Defining Environmental, Social and Governance Objectives

Appleton has always believed that achieving a client’s unique investment objectives demands active collaboration and a willingness to customize portfolios. We view ESG and impact investments through this same lens and our portfolio managers have helped design personalized values aligned strategies for more than 15 years via selectively screening and/or adding investments in certain sectors per the client’s wishes. Our ESG separate account mandates are built within the foundation of our municipal, Crossover and HGIGC mandates. For risk management and investment process integrity purposes, credit quality, liquidity, duration, and other strategy parameters remain in place.

Appleton has always believed that achieving a client’s unique investment objectives demands active collaboration and a willingness to customize portfolios. We view ESG and impact investments through this same lens and our portfolio managers have helped design personalized values aligned strategies for more than 15 years via selectively screening and/or adding investments in certain sectors per the client’s wishes. Our ESG separate account mandates are built within the foundation of our municipal, Crossover and HGIGC mandates. For risk management and investment process integrity purposes, credit quality, liquidity, duration, and other strategy parameters remain in place.

Working on the development and management of portfolios incorporating ESG-specific requests has taught us that no two clients have the same goals. For this reason, taking a consultative approach better serves our clients than presenting them with a standard Appleton ESG portfolio. To help in identifying ESG themes that may be most important to you, some common considerations are highlighted below.

Tailoring Exposures Based on Individual Ideals

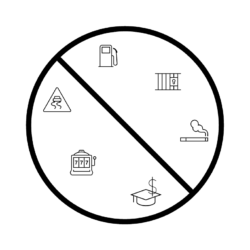

A frequently employed ESG practice involves screening out certain sector or thematic exposures. Doing so allows clients to avoid having their assets invested in bonds whose use of capital is considered undesirable. A few common tax-exempt screening exclusions include:

- Fossil Fuel

- Correctional Facilities

- Tobacco

- For-Profit Education

- Casinos or other Gaming

- Toll Roads (Emissions Reeducation)

ESG focused portfolios may also proactively target specific segments of the market that support an investor’s values and ideals. Green Bonds represent a good example. Municipal green bonds raise money to finance projects that seek to mitigate and/or adapt to climate change. For investors with a “green focus”, our team can work to allocate a portion of their portfolio to bonds specifically certified as “green”. It’s important to note that while green bond issuance has increased significantly in recent years, it is still a small portion of overall municipal issuance.

While green-certified bonds are a popular investment theme for ESG conscious investors, a breadth of other tax-exempt bond issuers may also support a client’s environmental or related values. Examples include bond issuers whose operations and use of capital supports clean water, healthcare accessibility, public education, and affordable housing. While not officially labeled as green bonds, these types of issuers may represent viable options for clients seeking ESG impact.

ESG Analysis Enhances Fundamental Credit Research

Appleton’s credit research team engages in extensive ESG analysis of tax-exempt bond issuers, a process that complements our fundamental research. ESG-related considerations not only support alignment of holdings with client values; they are also an important credit quality input. That is because we believe that favorable environmental, social and governance attributes are positively correlated with efficient municipal and corporate performance, and the opposite also tends to be the case.

Risk mitigation is the primary anticipated benefit of our proprietary ESG analysis. For example, if a city is in an area prone to hurricanes and underinvests in preparedness, a large storm could severely interrupt governmental operations for an extended period. This could have short-term economic ramifications as well as long-term impact, thereby weakening the economy, tax base and credit standing.

Proprietary Scoring Quantifies ESG Evaluation

Depending on the nature of the issuer and bond, our credit research team evaluates up to 7 distinct environmental factors, 21 social factors, and 19 governance factors, although individual issuers within each sector will typically be evaluated based upon 5-8 factors for each ESG category. ESG scores are calculated based on the specific factors that are seen as most relevant to the specific bond issuer.

Social factors such as employment base, education, and poverty rates influence our view of the stability and growth potential of a local economy. Environmental factors such as fuel diversity and compliance with federal clean-water regulations reflect prudent management of electric and water utilities. Good governance is an important element of fiscal management and ultimately a municipality’s credit quality.

Let’s Discuss Your Goals

The focus Appleton places on collaboration and customization helps to ensure investments reflect what matters most to you. Appleton’s team is happy to work with you to develop an ESG investment strategy that suits your goals.

Appleton’s ESG Score is based on a set of predetermined ESG factors identified and determined by Appleton. These factors are not all-inclusive and are subject to Appleton’s discretion. Consequently, scores are representative of Appleton’s research, due diligence and judgement and should not be construed as being endorsed by any regulatory authority or ESG-based organization. A list of applicable factors is available upon request. Appleton assigns only one ESG Score for each municipal bond issuer based upon the criteria that Appleton believes is most relevant to the issuer. These scores are not influenced by client inquiries or requests.

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

[email protected]

www.www.appletonpartners.com