Insights and Observations

Economic, Public Policy, and Fed Developments

- As we write, the House has passed President Biden’s $1.9 trillion stimulus bill, which the Senate is expected to take up this week. The bill will not be exactly as initially proposed – a $15 minimum wage increase fell afoul of reconciliation rules and has been removed – although the proposal has emerged largely (and somewhat surprisingly) intact. Further income limits on $1,400 stimulus checks have been implemented and a decrease in supplemental unemployment benefits from $400 to $300 is expected. Passage appears likely although it will be a test of the Democrats’ narrow control of both houses of Congress. Democrats hope to sign a bill into law before expiration of unemployment benefits on March 14th.

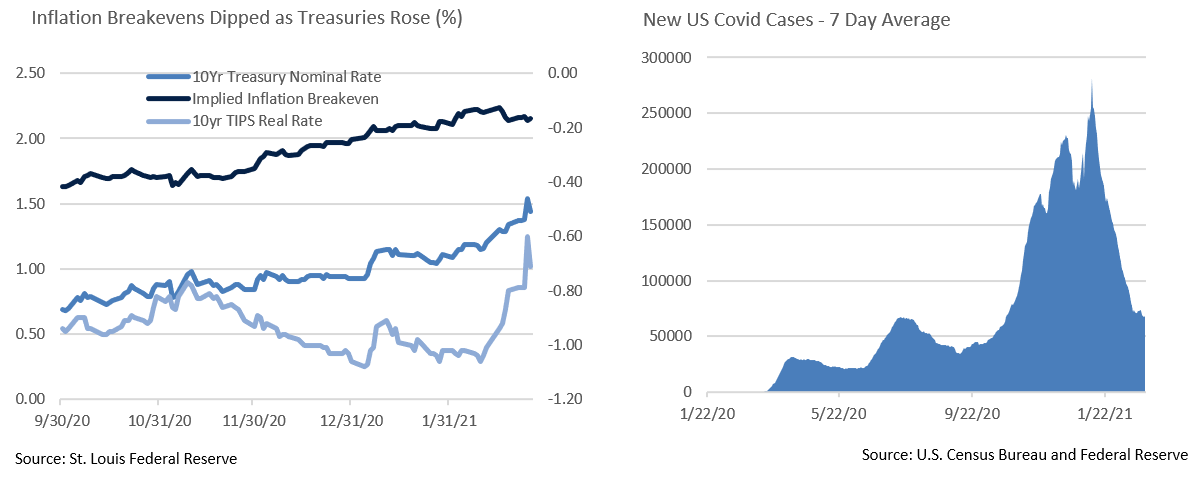

- Partly in response to the growing likelihood of a larger-than-expected stimulus bill, as well as a pronounced decline in COVID-19 cases and rising vaccination rates, Treasuries sold off in late February. The 10Yr briefly broke 1.60% before settling into a 1.40% range at month’s end. While the prevailing narrative is that the surge in yields is being driven by inflation fears, there is little current evidence of inflation, and the 10Yr TIPS breakeven rate, a measure of market inflation expectations, actually began dropping right around the time Treasury yields spiked. An increase in real rates from deeply negative levels appears to be a major factor, and some yield normalization is a sign of a healthier economy. While YoY comparisons will likely introduce noise in coming months, CPI also surprised to the downside in February.

- The labor market was even weaker than it appeared over the winter. January payroll numbers came in at only 49k new jobs added, while December and November were revised down by a combined 159k. However, there is encouraging evidence of improvement in weekly initial unemployment claims. Although still elevated, they continued trending down in February, in line with COVID-19 case counts. FDA approval of Johnson & Johnson’s single-shot vaccine and an aggressive US vaccination push offers considerable cause to hope for further job market gains. A concern lies in the potential for heavy temporary job losses in the retail, leisure, and hospitality sectors to become permanent if business failures exceed consensus expectations.

- An economic bright spot has been retail sales which surged 5.4% in January. Seasonal adjustments are complicated during a period where holiday shopping was anything but normal, but the simplest explanation may be the most accurate – stimulus checks delivered at the end of December likely were spent, not saved (there was no increase in the Fed’s Demand Deposit totals). This should be modestly additive to 1Q GDP.

