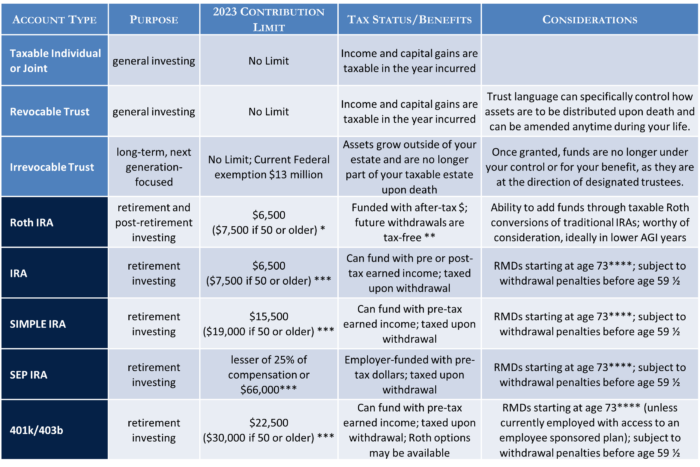

As we begin a new year, a few changes to 2023 retirement account contribution limits are noteworthy. An overview of these changes follows, although consultation with your Portfolio Manager or a tax professional is recommended before considering what options are right for you.

*Roth IRAs have contribution limits based on adjusted gross income; this varies depending on how you file your taxes.

**Subject to withdrawal penalties if held less than 5 years, or if under the age of 59½; income limitations may restrict ability to directly contribute. Please consult a tax expert.

***All contributions are limited, and if income is less than stated limit, contributions are capped at earned income limits. Please see your Portfolio Manager or Tax Expert for more information.

****Given the passing of Secure Act 2.0, the age to begin taking RMDs increased to 73 in 2023 and it will increase to 75 in 2033.

Charitable Giving and Related Legacy Considerations

- When paired with appropriate estate and retirement planning strategies, charitable and personal giving can create valuable tax benefits. We would be happy to have a further conversation surrounding gifting.

- A reminder that you can make qualified 501c3 charitable contributions in the amount of your required minimum distribution at any time during the year. Under Secure Act 2.0, individuals are allowed a one time gift of up to $50,000 to a charitable remainder unitrust, a charitable remainder annuity trust, or a charitable gift annuity. Please consult your Portfolio Manager and tax expert.

- Consider establishing a donor advised fund to front load planned charitable giving as doing so can potentially produce a significant taxable income offset. We are happy to help facilitate a conversation with your account custodian’s charitable giving department.

- 2023 annual federal gift tax exemption thresholds have increased to $17,000 per individual to any other individual. This can be a tax efficient way to transfer assets to your loved ones.

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

[email protected]

www.www.appletonpartners.com