Insights and Observations

Economic, Public Policy, and Fed Developments

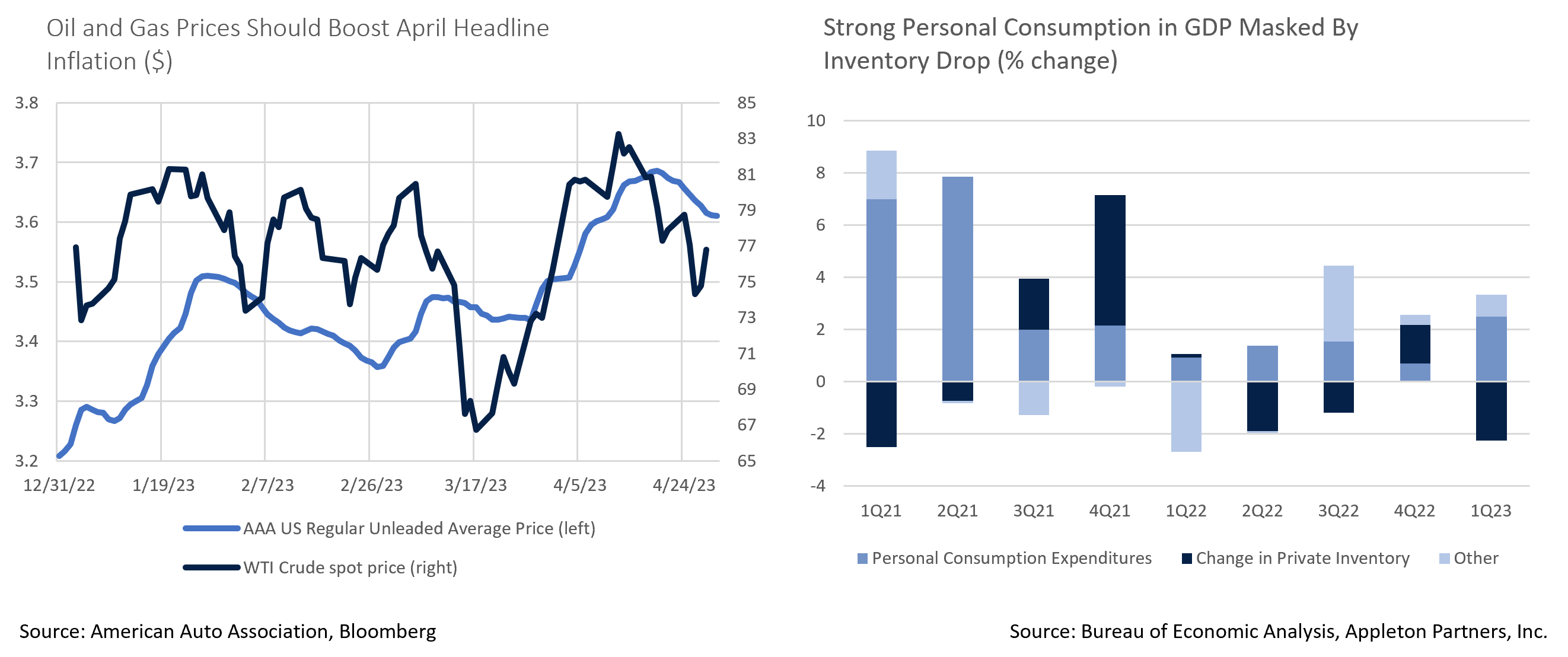

- Q1 GDP missed, +1.1% vs. +1.9%, yet below the surface it was a fairly strong report. After a persistent build-up over the last two years, a sizable drop in inventory levels detracted 2.26% from quarterly growth as consumption exceeded production. Underlying consumer demand was very solid; personal consumption rose a robust 3.7%, while final sales to private domestic purchasers grew 2.9%. Both values are the highest since the first half of 2021, a period marked by the post-Covid reopening trade. While this report covered a period largely before the banking sector turmoil, it suggests the economy was on solid footing at that time.

