Insights and Observations

Economic, Public Policy, and Fed Developments

- As expected, the Federal Reserve kept rates on hold during their final meeting of 2019. Chairman Powell was explicit in his post-meeting remarks, stating rates would remain on hold absent a “material reassessment” of economic conditions. The majority of Fed Governors no longer expect a 2020 rate move based on the latest “dot plot” of their forecasts. Futures markets disagree and suggest that a cut is possible before year-end. In recent years disagreement between the Fed and the market have been resolved in the market’s favor; the Fed may face pressure to loosen policy during or immediately after the upcoming presidential election.

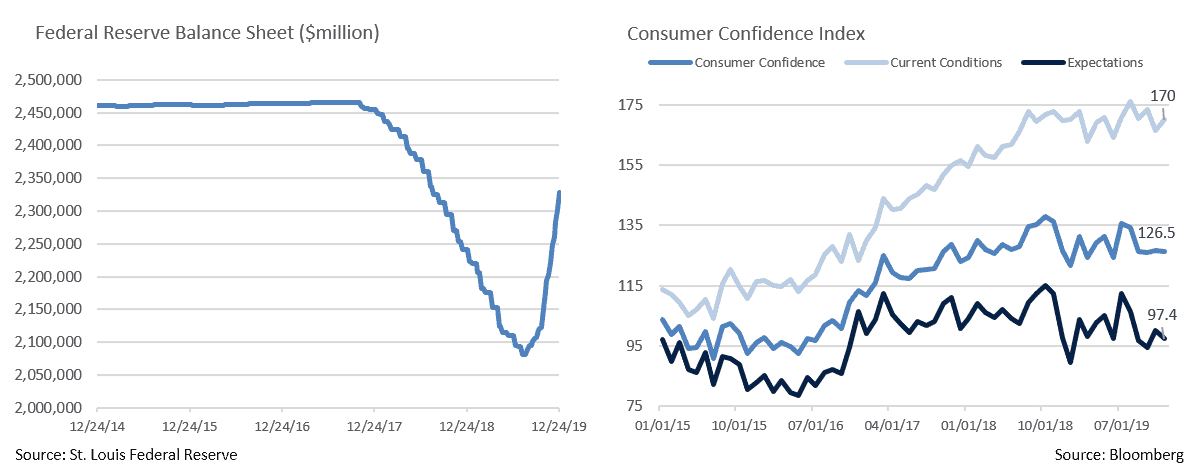

- While the Fed’s “QE by any other name” bond buying program announced in October has been widely reported, the impact has been notable. The Fed’s balance sheet has increased $248B from August lows (when the Fed began purchasing securities to calm repo markets), reversing roughly 2/3 of the runoff since late 2017. While still modest compared to QEII and QEIII, recent bond buying has already nearly matched the liquidity provided in the first round of QE in 2009 and is an underappreciated source of market support.

- The consumer has been a bright spot in the US economy, but in December this picture clouded somewhat. November retail sales growth of 0.2% missed expectations of +0.5%, conflicting with anecdotal reports of an extremely strong Black Friday weekend and “record breaking” holiday sales at Amazon. A late Thanksgiving pushing Cyber Monday into December may be a factor, and we feel the bulk of evidence still points to a strong holiday season and healthy consumer spending. An unusually large gap between current conditions and forward expectations is worth watching though, as a decline in consumer confidence would be worrisome.

- Durable Goods orders were also weaker than expected, down 2.0% vs. expectations of a 1.5% gain. Most of the weakness was due to a drop in defense spending (which, in the wake of a significant increase in the 2020 defense budget, will not persist) and a decline in civilian aircraft spending related to the grounding of the Boeing 737-MAX. Boeing’s decision to halt production of the airliner may detract 0.5-0.8% from Q1 GDP per Bloomberg News. Workers are not expected to be furloughed, minimizing spillover effects, and as long as the halt is short, impact to full-year GDP should be modest.

- While geopolitical risks remain acute, two longstanding concerns were greatly reduced in December. First, the Trump Administration announced a “Phase One” trade deal had been reached, and expects to sign an agreement on January 15th that essentially rolls back the tariff clock to May 2019. Second, Boris Johnson won a resounding victory in the UK Parliamentary elections on December 12th, gaining majority support for his Brexit plan. Conversely, it remains to be seen how a sharp escalation of US-Iranian tensions ultimately plays out.