- President Biden is rumored to be considering two names for the Fed Board of Governors – Michigan State Economics Professor Lisa Cook, and Howard University Professor William Spriggs. Cook earned degrees in Physics and Philosophy before completing a PhD in Economics from UC Berkeley and would bring a strong technical background to the Fed. Spriggs was an economist under the Clinton and Obama administrations, and with the AFL-CIO. Both have worked extensively on the impact of racism on economic outcomes, and we feel they would each be well qualified to join the Fed, if nominated.

Equity News and Notes

A Look at the Markets

- Equities rebounded off late January weakness as February began with the S&P 500 advancing 8 of the first 10 trading days. The S&P 500 and the MSCI All Country World Index both hit all-time highs on Feb. 16th based largely on a bullish narrative of fiscal stimulus, an accelerating vaccine rollout, and strong corporate profits. The tone changed over the last two weeks though as bond market rate fears spilled into equities.

- 10Yr UST yields rose by nearly 0.50% in short order, briefly touching 1.61% before closing the month at 1.44%. Equity investors were clearly rattled by the bond market’s gyrations, although we believe it was the speed of the move rather than absolute yield levels that caused the angst. There is little doubt that low interest rates have helped fuel a decade long rally in risk assets, although a few items are worth noting.

- First, the average yield on 10Yr USTs over the past decade of 2.13% is well above today’s level. Second, although higher yields lower the relative valuate of stocks, the 10Yr UST would have to rise to 2.10% before reaching the median historical gap between the S&P 500’s earnings yield and that of 10Yr USTs. Lastly, yields are being pressured by a global economy demonstrating sustained signs of recovery that are likely to accelerate as vaccines reach more people. A favorable long-term growth outlook is often accompanied by higher real interest rates. Recent rate moves have also not been accompanied by widening corporate credit or credit default spreads, both of which are risk signals.

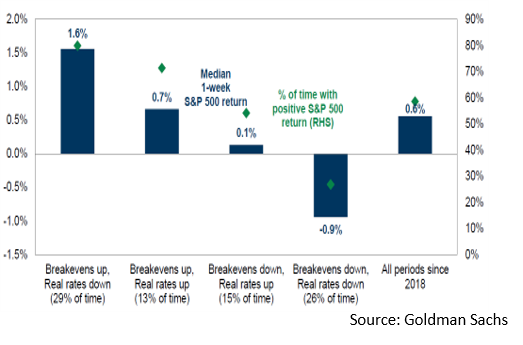

- Another piece of the puzzle lies in inflation expectations. Many investors fear pent-up demand coupled with sizeable additional stimulus will put upward pressure on prices. Modest inflation is not necessarily a bad thing for stocks as they have historically been an effective hedge. Stocks have produced above average returns during recent periods of higher inflation, measured here by inflation breakeven rates over the past 3 years. The risk would be a sharp rise in inflation prompting the Fed to raise rates and tighten monetary policy. Fed Chairman Powell has explicitly stated that they intend to let inflation run above the 2% target for some time before raising rates. The latest PCE inflation reading came in at 1.5%, although Prices Paid Index (PPI) in the ISM survey posted its highest reading since 2008. We will be closely following inflation measures and the Fed’s reaction to them.

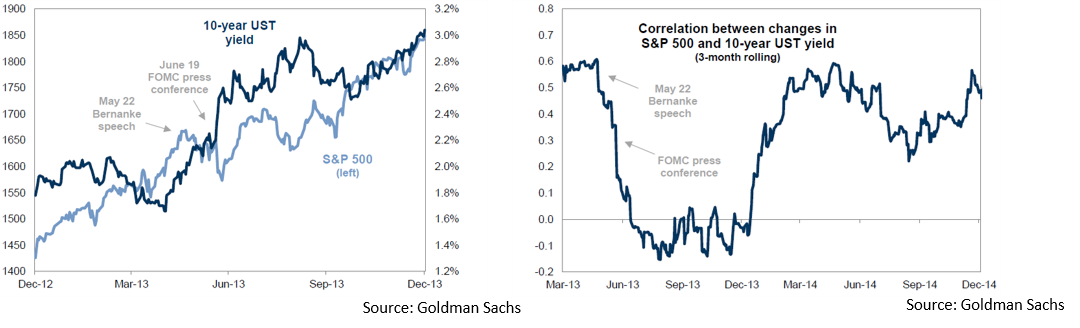

- Recent market volatility reminded us of the Taper Tantrum of 2013 when then Fed Chairman Bernanke announced a slowing in the pace of asset purchases. Bond yields spiked 40 bps in a week and the S&P 500 quickly lost about 6%. Bond yields continued to move higher although the pace waned as investors became more comfortable with a slow unwinding of Quantitative Easing. The correlation between stocks and yields subsequently reverted to the mean with stocks recovering their losses before moving on to higher levels.

