Insights and Observations

Economic, Public Policy, and Fed Developments

- Once again, trade hopes and fears were the biggest market movers over the past month. The stock market initially rose on Chinese reports that a “Phase One” deal would involve a rollback of existing tariffs, despite the Trump Administration’s cautionary reaction. The deadline to impose tariffs on EU auto imports also passed without action. However, Trump surprised markets at the start of December by imposing steel and aluminum tariffs on Brazil and Argentina, accusing them of “aggressive devaluation” of their currency. Although net beneficiaries of China’s agricultural imports being redirected from the US, both nations have recently been fighting, not encouraging, devaluation. Trade hopes faded further when Trump indicated he would be happy to wait for a Phase One trade deal until after the 2020 election, and that any such deal would have to be favorable for the US. We see little reason for the Chinese to sign an agreement perceived to be detrimental to their interests and feel this development is more indicative of stalemate than negotiating posture. The possibility for missteps remains high, with additional tariffs slated to go into effect on December 15th.

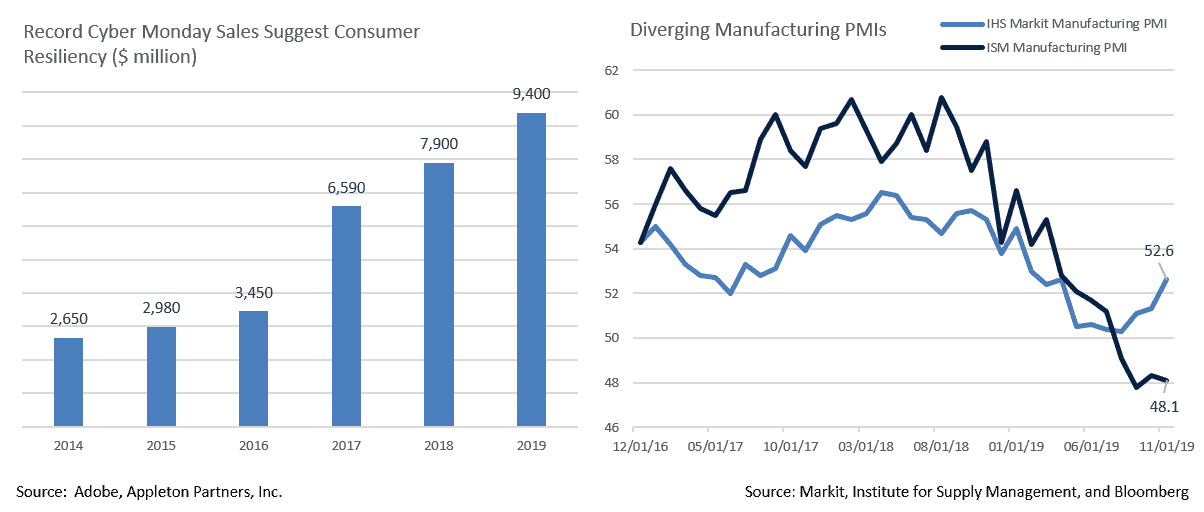

- While softening consumer confidence suggests recession fears have not yet been put to rest, we remain encouraged by the resilience of the US consumer. Retail sales beat modestly, although largely on the strength of volatile auto and gas sales. Likewise, a modest upward revision to the final University of Michigan consumer confidence survey didn’t fundamentally change a somewhat tepid reading. However, consumers came out in droves for the start of the holiday shopping season with both Black Friday and Cyber Monday posting year-over-year increases in online sales of roughly 20%. US consumers may be nervous about the economic outlook, but for now they don’t appear to be letting that discourage holiday spending. Experian reports that consumers expect to spend an average of $1,649 this holiday season, a 75% increase from 2018.

- Other economic indicators were less encouraging. Core PCE unexpectedly fell from 1.7% to 1.6%, suggesting further stimulus may be necessary to meet the Fed’s 2% inflation mandate. Durable goods orders surprised to the upside, but only just enough to maintain a flat trendline. Meanwhile, ISM manufacturing missed, slipping to 48.1 vs expectations of 49.2 (readings of less than 50 indicate contraction). An alternate measure, the IHS Markit PMI Index which favors a broader pool of smaller companies and gives more weight to new orders and output, pointed to a manufacturing recovery. A possible interpretation of this apparent disconnect is that the IHS index more readily captures the economic pulse of smaller, domestically-focused companies less susceptible to global trade.