- Looking into 2020, our base case is that recession risk continues to abate, although growth should slow from the 2018-2019 pace as the effect of tax cuts dissipates and higher trade costs are incurred. We expect short-term rates to remain on hold, anchoring the front end of the curve. We believe longer maturities may drift up slightly but the 10Yr UST will continue to remain range-bound absent external shocks.

Equity News and Notes

A Look at the Markets

- The decade ended with a banner year for risk assets as nearly every major asset class enjoyed gains in 2019. The S&P 500 gained 31.5%, its best annual performance since 2013. The index advanced 11 of the final 12 weeks of 2019 with every sector positive for the year. Several factors drove the bulls forward. First, the recession predicted by many never materialized. The economic recovery now enters its 128th month, the longest on record, as the 2010’s became the only decade in history without a recession. Second, the year ended with expectations of reduced trade conflict between the US and China, most notably in the form of an expected “Phase One” trade deal. Arguably the most important development was a dovish pivot by the Fed, cutting rates three times and adding over $400 billion to its balance sheet over the last four months.

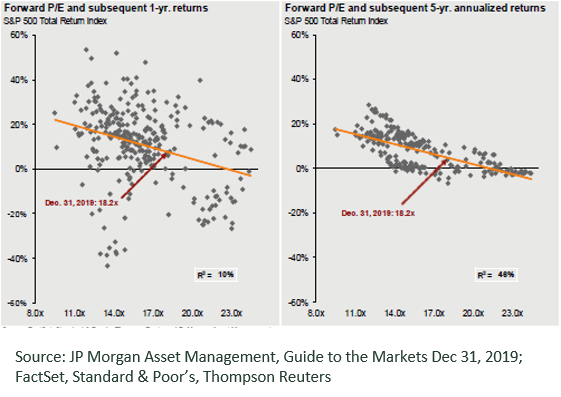

- The equity market’s buoyant returns were primarily a function of multiple expansion, as earnings growth was actually relatively flat. This contrasts to 2018, when earnings grew by over 20%, yet the market lost 4.4%. Looking back on these past two years, market price (2019) followed earnings growth (2018) which is what we’ve long emphasized tends to be the case over the longer term. Despite the uncertainties that existed for most of this year, investors were willing to pay more for stocks, taking the forward P/E from 14.5x to 18.2x. The odds of multiples expanding again to that extent in 2020 are low, so we will need renewed earnings growth to fuel more gains. The current outlook is reasonably favorable with Wall Street analysts expecting 9.2% earnings growth in 2020.

- As the chart below demonstrates, forward P/E ratios don’t tell us much about the year ahead so we hesitate to make portfolio shifts strictly on valuation. We do feel that stocks are expensive relative to their longer term averages (25-years: 16.3x), but history also tells us that a slight premium is warranted given where interest rates and inflation currently sit. While cheap versus expensive can be debated, we firmly believe that the margin for error is now considerably thinner.

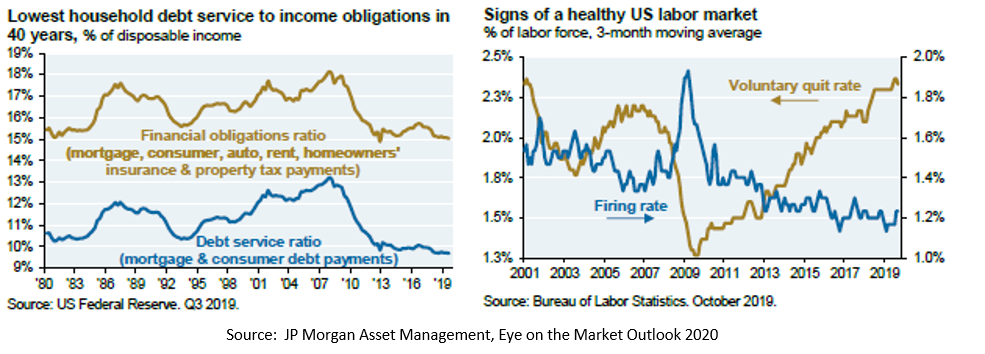

- We remain cautiously optimistic on stocks heading into 2020 due in large part to the state of the US consumer. The consumer has remained resilient in the face of trade worries, a manufacturing slowdown, and geopolitical flare-ups. Household debt recently climbed above $14 trillion for the first time, easily eclipsing the $12.7 trillion peak in 2008. That number requires context, however, as it only explains one side of the ledger. The consumer’s ability to service that debt is the best it’s been in 40 years when viewed as a percentage of disposable income. The strength of the jobs market is a huge part of this story and will be a key factor to watch as we move through 2020.