- We remain positive on stocks. Economic reopening is moving forward, the consumer is in great shape, corporate profits have rebounded (nearly 4% Q4 EPS growth and expectations for +24% in 2021), and the Fed remains accommodative. Nonetheless, we are wary of a larger than anticipated increase in rates and inflation expectations. Sectors that have historically performed well in such an environment include Financials, Energy, Materials, and Industrials. Companies with higher valuations tend to be more at risk as future cash flow is discounted at a higher rate. We are emphasizing high-quality secular growth names trading at a reasonable price and will look to add exposure to profitable companies in more cyclical sectors.

From the Trading Desk

Municipal Markets

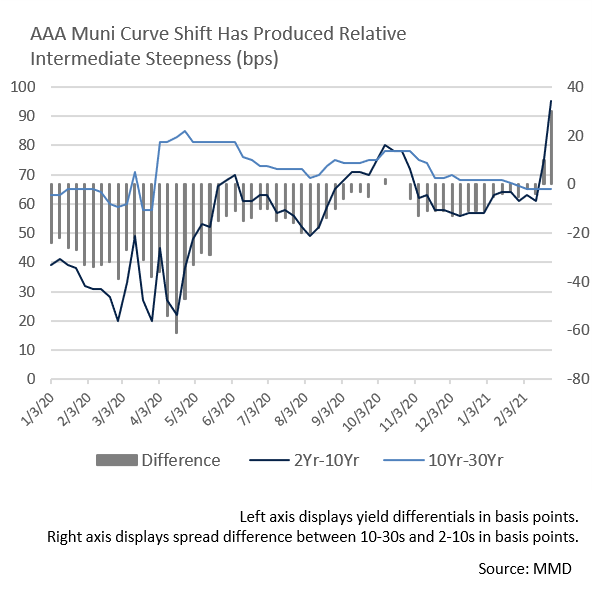

- After seeing bond yields grind lower and lower for an extended period, municipals finally reversed course and began to track upward pressure on Treasuries. 10Yr AAA municipals spiked from 0.87% to 1.14% over the last week in February and by 45 bps over the last two weeks.

- Curve steepening has been most visible among intermediate maturities, as the short end is still anchored by the Fed and 10-30Yr yield differentials have largely remained flat. By contrast, 2-10Yr AAA muni spreads increased 20 bps to 95 bps last week. We will gladly take advantage of an ability to add incremental yield when extending portfolios and find the 6 to 10-Yr maturity range to be an attractive position on the curve. Financial advisors and investors are grappling with the prospects of future inflation and upward rate pressure. It is our belief, as outlined in a newly published white paper, that active managers have considerable advantages relative to passive strategies during times of cyclical change.

- Market technical factors remain solid despite a recent pop in UST yields. Municipal supply is still modest with about $11.2 billion expected to come to market over the first week of March according to Ipreo, only $7 billion of which is tax-exempt. Municipal fund net inflows continue to be positive, although last week’s $38 million was the lowest recorded since September 2020. YTD net fund flows are +$26 billion.

Corporate Bond Markets

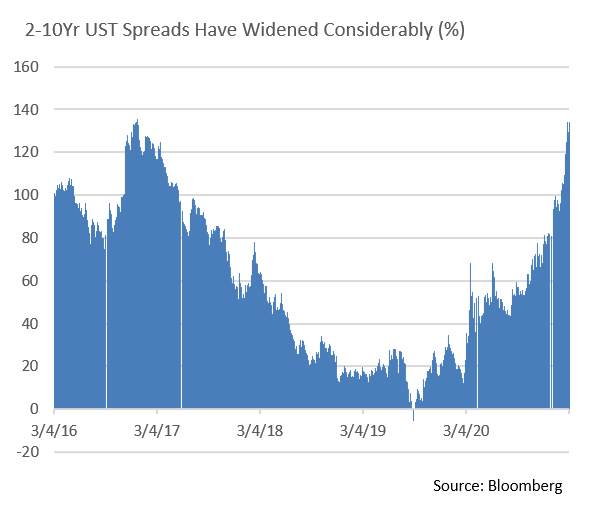

- Curve steepening was evident over the first two months of the year. A sizeable move up in rates during February drove 10Yr UST yields from 1.07% to 1.41%. This reflected concern over inflation prospects, as well as an increase in real rates in response to heavy Treasury issuance and an anticipation of accelerating growth. The spread between 2-10Yr USTs at the end of the month reached 127 bps, a level not seen since mid-March 2017.