- A point in March’s inflation reports worthy of attention is the impact of oil and gas price fluctuations on the headline numbers. While low headline inflation was embraced by bulls in March (notably, headline PPI fell a whopping -0.5%), those figures were pulled down as oil prices fell steeply at the end of February; the release notes energy inflation was responsible for 80% of the decline. Prices recovered late in March and are now at or above prevailing YTD levels. Gas prices failed to match the depth of March’s oil decline but rose in line in April as well. With inflation based on a monthly average of prices, recent improvements in headline inflation should more than reverse in April. The Federal Reserve will look through headline inflation to the core and “super-core” numbers, although these headline inflation accelerations may still impact the market narrative.

- The market is now paying more attention to the debt ceiling fight. While Speaker McCarthy’s bill passing the House would normally be encouraging, it would roll back much of the Biden Administration’s legislative accomplishments in return for a mere nine-month extension. It will not survive the Senate or a Presidential veto, and with a final vote of 217-215, McCarthy has little room to maneuver. Secretary Yellen updated her debt ceiling deadline estimate to early June; if the Treasury can stretch this to the middle of the month corporate tax receipts will buy additional time, but with Congress in session for only two weeks in May the risks of a misstep are higher than the market now appreciates.

- The May FOMC meeting went largely as expected, with the Federal Reserve hiking rates by 0.25% to 5.00-5.25%. The accompanying statement opened the door for a pause in June, though in his press conference Chairman Powell stressed no decision had been made and that assessing bank turmoil-related credit tightening would be important going forward. After a lengthy hiking campaign, the Fed has become data dependent. Markets expect a pause, followed by three cuts before year-end; we expect a hotter economy than consensus for the reasons outlined above and would not rule out a further hike.

- We also don’t expect the Fed to cut even if a recession materializes, simply because they have indicated they won’t. The March FOMC Summary of Economic Projections called for 0.4% GDP growth in 2023, and with Q1 forecasted at over 2% at that time, mathematically this indicates negative growth later in the year. However, this forecast did not stop the Fed from hiking in both March and May, and in an otherwise placid press conference Powell pushed back aggressively on the possibility of rate cuts in 2023. The Fed has been explicitly targeting demand destruction for some time as a means of sustainably dampening inflation; it does not make sense to expect that a weakening economy would cause them to change course. Every other time the market and the Fed have disagreed over this cycle, the Fed eventually won; we expect the same to happen here.

Equity News and Notes

A Look at the Markets

- US equities rallied in April as the S&P 500 gained +1.5% to raise YTD total return to +9.2%. The DJIA, which trailed the S&P 500 through Q1, outperformed (+2.5%) while the Nasdaq, the YTD leader, finished the month unchanged. Sector performance was mixed with tight dispersion and no discernable pattern between growth/value or cyclical/defensive. Only 3 out of 11 sectors closed lower (Industrials, Consumer Discretionary, and Materials), while Communication Services and Consumer Staples led. Notably, large-cap value stocks outperformed their growth counterparts in April for the first time this year (+1.4% vs. +0.9%).