- Odds of a Fed Funds Rate cut currently don’t exceed 50% until June, although it may become increasingly difficult for the Fed to cut rates close to the 2020 elections while maintaining a perception of political independence.

Equity News and Notes

A Look at the Markets

- Investors had much to be thankful for this year as the S&P 500 returned 3.6% in November to raise its year-to-date gain to 27.6%, the 14th best return through Thanksgiving in the Index’s history. Optimism over a “Phase-One” trade deal with China, an accommodative Fed, better-than-feared Q3 earnings, and stabilizing global economic growth all contributed to the positive momentum.

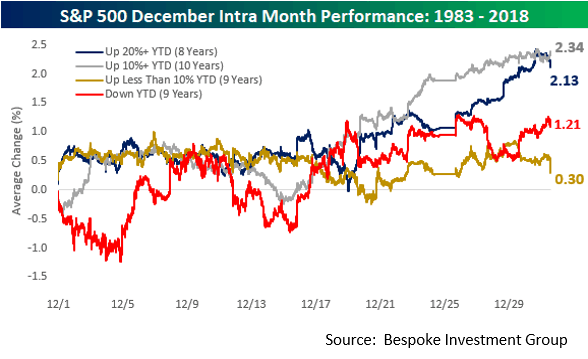

- December has historically been kind to equity investors, last year notwithstanding, with an average monthly return of 1.5% over the past 35 years. Interestingly, the market tends to do better than average when up over 20% heading into December, with an average gain of 2.1% over those 8 occurrences since 1983. December’s positive returns tend to occur in the back half of the month, a phenomenon known as the “Santa Claus rally.”

- The consumer has continued to drive the US economy and support equity markets despite handwringing about the prospects of recession from various pundits and media outlets. A low unemployment rate, positive wage growth, rising household net worth, and multi-decade lows in debt-to-assets and debt-to-disposable income have fueled household spending. As we highlighted on the preceding page, one needs look no further than Black Friday and Cyber Monday sales to come to the same conclusion. Americans spent a record $7.4 billion and $9.2 billion online respectively on Black Friday and Cyber Monday. Encouragingly, despite the continued shift to online sales, brick and mortar stores actually generated sales growth of 4.2%.

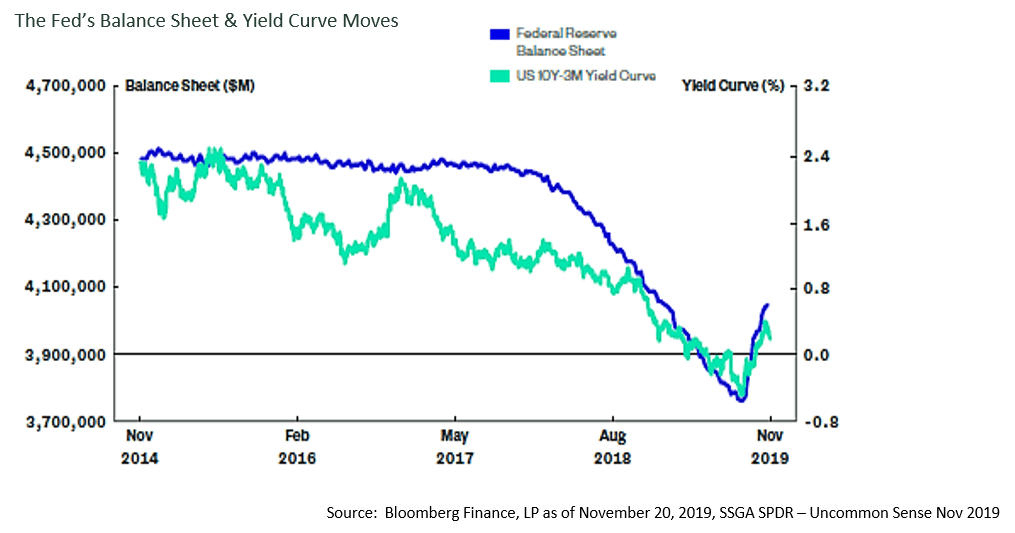

- A strong tailwind for risk assets has been provided by the Federal Reserves’ accommodative monetary policy stance. Given a sustained lack of meaningful inflation, the Fed is likely on pause following three rate cuts made during the July to October period. However, the Fed has been easing in another not as often talked about way – expanding its balance sheet. As seen in the chart below, the Fed’s balance sheet has increased by over $250 billion over the past few months, largely in response to turbulence in the repo markets. This has corresponded with a steepening of the yield curve. The “un-inversion” of the curve has been a positive recent driver for stocks and reminds us of another oft used axiom in the market: “Don’t Fight the Fed”.

