The asset management industry has long wrestled with the active versus passive debate across a spectrum of asset classes. At Appleton, we are strong advocates of active municipal bond management as it affords us the ability to customize solutions and capitalize on opportunities to add incremental yield and total return. Contrasting active municipal strategies with bond ladders, the most common passively managed tax-exempt strategy, warrants considering the characteristics and attributes of each approach.

Dynamic Markets Create Value Opportunities

Themunicipal bond market is extremely broad and diffuse, which are characteristics that highlight the benefits of research driven active management. Within a $4.0 trillion market featuring more than 1 million bond issues1, tax-exempt bonds introduce distinct regional differences, varying degrees of taxing authority and revenue support, and many unique bond structures. The municipal market is influenced by ever changing technical factors and periodic shifts in investor psychology. Issuance levels, dealer inventory, mutual fund flows, and credit perceptions all impact bond prices, and these and other nuances collectively contribute to an active manager’s ability to identify pockets of relative value.

Our investment process emphasizes proprietary research, issuer quality, and trading liquidity, as these are the building blocks needed to efficiently adjust portfolio exposures when we feel it is beneficial to do so. We believe bond managers with demonstrated expertise can positively impact tax-exempt performance over time by making proactive decisions and employing tactical flexibility not offered by bond ladders.

Municipal Securities Rulemaking Board, 2021

Foundations of Active Bond Management

Fundamental research drives Appleton’s municipal strategies. Quality is our top priority in security selection and every bond purchased must be investment grade and approved by Credit Research. This proprietary analysis is critical to reducing the risk of credit deterioration and in affecting subsequent buy and sell decisions. Unsettled markets brought on by changing credit perceptions, interest rate pressure, or other influences can be conducive to selective, opportunistic trading; for example, rotating out of fully valued credits, and/or bonds where we anticipate increased risk, and into more attractive issues.

Yield curve positioning is another element of our investment process that can benefit clients as market dynamics shift. Capturing relative steepness on the municipal curve can add meaningful incremental yield, particularly given the extent to which maturity spreads change over time. The accompanying chart illustrates this point by highlighting AAA municipal yield differentials over the past few years. Subject to the guidelines of a given account, we have long found that reasonable yield curve flexibility additive to performance.

Duration management is a central element of any fixed income investment process given the impact on portfolio yield and interest rate exposure. Active managers typically establish an appropriate duration target and then determine how to structure the portfolio accordingly, whereas duration is pre-defined in bond ladders.

Depending on considerations such as the shape of the yield curve, current interest rate levels, or a manager’s perspective on anticipated rate direction, portfolio duration can be implemented through quite different distribution of bond maturities. Examples include bell shaped, barbell shaped, or bulleted bond holdings, and active managers have the flexibility to later adjust portfolio structures should it be advantageous to do so.

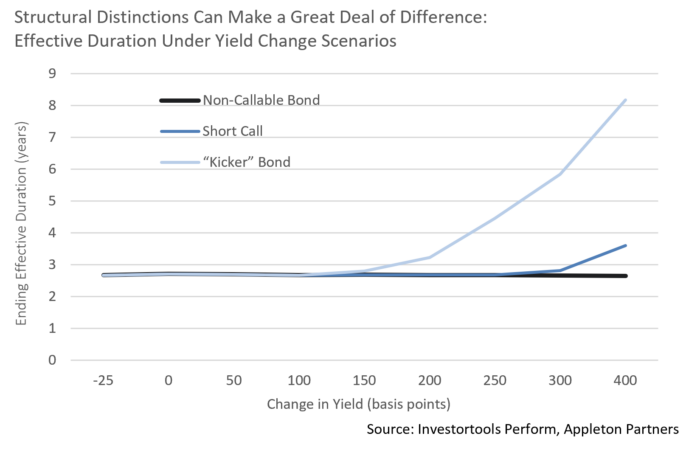

Bond structure refers to the nuances of a specific bond issue, characteristics that vary considerably when comparing distinct offerings of the same issuer. Evaluating factors such as term, call provisions, or the time period between a bond’s call and maturity allows our investment team to select the specific bonds that appear to offer the best contribution to a portfolio’s risk-reward profile. This is important given the extent to which structure can influence how a bond might react to interest rate moves. Analyzing the benefits and risks associated with bond structure demands a combination of trading, research, and portfolio management insight, expertise that is integrated within Appleton’s collaborative investment process.

The Power of Personalization

Appleton municipal portfolios are exclusively invested as separately managed accounts (“SMAs”), as we believe this gives us the flexibility needed to tailor solutions to unique client objectives. SMA investors own individual bond holdings, maintain their own cost basis in each security, and have control over an account’s cash flow, attributes mutual funds and other pooled vehicles do not offer. These and other characteristics give an active manager the potential to add value through proactivetax management.