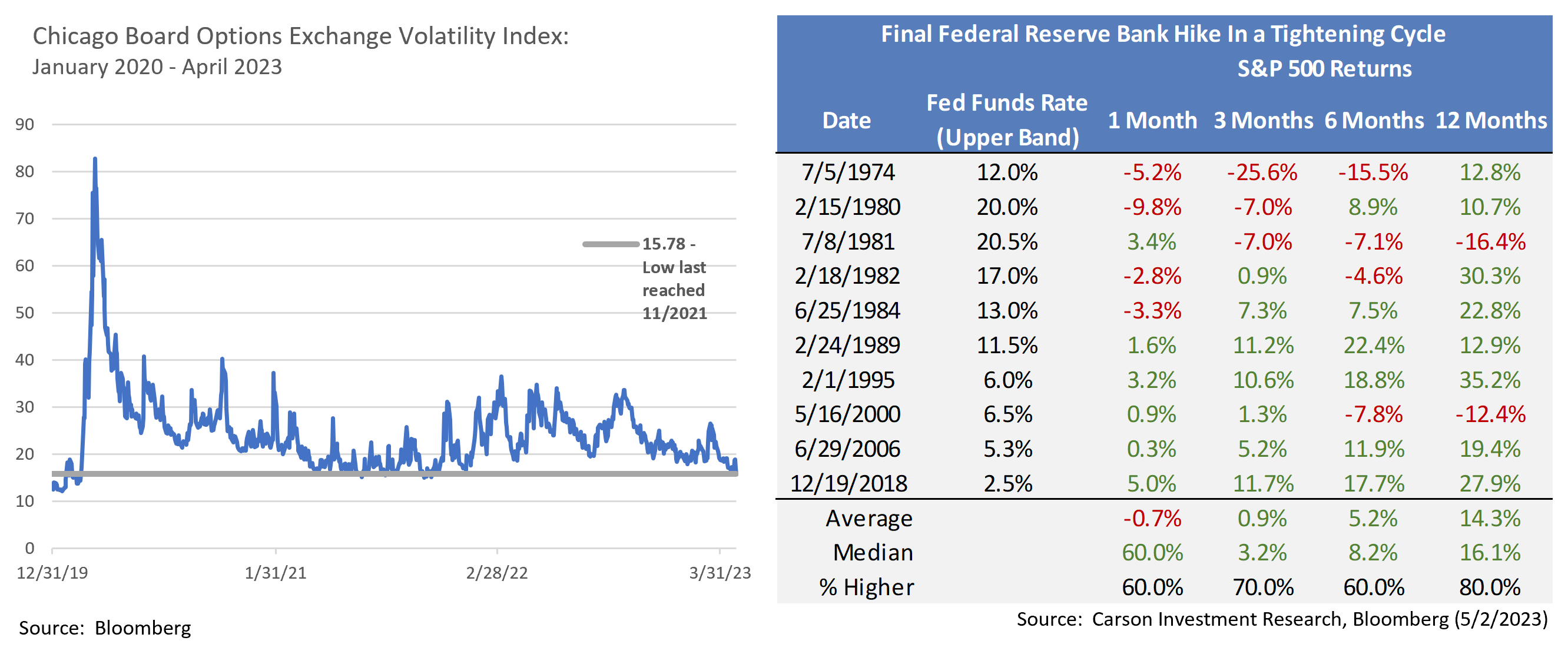

- While headline risks bubbled to the surface, April’s underlying price action was relatively muted. The VIX ended at 15.8, its lowest level since November 2021 and well below the recent average of 24.4. Only one day in April had posted > +/- 1% move until the final week when two such days occurred. For context, the first 3 months of the year saw 29 of 62 trading days breach the +/-1% threshold and we have not had a month with 3 or fewer >1% days since November of 2021. We expect this relative calm to be broken due to the May 3rd FOMC meeting and the debt ceiling debate heating up.

- A significant market outlook variable lies with earnings growth. CY2023 S&P 500 estimates have stabilized around $220/share largely due to a better-than-feared Q1 season. With over half reporting, 77% of companies have beaten consensus expectations and by an average margin of +6.9%. That has raised the blended earnings growth rate from -6.7% at the beginning of Q3 to a current expectation of -3.7%. Tech bellwethers such as AMZN, MSFT, and GOOG have been big contributors and all eyes are now on AAPL. These companies stand to benefit as defensive plays provided their profitability endures over the course of an economic slowdown.

- Investors looked past much of the banking sector turmoil which crested in mid-March and carried on throughout April. First Republic (FRC) recently became the latest bank failure and further fallout remains possible. We believe the issues at SVB, Signature Bank, and FRC are not systemic and anticipate that regulators will continue to ring fence depositors. The Fed is acutely aware of contagion risks, although they simultaneously are focused on broader financial conditions and the need to maintain inflation vigilance. Nonetheless, the entirety of the tightening cycle coupled with questions surrounding the health of regional banks may afford the Fed the rationale needed to signal a pause in its rate-hiking campaign. Historically, stocks have behaved well following the end of a hiking cycle. We do not want the Fed to be forced into later quickly reversing course and would prefer to see a pause to assess the impact of higher rates and tighter credit on the economy.