- Amid the UST sell-off, the Investment Grade Corporate market remained healthy with credit spreads intact. In fact, spreads are tighter now than at year-end 2020 and taking on credit exposure has generally been additive to performance. The Bloomberg Barclays IG Corporate Index has tightened from 96 bps at the start of the year to 90 bps, a healthy market indicator. Most spread tightening has been at the front of the curve; longer spreads are little changed and have tended to move more closely with Treasuries.

- Despite reasonably strong January and February issuance ($265.2B vs $220.4B over the same period of 2020), we expect to see supportive technical factors continue in 2021. The market expects negative net issuance over the full year after a very heavy 2020 calendar left corporations well capitalized. We remain positive on high quality corporate credit and are seeking to capitalize on the incremental yield offered by a bear steepening yield curve.

Financial Planning Perspectives

Wealth Tax Momentum Grows Along with Political Debate

A shift in the balance of power in Washington may be ushering in increased taxation on high wealth citizens. Along with the potential for upper income and corporate tax increases later in 2021 or 2022, Senator Elizabeth Warren, Congresswomen Pramila Jayapal, and Congressman Brendan Boyle on March 1st proposed the “Ultra-Millionaire Tax Act”. Whether one sees current tax initiatives as seeking to make sure the wealthy “pay their fair share”, or as burdensome overreach, this may be the beginning of a trend that clients should consider.

The “Ultra-Millionaire Tax Act” would allow the IRS to tax an individual’s household net worth for the first time by instituting a:

- 2% annual tax on the net worth of households and trusts between $50M and $1B

- 1% annual surtax (3% tax overall) on the net worth of households and trusts above $1B

According to the Warren press release, it is estimated that the proposed tax would generate an additional $3 trillion over the next 10 years. Additionally, the plan includes robust anti-evasion and avoidance measures, such as:

- $100B to rebuild and strengthen the IRS, ensuring the agency has the resources needed to fully implement the proposed legislation;

- 30% minimum audit rate for taxpayers subject to the “Ultra-Millionaire Tax”;

- 40% “exit tax” on the net worth above $50M of any American who renounces their citizenship to escape paying taxes;

- New tools to help measure hard-to-value assets, enabling the IRS to tighten and expand upon existing valuation rules and;

- Systematic third-party reporting that builds on existing tax information exchange agreements adopted after the Foreign Account Tax Compliance Act, and penalties for underpayment.

While the political prospects of the “Ultra-Millionaires Tax” are highly uncertain, particularly in the Senate, several states have also debated or introduced wealth tax legislation in recent years. In Massachusetts, the Fair Share Amendment is very likely to be placed on the ballot in November 2022. Also known as the “Massachusetts Millionaires Tax”, if enacted, it would create a graduated state income tax for the first time (five other similar measures were previously defeated). The Massachusetts proposal would establish a 4% surtax on annual income over $1M. A December 2020 survey from MassINC Polling Group indicated that 72% of Bay State voters would back the tax.

Similar tax policy is gaining traction across several states. California offers a prime example as legislators sought a 0.4% tax on wealth above $30M in 2020 and proposed to retroactively increase the state’s top income tax rate of 13.3% to as much as 16.8% for those earning more than $5.9M. While the measure ultimately failed, it could be reintroduced later this year. Although a similar wealth tax measure was defeated in Illinois this past November, Washington State just introduced House Bill 1406, a measure that seeks a 1% wealth tax on residents’ worldwide assets in excess of $1B.

Regardless of how wealth and high-income tax policy ultimately plays out, it bears monitoring from a long-term financial planning perspective. We encourage clients to reach out with questions concerning their state’s current and prospective laws, as well as how various wealth management strategies might fit into the equation.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]