Insights and Observations

Economic, Public Policy, and Fed Developments

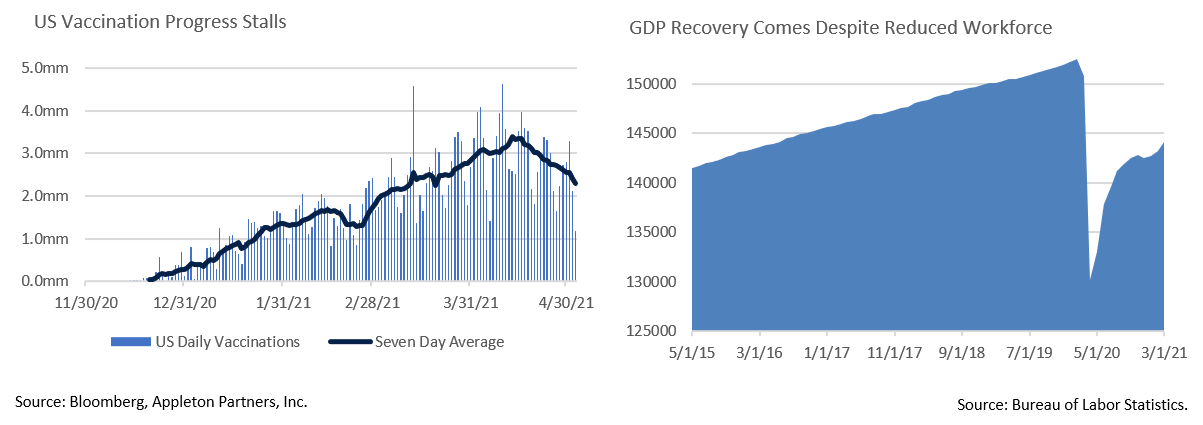

- Growing strength in both the labor market and consumer spending was confirmed with the release of the first Q1 GDP estimate. While the headline number of +6.4% represented a modest miss vs. expectations of 6.7%, the underlying data was incredibly strong. Notably, absent a drawdown of inventories detracting 2.64%, growth would have been closer to +9.3%. Final Sales to Private Domestic Purchasers, a good indicator of underlying consumer demand, rose a whopping 10.6%. While this expansion was fueled by rapid progress against the COVID-19 pandemic and federal stimulus payments, inventory depletion coupled with the lingering effects of the second stimulus check should also support Q2 growth. US GDP now sits only 0.87% below its pre-recession high and is higher YoY.

- The remarkable recovery has a dark side; although the labor market is recovering, 8.5 million fewer Americans are employed than were before the pandemic hit. While achieving YoY output growth is a positive milestone, the fact that this occurred with a sizable reduction in workforce adds weight to the argument that technology and automation is driving pandemic recovery. These developments risk accelerating secular trends that have hurt labor, and while the Services sector provides opportunity for further growth, it is hard to argue that some of these job losses will not be permanent.

- Inflation-related releases revealed a widely expected pickup in inflation, with the PCE deflator rising from +1.3% to +2.3% in the initial Q1 report, and headline CPI increasing to +2.6% YoY. Core was more muted at +1.6%. Caution is warranted when interpreting inflation numbers; YoY comparisons now introduce a powerful “base effect” that skews current numbers higher given the prior year’s depressed levels. Federal stimulus payments are also temporarily boosting demand. If the economy takes longer than expected to return to full employment, as we are afraid may be the case, out-of-work Americans will weigh on aggregate demand. After a mid-month peak, the relative stability of the UST curve speaks to the market’s growing comfort with the inflation outlook.

- Another potential worrisome sign is that the nation’s vaccination effort, which has shattered all expectations coming into the year, is stalling. The 7-day average daily vaccination rate peaked in mid-April at around 3.4M doses and has since fallen by more than a 1M doses per day. This is occurring with not quite half the country having received one dose, and less than 30% fully vaccinated. There is evidence of vaccine hesitancy amongst several demographic groups, and many infectious disease professionals are concerned that the vaccination effort may fail to achieve herd immunity. A strong economic recovery is in part predicated on receding pandemic restrictions and perceived risks. The US may still be fighting pockets of infection with localized economic limitations for some time, a prospect that is not embedded in most economic forecasts.

- Asset class implications of President Biden’s “American Families” infrastructure plan are discussed elsewhere in this piece. Suffice to say, the White House has taken a very expansive interpretation of infrastructure. The plan would represent the largest reshaping of the role of government in American life since at least the Reagan Administration, and while the current proposal is an opening in a much larger negotiation, the Biden Administration did a much better job than we or many others expected in getting the American Rescue Plan passed at desired spending levels. There is a very narrow window through Congress to pass this bill, and many details are likely to change, but it is premature to assume the final bill will be significantly reduced or substantially altered. From a macro perspective, the size and scope of federal spending will need to be factored into full year 2021 and 2022 economic expectations.