- The adage of “sell in May and go away” has not held true over the past decade with stocks rising 9 of the past 10 years. May has gotten off to a rocky start and there are plenty of potential catalysts for movement in either direction. We are focusing on the remainder of earnings season with an eye on company outlooks. We are also closely following the labor market for signs of a slowdown, as post-pandemic tightness has been a pillar of consumer strength. Finally, the debt ceiling debate is heating up as we move closer to deadline dates. Given economic concerns, the effect of Fed policy, banking turmoil, and with elections around the corner, we expect politicians to move past brinksmanship and get a deal done, hopefully sooner rather than later.

From the Trading Desk

Municipal Markets

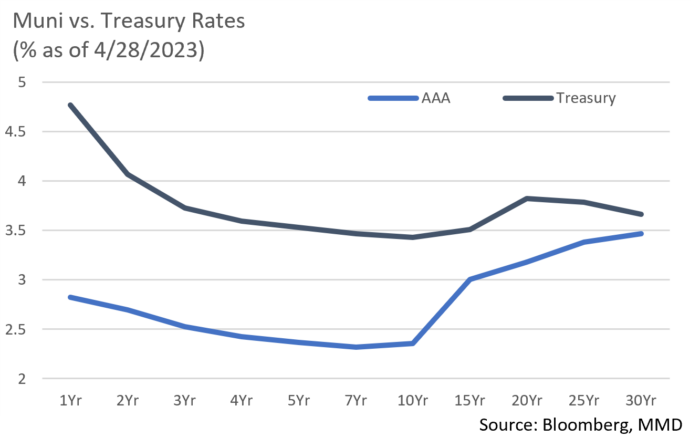

- After yields fell throughout the first half of April, the market significantly corrected towards the end of the month. This was not surprising given that rich Muni/UST ratios have been persistent for some time. Markets were further aggravated by an increase in net outflows (-$5.9B YTD), elevated supply, and modestly widening high grade credit spreads.

- Municipal underperformance resulted in an uptick of 5 and 10-year Muni/UST ratios which closed April at 67% and 68% respectively, while 30-year ratios bumped up to 92%. The front end of the curve remains expensive, and we do not see this changing until yields are more competitive with short USTs.

- Municipals gave back much of the prior month’s gains at the tail end of April with shorter maturities faring worse than longer issues. Long maturities have gained almost 4% YTD, while intermediate bonds have returned +2.5%, and bonds maturing inside of 4 years <1%. Short-term borrowing costs have been volatile as demonstrated by the SIFMA Municipal Swap Index. SIFMA yields, which are largely driven by technical factors, have ranged from a 2023 low of 1.66% to a high of 4.35% in March, a dynamic that has unsettled the shorter portion of the curve.

- 30-day visible supply has increased but remains weak as YTD issuance lags 2022 by 20-25%. However, roughly $7.4B is expected to come to market as the SVB and Signature Bank municipal portfolios are liquidated, although only 10% is expected to offer 4 or 5% coupons, and a good deal of the inventory are longer maturities. While most of these bonds fall outside our buying preferences, this supply will provide valuable price discovery.

- April marked a low point for coupon payments and maturities with higher cash flow expected in upcoming months. May redemptions should be about $23B (50% above April’s figure), followed by $36B in June, $40B in July, and $44B in August, cash flow that should be market supportive. We continue to find value in the 10 to 12-year portion of the curve and are looking to add credit diversification when value materializes.

