Don’t Allow Tax Reform To Create Complacency

Last year’s tax preparation season was the first following passage of the 2017 Tax Cuts and Jobs Act. Individual tax reform implications, including doubling the standard deduction and imposition of a $10,000 state and local tax deduction (SALT) cap, have been widely discussed. As expected, the number of filers itemizing deductions in 2018 dropped significantly from roughly 45 million to 18 million.

While tax planning may have gotten a lot simpler for most, there are still many important items to consider heading into year-end. Acting now can help reduce your near and longer-term tax burdens.

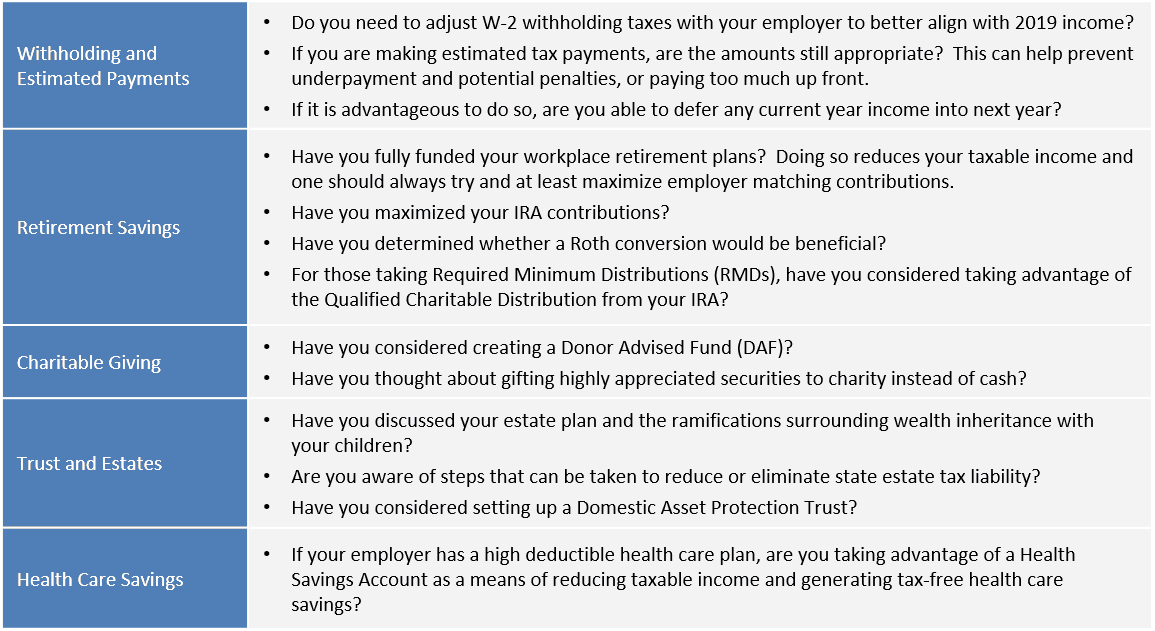

What Factors Should I Consider?

Our Recommendations

Be proactive. Informed tax planning is essential to efficiently managing current obligations as well as the amount of your wealth that can be shielded from future estate taxes. Working closely with your tax advisor and portfolio manager can make a big difference. Reach out and let’s plan together.

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

[email protected]

www.www.appletonpartners.com