Insights and Observations

Economic, Public Policy, and Fed Developments

- In a dramatic 11th hour twist, a deal to keep the Federal government open came together after Speaker McCarthy made the unexpected move to abandon his hard right colleagues and instead seek a bipartisan deal. The continuing resolution passed with the support of almost all Democrats and slightly more than half of Republicans. The move was unexpected given the fragility of McCarthy’s coalition and rules making it easy to seek a vote to remove a Speaker, and sure enough McCarthy failed a no-confidence vote on Tuesday evening. It remains to be seen who will replace McCarthy and the process has the potential to significantly delay the 2024 budget and increases the chances of a November shutdown.

- Assuming the House successfully selects a Speaker, the remaining budgetary differences are fairly small. The House bill extends 2023 spending levels for 45 days; the Senate proposal set 2024 spending at levels agreed to in the debt ceiling bill. The media is making much of this difference; in practice it amounts to about 1%, a far cry from the 27% discretionary spending cuts Republican hardliners had initially sought. We expect a final result very close to the levels set in the debt ceiling bill, though the uncertainty around the Speakership is a wildcard.

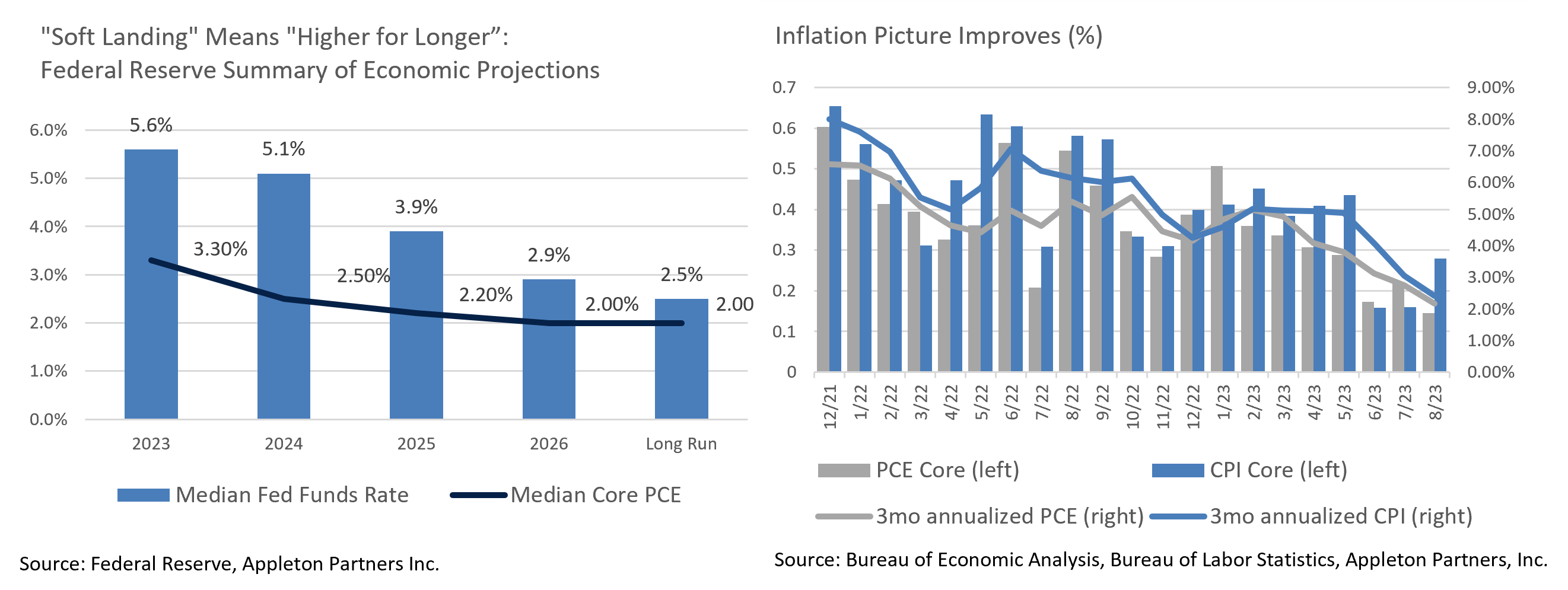

- Inflation continues to improve, albeit with some noise in the most recent releases. Both CPI and PCE headline inflation came in relatively hot on energy price increases (gasoline rose 10.7% in PCE), but Core was split, with a higher-than-expected Core CPI at +0.3% but a lower-than-expected Core PCE of +0.1%. Encouragingly, the so-called PCE “supercore” (which BLS began reporting this month) fell to +0.14% monthly and +4.4% YoY. Despite the blip in Core CPI, inflation is clearly falling, though the run-up in oil prices is still concerning and could start flowing through to Core if unchecked.

- As expected, the Federal Reserve left their benchmark rate unchanged at 5.5% in September. The “dot plot” still indicates the Fed expects to hike one more time before year-end, and while there is a huge amount of dispersion, the Fed expects a median 5.1% rate at the end of 2024. We feel one additional hike is reasonably likely, but it may not occur until January.