- A strong tailwind for risk assets has been provided by the Federal Reserves’ accommodative monetary policy stance. Given a sustained lack of meaningful inflation, the Fed is likely on pause following three rate cuts made during the July to October period. However, the Fed has been easing in another not as often talked about way – expanding its balance sheet. As seen in the chart below, the Fed’s balance sheet has increased by over $250 billion over the past few months, largely in response to turbulence in the repo markets. This has corresponded with a steepening of the yield curve. The “un-inversion” of the curve has been a positive recent driver for stocks and reminds us of another oft used axiom in the market: “Don’t Fight the Fed.”

From the Trading Desk

Municipal Markets

Municipal Markets

- The Municipal curve continued to steepen during November with the spread between AAA 2s to 10s ending the month at 44 basis points, up from lows of 20 basis points at the beginning of the quarter. The recent steepening creates an environment more favorable to selling shorter bonds and buying some longer ones than when the curve is flatter. With this in mind, we are reviewing client duration targets and looking for opportunities to extend maturities after holdings have rolled down the curve.

- As a tax efficient manager, we proactively seek to realize losses in portfolios. However, given the rate environment over the last 11 months and tight credit spreads, there are very few meaningful losses in our portfolios. Should there be client requests, we ask to be made aware as soon as possible and will review the portfolio.

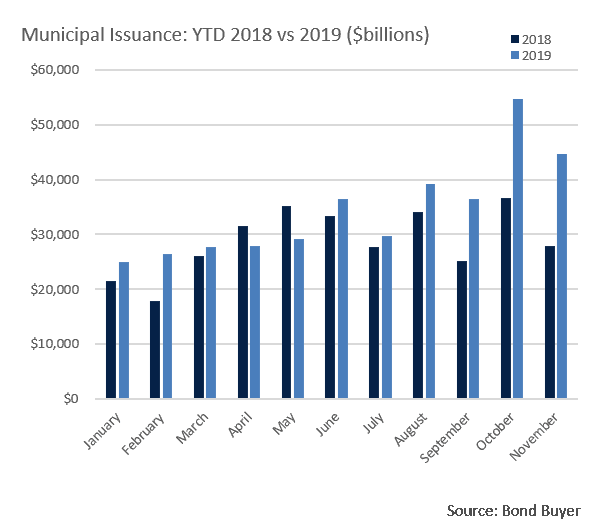

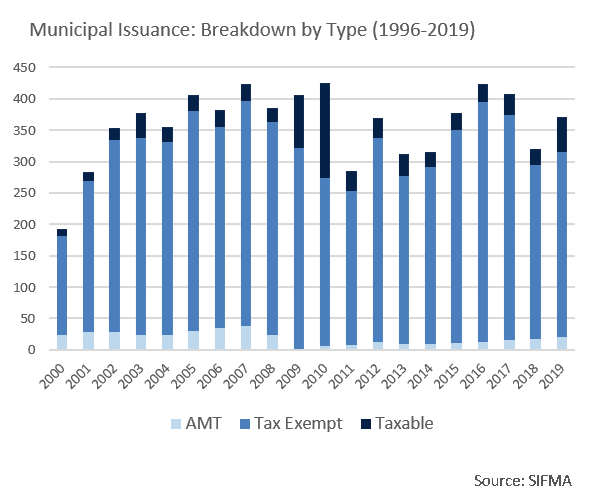

- A jump in municipal issuance has driven year-to-date totals to $377.67 billion, 11% ahead of 2018’s full year. This year began quite slowly, although more recent offerings have since catapulted issuance ahead of 2018’s pace on the back of falling rates. After a slow Thanksgiving week, $18 billion was expected to come to market the following week. As has been the case all year, demand is more than meeting supply with year-to-date municipal mutual fund flows now exceeding $84 billion.

Taxable Markets

- The months of October and November produced a surge in taxable municipal Issuance. The $25.9 billion issued in those two months alone narrowly surpassed 2018’s entire total of $25.1 billion. This year’s $56.1 billion of new taxable municipal debt is already the largest annual total since the Build America Bond (BAB) market boom of 2010.

- New supply was spurred by several factors, most notably a sharp drop in yields late in the year. This created the potential to economically refund tax-exempt debt with taxable issues. At Appleton, we see this as a positive trend as it has unearthed incremental value opportunities in our High-Grade Intermediate Gov’t/Credit and Strategic Municipal Crossover strategies.

