Appleton Wealth Management recognizes the importance of integrating estate plans with client investments and assets as part of each client relationship. As part of the client onboarding process, we offer a review of our clients’ current planning documents to determine if they continue to meet their ongoing goals and objectives.

Why Plan?

In our experience, people often are reluctant to engage in the estate planning process because they don’t know where to begin, think it something to address later in life or don’t wish to face their own mortality. However, addressing these issues presently can provide peace of mind knowing that assets will pass to the loved ones or charities that they desire.

In addition to ensuring that families are protected financially, there a numerous benefits to planning, some of which include:

- Avoiding probate and its associated costs and delays;

- Maintaining family privacy;

- Addressing incapacity and providing continuity;

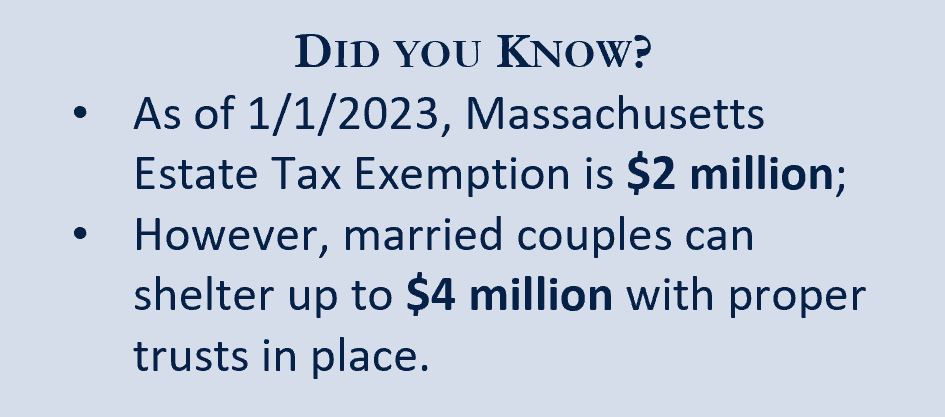

- Minimizing state and federal estate taxes;

- Providing creditor protection;

- Helping to reduce possibilities of intra-family disputes; and

- Business continuity.

While each family is unique and while each may have differing needs, creating and funding your estate plan now can go a long way to ensuring peace of mind, family security and the knowledge your assets will not be subject to unnecessary taxes or claims.

What core documents do most individuals need?

Depending upon asset levels and specific client circumstances, most individuals should have the following core documents as part of their base estate plan:

- Revocable Living Trust;

- Pour-over Will;

- Durable Power of Attorney;

- Health Care Proxy; and

- Living Will.

How can Appleton assist?

Recognizing the importance of estate planning as part of the wealth management process, we routinely review estate planning documents to make certain our clients not only understand their operation and impact but to insure they comport with their ongoing wishes. For those that have yet to engage in the estate planning process, we can review your goals and assets and suggest the appropriate instruments to meet your objectives. While Appleton cannot draft or write these documents we can make estate planning attorney recommendations and work with you to review draft documents.

As a fiduciary with your best interests in mind, we routinely engage with clients’ estate planning attorneys and CPAs to address our clients’ planning needs and work to keep our clients informed of relevant tax law changes that may impact their planning.

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

[email protected]

www.www.appletonpartners.com

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. This presentation may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements. Historical performance is not indicative of any specific investment or future results. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor.

Any references to outside content are listed for informational purposes only and have not been verified for accuracy by Appleton. Appleton does not endorse the statements, services or performance of any third-party author or vendor cited.

INVESTMENT PRODUCTS: NOT FDIC INSURED – NO BANK GUARANTEE – MAY LOSE VALUE