- More importantly, the Fed’s outlook indicates they expect a “soft landing,” with inflation slowly falling to their 2.0% target only in 2026, growth slowing but not faltering, and rates remaining elevated through at least 2025. The equity markets have priced a soft landing for some time now; the Fed’s outlook was little changed from June, but the market has belatedly realized a “soft landing” means “higher for longer” and the yield curve steepened significantly in response. The curve remains deeply inverted and the 10Yr UST is currently the lowest yielding part of the curve, but Tuesday’s 4.80% is the highest this maturity has yielded since late 2007. Rate moves of this size often have unintended consequences and we remain vigilant for cracks forming in the economy.

- Complicating the Fed’s job, the United Auto Workers (UAW) went on strike on September 15th, walking out on several Big Three auto plants. At present, only 25,000 of UAW’s nearly 150,000 workers are on strike, though that number is slowly rising. This comes at a dangerous time for the Fed, as their focus shifts from the current level of inflation to whether growth and labor demand is too strong and might cause inflation to reaccelerate. A strike of this size could skew employment statistics and cause growth to slow, but these effects are likely to be only temporary unless the strike becomes protracted. Large temporary effects like this will cloud the Fed’s picture of current labor conditions.

Equity News and Notes

A Look at the Markets

- Stocks were down across the board in September as the S&P 500 fell 4.9%, the worst month since December and its first back-to-back monthly losses in a year. After hitting a closing YTD high on July 31st, the S&P has lost 6.3% over the past 2 months to fall back below its 50- and 100-day moving averages. The DJIA was a relative outperformer, declining 3.5%, while the Nasdaq lost 5.8% and the Russell 2000 fell 6.0%. The Energy sector was the lone gainer (+2.5%) as WTI crude traded as high as $95/barrel. Weakness in office REITs led to the broader sector posting a -7.8% September return.

