Insights and Observations

Economic, Public Policy, and Fed Developments

- After 35 days, the longest government shutdown in US history ended on January 25th. Facing attrition within his own party, and after an air traffic controller shortage briefly led to a ground halt at LaGuardia Airport, the President signed a 3-week continuing resolution. This resolution did not include wall funding, but appropriated $5.7 billion for border security measures, including modernizing ports of entry and additional immigration justices. Trump left the door open to shutting the government down again or declaring a national emergency on February 15th when the continuing resolution expires, but he will be working from a considerably reduced bargaining position. Polls revealed he was losing in the court of public opinion, leaving Congressional Republicans with little appetite for a second shutdown. The CBO estimates the protracted battle has already reduced Q1 ‘19 growth by 0.4% due to lost wages and delays in government activity.

- Fed Chairman Jerome Powell’s gradual effort to walk back market-rattling comments from the December FOMC meeting culminated in the January 30th meeting. Noting that “we don’t have a strong prior – we’re not making a judgement,” Powell stressed the importance of inflation to the Fed’s decision making, reiterated that their inflation target is symmetrical, and notably made no mention of the dot plot or prospects for two hikes in 2019. This was broadly interpreted as a commitment to pause interest rate hikes. We would argue this isn’t entirely accurate; instead, Powell has abandoned a preset rate path and committed to be data-dependent. We view this as positive and do not feel that the current inflation picture dictates further rate hikes. Should that change, investors ought not rule out Fed activity later in the year.

- Trade negotiations continue, with Chinese negotiators reportedly offering to increase purchases from the US to close the trade deficit by 2024; US negotiators are allegedly holding out for 2021. This may be difficult in practice, as the primary driver of the trade deficit is US demand for Chinese goods and increased Chinese purchases from the US would require corresponding cuts from other countries. Complicating the picture, the US filed charges against Huawei, a large Chinese telecommunications equipment and consumer electronics manufacturer, on January 28th, alleging theft of trade secrets and violation of Iranian sanctions. Trade negotiations are delicate and progress on intellectual property law has been difficult. Nonetheless, we believe the market would embrace even a somewhat superficial deal, as it would reduce the risk of tariff escalation and provide forward business clarity. The trade war appears to be weighing on corporate earnings – Apple, Caterpillar, and Nvidia all cut guidance in January citing Chinese weakness.

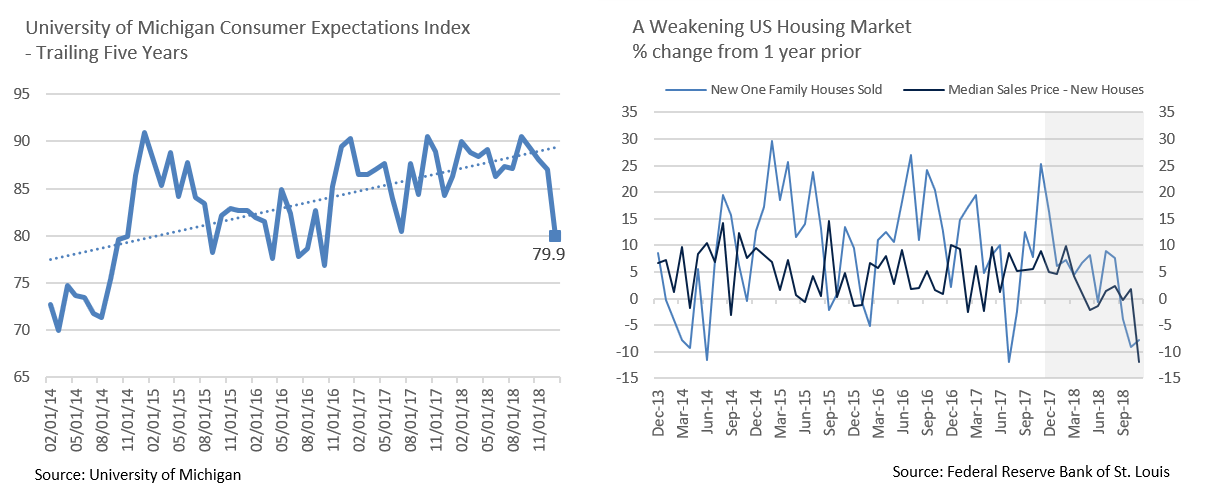

- While most economic indicators remain robust, a few suggested economic softening in January. The housing market may be showing signs of topping; new single-family sales crested in May, and median selling prices have begun to fall. Finally, the University of Michigan Consumer Expectations index dropped to the lowest level since October 2016. The timing of the release suggests the government shutdown may have impacted the reading, and December’s equity market sell-off also likely weighed on the indicator. We anticipate a rebound in February consumer confidence, assuming a second shutdown does not occur.

