It’s Not Just An Academic Exercise

Sending a child off to college represents one of life’s exciting transition points. While its generally understood that hitting the books in high school can set one up for subsequent academic success, and that higher education savings plans ought to implemented long before matriculation, we encourage clients and their families to also think through a broader set of related financial matters.

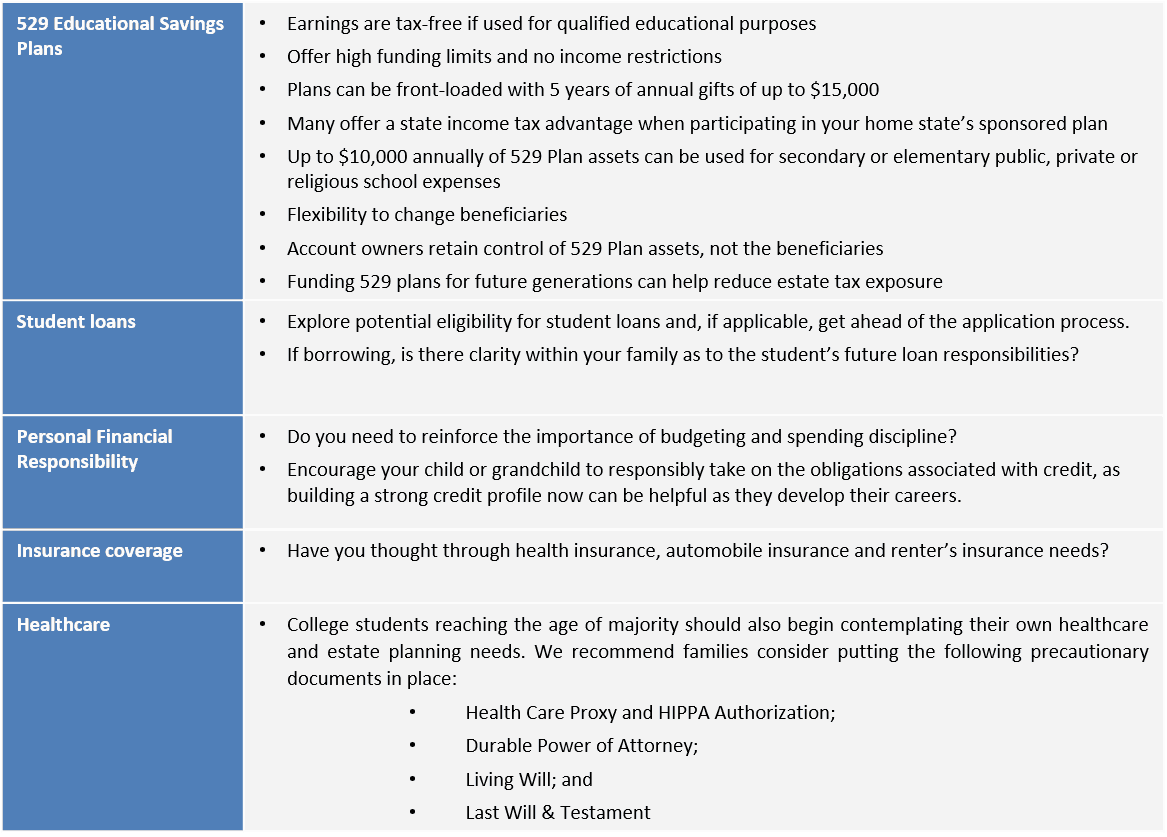

What Factors Should I Consider?

Our Recommendations

Plan ahead and communicate. Helping your children or grandchildren successfully navigate their college years demands more than just academic preparation. We also urge families to take a close look at educational savings and borrowing options, insurance and healthcare coverage needs, as well as engaging in discussions concerning personal financial responsibilities.

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

[email protected]

www.www.appletonpartners.com