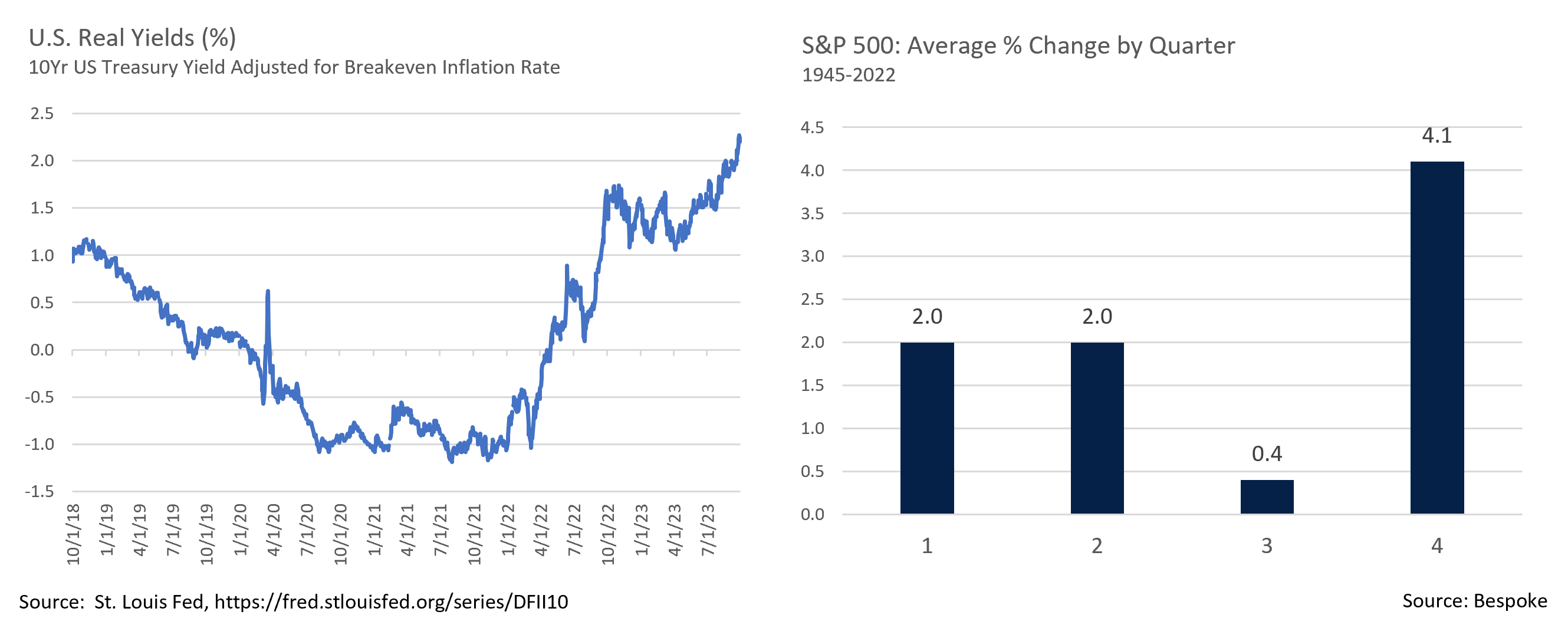

- September has historically been the weakest month of the year for stocks, and several recent headwinds sustained the trend. Chief among them was “higher for longer” interest rate messaging from the Fed, as good economic news fuels Fed concerns that a hot jobs market could lead to higher inflation. With a hawkish Fed, interest rates climbed higher across the curve with the 2Yr UST gaining ~20 bps and hitting its highest point since 2006. The 10Yr UST sold off by ~50 bps. These moves are troublesome for risk assets given that they have been driven by real yields (adjusted for inflation). As real yields rise, stock valuations typically come under pressure as bonds present a more compelling alternative.

- The US dollar and price of oil both hit fresh highs in September as rates rose. Oil was boosted by better than feared economic data (demand) and by extension of production cuts from Saudi Arabia and Russia (supply). The dollar is riding an 11-week winning streak as investors seek out the relative safety and appeal of the US. Both trends may prove problematic for companies, especially those with significant overseas revenue exposure. Other headwinds include the resumption of student loan repayments, although the ultimate impact may be muted as the payments represent less than 0.5% of GDP annually. There was also the looming government shutdown, although a deal was reached at the last minute to secure funding through mid-November.

- Other bearish headlines included the UAW strikes, regulatory action against Big Tech, China property woes, and an overall lack of breadth in a market driven by only a handful of stocks. On their own, no one headline would be a concern, but with the backdrop of a hawkish Fed the collective impact has bears in control for the time being.