Equity News & Notes

A Pause Is Likely After January’s Rebound

- During periods of heightened volatility, superlatives often describe stock market moves. So, it was not surprising to see that the “worst quarter since 2011” (Q4 ’18) was followed by the “best January since 1987”. After a dismal three-month stretch, the S&P 500 rallied over 15% from its 12/24 low and sat at +8% YTD at the end of January. What’s been driving the rally? High-beta stocks that led on the downside have been leaders on the way back up. SPHB, an ETF that tracks high-beta stocks, is up 21.7% since the 12/24 low, while its low-volatility counterpart, SPLV, is only up +11.7%. Despite this disparity, market breadth has been positive, a good technical sign.

- Why have stocks rallied? Let’s recall the reasons offered for Q4’s decline – fears of an escalating trade war with China, a global economic slowdown, potential for a Fed monetary policy mistake, and concern about corporate earnings. Throw in a contentious political climate and equity investors had a host of reasons to be fearful. While these risks remain very real, we argued that the price reaction was overdone. The direction was right, just not the magnitude. As January concluded, the two principal headwinds – China trade and the Fed – had both somewhat abated. Trade détente with China (likely in the form of a loose “deal”) has become our base-case assumption. The Fed has also pivoted to a more patient posture on monetary policy. While global economic growth has been decelerating, the US remains a bright spot, as evidenced by the January jobs report (+304K) and ISM results (56.6 vs 54.2 consensus). Investors have gotten more comfortable with slowing growth and are no longer pricing in a “hard landing.”

- As we push through earnings season, corporate results have been mixed. Not great, but better than feared. Economic conditions are not binary. There is a solid middle ground between rapid growth and a damaging slowdown. The blended annualized earnings growth rate is currently 12.5%, well below the 16.3% estimate of 9/30/18, but on track for the fifth straight quarter of double-digit growth. Analysts and investors alike have lowered the bar for corporate earnings, a prudent step that creates a constructive backdrop for potential upside surprises. We’re seeing this dynamic play out positively, as the average stock price has increased by 1.12% on earnings reports this quarter, the highest since early 2009.

- While we are comfortable with equity valuations given lack of recessionary indicators, a recent modest weakening US dollar, recovering oil, and improving trade and Fed sentiment, near-term expectations ought to be tempered. The market will need to digest its rapid growth off the Christmas Eve low. It is impossible to predict day-to-day moves, but we wouldn’t be surprised to see some retracement of recent gains. Market recoveries are rarely “V”-shaped, and, in our view, equities may have entered overbought territory given the swiftness of the recovery.

- Finally, a few comments on the US dollar. The dollar has strengthened over the past year as investors flocked to the greenback amidst Fed tightening, trade war concerns, and the disparity in economic growth between the US and the rest of the world. Though it hasn’t gotten as much press as tariffs, US multinationals have cited a stronger dollar as one of the biggest risks heading into 2019. With some of those concerns fading, the dollar has weakened a bit and could provide a tailwind for equities. A lower dollar also helps commodities (oil) and emerging markets, both of which are positively correlated with risk appetite.

From the Trading Desk

Municipal Markets

- Market technicals remain favorable, with January’s issuance of $22.34 billion lower than expected, and up only slightly from a weak first month of the prior year according to Thomson Reuters. New money volume of $16.05 billion fell 6.8% vs. the same period of 2018. Issuance should pick up as the year progresses, with analysts looking for roughly 10% growth relative to 2018’s level of $338.9 billion. Demand has been supported by a bounce back in mutual fund flows which turned positive over the last two weeks of 2018 and remained strong in January with $3.99 billion of net inflows.