Equity News and Notes

A Look at the Markets

- Stocks moved higher in April as the S&P 500 enjoyed its best month since November, gaining 5.34% to bring YTD total return to +11.84%. The S&P was joined in making its all-time high by Nasdaq and the DJIA. The bullish narrative remains the same: unprecedented fiscal stimulus, an accommodative Fed, rapid vaccine rollout, an improving economy, and a rebound in corporate earnings.

- Concurrent with equity strength, 10Yr UST yields fell for the first time since November. We do not think this was a coincidence given heightened sensitivity to rising yields. With a levelling off in rates came a pause in the value trade as the R1000 Growth outperformed the R1000 Value by 280 bps for the month. All 11 S&P sectors were positive, although a rotation back into growth was evident with Consumer Discretionary and Communications Services leading and Industrials and Energy lagging. Should macroeconomic data remain ahead of expectations and bond yields rise, value names could return to favor. Our portfolios retain exposure to cyclical, economically sensitive sectors, while focusing on secular growth.

- April ushered in Q1 earnings season and, so far, the results have been strong. With 60% of the S&P 500 having reported as of 4/30, 86% have beaten earnings projections, the highest “beat rate” since at least 2008. The margin of the beats is equally impressive with companies reporting earnings 22.8% above estimates vs. a 5-year average of 6.9%. The blended Q1 earnings growth rate is up to +45.8% vs. expectations of +23.8% as of 3/31. A growing percentage of companies are also offering positive forward guidance (62.5% vs 37% 5-year avg.), an indicator of corporate optimism.

- Nonetheless, investor reaction has been muted. On the subsequent trading day after announcing, stocks that beat are only up 0.25% versus a long-term average of 1.10%. This signals that much of the good news has been priced in and elevated valuations are proving to be a high hurdle. Earnings will need to play catch-up to stock prices to justify higher-than-average valuation multiples.

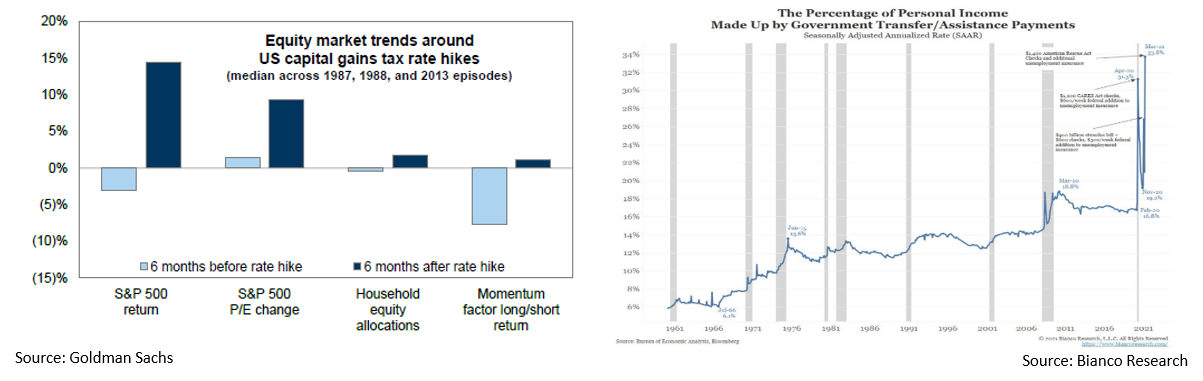

- The prospect of higher taxes has come into focus given President Biden’s proposed increase in the long-term capital gains rate from 20% to 39.6% for households earning over $1 million. We do not think the proposed change would be enacted retroactively, nor do we think 39.6% will be the final rate. Negotiation will likely produce a rate closer to 28%. Recent history offers guidance as to potential stock market impact. Stocks have tended to fall as households reduced equity exposure in the months leading into a capital gains hike, although they more than rebounded over the subsequent 6 months. We anticipate a similar reaction this time should a bill pass, with volatility driven by investors taking gains ahead of an increase followed by money finding its way back into stocks. Prior capital gains tax hikes have also prompted a rotation out of momentum names, or “winners”. This could present a headwind for some of the FAANG names.

- We found the accompanying chart fascinating as it reveals that a third of Americans’ income over the past year was comprised of government transfers. This has heavily factored into a robust savings rate, record household net wealth, booming consumer confidence, and retail sales strength. The consumer makes up roughly 70% of GDP, so it is little surprise that the economy is posting its strongest numbers in nearly 40 years. But this also gives us pause. A need to eventually pay for these transfers raises Modern Monetary Theory and deficit debates. Second, and more pressing, is the potential for excess liquidity leading to higher inflation. With the supply chain still under stress, excess demand is likely to produce price pressure. The key questions will be how persistent inflation becomes, what the Fed intends to do about it, and when.