- October will bring a respite from the focus on macro as Q3 earnings season arrives. Earnings growth is expected to come in at -0.1%, an estimate that would mark the 4th straight quarter of negative earnings growth. Notably, estimates are improving, as the June 30th projection for Q3 was -0.4%. Earnings guidance will be paramount as investors start looking ahead to 2024. Stabilization in forward earnings could help support equities from a valuation standpoint, and the S&P 500’s forward P/E has already dropped to 17.9x from 19.1x at mid-year, leaving this metric in the ballpark of its 10-year average of 17.5x.

- We see potential for a bounce as Q4 begins. Seasonality tends to create a late year tailwind and the market has shown some signs of bottoming. Relative strength indicators are at the lowest in a year, several internal gauges are flashing signs of excess selling, and valuations are not as challenging as they were earlier in the year. Technically, the S&P 500 is closer to longer term areas of support at the 4,200 level (200-day moving average) which gets us closer to a 10% drawdown (average year has a -14.3% drawdown). We are looking for signals from the jobs market, inflation measures, and ultimately the Fed for signs of stabilization in the bond market. Should rates steady, the stock market might be able to complete its own bottoming process, setting the stage for a potential year-end rally.

From the Trading Desk

Municipal Markets

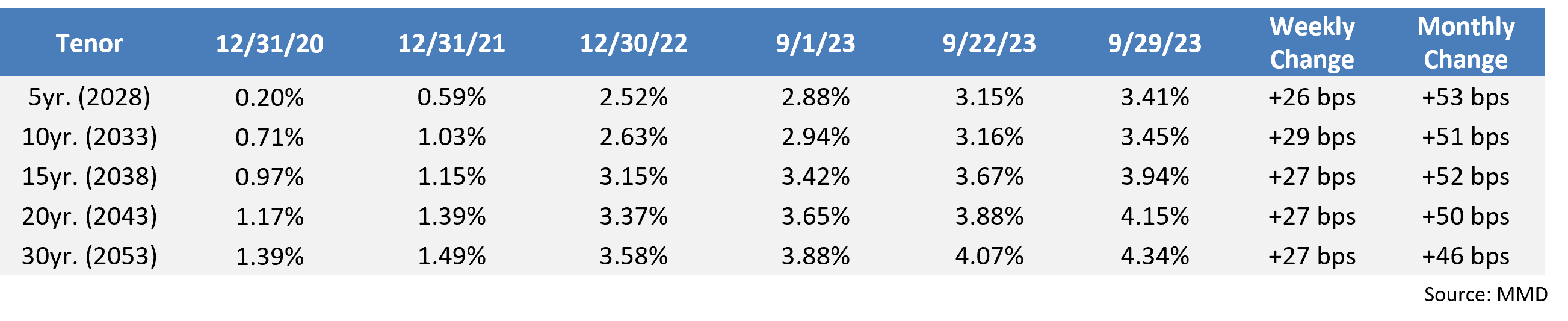

- Municipal yields rose 55 bps, 53 bps and 51 bps in September over 2, 5, and 10-year maturities respectively, following USTs up as “higher for longer” rate expectations sank in with investors. Much of that move in 10-year issues, ~29 bps, occurred over the final week of the month and 10-year AAA yields of that maturity have now reached highs not seen since January of 2009 when yields hit 3.53% and the Fed Funds rate stood at 1.50%. On a tax-equivalent basis, yields on 10-year AAA munis for those in a combined 42% tax bracket hit 5.94% at the end of Q3. We see significant value among high quality issuers with nominal yields at current levels, and adding some duration at this point in the cycle is a worthy consideration.

- A challenging month for the municipal market pushed 2, 5 and 10-year AAA muni/UST ratios to 72.5%, 74% and 75.5% respectively after ratios spent most of the summer at relatively rich levels in the 60s. The bellwether 10-year ratio is now at a YTD high, suggesting there is greater relative tax-exempt value than earlier in the year.

