Insights and Observations

Economic, Public Policy, and Fed Developments

- After President Trump killed an 11th hour short term spending bill passed with bi-partisan support by the Senate based on its failure to increase funding for his border wall, the Federal Government shut down at midnight on December 20th. While initially saying he would be proud to shut down the government over border security, Trump quickly pivoted and blamed Democrats. With Congress unable to pass a bill with Trump’s desired $5.6B for a border wall, and with the President currently refusing to back down, some creativity may be required to pass a spending bill. A potential deal where the Democrats agree to increased border security resources, including creative border barrier funding language, in return for clarity on the legal status of DACA has been hinted at by various parties. Resolution is important to settling highly volatile markets, as the current impasse will shave 0.1% off of GDP every two weeks according to the Council of Economic Advisors, while also dampening appetite for risk assets.

- November’s employment report came in light at 155k vs expectations of 198k, with unemployment unchanged at 3.7%. Average hourly earnings also missed slightly at 0.22% vs. 0.30%. Digging more deeply, with the workweek decreasing by a tenth of a percent, average weekly earnings were up only 0.07%. The Real Earnings Summary report painted a similar picture, with real average hourly earnings up 0.3%, but real average weekly earnings declining 0.1% due to a 0.3% drop in the workweek. While this was a weak report, it was not so weak as to cause fundamental concern that the economy was teetering on recession, and the market took it in stride. We feel similarly and are more concerned about interest rate policy, trade, and other aspects of DC politics than the current state of the US economy.

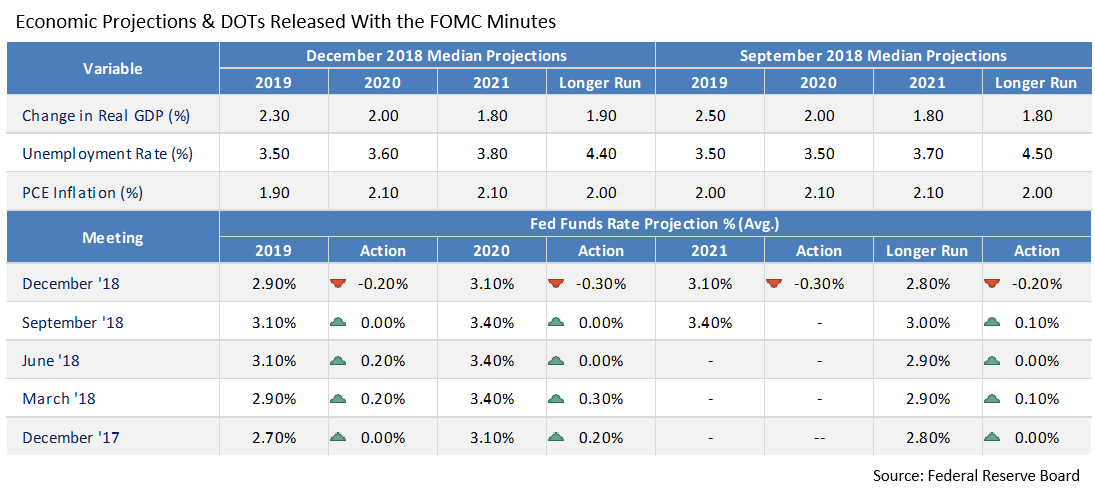

- That said, when the Fed met on December 19th, they raised short term rates a quarter point, but surprised markets by only reducing their “dot plot” from three hikes to two in 2019. While the reduction in forward guidance was reasonably dovish, the market had expected a larger downward revision, or even potentially a full pause. Markets traded off mildly on the news, but the decline gathered steam during the accompanying press conference when Powell implied that the Fed was resisting political pressure from the White House, and was not preoccupied by the equity market reaction. Market participants interpreted this as the end of the “Yellen put” that had seemingly shored up equity markets in recent years, although Powell later emphasized the Fed’s conditions dependent policy flexibility.

