When Should I Begin Taking My Benefits?

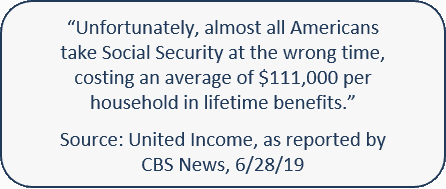

Making a Social Security Retirement Benefit election is a decision nearly all Americans will make during their lifetimes, and one that may significantly influence one’s retirement income. Often, however, information can be confusing, which can lead to making compromised election decisions. When to begin taking distributions may seem straightforward. In reality though, it is not.

Making a Social Security Retirement Benefit election is a decision nearly all Americans will make during their lifetimes, and one that may significantly influence one’s retirement income. Often, however, information can be confusing, which can lead to making compromised election decisions. When to begin taking distributions may seem straightforward. In reality though, it is not.

What Factors Should I Consider?

Here are some important considerations:

- Asset sufficiency and income needs assessment;

- Your anticipated retirement age;

- Your personal health and family longevity history;

- Marital status and your spouse’s social security situation

Notable age milestones:

- 62 is the earliest one can elect to begin receiving benefits

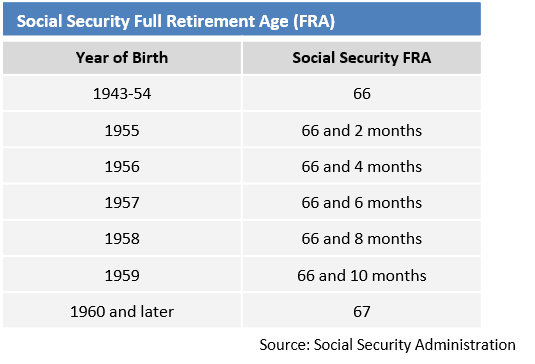

- 65-67 represents Full Retirement Age (FRA) for Social Security benefits

- 70 is the latest one might wish to defer benefits, as there is no value in waiting longer

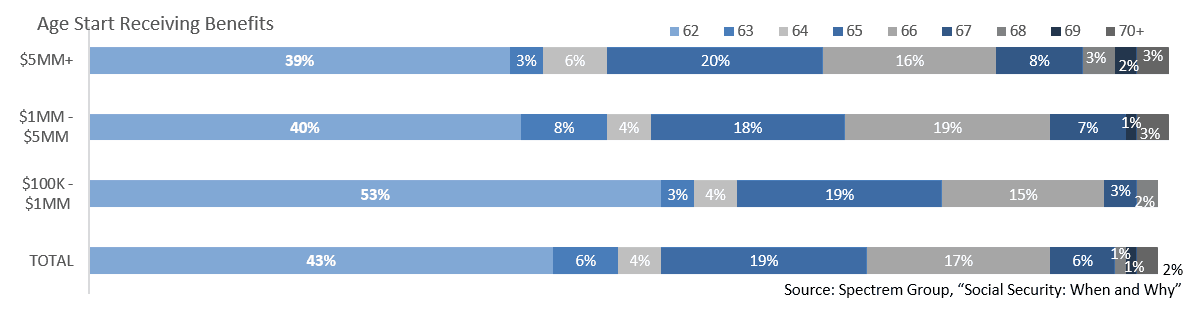

As the below chart reveals, as net worth increases Social Security distributions tend to be deferred. Although individuals receive an 8% benefit increase each year they forgo benefits beyond their Full Retirement Age (FRA), postponing requires current income sufficiency as well as living long enough to make up for the deferred income.

Our Recommendations

- Think about your personal situation. We are happy to help you assess your income needs, age considerations and options before you make an election.

- Visit www.ssa.gov to set up an online account. Take the time to confirm your earnings history is accurate.

- Do not claim benefits before you attain your FRA unless you are certain this is the right choice for you.

- When you are ready to make an informed decision, make an appointment at your local Social Security Administration office. Making elections in person tends to reduce the likelihood of avoidable mistakes.

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

[email protected]

www.www.appletonpartners.com