Insights and Observations

Economic, Public Policy, and Fed Developments

- As was widely expected, Chairman Powell laid the groundwork for a July rate cut in his remarks after June’s Fed meeting, stressing the commitment to sustain the economic expansion while reiterating that persistent below-target inflation, even transitory, could lower long-term inflation expectations. An “insurance cut” of 25 basis points at July’s meeting is now priced by futures markets. A stronger than anticipated early July jobs report somewhat tempered rate cut expectations, although we still expect the Fed to respond to a persistent inflation undershoot.

- The US budget deficit widened to $739 billion in the first 8 months of the fiscal year, a 39% increase from the prior year, after 2.3% revenue growth failed to keep pace with a 9.3% rise in spending. The CBO now projects the federal government will hit the debt ceiling in late September or early October. After the government shutdown at the start of the year, we expect an equally bruising partisan fight. The markets appear to agree; recently Treasury Bills due on October 3rd, roughly the date we hit the ceiling, were issued at a premium to maturities immediately before or after, suggesting bidders were uneasy over possible settlement delays. While an actual default is unlikely, the risks of political brinksmanship compromising business confidence and rattling markets is very real.

- Trade tensions cooled in late June when, after a month of fiery rhetoric, Presidents Trump and Xi agreed to a new tariff “truce”. Trump hinted he may lift Huawei’s blacklist status, a major concession criticized by congressional foes and allies alike, while China agreed to step up purchases of American farm goods. While we welcome the reduction in hostilities, no detail or deadline for talks was provided and existing tariffs remain in place. Overall, we believe this latest trade war development still leaves the US worse off than where we were in December, time of the last truce.

- There is also growing evidence the trade war is having an economic impact. US manufacturing confidence remains stronger than most of the world, but both continue to weaken and global confidence indices are now in contraction. Additionally, as we forecast last month, exports and imports dropped sharply in April after that month’s activity was front-loaded in March in advance of tariff increases. This is a primary reason why we expect Q2 GDP to significantly drop from Q1.

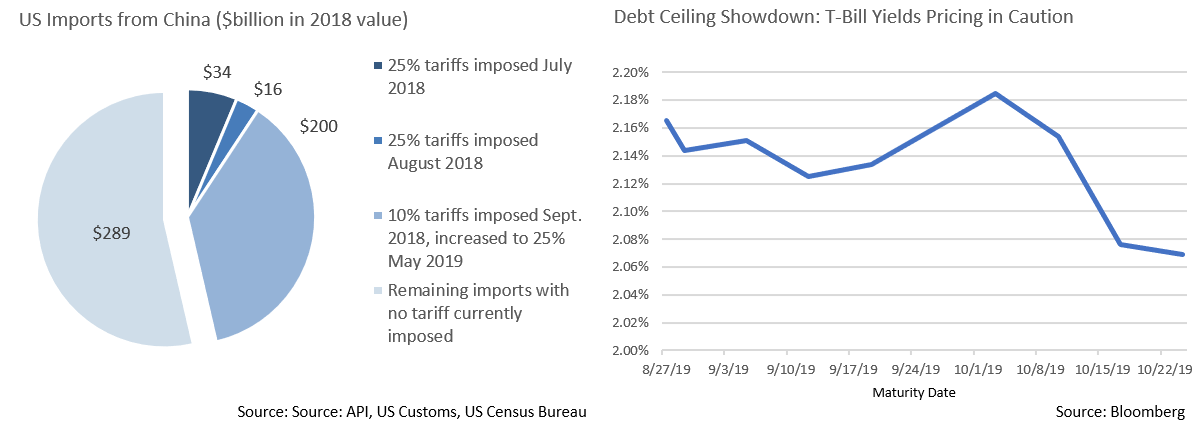

- And while some commentators downplay the impact of already imposed tariffs, we feel they are wrong to do so. In 2018, total imports from China were $539 billion. $250 billion in goods have been subjected to new tariffs, while Trump has threatened tariffs on the remaining $300 billion. If implemented, essentially all Chinese imports would be subject to a 25% tariff, for total duties of $135 billion. This comes to about 0.7% of GDP, or roughly a fourth of last quarter’s annualized growth rate, a significant impact at a time when we already expect GDP growth to decelerate. As it stands, tariffs on $250 billion in goods currently in place cost $63 billion, or roughly 0.3%.