Corporate Bond Markets

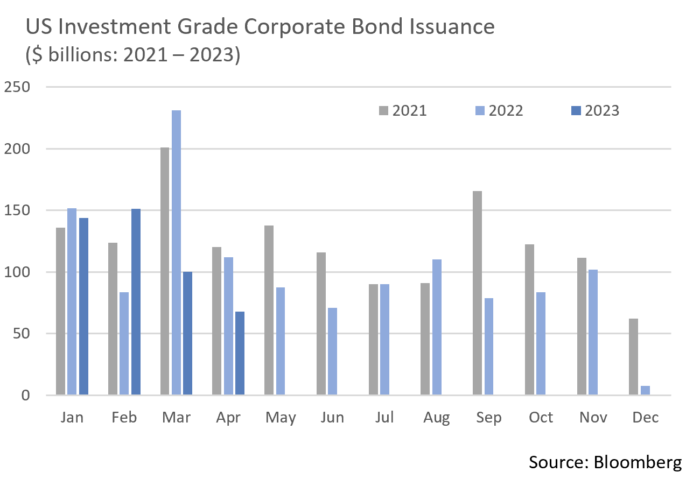

- The Investment Grade primary market fell well short of consensus in April as uncertainty left over from the regional banking shakedown left little room for opportunistic periods to issue new debt. The $65.7B that did come to market was well received although it was a bumpy ride getting there. Consensus had called for about $100B, and while April was a miss, prospects for a more robust May are high as issuers exit earnings blackouts. Additionally, earnings have been more positive than anticipated, which may prompt capital raises in the coming months ahead of future economic uncertainty. May borrowing is expected to climb to $150B, a level we feel will easily be absorbed.

- Prior to March’s credit sell-off, IG credit spreads remained range bound, trading at roughly 20 bps with an average option adjusted spread (OAS) of 122 bps. After hitting a YTD high of 163 bps on March 16, spreads quickly receded over the remainder of the month, settling in around 136 bps. We see slightly more room for spreads to tighten, although catalysts for widening continue to be inflation and/or a deepening recession.

- High Yield Corporate spreads also retreated as the market came back to life with investors returning to risk assets, a healthy dynamic for corporate credit at large. The OAS on the US HY Index began the month at 455 bps and rallied to hit 439 bps to close April, with high yield excess returns exceeding those of IG credit. A spread differential between IG and HY that had been gradually converging prior to the SVB meltdown has since widened back out. In March, investors pulled close to $7B out of high yields funds, although April’s positive net fund flows of $8B offered a positive indication of credit appetite. Volatility should remain in this segment of the market as investors navigate economic conditions, although we are encouraged that spreads are narrowing.

