Successful Planning Requires More Than Paperwork

At Appleton, we are committed to comprehensive, personalized estate planning and stand ready to help our clients and their families manage what can be a confusing and emotionally challenging process.

At Appleton, we are committed to comprehensive, personalized estate planning and stand ready to help our clients and their families manage what can be a confusing and emotionally challenging process.

Many individuals and families fail to adequately protect their assets, realize their wealth transfer goals, minimize taxation, or achieve philanthropic objectives by not taking prudent estate planning steps.

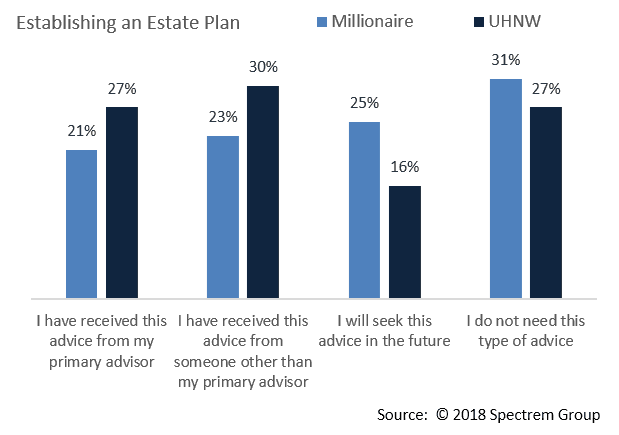

Furthermore, a sizeable percentage of wealthy families have not even received estate planning advice, or do not feel they need such advice. In our view, this can create potential legal, personal and family vulnerabilities during times of stress that could have otherwise been avoided.

What Factors Should I Consider?

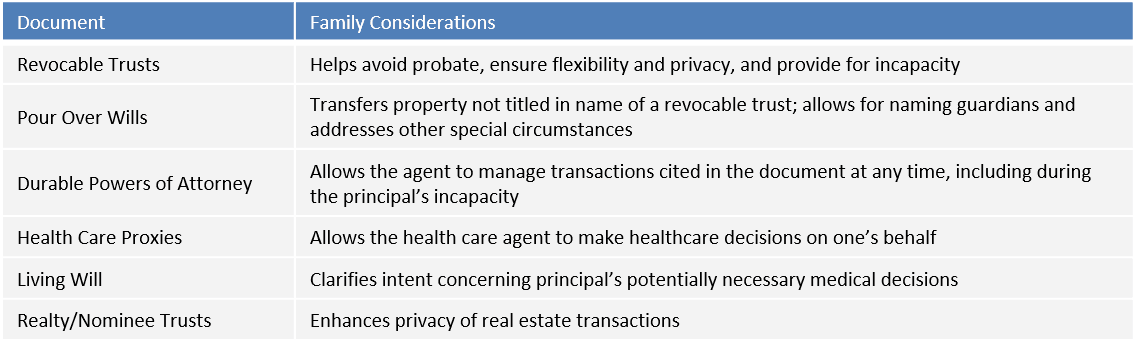

Estate planning is an inherently personal process, as every individual and family is unique. There is no “one-size-fits-all” approach, and reviewing your estate plan documentation with an advisor is highly recommended.

Other important estate planning steps include reviewing and updating beneficiary designations for insurance policies and retirement accounts, considering filing a homestead exemption, and documenting financial assets and other important memoranda.

Our Recommendations

First and foremost, we advise clients to periodically work with their Appleton Portfolio Manager in reviewing estate plans and potential needs. This can help ensure that plans meet your goals, whatever they may be, remain up to date, and optimally reflect your personal wishes. Life is not static, nor should be your estate planning process.

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

[email protected]

www.www.appletonpartners.com