Stock Market Valuation . . . What the Numbers Tell Us and What Isn’t So Clear

Reading the stock market tea leaves is no longer primarily a challenge undertaken by investment professionals, as anticipating the market’s direction has become part of our popular culture. One need only turn on CNBC and a host of other broadcast and online news sources to access a diversity of opinions concerning market valuation and what may come next for equities. How do broad market metrics relate to performance expectations, and what does Appleton consider when developing portfolio strategy?

A Broader Perspective Adds Insight

A Broader Perspective Adds Insight

Context matters and we believe looking at market metrics such as S&P 500 price-to-earnings (P/E) in isolation can oversimplify the outlook for equities. While statistics of this nature are revealing, stock specific fundamentals remain integral to our decision-making. For us, managing risk requires careful consideration of both idiosyncratic risk – that which is company specific – as well as market valuation.

An Era of Stagflation

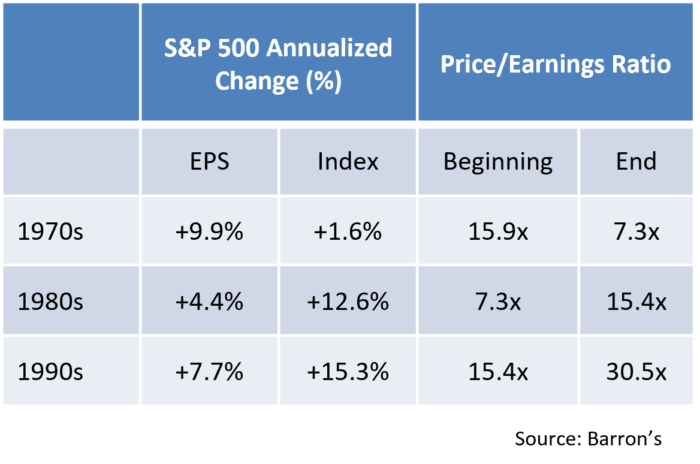

Those who lived through the 1970s may recall gas lines, double digit money market yields, and sharp increases in the actual level and volatility of inflation. Stock ownership creates a claim on the future cash flow of a business, the present value of which depreciates as interest rates increase. As such, the above table reveals the extent to which market multiples collapsed in the 1970s under the weight of high inflation and interest rates. Largely as a result, index returns were weak despite surprisingly strong corporate earnings growth. In hindsight, evaluating company performance without consideration of the macro environment would have left one with far too optimistic an outlook.

Multiple Expansion Fuels Stock Market Gains

The next two decades told quite a different story as index returns far outpaced earnings growth. Why the spike in enthusiasm for stocks in the 1980s despite a decade of largely sluggish growth in corporate earnings (+4.4% annualized)? Quite simply, risk appetite returned as inflation was subdued, interest rates declined markedly, and the economy recovered. Given this cyclical change, P/Es normalized at 15.4x by decade’s end. Investors focusing solely on relatively weak earnings growth may have missed out on multiple expansion-led, double digit annualized S&P 500 performance.

A healthy macro environment gave way in the mid-to-late 1990s to what Former Fed Chairman Alan Greenspan famously referred to as “irrational exuberance” in 1996, the early days of what became known as the “Tech Bubble”. The impact of market sentiment during the 1990s was profound as evidenced by the S&P 500 P/E doubling to a highly elevated 30.5x. As in the prior decade, 1990’s stock returns were fueled by multiple expansion, not earnings growth, as a persistently positive feedback loop persisted until the dot com frenzy finally collapsed in March 2000.

Time Horizon Influences The Drivers of Performance

Time Horizon Influences The Drivers of Performance

What conclusions can we draw from this history lesson? For one, the level of interest rates and inflation matters a great deal in terms of market momentum, as risk appetite tends to rise in low-rate environments as the present value of future cash flow increases. The converse is often the case when interest rates and inflation rise to problematic levels. Over short periods of time, sentiment can be a powerful performance factor.

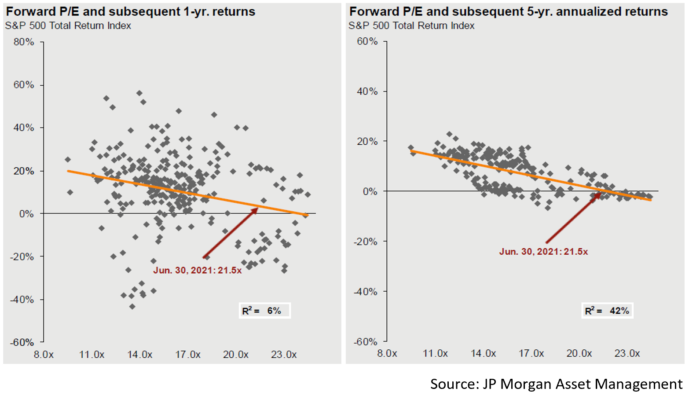

The accompanying S&P 500 forward P/E and subsequent return regression data demonstrates the extent to which current valuation influences longer-term performance expectations. While market valuation has significant predictive value over a period of several years, it has minimal influence in the short term. Corporate earnings and overall risk appetite arguably impact next year’s performance far more than the market’s current valuation level. In our view, valuation is inherently a relative consideration and not necessarily a reason to sell market exposure or an individual security. Nonetheless, higher multiples create reduced margin for error and may serve as a cautionary signal.