Financial Planning Perspectives

Secure Act 2.0 & Inherited IRAs

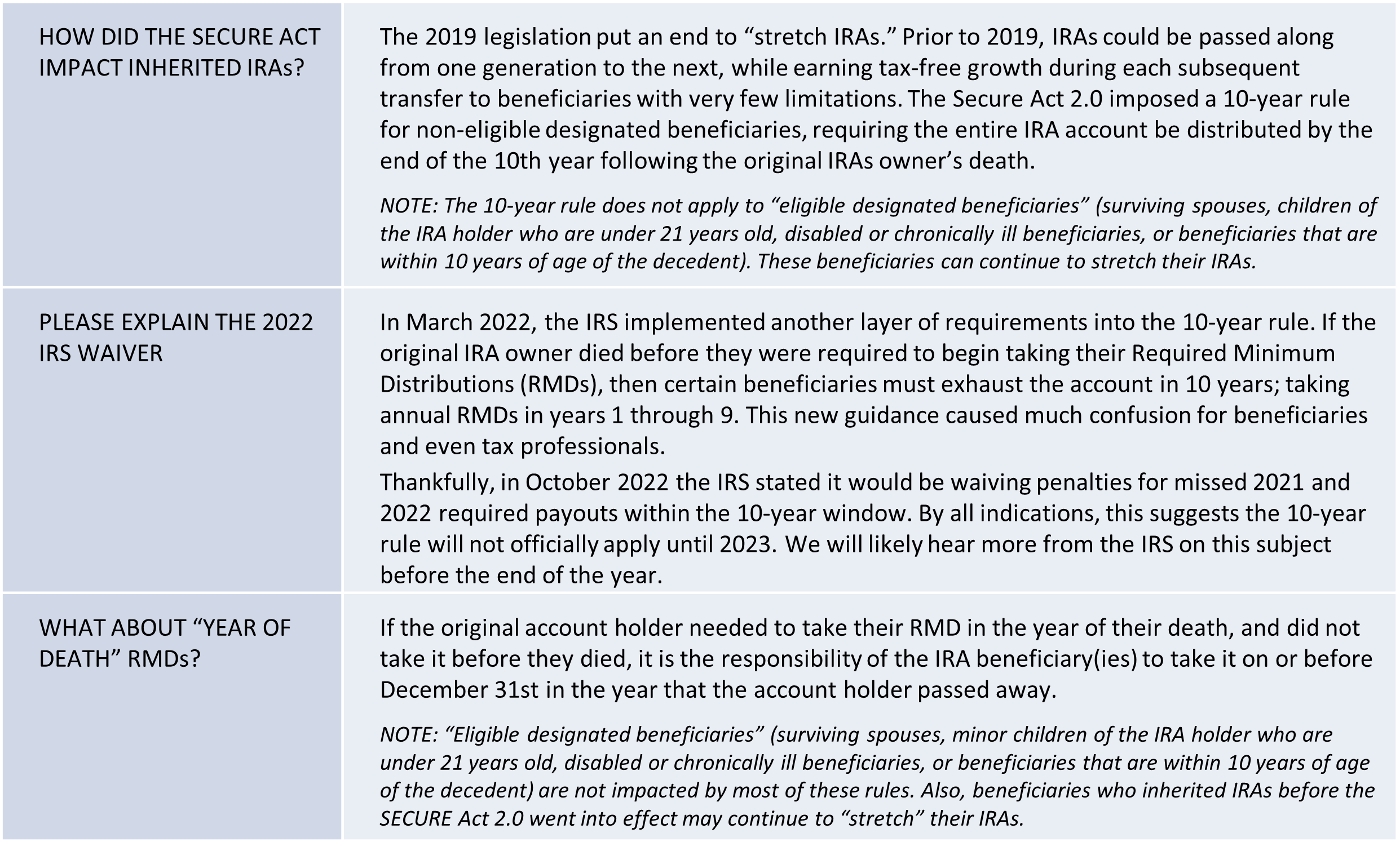

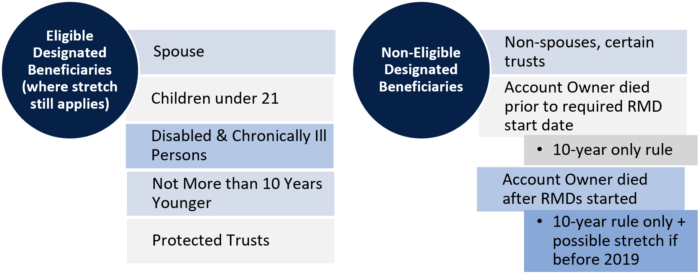

In April’s Financial Planning Perspectives, we highlighted the SECURE Act 2.0 and its provisions aimed at helping the younger generation save for retirement. This month we take a close look at how the SECURE Act 2.0 impacts IRAs, particularly the rules surrounding Inherited IRAs. When clients of ours unfortunately pass away, we work with their families to ensure proper financial planning is undertaken. This is an important topic for beneficiaries, and we often get questions surrounding Inherited IRAs.

In April’s Financial Planning Perspectives, we highlighted the SECURE Act 2.0 and its provisions aimed at helping the younger generation save for retirement. This month we take a close look at how the SECURE Act 2.0 impacts IRAs, particularly the rules surrounding Inherited IRAs. When clients of ours unfortunately pass away, we work with their families to ensure proper financial planning is undertaken. This is an important topic for beneficiaries, and we often get questions surrounding Inherited IRAs.

This is a complicated subject, so please contact your Portfolio Manager or tax professional with questions about your personal situation.