Multi-Factor Authentication is a security protocol method in which a computer user is granted access only after successfully presenting two or more types of validation credentials. For example, a password and a code sent to your phone or email.

Multi-Factor Authentication is a security protocol method in which a computer user is granted access only after successfully presenting two or more types of validation credentials. For example, a password and a code sent to your phone or email.

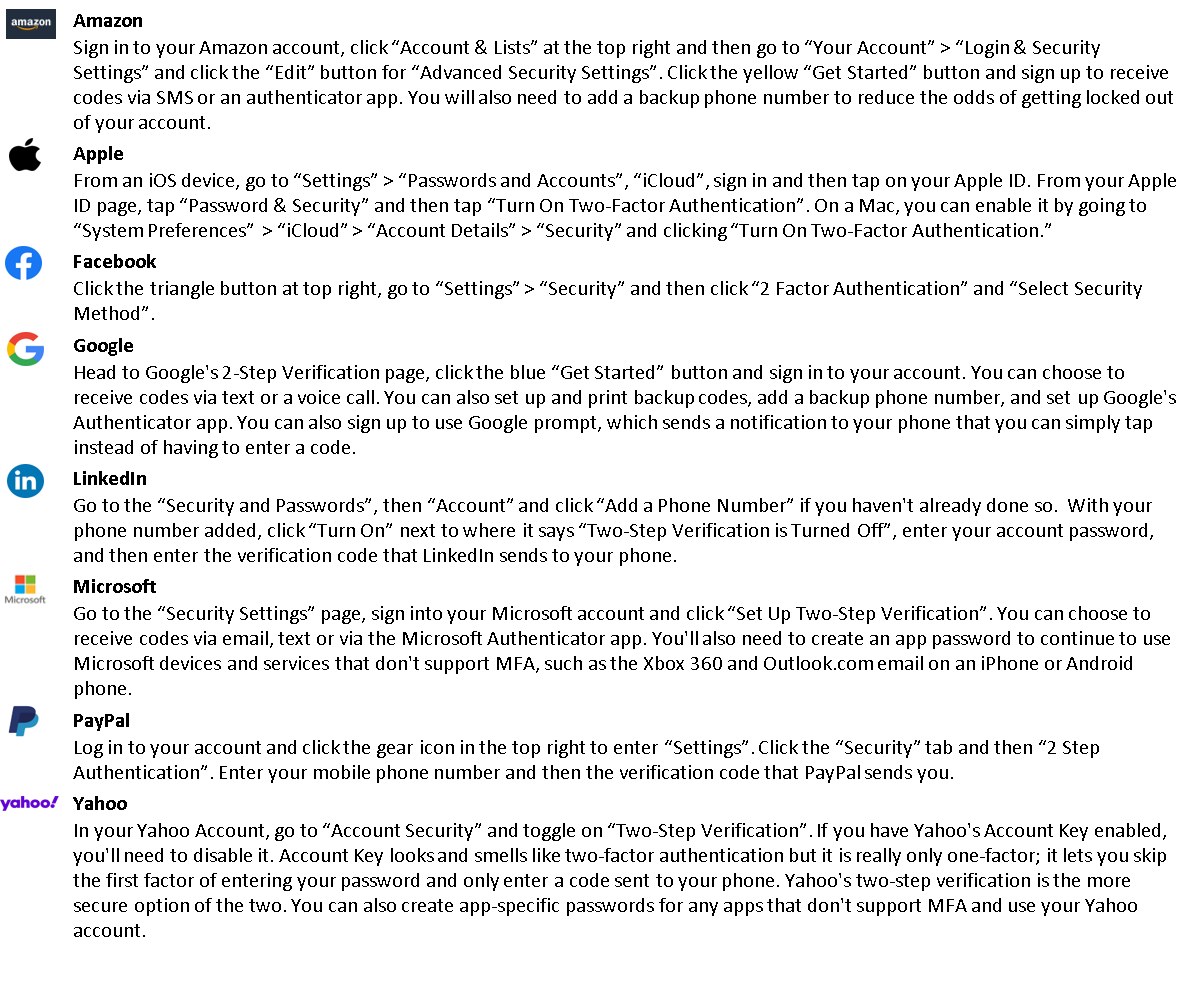

Most web sites that house sensitive personal information and require usernames and passwords offer an ability to implement MFA, although it is often referred to by different names. The process required to set up MFA is unique to individual web sites and may vary depending on how a web site is accessed, but typically involves following steps outlined within “Settings” and “Security”. Directions specific to some of the more popular online destinations follow below.

Multi-Factor Authentication Implementation Instructions

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

[email protected]

www.www.appletonpartners.com