Depending on a client’s state of residence, in-state bonds often represent the core of our tax-exempt portfolios. However, even in high tax states incorporating out-of-state bonds usually makes sense for diversification and risk management purposes. Strong demand may cause in-state bonds to trade rich to out-of-state paper, particularly in states with high marginal tax rates, and accordingly, we find that going beyond state lines can increase after-tax portfolio yield. Comparing individual credits and their respective yields on a tax-equivalent basis as bond prices fluctuate is an element of our municipal investment process that has historically enabled us to enhance a client’s net portfolio income.

We also generally look to minimize short-term capital gains and enter positions with the expectation of a multi-year holding period. Portfolios built out with cash are usually initially slightly long of portfolio targets to minimize the need for extension trading and potential accompanying tax consequences. Working closely with advisors, we also seek to realize losses when it is in the client’s interests to do so, although such trading is subject to market liquidity and other potential concerns such as the ability to efficiently reinvest proceeds. Tax management of this nature represents a valuable tool through which our active investment process seeks to benefit municipal clients.

Climbing the Ladder

Passive municipal portfolios are most often managed in the form of bond ladders. These structures may be attractive for those seeking simplicity and predictability. Municipal ladders are cost effective, “buy-and-hold” approaches that take a good deal of variability off the table, although they lack the flexibility to proactively react to changing market conditions.

Municipal ladders are typically made up of a series of investment grade bonds that mature sequentially, thereby creating a “ladder.” Bond proceeds are typically reinvested at the top of the ladder, a process that effectively replaces maturity structure as bonds roll down the ladder. This can be advantageous in rising rate environments as maturing capital and income is reinvested at higher nominal yields, although the amount of capital that can be redeployed in a ladder at a given time is limited by the timing of each bond maturity. By contrast, active strategies allow managers to adjust portfolio exposures much more quickly.

It should be emphasized that a laddered portfolio’s income is dependent on yield levels across the maturity range of the ladder at the time of purchase. Yield curve positioning and duration management is determined by the structure of the ladder established at inception rather than reflecting active decisions throughout the life of the portfolio.

Proactive Decision-Making Can Make A Difference

Investors have access to an incredible diversity of options across asset classes, styles, and vehicles. We have long recommended investment grade municipal portfolios as a means of generating high quality, tax-advantaged income, and feel that actively managed separate accountsmaximize our ability to capitalize on changing market dynamics. Ultimately, having the flexibility to adjust portfolio positioning and bond exposures in response to prevailing market conditions has proven to be beneficial over the long run.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience.

"The high-grade tax-exempt markets are typically characterized by relative price stability, particularly when contrasted with lower grade credits, let alone equities. But it’s been anything but the case so far in April, as extreme volatility has driven up municipal yields at an unusual pace. Advisors and investors are understandably looking for answers, and we aim to provide some below. The primary driver of this turbulence is a liquidity crunch, which has been exacerbated by the factors noted below..."

"Cutting through the “noise” during times of high market volatility can be challenging but this piece attempts to do so by offering our perspective concerning recent market events, some historical context, and a few forward thoughts. Appleton’s Wealth Managers are available to discuss your personal circumstances, so please reach out..."

"Exchange-Traded Funds, or ETFs, have arguably been one of the most important investment innovations in recent decades. They allow retail investors to combine the modest investment minimum and broad diversification benefits of mutual funds with the real time intra-day liquidity of stocks. Further, ETFs also offer tax efficiency, in part by not requiring a sale of securities (and the potential realization of capital gains) to meet other investors’ withdrawals..."

Economic & Market Commentary

09.19.2022

Beyond Ladders: Attributes of Active Bond Management

The asset management industry has long wrestled with the active versus passive debate across a spectrum of asset classes. At Appleton, we are strong advocates of active municipal bond management as it affords us the ability to customize solutions and capitalize on opportunities to add incremental yield and total return. Contrasting active municipal strategies with bond ladders, the most common passively managed tax-exempt strategy, warrants considering the characteristics and attributes of each approach.

Dynamic Markets Create Value Opportunities

The municipal bond market is extremely broad and diffuse, which are characteristics that highlight the benefits of research driven active management. Within a $4.0 trillion market featuring more than 1 million bond issues1, tax-exempt bonds introduce distinct regional differences, varying degrees of taxing authority and revenue support, and many unique bond structures. The municipal market is influenced by ever changing technical factors and periodic shifts in investor psychology. Issuance levels, dealer inventory, mutual fund flows, and credit perceptions all impact bond prices, and these and other nuances collectively contribute to an active manager’s ability to identify pockets of relative value.