- Geopolitics are always a risk to markets, as the start of the year reminded everyone. The airstrike that killed a top Iranian general and subsequent Iranian retaliation is worrisome but one of a long line of events that have elevated tensions for investors and non-investors alike over the years. The market reaction has so far been muted, as it hasn’t changed the overall economic narrative, but we need to watch for shocks to business and consumer confidence, such as could be brought on by a sizeable sustained increase in oil prices. The Fed has signaled that it will remain accommodative until it sees signs of long-term inflation. Though we haven’t seen it yet, a surge in oil prices could lead to higher inflation, potentially shifting the Fed from being a tailwind to a headwind.

From the Trading Desk

Municipal Markets

- Tremendous retail demand remained the story in the municipal asset class as the year closed, with mutual funds taking in a record $93.6 billion in net new assets in 2019. Furthermore, all 52 weeks produced positive net cash flow.

- Although 2019’s level of net negative municipal issuance of $50 billion is unlikely to be repeated, net new supply is still likely to be constrained. JP Morgan projects $20 billion of net negative issuance in 2020, although some strategists forecast slightly positive numbers. Furthermore, taxable offerings are supporting muni supply as tax-exempt issuance remains under pressure. We remain favorable on market technicals entering 2020 and see sustained support for the muni market given strong demand and a lack of tax-exempt paper.

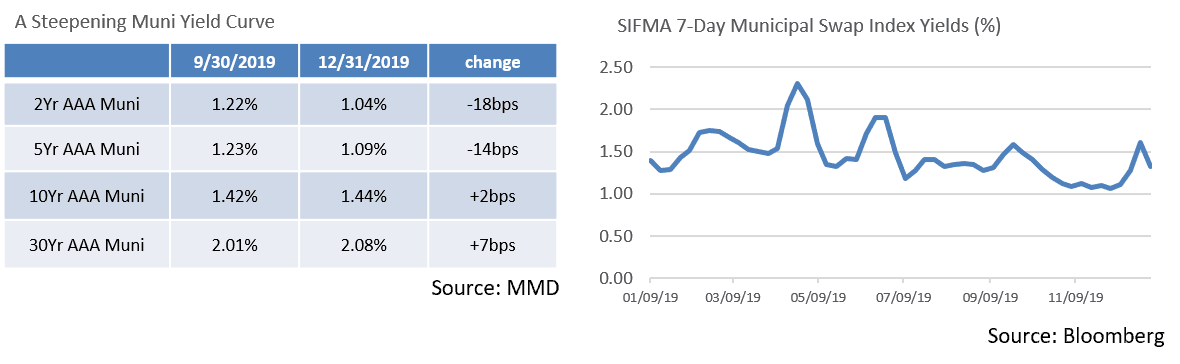

- Despite a steepening in the AAA municipal curve over Q4, the front end remained quite flat at year-end, with only 1 basis point of yield pick up over the first 4 years. This has maintained the potential appeal of Variable Rate Demand Notes (VRDN) for front-end exposure. SIFMA, the proxy for VRDN yields, finished December at 1.32%, equivalent to 8-year AAA municipal yields.

- With the Fed signaling short rates are likely to remain on hold and recession fears abating, the differential between 2 and 10-year AAA municipals increased meaningfully as Q4 closed, moving from 20 to 40 basis points over the quarter. We continue to see value in the 6 to 12-year maturity range.

Taxable Markets

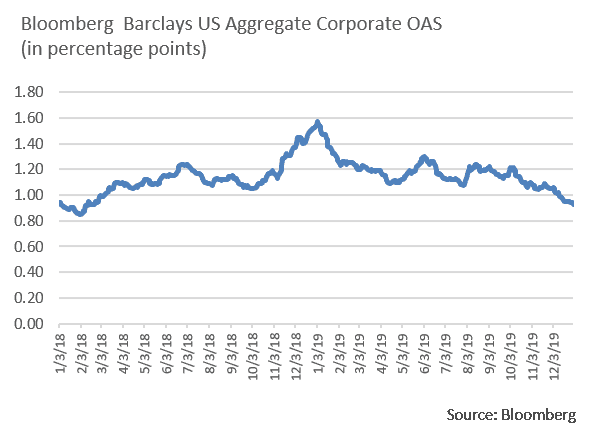

- Investment grade credit spreads closed December by hitting lows not seen since late February 2018. A steep 11 basis points monthly decline (105 vs. 94) in the Bloomberg Barclays US Aggregate Corporate Index OAS vs. 10Yr UST was spurred by lack of supply and a rush to put cash to work before year end.