- On a happier note, while May retail sales of 0.5% missed expectations of 0.6%, this was a solid number that followed upward March and April revisions, 1.6% to 1.8% in the former and a whopping -0.2% to +0.3% in April. We were watching closely for improvement in recently poor retail sales data, concerning at a time of growing inventory levels and tariff-related pressures, and May’s release delivered. While there is plenty of evidence of weakness elsewhere, a retail turnaround is welcome, as we consider this a precondition for the US economy to continue to avoid recession.

Equity News & Notes

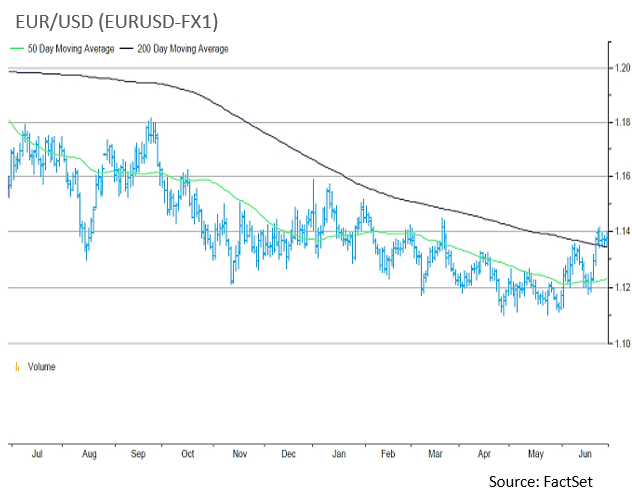

- Despite falling modestly in the last trading week of the quarter, the S&P 500 gained 6.9% during June, the best June performance since 1955. Overall, the first half produced a robust 17% rise in the S&P 500, the best first half since 1997. Broad consensus that the Fed will cut rates as soon as the July meeting and potentially push through further easing later in the year prompted equities to rally in the face of ongoing economic and trade concerns. A declining dollar has been a positive for multinationals, commodities and materials, as well as emerging markets, while dovish ECB language and a US-Mexico agreement to forestall opening another trade war front also helped spark a relief rally.

- The markets got some additional juice the first trading day of July after it was reported that Presidents Trump and Xi agreed to a “cease fire” that avoided additional tariffs, and Trump waived previously announced restrictions on Huawei, China’s embattled tech giant. The trade saga, while exhausting, appears to have at least temporarily regained steadier ground, easing escalation fears.

- As we’ve long emphasized, earnings ultimately drive equity performance, and the first half has been underpinned by 2019 estimates that have largely remained stable. Nonetheless, growth is slowing, and we will be carefully monitoring 2Q earnings reports for evidence of cracks in corporate guidance and/or declining consumer confidence. Current consensus calls for 2Q earnings to fall by 2.6% year-over-year. If so, it would mark the first back-to-back earnings declines since 2016. However, coming off a high base, we are not yet overly concerned. Companies can more easily beat lowered expectations, although signs that full-year consensus numbers are trending lower than expected would raise alarms.

- From a valuation perspective, the forward S&P 500 P/E ratio stands at 16.8x, slightly elevated relative to the 25-year average of 16.3x. We remain comfortable with this, particularly against the backdrop of a 2% 10-year UST yield and inflation remaining below 2%. We continue to favor growth and/or cyclicals given the high valuations attributed to defensive stocks and the former groups’ more attractive valuation relative to growth.

