Insights and Observations

Economic, Public Policy, and Fed Developments

- The ongoing pandemic, and our attempts to contain and defeat the COVID-19 virus, should continue to dominate the financial markets for the foreseeable future. More than 100,000 Americans, and nearly 400,000 people globally, have lost their lives to this pandemic, a number that will sadly grow.

- One reason the pandemic is driving the market is that economic releases have been so bad as to defy comprehension. Retail sales fell through expectations of a -12% drop to a record -16.4%, prompting concerns on the report’s accuracy. ISM Non-Manufacturing collapsed, and while the headline reading of 41.8 beat expectations, it was due to a surge in the supplier delivery component driven by pandemic-related shipping delays. Meanwhile, the Bureau of Labor Statistics noted the headline unemployment rate of 14.7% is likely understated due to difficulties in capturing business failures, and will likely be revised higher. With the unprecedented size and speed of this downturn, even measuring the contraction has become difficult, making fundamental analysis challenging.

- That said, we have seen some encouraging signs in the latest economic releases that deserve attention. Boeing unexpectedly resumed production of its 737 Max, a development that should benefit upstream suppliers. While US existing home sales fell nearly 18% in April, new home sales unexpectedly rose 0.6%, a function of new supply being less constricted by the virus than existing homes. And while Manufacturing PMI remained in recession territory, it recovered modestly in May, implying the rate of contraction has slowed.

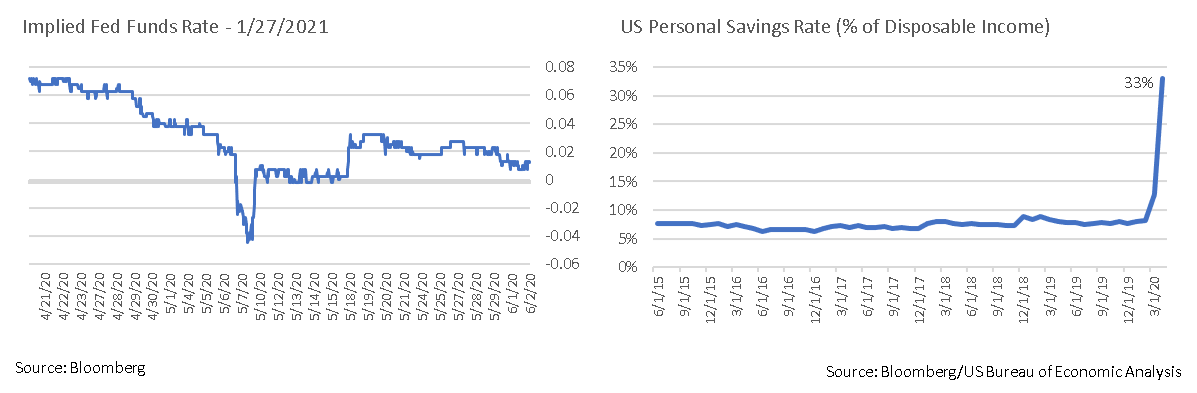

- April’s personal consumption drop of 13.2% coupled with a 10.5% rise in transfer payment-aided personal income fueled a savings rate increase from 12.7% to a whopping 33%. This will, depending on the course of the virus, either provide substantial dry powder for a V-shaped recovery, or cushion the effects of a lengthy and drawn out rebuilding. It is too early to call a bottom, but we see evidence the economy is no longer in free fall.

- The first GDP revision showed a headline reduction from -4.8% to -5.0%, but the underlying details were modestly encouraging. Consumption was stronger than originally measured, -6.8% vs. -7.6%, and Final Sales to Private Domestic Purchasers rose from -6.6% to -5.8%. That said, our expectations for a historically bad Q2 contraction of roughly a third remain unchanged, as small changes in the starting position will do little to mute the unprecedented half of economic activity.

- Trade hostility with China resumed as President Trump followed through on threats to halt US funding to the WHO over his belief they were under Chinese control – an action that will increase the organization’s dependence on China – as well as refused to certify Hong Kong’s independence after China-backed government crackdowns on protests. He did not terminate the Phase One trade deal, but when China responded by restricting US agricultural imports, a condition of that deal, termination of the agreement is looking increasingly likely. A resumption of trade hostilities and higher tariffs would further slow the economic recovery.