- With investment grade corporate credit spreads trading at rich levels, the ability to invest in highly rated bonds with relatively low risk profiles, no M&A exposure, and low correlation to most other asset classes can be attractive. Taxable municipals have had appeal to non-US buyers, insurers looking to meet capital requirements, and other risk-conscious liability-driven investors. Not surprisingly, California, Texas and New York have produced the largest taxable municipal supply.

Financial Planning Perspectives

2020 Taxes: A Look Ahead

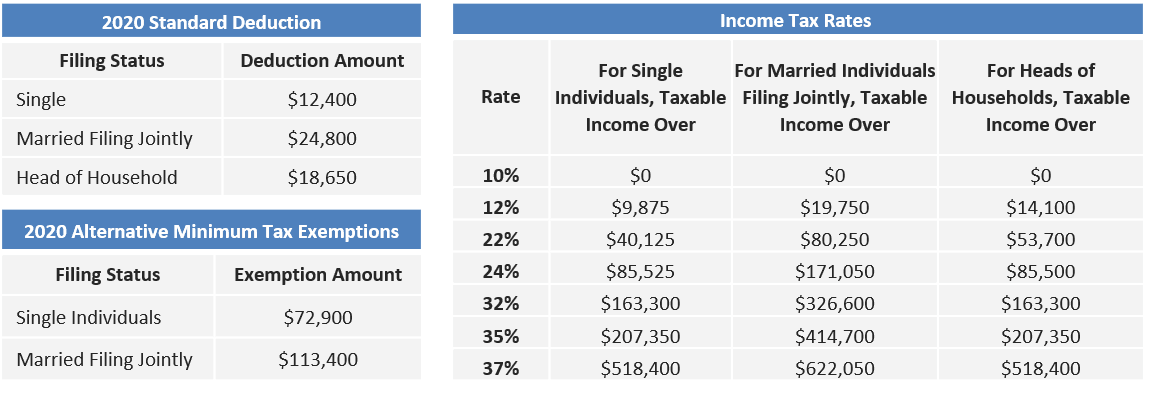

Last month’s Financial Planning Perspectives focused on proactive individual tax and planning considerations heading into year-end 2019. We are continuing this theme by summarizing 2020 inflation-adjusted brackets, standard deductions, retirement plan caps and other changes. Reviewing these tables with your tax advisor can help in identifying beneficial planning and retirement savings considerations.

A review of 2020 IRS forward guidance reveals several points of note:

- The Annual Gift Exclusion remains the same at $15,000 per individual

- The Child Tax Credit remains at $2,000 per qualifying child and is not adjusted for inflation

- Federal Estate & Gift Tax Exemption has increased from $11.4 million to $11.58 million

- 20% capital gains rates will begin at $441,450 of income for individual taxpayers and $496,600 for those married filing jointly. Most others will pay 15% and some will have no liability.

- Defined Contribution Plan Limits for 401(k), 403(b), Thrift Savings Plans and certain 457 Plans have increased $500 to $19,500

- Furthermore, “catch-up” provisions available to those ages 50 or older increased by $500 to $6,500

Although individual circumstances differ and often warrant personalized tax strategies, we encourage clients to plan well ahead of filing their returns. Understanding changes in IRS regulations can uncover opportunities to trim your tax bill while more efficiently pursuing retirement savings, charitable giving, or other financial objectives. For a complete list of updates, please see Revenue Procedure 2019-44.

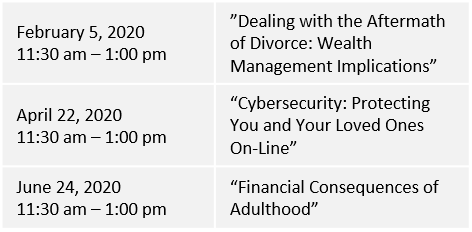

Appleton Answers: “Lunch and Learn” Workshops

Appleton Partners is pleased to continue hosting a series of “Lunch and Learn” workshops that began this November. Each meeting will gather a small group of clients to discuss a specific topic. Space is limited so please sign up for whatever session(s) is of greatest interest. These interactive workshops will be held in our office at One Post Office Square on the 20th Floor. Parking at The Garage at Post Office Square (across Pearl Street below the park) will be validated.

To sign up, click here: EVENT REGISTRATION. We encourage you to invite a family member, friend or colleague whom you feel would benefit from participating. Please use the same process to register them in their own names.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]