- Our tax-exempt portfolios have had a longstanding preference for premium bonds, an element of our investment process that reflects several objectives. Premium bonds have a lower sensitivity to changes in interest rates than par or discounted bonds due to their higher current income, which moderates a bond’s duration. Cash flow from premium bonds creates an enhanced ability to reinvest at higher rates should interest rates rise. Premium callable bonds also offer greater protection against extension risk, as higher coupons generate a cushion to absorb yield increases before a bond trades to maturity, which can add unwanted duration. Sheltering clients from the “market discount”, or De Minimus Tax, is another reason we prefer bonds trading above par.

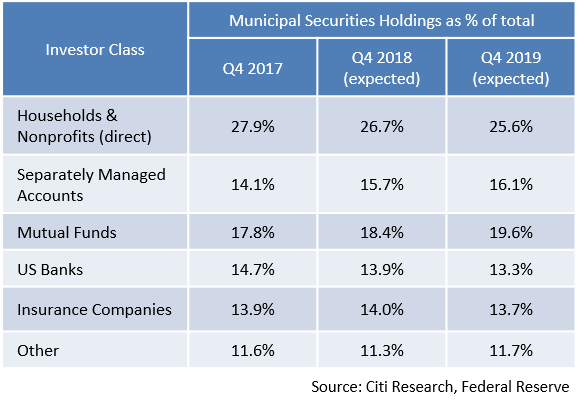

- Although the Federal Reserve estimates that the $3.77 trillion municipal securities market will end 2018 having declined by 1% relative to 2017 and should remain flat in 2019 ($3.75 trillion projected), the market’s ownership structure is evolving. Banks and P&C insurance companies are reducing their municipal holdings due to 2017’s corporate tax reduction, although demand is growing through separately managed accounts and mutual funds.

Taxable Markets

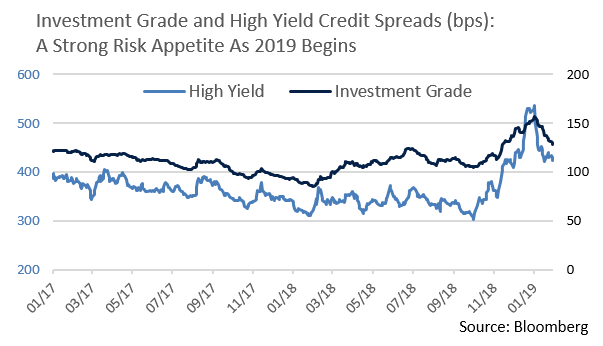

- Q4’s negative corporate credit sentiment turned sharply positive in January with the Investment Grade and High Yield markets enjoying one of their best months in several years as spreads tightened by 35 and 103 basis points, respectively. Economic slowdown fears abated, fostering strong market demand. Corporate bond issuance of $125 billion was up 45% in 2018 from the prior year’s $86 billion as issuers took advantage of generally favorable market conditions.

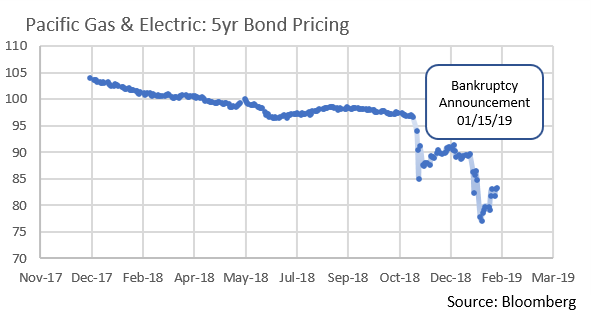

- The biggest corporate news was Public Gas & Electric (PG&E), the nation’s largest utility, filing for Chapter 11 bankruptcy on January 29th, a fallout from California’s catastrophic wildfires. With more than $50 billion in liabilities and facing onerous legal claims, PG&E’s fate will impact many stakeholders, including equity and bond owners, and municipal entities with electric grid and other service relationships with PG&E. PG&E has $22 billion in outstanding debt, including $920 million of municipal obligations. PG&E bond prices have been volatile and should remain so until the extent of the utility’s liabilities, and the path this complex bankruptcy takes, becomes clearer. Appleton Partners does not own PG&E debt in any client accounts. PG&E’s travails have largely been viewed as idiosyncratic and have yet to impact corporate risk appetite.