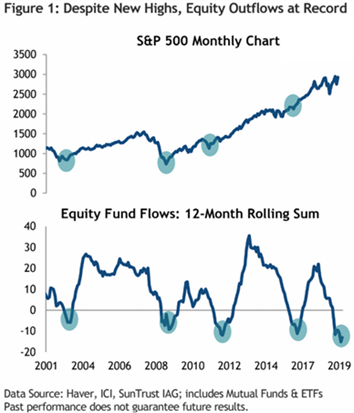

- Another reassuring data point is a lack of “froth” in the equity markets. According to Lipper Inc., domestic equity ETFs and mutual funds experienced net outflows of nearly $74B through the end of June. That’s hardly a sign of “irrational exuberance” (for those who recall the days of Chairman Greenspan). Further, a Bank of America survey of fund managers indicates an unusually high average cash position of ~5.5%. Lastly, the American Association of Individual Investors (AAII) survey still reports more bears than bulls. Skepticism is healthy, and we are currently rallying in an environment that is hardly rosy. That can be a good thing, but we’ll continue to be guided by corporate and market fundamentals.

From the Trading Desk

Municipal Markets

- The first half of 2019 closed much as it began, with very high demand for municipals coupled with constrained supply. Net retail fund inflows reached $45.7 billion YTD as of early July, the best start to a year since the data began being tracked in 1992. Playing into a widespread belief that rates are staying low and may be trending lower, Long Term funds have received the lion’s share of fund inflows, $26.4 billion YTD, while Intermediate funds took in $15.8 billion.

- On the supply side, Q2 issuance of $88.7 billion slowed 11% relative to the same period of 2018. We do not see supply dynamics changing significantly anytime soon, as weekly issuance over the remainder of 2019 would have to average $6.8 billion just to meet last year’s total of $338 billion. New money issuance is down 3.6% vs. 2018. Furthermore, JP Morgan modified its expected 2019 target for net negative issuance to -$78 billion from -$63 billion. New deals remain oversubscribed and we see tight market conditions remaining in place.

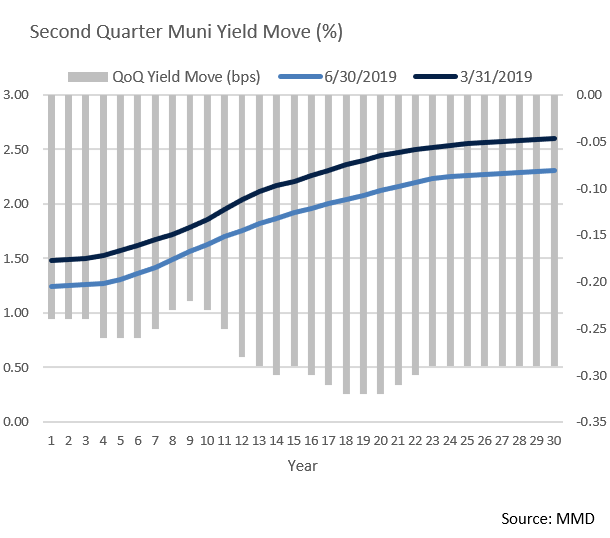

- Municipal yields ground lower across the curve at the end of June with munis following the lead of Treasuries. 2-year muni yields fell 24 bps over the course of Q2; 5-years (26 bps), 10-years (23 bps) and 30-years (29 bps) followed suit.

- Despite strong performance, municipals underperformed Treasuries during Q2, with the 10-year AAA muni/UST ratio increasing from 77.2% to 81.5% at the end of June, up from early May’s low of 70.9%. With technicals extremely strong and an interest rate cut of 0.25% expected at July’s Fed meeting, we anticipate 10-year ratios in the 78-82% range for the foreseeable future.

- Lastly, the muni curve steepened a bit in June as short rates dropped after flattening during Q1. 2-10s ended Q2 with a 38 bps spread, up from a low of 22 bps in mid-May. We have lowered our trading range for the 10Yr UST to 1.70% – 2.20% with a bias towards the lower end and see an accommodative Fed leading to further modest curve steepening. With a lid on interest rates, we are maintaining Intermediate portfolio duration at 4.60-4.70 years.