Our investment process emphasizes proprietary research, issuer quality, and trading liquidity, as these are the building blocks needed to efficiently adjust portfolio exposures when we feel it is beneficial to do so. We believe bond managers with demonstrated expertise can positively impact tax-exempt performance over time by making proactive decisions and employing tactical flexibility not offered by bond ladders.

Foundations of Active Bond Management

Fundamental research drives Appleton’s municipal strategies. Quality is our top priority in security selection and every bond purchased must be investment grade and approved by Credit Research. This proprietary analysis is critical to reducing the risk of credit deterioration and in affecting subsequent buy and sell decisions. Unsettled markets brought on by changing credit perceptions, interest rate pressure, or other influences can be conducive to selective, opportunistic trading; for example, rotating out of fully valued credits, and/or bonds where we anticipate increased risk, and into more attractive issues.

Duration management is a central element of any fixed income investment process given the impact on portfolio yield and interest rate exposure. Active managers typically establish an appropriate duration target and then determine how to structure the portfolio accordingly, whereas duration is pre-defined in bond ladders.

Depending on considerations such as the shape of the yield curve, current interest rate levels, or a manager’s perspective on anticipated rate direction, portfolio duration can be implemented through quite different distribution of bond maturities. Examples include bell shaped, barbell shaped, or bulleted bond holdings, and active managers have the flexibility to later adjust portfolio structures should it be advantageous to do so.

Bond structure refers to the nuances of a specific bond issue, characteristics that vary considerably when comparing distinct offerings of the same issuer. Evaluating factors such as term, call provisions, or the time period between a bond’s call and maturity allows our investment team to select the specific bonds that appear to offer the best contribution to a portfolio’s risk-reward profile. This is important given the extent to which structure can influence how a bond might react to interest rate moves. Analyzing the benefits and risks associated with bond structure demands a combination of trading, research, and portfolio management insight, expertise that is integrated within Appleton’s collaborative investment process.

The Power of Personalization

Appleton municipal portfolios are exclusively invested as separately managed accounts (“SMAs”), as we believe this gives us the flexibility needed to tailor solutions to unique client objectives. SMA investors own individual bond holdings, maintain their own cost basis in each security, and have control over an account’s cash flow, attributes mutual funds and other pooled vehicles do not offer. These and other characteristics give an active manager the potential to add value through proactive tax management.

We also generally look to minimize short-term capital gains and enter positions with the expectation of a multi-year holding period. Portfolios built out with cash are usually initially slightly long of portfolio targets to minimize the need for extension trading and potential accompanying tax consequences. Working closely with advisors, we also seek to realize losses when it is in the client’s interests to do so, although such trading is subject to market liquidity and other potential concerns such as the ability to efficiently reinvest proceeds. Tax management of this nature represents a valuable tool through which our active investment process seeks to benefit municipal clients.

Climbing the Ladder

Passive municipal portfolios are most often managed in the form of bond ladders. These structures may be attractive for those seeking simplicity and predictability. Municipal ladders are cost effective, “buy-and-hold” approaches that take a good deal of variability off the table, although they lack the flexibility to proactively react to changing market conditions.

Municipal ladders are typically made up of a series of investment grade bonds that mature sequentially, thereby creating a “ladder.” Bond proceeds are typically reinvested at the top of the ladder, a process that effectively replaces maturity structure as bonds roll down the ladder. This can be advantageous in rising rate environments as maturing capital and income is reinvested at higher nominal yields, although the amount of capital that can be redeployed in a ladder at a given time is limited by the timing of each bond maturity. By contrast, active strategies allow managers to adjust portfolio exposures much more quickly.

It should be emphasized that a laddered portfolio’s income is dependent on yield levels across the maturity range of the ladder at the time of purchase. Yield curve positioning and duration management is determined by the structure of the ladder established at inception rather than reflecting active decisions throughout the life of the portfolio.

Proactive Decision-Making Can Make A Difference

Investors have access to an incredible diversity of options across asset classes, styles, and vehicles. We have long recommended investment grade municipal portfolios as a means of generating high quality, tax-advantaged income, and feel that actively managed separate accounts maximize our ability to capitalize on changing market dynamics. Ultimately, having the flexibility to adjust portfolio positioning and bond exposures in response to prevailing market conditions has proven to be beneficial over the long run.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience.

What’s Behind Municipal Market Dislocation?

Tariff Turmoil: Observations and Advice

Diving in the Shallow End: Municipal Bond ETF Liquidity