- Coupled with low US Treasury yields, the cost of issuing high grade corporate debt is now far lower than it has ever been. In 2017 investment grade spreads of 93 basis points combined with a 2.41% 10Yr UST yield created a 3.34% yield. At year-end, the cost to issue investment grade debt has fallen to only 2.85%, with spreads of 94 basis points and a 1.92% 10Yr UST. Although we expect January to be a busy month of issuance, it could be short-lived. Dealers are calling for issuance to be down 5-8% YOY in 2020. Reduced new supply coupled with still strong credit conditions should help spreads stay range bound.

- The Federal Reserve’s balance sheet hit a 7 year low of just over $3.7 trillion in September after several months of not buying longer dated Treasury debt and mortgages. However, structural problems in the repo markets forced the Fed to begin buying again while also offering daily cash facilities to banks to meet overnight funding needs. This intervention has rapidly expanded the balance sheet to $4.1 trillion, helping to maintain liquidity, keep a lid on interest rates, and sustain risk appetite. Signs of repo market stability should allow the Fed to taper its balance sheet growth although no public stance has yet been communicated.

Financial Planning Perspectives

The New Year Introduces Sweeping New Retirement Changes

A massive year-end $1.4 trillion spending bill passed by Congress and signed by President Trump on December 20th included the Setting Every Community Up for Retirement Enhancement (SECURE) Act. The SECURE Act, which became effective January 1, 2020, is arguably the most important piece of retirement legislation since the 2006 Pension Protection Act and will have wide ranging ramifications.

Three specific SECURE Act provisions are particularly noteworthy relative to client retirement planning:

- The start date for Required Minimum Distributions from retirement accounts has been extended to age 72 for those individuals who did not attain the age of 70 1/2 prior to December 31, 2019;

- Repeal of the age limitation on traditional IRAs, which now matches 401(k) and Roth IRA rules, enables continued contributions after age 70 1/2 for those with earned income;

- With limited exceptions, the popular “Stretch IRA” has been eliminated through a provision that now requires assets of inherited retirement plans to be distributed within 10 years for newly inherited accounts in 2020 and beyond.

Moving back the start date for RMDs and allowing for continued IRA contributions while working beyond age 70 1/2 are significant victories for individuals living longer and seeking to save more for their retirement. However, for retirement plan beneficiaries (other than surviving spouses, minor and disabled individuals), elimination of the Stretch IRA is a retirement savings setback given the need to fully distribute inherited plan assets within 10 years.

Other notable changes in the legislation include:

- Increased access to Retirement Plans for small employers and their employees;

- Greater flexibility for employers to offer annuities in company retirement plans;

- $500 Tax Credit to encourage smaller employers to auto enroll employees in their company plans;

- Mandated Lifetime Income Disclosures for Defined Contribution Plans indicating how much income a lump sum balance could generate;

- Allowing long-term part-time employees to participate in company 401(k) plans (employees with 500 hours worked for three consecutive years);

- Allowing up to $10,000 of 529 Plan funds over a lifetime to be used to pay off student loan debt;

- A new 10% penalty exception for Birth or Adoption up to $5,000

- Kiddie Tax reverts back to child’s parents’ marginal tax rate

Appleton Answers: “Lunch and Learn” Workshops

Appleton Partners is pleased to continue hosting a series of “Lunch and Learn” workshops that began this November. Each meeting will gather a small group of clients to discuss a specific topic. Space is limited so please sign up for whatever session(s) is of greatest interest. These interactive workshops will be held in our office at One Post Office Square on the 20th Floor. Parking at The Garage at Post Office Square (across Pearl Street below the park) will be validated.

To sign up, click here: EVENT REGISTRATION. We encourage you to invite a family member, friend or colleague whom you feel would benefit from participating. Please use the same process to register them in their own names.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]