- After Fed Funds futures began to imply a negative Fed Funds Rate, Chairman Powell squashed concerns, indicating while nothing was off the table the Board was unanimous in their belief that negative rates were “not an attractive tool.” The Fed has been very careful not to surprise market interest rate policy expectations, and we believe Powell should be taken at his word. Should the Federal Reserve aim to enact negative interest rates, the move would likely be well telegraphed. By the middle of the month the markets had come around to our thinking, and expected rates remain positive.

Equity News and Notes

A Look at the Markets

- The stock market’s remarkable resiliency continued in May as economic reopening hopes extended the rally. The S&P 500 has now posted its best 2-month performance (+18%) since March/April of 2009. The Index closed the month at 3,044, a level not seen since early March, 36% above the March 23 low, having retraced more than 2/3 of its losses.

- Many investors are understandably questioning the stock market’s strength given profound current economic weakness. It is difficult to reconcile equity markets being down less than 5% YTD when roughly 40 million Americans are out of work and countless small businesses remain shuttered. But allow us to offer a few explanations.

- The stock market is a forward-looking discounting mechanism. Many economic indicators appear to have stabilized with clear signs of bottoming demonstrated in late April and May. While that doesn’t speak to how long a recovery may take (we believe the process will be lengthy), it does suggest the worst is behind us.

- Looking at stock valuations, the market’s forward P/E is nearly 22x, a level not seen since the early 2000s. However, looking ahead to consensus 2021 earnings estimates, the market is trading at a slightly more reasonable 18.5x. Investors have largely put 2020 behind and are focusing on 2021 and 2022.

- The economy is not the stock market, as the former is largely comprised of domestic small businesses that have borne the brunt of the damage, while the latter is dominated by globally focused large companies. The US economy is consumer-driven (~70%), while a much smaller percentage of the stock market is directly levered to the consumer.

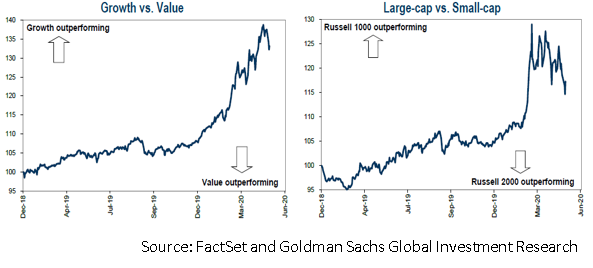

- Lastly, the stock market might not be sending a clear signal due to a lack of breadth. While the capitalization weighted headline Index is only down 5% through the end of May, the equal-weighted S&P 500 has declined by more than 12%; the difference owed to the five largest stocks in the S&P 500 being up ~15% YTD.

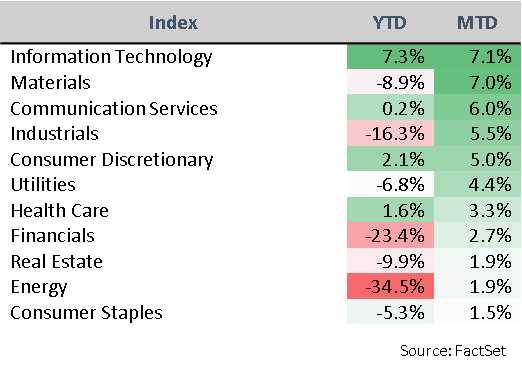

- The tug-of-war between economically sensitive sectors and those that benefit from the “stay-at-home” trend continues. Despite a shift to a cyclical “re-open” trade towards the end of the month, the Technology and Communication Services sectors still outperformed, while Financials and Energy lagged.

- From a style standpoint, growth continued to outperform value in May, although we did see small cap equities outperform large cap stocks. This is a healthy development as it is an indication of market breadth and is often associated with economic vitality. Performance dispersion that clearly differentiates winners from losers is a good environment for active managers, as we are stock pickers at heart. Nonetheless, broad participation in the market’s resurgence is a good sign. Given our expectation of a slow economic recovery, our portfolios continue to favor large cap growth stocks with healthy balance sheets.