Taxable Markets

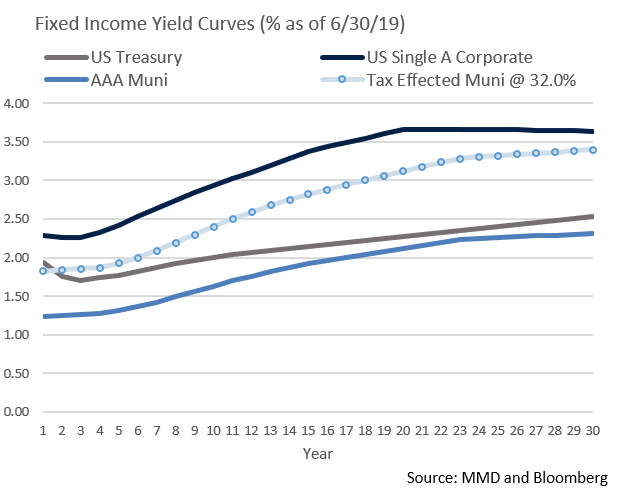

- In today’s yield compressed environment, shorter-dated IG corporate bonds may offer an attractive after-tax yield alternative to similar maturity municipal bonds. Several factors (very strong retail demand, favorable technicals, and a positive credit environment) have created conditions in which high quality muni yields have remained tight for a prolonged period. The 10Yr MMD Municipal curve was yielding only 1.60% at the end of June, while that same 10Yr maturity on the A-rated corporate curve yielded 2.93%. The tax effected 1.60% muni bond (@32%) translates to 2.40%, 53 bps less than the A rated corporate bond. For those able to accept modestly greater credit risk, adding crossover IG corporate bond exposure to a core muni account can be additive, especially for investors in mid-tier tax brackets.

Financial Planning Perspectives

Plan Ahead If You Wish To “Age-In-Place”

As Americans age and begin making financial and emotional preparations for retirement, one of the more vexing problems lies with living arrangements. Staying at home is a common objective, but one that is not easily realized. Most homes – fewer than 1% according to some credible estimates – are properly equipped to address the challenges of an aging population. Many impediments may exist such as mobility hurdles caused by stairs and doors, potentially unsafe bathroom fixtures, and difficult kitchen logistics. These and other physical obstacles can compromise the ability to safely stay in one’s home.

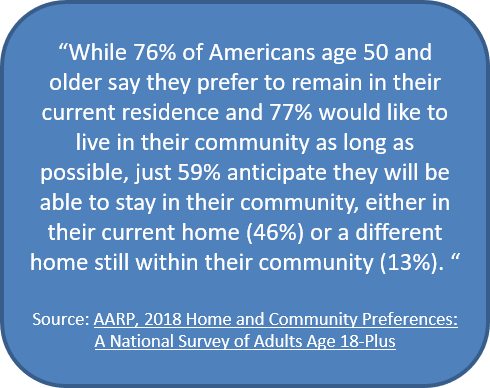

A 2018 AARP Home and Community Preferences Survey emphasized that 76% of respondents would like to be able to stay in their homes for as long as possible. In decades past, not as much emphasis was placed on “aging-in-place”. We applaud efforts to help seniors remain in their residences should they wish to do so, thereby avoiding the potential financial and emotional burden of assisted living or nursing homes or being forced to live with a child or other relative. But doing so requires considerable thought and planning.

According to the U.S. Census Board, by 2030 over 70 million Americans will be age 65 or older, representing approximately 20% of the population. With Americans living longer in retirement, stay at home options are rapidly growing. Many builders and developers are enhancing the functionality of 55+ communities, and senior care-giving companies are multiplying. Successful planning begins with assessing one’s needs well ahead of time. The likelihood of staying in your home demands a willingness to address important questions about aging, such as:

- Have you done a safety/aging assessment of your home?

- Have you considered your likely future healthcare needs?

- Do you need to consider scenarios outside of the home?

- Have you evaluated a caring giving/nursing home scenario with a parent or grandparent?

- What services, such as meal delivery or preparation, cleaning or additional household support will be needed?

- Have you thought about the stress that not having a plan could cause your loved ones?

For many, there are very real benefits to remaining in the comforts of home. Broadly speaking, individuals who “age-in-place” tend to:

- Spend less money for their living arrangements and care;

- Find it easier to maintain family, friend and social networks;

- Have a better quality of life and a more optimistic outlook; and

- Maintain greater cognitive function for longer

While it is impossible to plan perfectly for one’s aging, not having thought through the journey is more likely to introduce emotional and economic challenges down the road.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]