Financial Planning Perspectives

Financial Literacy: Educational Resources to Consider

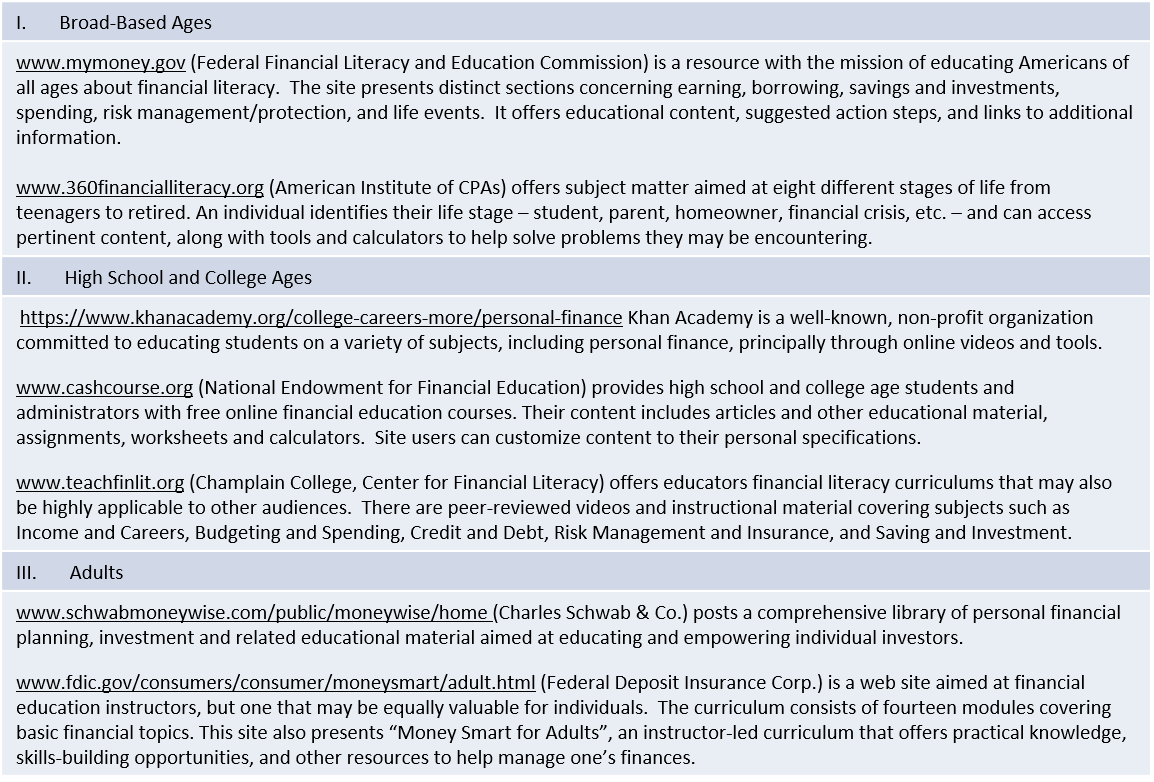

January’s Review and Outlook discussed financial literacy, a national educational challenge that is becoming ever more acute as America’s population ages and wealth transfer accelerates. This subject struck a chord with many clients and we are following up with recommended educational resources. Your feedback is valued, so please let us know how we can help your family members better understand and address their financial planning needs.

At Appleton, safeguarding your assets and privacy is an absolute priority. While the assets of your account(s) we manage are housed at your custodian bank, we maintain internal practices to keep your non-public personal information secure. We carefully monitor the physical security of our office as well as our IT systems, engaging outside support and testing on the latter. Your Private Client Services team, and all Appleton personnel, is trained on cybersecurity and fraud detection. They are your first line of assistance concerning the security of your portfolio and personal information. Email and telephone fraud schemes have unfortunately become routine. Please note that we will never seek personal information that is not pertinent to our management of your account. For example, you will never be asked by us to change or reveal passwords, for access to your computer, to wire money, or disclose credit card information. We are here to help and invite you to call us with questions or concerns.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]