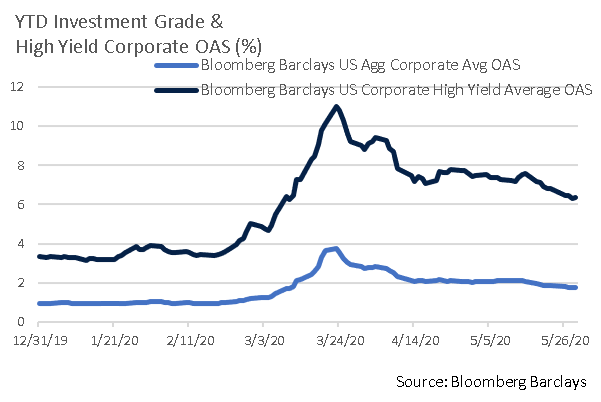

- Partially due to the disconnect between the economy and the stock market, investor sentiment remains negative as evidenced by fund flow data, positioning, and survey data. Market participants have a growing list of risks to contend with, including recent additions such as elevated tensions with China, civil unrest at home, and the threat of regulation on big tech companies to go along with the ongoing pandemic, a recession, and the upcoming election. History tells us markets tend to do well when they have a “wall of worry” to climb, and extreme negative sentiment can be a good contrarian indicator. We have enjoyed a very strong bounce over the past two months largely driven by unprecedented fiscal and monetary policy measures. Credit spreads have improved and the yield curve has steepened, but bond yields have remained rangebound, a trend that hasn’t confirmed the equity market’s move higher. We will continue to monitor these factors for signs of improving conditions as the economy slowly reopens.

From the Trading Desk

Municipal Markets

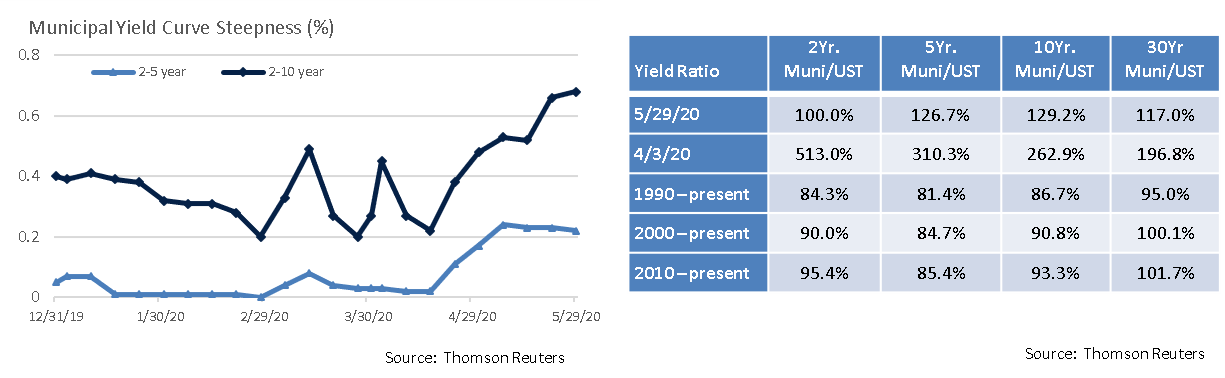

- Municipal yields ground lower in May. Extremely low US Treasury yields, healthy retail municipal demand (+$2.9B net fund inflows over 2 weeks ended 5/27), confidence building market support from the CARES Act and Municipal Liquidity Facility, as well as an expectation of further economic aid to states and municipalities more than offset dismal Q2 economic data and tax revenue weakness. Tax-exempt bonds staged an impressive rally, with 10Yr AAA municipals ending the month at 0.84% and 2Yrs at 0.16%, yields that broke through 2/29 levels.

- The rebound off March’s price lows has been dramatic. As we enter June, the Bloomberg Barclays Municipal Managed Money Short/Intermediate Index has returned 3.02% YTD. Technical factors have been favorable, with fund flows recently solidified and Citi Research expecting net negative municipal issuance of $5.8B over the next 3 months.

- Municipal curve structure is supportive of adding duration, as the 5/29 spread between 2s and 10s of 68 bps significantly exceeds that of 2s and 5s (22 bps). Curve steepness is now more pronounced than at any time since October 2018. In this environment, front-end exposure is challenging, although the upcoming deferred tax payment season may prompt money market selling and more attractive VRDN yields.