- The final Q3 GDP revision saw the growth rate drop one tenth of a point to 3.4%. The drop was primarily driven by a reduction in PCE and exports, partially offset by an increase in private inventory investment. Meanwhile, the PCE deflator rose, as was broadly expected, from 1.8% to 1.9% in November. Personal consumption and consumer confidence numbers were solid, although housing demand and selling prices have continued to weaken somewhat, possibly due to this year’s tax reform. Overall, we see the US economy moderating, weaker global economic conditions, and sub-2% inflation creating a case for either one Fed Fund rate hike in 2019, or perhaps even none

Equity News & Notes

Investors Face Volatile Markets As A New Year Begins

- We believe the US equity markets have been experiencing a policy-driven correction, not signaling a credit crisis or recession. Investors are trying to make sense of potential policy errors of a monetary (raising rates too far, too fast), fiscal (excessive deficits) and foreign policy (trade policy) nature. There’s been a disconnect between fundamentals and price action. Markets are pricing in flat to negative corporate earnings. Should we get relief from a more dovish Fed in 2019, and/or from the White House on trade, we do not see a recession. The US economy is predicted to grow 2-2.5% in 2019 with the IMF forecasting global growth of 3.7%. While those numbers have moderated, slowing growth is not the same as contraction.

- Q4’s equity downturn also seemingly priced in negative 2019 corporate earnings growth, something we also do not anticipate. Earnings are estimated to increase 12.4% in 4Q18 and 7.6% in CY19, although the latter figure should come down. Couple this with a forward S&P P/E of 14.4x (25-year average is 16.1x) and we could have a favorable set-up for equities. Early 2019 trading has offered some optimism in that regard.

- For most of the past decade, short term interest rates were low enough to disincentivize savings, in part the goal of easy monetary policy. The TINA Trade (“There Is No Alternative”) kept a bid under stocks as many were willing to accept the risks of the stock market given paltry yields on cash and other lower risk fixed income. With the Fed continuing its tightening cycle, short term rates have moved up dramatically, with the 1-month T-Bill yield closing the year at 2.4%. Many investors are now more willing to move to short-term fixed income vehicles and ride out the volatility. We believe this is one reason the “buy-the-dip” mentality diminished during a challenging fourth quarter.

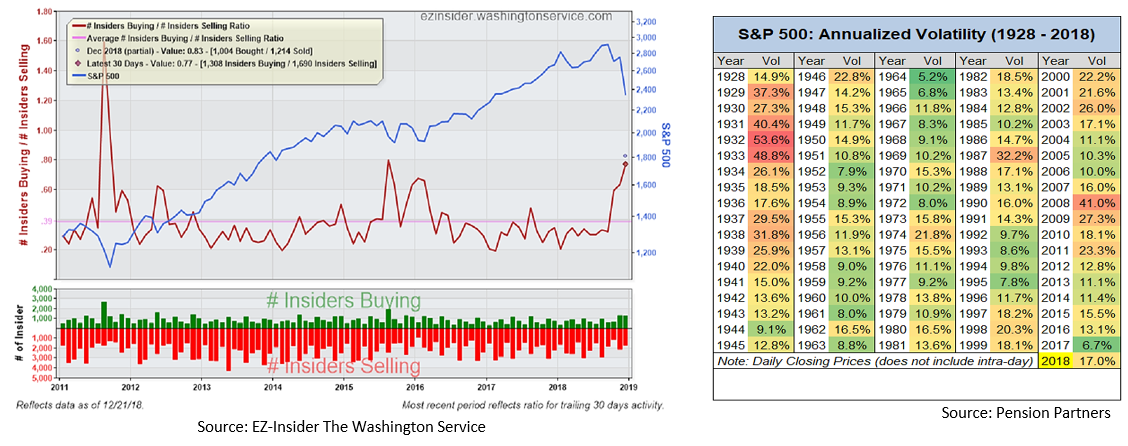

- Even if retail investors aren’t buying the dip, corporate insiders are. During the recent correction, the ratio of insider buyers to sellers hit its highest mark since the summer of 2011 when S&P downgraded the US debt rating. We were also at this level in late-2015 as investors grappled with the Greek debt crisis and a Chinese stock market crash. We like to see insiders buying their own stocks. It isn’t a perfect indicator, but one that hints we might be getting closer to a bottom.