- We expect issuance to remain below average this month as yields are elevated, further propping up demand for new issues. Trading in the secondary market will remain dependent on economic factors and is becoming increasingly influenced by tax-loss swaps on the longer end as we enter Q4. October has an estimated $32 billion coming back to investors, down from a high of $48 billion in August, and is historically one of the lightest months for redemptions. This technical factor, coupled with supply outpacing demand, lessens the squeeze on liquidity and should offset any potential additional negative price action.

- We continue to find value in the 7 to 10–year maturity range, as yields shifted up roughly 50 bps across the curve over the course of September.

Corporate Bond Markets

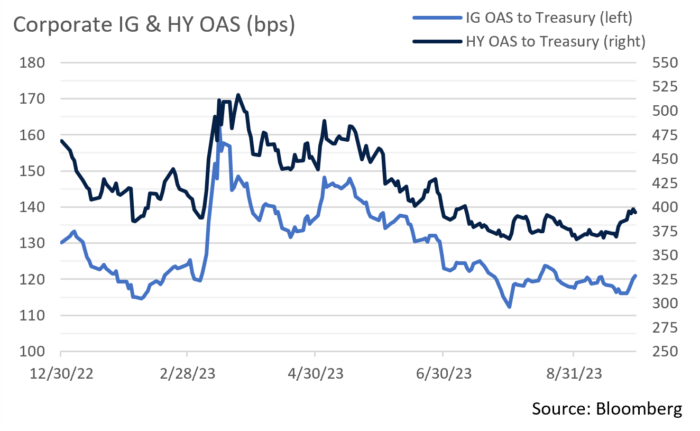

- Investment Grade credit spreads have been range bound. OAS on the Bloomberg US Aggregate Corporate Bond Index ended September at 121 bps after a MTD low of 116 bps was realized on the 20th, just 4 bps wider than the July 31st YTD low of 112 bps. Despite considerable volatility, spreads remain slightly tighter than the 5-year average of 123 bps as investor demand for high grade credit has been sustained and credit fears have stayed muted.

- High-grade corporate performance has been driven by moves in USTs, a factor that accounted for -0.62% of the overall -0.73% total return on the month. Excess return relative to USTs has been +2.22% on a YTD basis, a nominal but positive risk premium. We continue to believe that IG Credit spreads will remain close to near term averages.

- Primary market supply of IG credit beat expectations in September with ~$124 billion hitting the market vs. a projected $120 billion. The path to getting there was inconsistent, and issuers were selective about coming to market. Average new issue concessions of 9 bps are still tracking lower than 2022’s average of 13 bps, although order oversubscriptions of 2.5x fell well below the YTD average of 3.5x. The Financial sector accounted for 55% of monthly new issuance volume, followed by Utilities at 9%. YTD volume of $981 billion is tracking very close to last year’s pace and we are assuming that new issuance for the full year should land close to the $1.2 trillion market expectation.

- High Yield has been a recent bright spot in the fixed income markets. The lower quality Bloomberg US Corporate High Yield index returned -1.18% on the month vs. a -2.67% loss for its high-grade counterpart. For most of the month, High Yield credit spreads remained very close to YTD tights, reaching an OAS of 367 bps before closing at 398 bps. High Yield new issuance was a robust $24 billion on the month, the largest new supply since January 2022 and a sign of persistent demand for credit.

Financial Planning Perspectives

Avoiding Probate Through The Use Of Revocable Trusts

Look Out for Your Beneficiaries’ Future Interests

The most efficient way to ensure that your estate assets are protected from taxation and are made more readily available to your designated beneficiaries is to create a revocable trust. It offers an ability to make changes as you see fit and avoids probate courts when assets are distributed.

By avoiding probate, one creates a much clearer succession path for those inheriting assets. The probate process can take months, possibly longer, to determine how property should be distributed. It can also prompt tensions with a family as they would need to determine how to distribute assets after a loved one has passed. There are many unfortunate cases where lack of account documentation and trust designation ended up making the inheritance process much more difficult than it needed to be. Probate court also introduces considerable legal and court documentation expenses.

However, revocable trusts are not for everyone, and certain scenarios may make the economics of creating a trust unattractive.

