dec.), and ISM prices paid (30-month low) all showed a moderation, although the “base effect” issue discussed in the macro section is a cautioning factor. The labor market has showed signs of cooling with ADP private payrolls slowing and JOLTS job openings dropping modestly. The all-mighty US consumer remains resilient for now, offering support for bullish hopes for a reasonably soft landing.

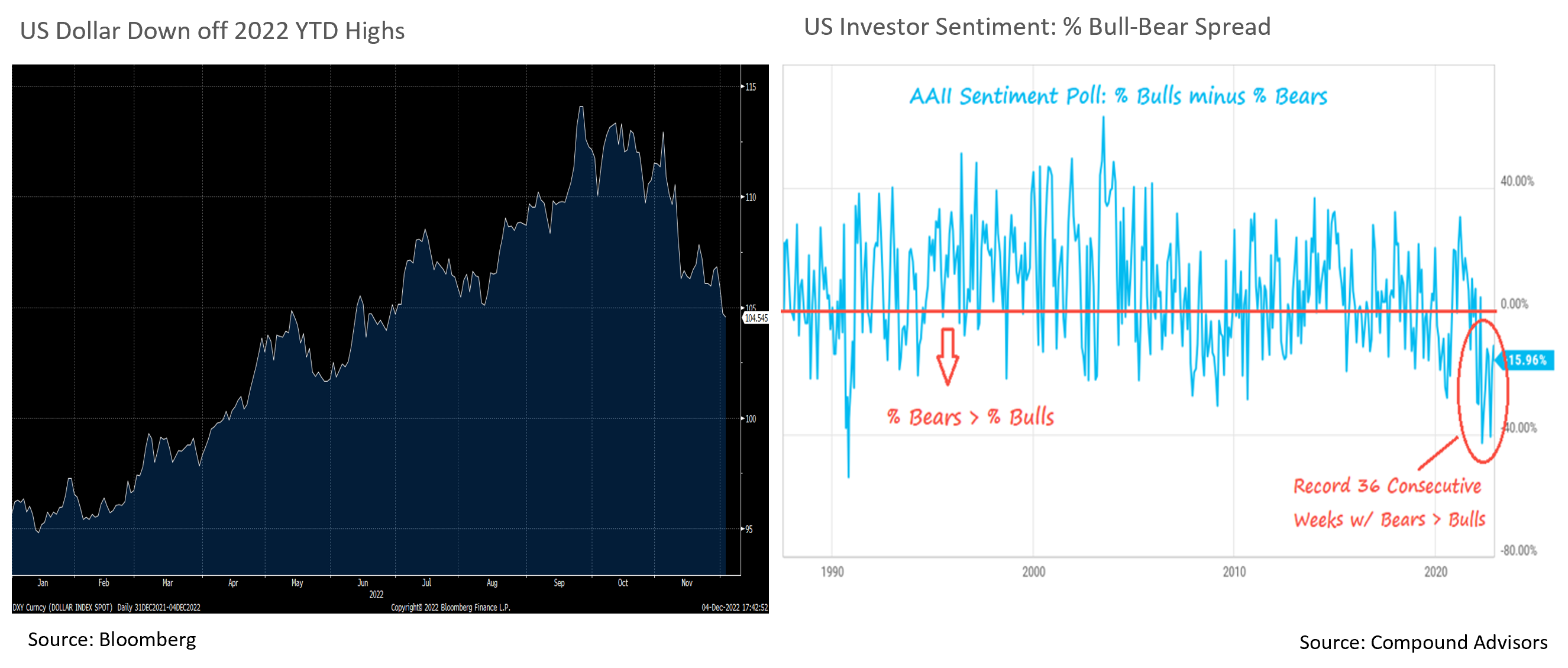

- A key indicator we are tracking in assessing the likelihood equities can sustain a recovery is the US dollar. The greenback had enjoyed its best start to a year through October since 1985, gaining 16% vs. a basket of foreign currencies. Much of that was reversed in November, with the DXY index falling 5%. Excessive dollar strength has contributed to the Fed’s desire to tighten monetary conditions, while also creating a headwind for US multinational earnings. By contrast, a weaker dollar contributes to a “peak inflation” narrative and is supportive of a more bullish easing of monetary policy conditions.

- The S&P 500’s +14% performance in October and November left the index back above 4,000 and, more importantly, it regained its 200-day moving average for the first time since early April. The 200-day moving average is a long-term technical indicator often used to gauge market trends. In the 13 instances since 1950 that the index closed above its 200-day moving average after trading below for at least 6 months, only once did the index go on to make new short-term lows. While we always emphasize stock specific fundamentals, it is encouraging that the average 1-year return in such situations has been +18.8%, a historical pattern that suggests healthier risk asset conditions.

- Bulls also have negative sentiment on their side as it is often a contrarian indicator. As of November 30, the AAII survey showed bears outnumbering bulls for the 36th consecutive week, the longest run in the survey’s history going back to 1987. The market has historically posted above-average gains 6 and 12 months out when this has been the case as a subsequent change in perceived conditions can produce a reversal in risk appetite.

From the Trading Desk

Municipal Markets

- After posting negative returns for most of 2022, November was a strong month for municipals as yields receded amid growing speculation that an earlier than once anticipated Fed pivot might be forthcoming. The Bloomberg Barclays Municipal Managed Money Intermediate Index rose 4.32%, narrowing YTD declines to -7.72%.

- AAA Municipal/UST ratios declined considerably in November as the tax-exempt market rallied, with 2 and 10-year ratios of 63% and 78% respectively falling from 72% and 85% recorded at the end of October.