- We remain constructive on equities over the medium to long term for the reasons discussed in this piece. Yet over the coming months, investors may face challenges associated with rising rates, higher taxes, and eventually, a less accommodative Fed. We will be carefully monitoring these issues as the year moves along.

From the Trading Desk

Municipal Markets

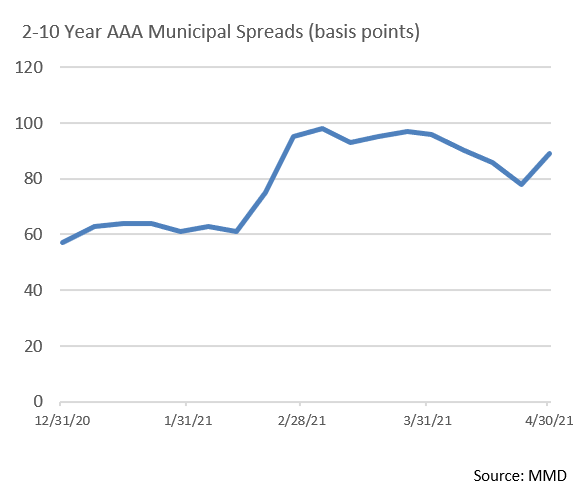

- The municipal curve ground lower once again in April with 10Yr AAA yields starting at 1.11% and ending at 0.99%. This move offers more evidence of investor appetite for municipals, especially given the prospects for higher upper income tax rates. While the curve flattened by 7bps over the month to 89bps, it remains significantly steeper than the 57-bps level at which we began 2021. We continue to find more attractive relative value in the 6 to 9-year range given compressed shorter maturity yields and a relatively flat long end.

- April muni issuance increased by about 6% vs. the same month of last year. 2021 YTD issuance is 12.6% higher than 2020, according to The Bond Buyer. Many commentators are predicting significantly higher issuance this year than last year, which would require an acceleration in new supply over the remainder of the year. Tax-exempt advanced refundings were eliminated by the 2017 Tax Reform; if they were to be reinstated it would provide a boost to tax-exempt supply. Additionally, an infrastructure package would also likely increase municipal supply. With no lack of buyers, issuance should be well received in the marketplace.

Corporate Bond Markets

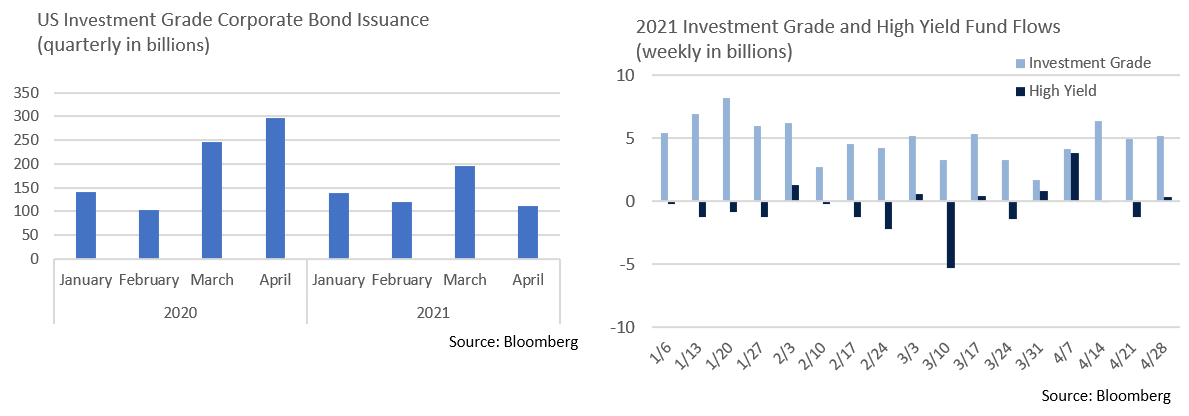

- After a quiet end to the month, $110.8 billion of IG corporate issuance in April easily beat estimates of $95 billion. That brought YTD issuance to $547 billion, down 23% on a YoY basis vs. extraordinarily high levels of a year ago. April’s new issuance was led by Financials, with jumbo deals from B of A, JPM Chase, Morgan Stanley, Goldman Sachs, and Citigroup accounting for $72 billion of the $110.8 billion in new funding. Just over $73 billion in IG corporate maturities are coming due in the finance sector, and April’s issuance surge may be preemptive funding of upcoming maturities given the risk of rising debt costs.