- We feel municipals still offer attractive relative value. While the dislocated ratios of March and April have predictably receded, 5Yr and 10Yr AAA muni/UST ratios of 126.7% and 129.2% respectively ended May well above long-term historic averages. This should provide a cushion for municipals.

Corporate Bond Markets

- The Federal Reserve buttressed the credit markets in late March when it announced that corporate bond buying would be part of its market support program introduced through the CARES Act. A Special Purpose Vehicle was established through which the Fed’s Primary and Secondary Credit Facilities would make loans and purchases. Initial funding was to be $50B for the Primary Market Facility and $25B for the Secondary, a “downpayment” on up to $750B in potential future market support. The mere availability of this backstop has helped drive corporate spreads tighter. In May we saw the facility utilized for the first time when the Fed purchased $1.3B of Investment Grade and High Yield ETFs.

- The Fed’s historic actions have helped maintain a favorable environment for corporate borrowing. The cost of financing is extremely low, and demand remains high. Investment Grade corporate issuance has been correspondingly robust. After another strong month, YTD issuance climbed over the $1 trillion mark, a milestone not typically reached until November. High Yield is following suit, with $150B coming to market over the first five months of the year.

- The current environment has been favorable for performance. Nonetheless, we remain credit vigilant and do not factor potential Fed support or other non-company specific elements into our proprietary research and credit ratings.

Financial Planning Perspectives

Thoughts on Asset Allocation

As we navigate the healthcare and economic effects of an ongoing pandemic, it is not surprising that many investors react to fear and uncertainty by becoming overly defensive. As our last edition of Quarterly Perspectives discussed, stress can induce detrimental decision-making, such as liquidating portfolios at inopportune moments. Asset allocation discipline can help facilitate better long-term results, a process that requires being purposeful in defining and maintaining appropriate portfolio strategy and asset class exposure based on one’s risk profile and needs.

Foundations of Asset Allocation

Asset allocation should be inherently personal in our opinion, tailored to individual circumstances based on a combination of three primary factors:

1. Risk tolerance

2. Time horizon

3. Rate of return objective

While this may seem simplistic, individuals are often uncertain as to how to begin and can therefore be susceptible to making arbitrary asset allocation decisions. Doing so may introduce too much or too little risk, thereby jeopardizing long-term goal achievement. Asset allocation plans to which an individual is not committed are also far easier to walk away from during turbulent times.

Aim for Outcomes

From an investor’s perspective, stocks, bonds and other investments are simply a means to an end, asset class exposures that seek to help reach defined asset objectives and/or meet future liabilities. Working with an advisor in the planning process to reverse engineer one’s targeted returns offers valuable planning perspective. Modeling an asset allocation mix geared towards personal financial goals and understanding what constitutes a realistic long-term rate of return if you stay the course can help develop the confidence needed to maintain a long-term investment strategy.

The Value of Portfolio Efficiency

Understanding the relationship between one’s investments and a portfolio’s overall risk and reward balance is essential to asset allocation modeling. For example, introducing investments with minimal correlation to each other may allow investors to take on greater absolute levels of risk and potential return from individual exposures without increasing a portfolio’s overall expected risk.

Our Approach

At Appleton, we strive to collaboratively determine an optimal asset allocation for each client at the outset of the relationship. We subsequently review these models on a regular basis and adjust as circumstances change. Significant market moves should periodically introduce rebalancing, not emotional reactionary asset allocation changes, a principle we continually reinforce when reviewing each client’s progress.

The past couple of months have reminded investors that the US economy and the capital markets do not necessarily move in tandem and market timing is very difficult. The speed of the rebound from March’s equity market lows did not leave much time for individuals who had decided to de-risk their portfolios to get back in. The rewards one typically reaps as a long-term investor are not free. The price of admission are the periods of time in which markets fall. Trust the process, stay the course, and you are likely to be rewarded over the long run.

Don’t be fooled. No one knows what is going to happen to markets tomorrow, next month or a year from now. But we can draw upon a wealth of history of how asset classes have performed over long periods, the variability of those returns over time, and how asset classes have interacted in developing risk efficient, personalized asset allocation plans. Doing so may be the best investment decision you can make.

Our Recommendations

These and a flurry of other new Federal regulations risk creating confusion. Appleton is here to help, and we invite you to reach out to your portfolio manager to discuss how we can help you benefit.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]