- Although less compelling relative valuation may cause some municipal buyers to pull back a bit, we see technical factors remaining strong which should bolster near-term performance. Yield levels are still far more attractive than has been the case over the past few years, supply remains tight, and December 1st and January 1st interest payments are approaching.

- A more positive tax-exempt market backdrop should be supportive of a recovery in retail demand in the months ahead. Lipper Inc. reports YTD net mutual fund flows of -$112 billion and a 4-week average of -$2 billion. Despite these outflows, sentiment is improving, and this should continue given demand for tax-advantaged income coupled with more attractive yields.

- As year-end approaches, tax loss harvesting is an important consideration. Very modest supply is complicating matters with Bond Buyer reporting that November issuance fell short of $20 billion for the first time since 1999. As a result, secondary trading, which has been averaging about $12 billion per day, and daily bid wanted lists averaging $1.6 billion in November (+23% above the 2022 monthly average), are demanding our traders’ attention.

Corporate Bond Markets

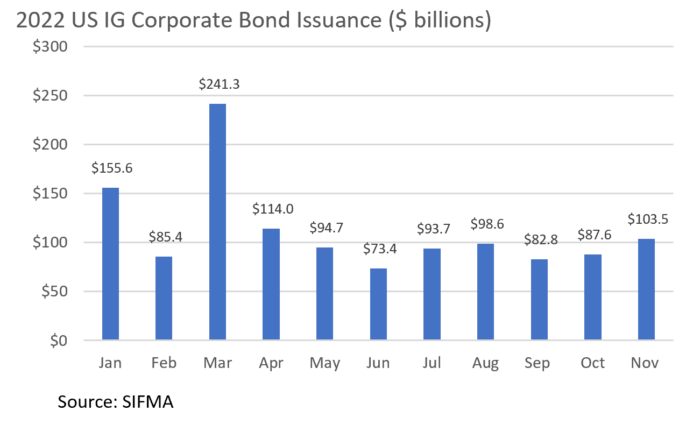

- November’s monthly Investment Grade Corporate supply was projected to be in a $75 billion range, but two solid weeks to close the month enabled the total to reach $101.9 billion. Despite beating expectations, 2022 issuance is now expected to only reach $1.250 trillion, which would be the lightest volume of new supply in three years. The persistence of spread/rate volatility, a rapid rise in US Treasury yields, and lack of risk-taking conviction have been the main inhibitors to new debt offerings. December is undoubtably going to be a very light month in the primary market and we expect similar primary market volumes to linger into 2023. New issue supply constraints are likely to have a positive effect on spreads for some time.

- Option adjusted spreads on the Bloomberg Barclays Corporate Bond Index moved steadily tighter on the month, driven in large part by a credit backdrop calmed by signs of reduced inflationary pressures. The Index OAS touched lows not seen since the beginning of June and hit 130 bps on 11/23/22. The Fed Chairman’s speech at the end of the month was perceived to be somewhat dovish by many and this coupled with strong payroll numbers drove spreads wider to 133 bps. Still, this proved to be the best performing month of the year for IG credit as returns on the above referenced index of +5.18% were the best since April 2020. Should inflationary pressures stabilize on a sustained basis and begin to wane, a Federal Reserve pause in early 2023 is likely, and we would expect that to help keep spreads reasonably tight over the balance of next year.

- Investment grade corporate bond funds continue to lose assets as -$6.9 billion of net outflows were recorded in November. This brings the YTD net fund outflow total to -$125.7 billion. Typically, IG credit markets gain a more solid foundation over the course of the month, but investors have not seen it that way this year. Fund outflows reflect market sentiment which has been shaky for some time, yet November’s more positive tone should help investors gain greater conviction.

Financial Planning Perspectives

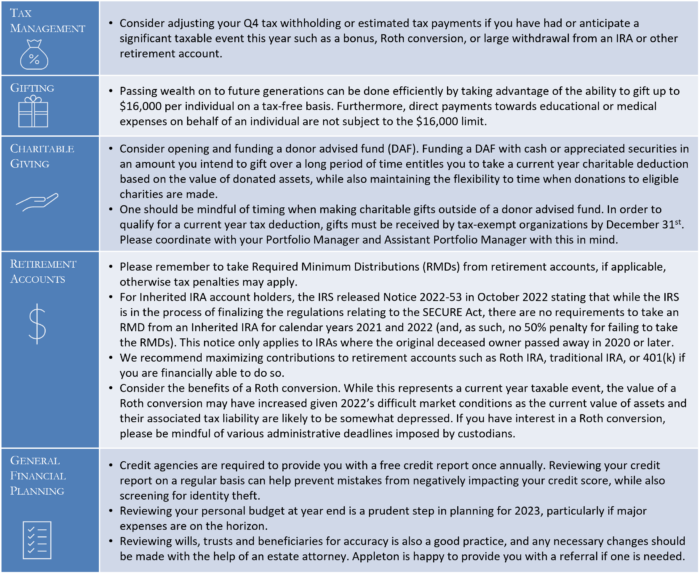

Year End Steps to Finetune Your Finances

As 2022 draws to a close, we encourage clients to consider several tax planning strategies. Here are a few items that you may want to discuss with your Portfolio Manager.

At Appleton, we take great pride in the wealth management and financial planning services provided to our clients.

Is there someone you care about who might benefit from working with us, but you’re unsure how to make the introduction?

If so, please let us know. We’re happy to help.

Please contact your Portfolio Manager or reach out to:

Jim O’Neil, Managing Director

617-338-0700 x775 | [email protected] | www.www.appletonpartners.com