- Spread volatility was muted with spreads trading in a very tight band of about 4 bps. The Bloomberg Barclays US Corporate Index closed the month at an OAS of 88, 2 bps tighter than at the end of Q1. Energy and Transportation (just over 10% of the index) have tightened the most YTD (-20 bps and -17 bps respectively. This reflects rising economic optimism after difficult 2020 sector conditions. Financials, 30.5% of the index, saw only a modest 4 bps spread contraction.

- A positive credit tone and solid earnings releases support a favorable economic reopening narrative. Better-than-expected GDP growth of +6.7% (QoQ annualized) did little to move credit market spreads. We believe economic confidence is already priced into the IG Corporate markets and anticipate spreads will remain range bound over the near term.

- Broadly speaking, demand for taxable fixed income remains extremely strong. Lipper Inc. reported $217.6 billion of net new flows into taxable bond mutual funds YTD through 5/3. Economic momentum and investor enthusiasm should keep the IG Corporate bid strong for some time.

Financial Planning Perspectives

American Families Plan Prompts Tax Planning Questions

President Biden’s initial address to Congress introduced the American Families Plan, a sweeping proposal that has the potential to impact personal financial planning. Bear in mind that the political process has only just begun, and the end-product is far from clear. The primary emphasis of the plan lies in bolstering federal support for childcare and education, including extension of the new child tax credit, universal preschool, and free access to community college. Funding will largely come from proposed tax changes affecting wealthy Americans.

President Biden’s initial address to Congress introduced the American Families Plan, a sweeping proposal that has the potential to impact personal financial planning. Bear in mind that the political process has only just begun, and the end-product is far from clear. The primary emphasis of the plan lies in bolstering federal support for childcare and education, including extension of the new child tax credit, universal preschool, and free access to community college. Funding will largely come from proposed tax changes affecting wealthy Americans.

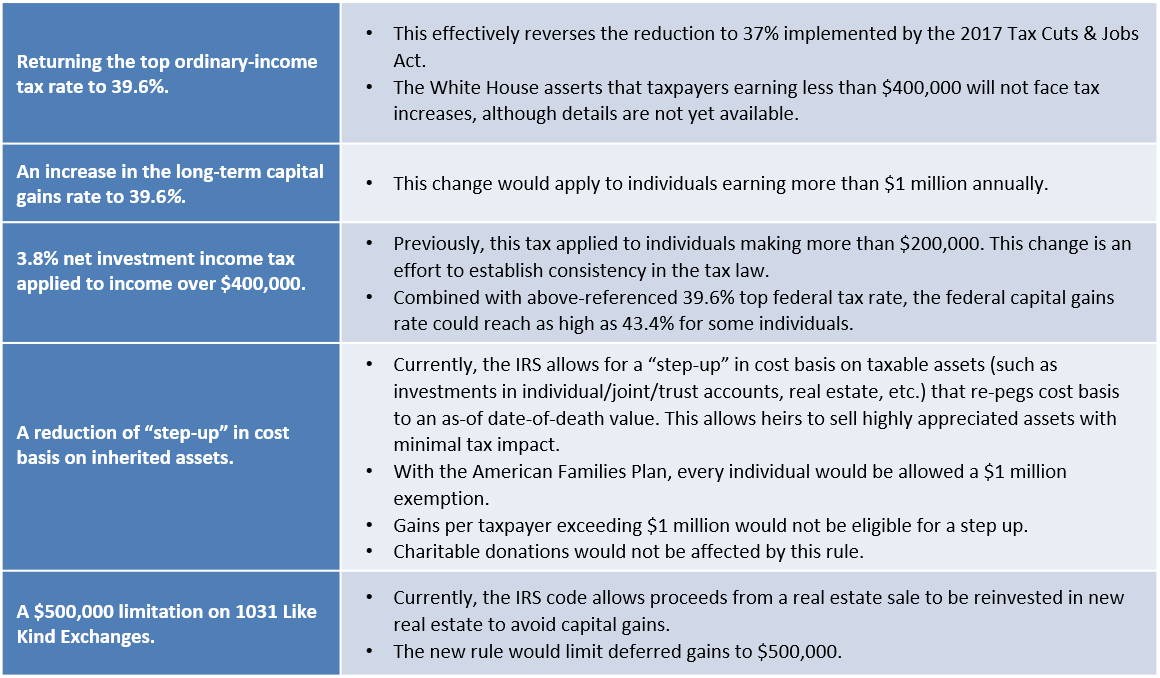

Highlights of the tax proposal include:

Interestingly, certain items highlighted by President Biden during the campaign, such as changes to the estate tax exemption, were not included in the American Families Plan. The President did, however, include directing $80 billion to the IRS to assist in audit capacity and other tax enforcement measures.

This proposed legislation will invariably change as it makes its way through Congress. As such, we will monitor potential outcomes and are prepared to discuss and make any appropriate adjustments to your plans and investment portfolio. If you have questions, we will welcome an opportunity to speak with you.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]