- 2018 was the only year other than 1990 with two drops of at least 10% from separate all-time highs. Why all the volatility? Many are quick to blame algorithmic trading, systematic trading, hedge funds, and even ETFs. While intraday swings have seemingly become the norm of late, it’s important, as always, to keep the longer-term perspective in mind. What the market does in a given day typically should not impact your long-term investment plan. Furthermore, the accompanying chart demonstrates that 2018’s volatility was not unusual. The average calendar year volatility for the S&P 500 since 1928 has been 16.3%, only modestly less than last year’s 17%. The last few benign years lulled investors to sleep. Heightened recent volatility is much more typical than the extremely tranquil markets of 2017.

- Fixed income assets did well during the fourth quarter, offsetting some of the volatility and losses on the equity side in balanced accounts. This contrasts nicely with January’s correction when both stocks and bonds atypically sank. As always, maintaining asset allocation appropriate to one’s goals and risk tolerance is critical.

From the Trading Desk

Municipal Markets

- AAA municipal yields dropped across the curve over the final two months of the year. This was largely a function of dwindling inflation concerns, weakening global economic prospects, and anticipation of a slowing pace and potential magnitude of 2019 Fed Funds rate increases. The futures markets were pricing in only a 10-20% chance for a rate increase at any of the Fed’s 2019 meetings as trading moved into the second week of January.

- Municipals took their lead from Treasuries, with the tax-exempt yield curve continuing its flattening trend. Over the month of December 2s-10s dropped from 59 to 50 basis points. As the market gets more comfortable with the idea that the Fed may be on hold, we could see short rates decline, leading to a bit of steepening.

- Although municipal yields were lower across the curve, the drop in the 5 to 12Yr range was largest, causing the 10-year Bloomberg Barclays index to be the strongest performing segment in Q4 at +2.09%. For the year, the 3-year Bloomberg Index outperformed at +1.76% while the Long Bond Bloomberg Index (22+ years) was the worst performing at +0.34%.

- As we look ahead, municipal market conditions appear reasonably favorable. The average expectation of municipal analysts for full year issuance is $370B vs. $338B in 2018. There should be net negative issuance of $70B to support the market according to JP Morgan, down from a $121B net negative total in 2018. To start the year, coupon payments and maturities should double expected January municipal issuance of $21.5B according to Citigroup. Additionally, most strategists believe that mutual fund flows will turn positive in 2019 after sizeable Q4 outflows as investors get a better handle on their tax situation and the benefits municipal securities offer post-2017 tax reform, particularly in high tax states.