Making Sense of the Pandemic Bull Market

Making Sense of the Pandemic Bull Market

The rebound off last year’s lows has been remarkable, with the S&P 500 rising more than 100%. Yet below the surface we see two very different cycles. Multiple expansion fueled by a policy backed resurgence of risk appetite led March 2020 to March 2021’s rally, not corporate earnings growth which languished in the face of economic weakness. In fact, 2020 S&P 500 earnings dropped -14% after incurring -15% and -32% declines in Q1 and Q2 respectively. The ability of the S&P 500 to appreciate more than 20% over the full year despite a sharp drop in earnings reflects investors looking past current conditions as economic prospects improved.

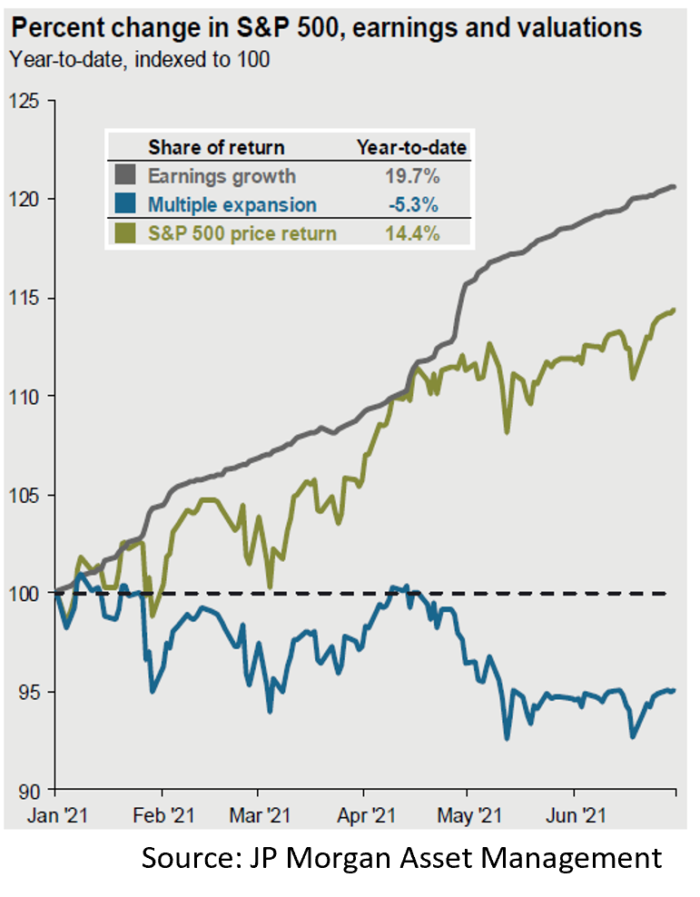

A different market dynamic has been at work so far in 2021 as multiples have begun receding with corporate earnings growth assuming leadership. Q1 2021 earnings grew at 47% and Q2 is expected to be up 90% off last year’s cyclical lows. As a result, the S&P 500 has been able to continue its upward ascent despite multiples contracting from close to 23x to 20.8x. Recent S&P 500 performance attribution is revealing as earnings growth has contributed +19.7% to the Index’s total return through the end of Q2, whereas contraction in market multiples has detracted -5.3%. Despite strong earnings growth, we are now in an environment marked by concern about inflation, prospective interest rate hikes, and Federal Reserve tapering. These potential headwinds have contributed to contracting sentiment, and earnings rather than a rising tide must lead the market forward.

A degree of caution is warranted, as not only P/E but also metrics such as Price/Book, Price/Revenue and CAPE (cyclically adjusted P/E) are relatively high. Yet it bears reemphasizing that valuation is relative and digging more deeply into the macro context offers us comfort. In stark contrast to earlier decades, interest rates and bond yields remain at extraordinarily low levels. The flagship 10Yr UST yield of 1.29% is roughly equivalent to the S&P 500’s dividend yield. And at a forward P/E of 20.8x the S&P 500’s earnings yield is a healthy 4.75% in a very low yield environment. Despite anticipated moves towards normalization, the Federal Reserve is being extremely careful about pulling back on liquidity and monetary policy support.

As investors, while it is incumbent upon us to recognize cycles marked by differing macroeconomic conditions, policy direction, and investor sentiment, such analysis should not displace stock specific research. Appleton’s analysts also focus intently on a company’s balance sheet, competitive position, and management. Our approach is often considered “GARP”, or “Growth at a Reasonable Price.” How much we are willing to pay for a stock is influenced by its anticipated growth rate as well as the market environment. A useful way to view expected growth relative to price is through a stock’s PEG ratio, or simply P/E divided by earnings growth rate. In our view, the value of a stock in a low rate, expanding economy is higher than in a higher rate environment grappling with less favorable macro conditions.

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

[email protected]

www.www.appletonpartners.com