Preserve Privacy

Revocable trusts also protect the privacy of the trust owner and the trust beneficiaries. When an estate goes through probate, details of the estate become a matter of public record and can be easily accessible. Dealing with death can be a difficult, emotional process and revocable trust adds an additional layer of privacy and security for all involved in the estate.

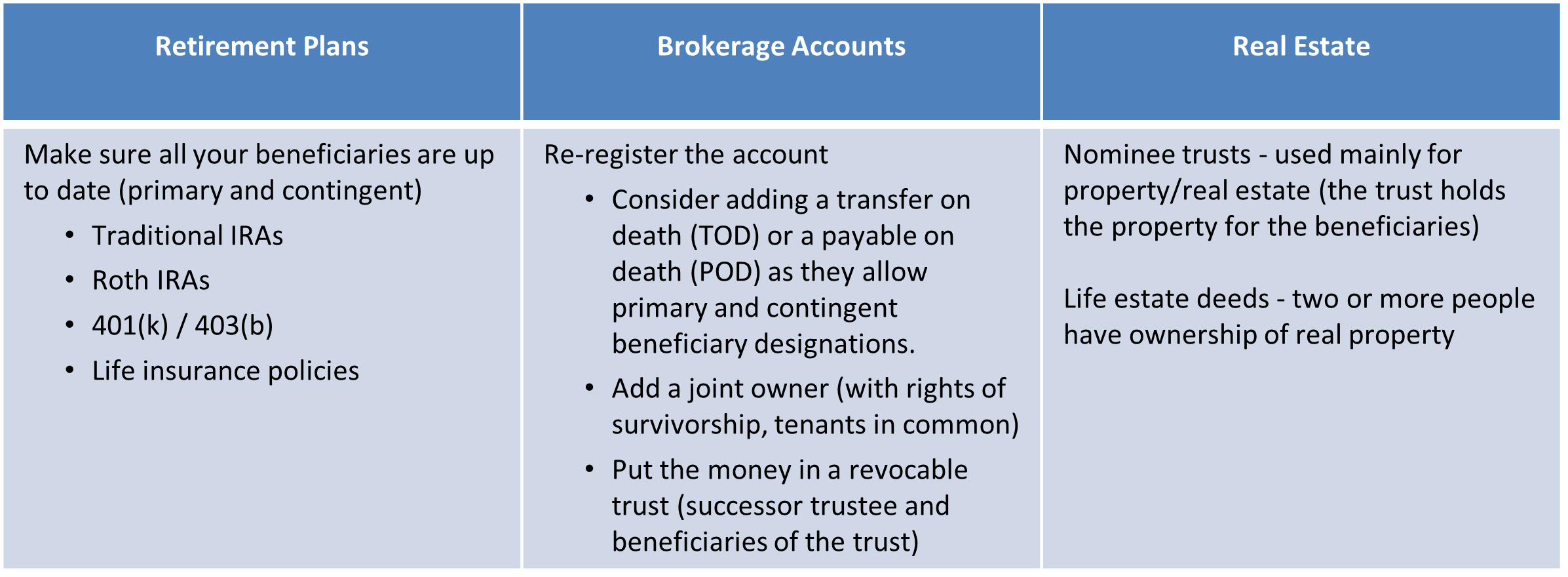

Specific Recommended Steps by Account Type

It’s Not Difficult to Make Changes

In most cases, it only requires signing a few forms. We encourage you to reach out to your Portfolio Manager to talk about what might need to be done with your accounts. We are here to make it easy for you to implement documentation that protects your interests and will prepare the necessary paperwork.

Upcoming Webinar: How Does Secure Act 2.0 Impact Your Retirement Planning?

SECURE Act 2.0: What it Means for Retirement Planning

Date: October 18, 2023

Time: 4:00 pm ET

For questions concerning our financial planning or wealth management services, please contact:

Jim O’Neil, Managing Director

617-338-0700 x775 | [email protected]