Taxable Markets

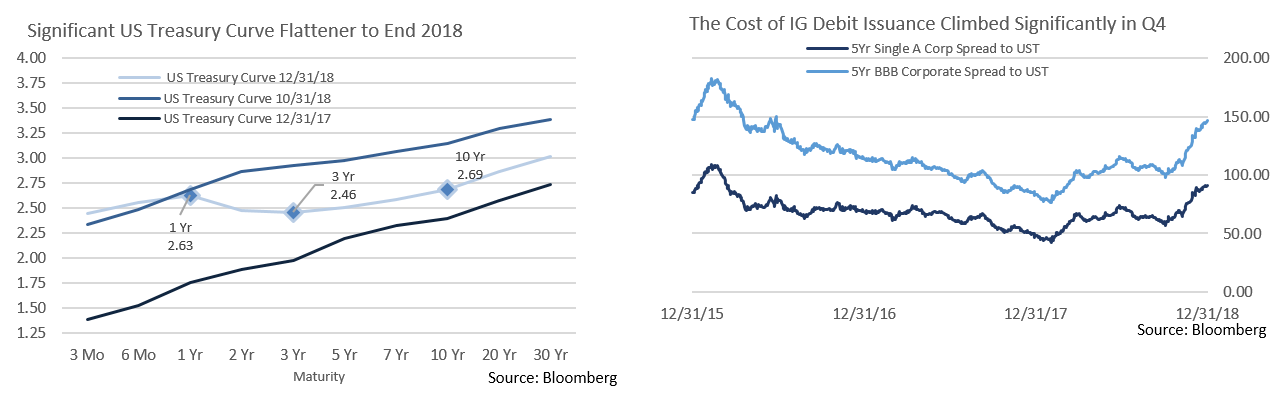

- A sharp December flight to quality drove the US Treasury yield curve into a rapid Bear Flattener. The very short end remained stable with the 1Yr hovering around 2.63%, although the long end dropped 28 basis points to 3.02%. The bellwether 10Yr dropped 30 basis points to 2.69%, while 2, 5, and 7Yr yields also fell by 30+ basis points, leaving the curve inverted.

- The last time that we had a meaningful US Treasury curve inversion was early 2006 and it lasted through the middle of 2007. Yield curve inversion is a well-chronicled indicator of potential recession, although it has typically occurred with 12-18 months delay. We see the Fed becoming a bigger influence on the curve, and current expectations are they will refrain from 2019 rate hikes.

- Investment Grade corporate issuance was almost nonexistent in December at only $7.95 billion. Several factors contributed, including repatriation rules that have reduced borrowing needs, political headline risks, trade uncertainty, and rising issuance costs.

- In fact, the cost of issuing a 5Yr single A corporate bond rose from 2.68% at the beginning of the year to 3.42%, with 0.44% of this due to spread widening and 0.30% a function of increased 5Yr US Treasury yields.

Financial Planning Perspectives

Financial Literacy: Expanding Traditional Curriculums

Financial literacy is a high-profile topic these days, with many articles and stories featuring this subject matter. We applaud this development and see raising financial literacy as linked to successful family wealth planning.

The lack of financial literacy is a broad-based problem, and one that is not merely tied to one’s socio-economic background. A 2016 study from the FINRA Foundation entitled, “National Capability Study”, revealed that nearly two-thirds of all Americans could not pass a basic financial literacy test!

A recent article in Fortune, citing the survey, added rather grim statistics:

- 44% of Americans don’t have enough cash to cover a $400 emergency;

- 38% of U.S. households have credit card debt averaging $16,048 with an APR of 16.47%;

- 43% of student loan borrowers are not making payments; and

- 33% of American adults have $0 saved for retirement.

Despite our country’s high level of wealth, a 2015 OECD (Organisation for Economic Co-operation and Development) study placed the United States below average among 15 year old financial literacy. If not addressed, this is a trend that does not bode well for the future.

Furthermore, while these national statistics are disconcerting, a recent survey conducted by the Spectrem Group emphasized that millionaires also evidence a  serious lack of understanding of financial terminology and concepts. The study entitled, “The Financial Literacy Gap Among Millionaires”, points out significant discrepancy between perceived and actual knowledge of finances and investments.

serious lack of understanding of financial terminology and concepts. The study entitled, “The Financial Literacy Gap Among Millionaires”, points out significant discrepancy between perceived and actual knowledge of finances and investments.

Our educational system is only beginning to address the problem, as only six states currently mandate personal finance as a prerequisite for high school graduation (Alabama, Missouri, Tennessee, Utah, Virginia, and as of 2019, New Jersey for middle school).

At Appleton, we take financial literacy seriously at all levels of family relationships and stand ready to help as needed. Your family’s well-being is at the center of our calling. Involving children and grandchildren in the family planning process is an important ingredient of long-term wealth management success, yet that requires not just engagement, but financial literacy. Proficiency in financial planning concepts will allow your loved ones to better understand your multi-generational plans, while also more successfully navigating their own financial path.

Please let us know how we can assist. Happy New Year!

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]