Insights and Observations

Economic, Public Policy, and Fed Developments

- Inflation talk dominated the financial news in March as President Biden’s $1.9 trillion stimulus plan was signed into law and the White House laid out the basis of a large infrastructure bill. There is a widespread belief that inflation will rise in coming months; YoY comparisons are about to begin being made against a very low base impacted by last March and April’s economic shutdowns. Even if the Core PCE, the Fed’s preferred inflation measure, were to remain flat this March and April, comparisons with the same months of 2020 would cause Core PCE to rise from February’s 1.41% to 1.95% by April. This base effect sheds no light on the more pressing question of whether inflation will persist. Evaluating upcoming monthly or quarterly changes should offer better perspective.

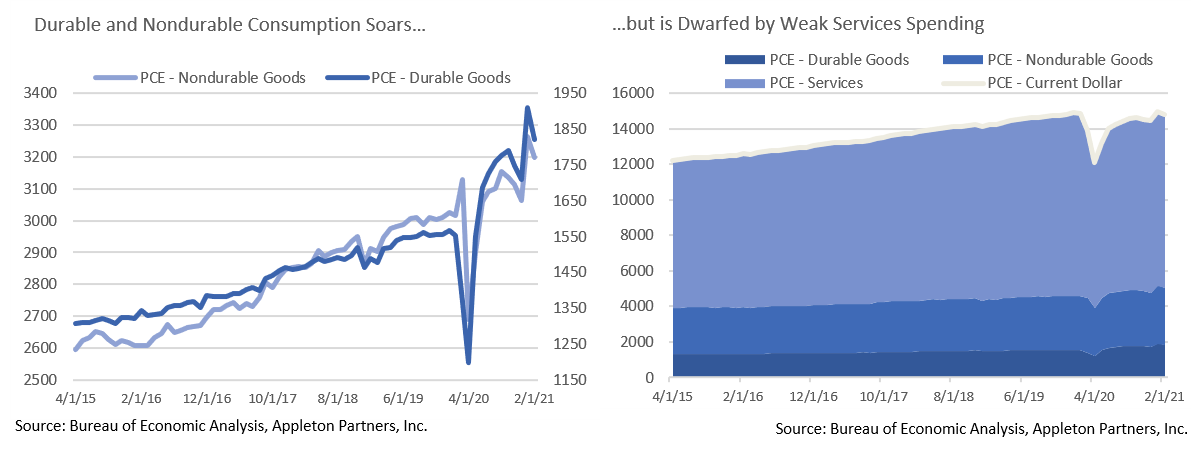

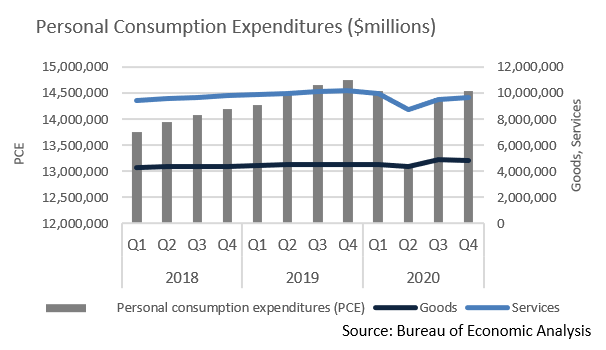

- There are several reasons to discount inflation fears; the simplest is that large stimulus efforts such as QEI through QEIII, and the American Recovery and Reinvestment Act failed to produce a meaningful surge. Additionally, while recoveries in Durable and Nondurable Goods consumption to above-trendline pre-pandemic levels have generated a great deal of attention, goods consumption is dwarfed by services and comprises only 30% of all consumer spending. With two-thirds of consumer spending still lagging, it is hard to see demand being sufficient to cause the economy to overheat.

- Despite strong momentum in the March employment report, a deeper look reveals that the pandemic is still weighing heavily. Although 11.4 million Americans reporting in The Household Survey that they either did not work at all or worked fewer hours because their employer had lost or closed their business was an improvement from the prior month’s 13.3 million, a sizeable employment gap persists. The economy bears scars that will take time to heal, and although labor demand is improving, it remains weak.

- Nonetheless, there are tangible signs that economic areas hit hardest are beginning to recover. March’s employment report produced a headline number of 916k new jobs, suggesting that labor demand is strengthening. Notably, most of the jobs were in leisure and hospitality, food service, and bars. Hiring in these sectors could point to an acceleration in services spending.

- While manufacturing is no longer the engine of the US economy, February’s ISM Manufacturing report was exceptional; the headline reading reaching levels not seen since 1983. This was followed by an equally strong ISM Services report. The index rose to 63.7, the highest reading since records began in 1997.

- Meanwhile, retail sales fell 3% in February and there was a surprise -1.1% drop in retail orders, although weather and supply bottlenecks were partly to blame. Notably, automobiles were down 8.7% as chip shortages constrained supply. A 200,000-ton container ship running aground and blocking the Suez Canal for several days captured popular imagination, while adding considerable strain to global supply chains and complicating efforts to assess the inflationary impact of backlogs.

- There was worrying news on the issue that has framed health and economic news over the past year: COVID-19. A drop in US cases since the start of the year has stalled and case counts are rising again. The “reopening trade” was fueled by a far-quicker-than-expected US vaccination push, and if too-rapid reopening contributes to a sustained new wave of infections, the recovery could be jeopardized.

From the Trading Desk

Municipal Markets

- Favorable economic forecasts, forthcoming additional stimulus, and growing inflation concerns produced sustained upward pressure on Q1 fixed income yields. As noted below, USTs moved sharply higher and municipals followed, although they somewhat lagged. 10Yr AAA muni yields rose during Q1 from 0.71% to 1.12%. Curve steepening was pronounced with the spread between 2s and 10s rising from 57 to 98 basis points. We welcome a more normalized curve as it creates better opportunities to invest client assets and bolsters reinvestment income. As active managers, we are looking for opportunities to enhance yield and total return while seeking to protect capital as rates adjust.

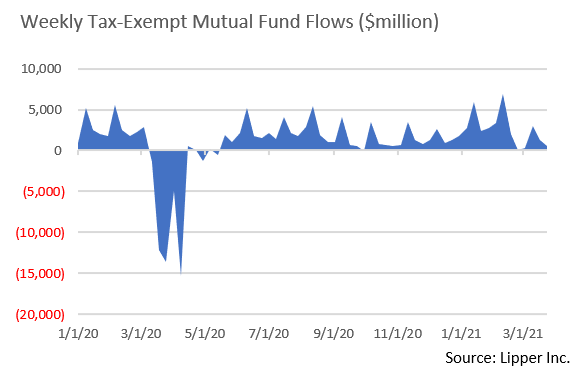

- The positive technical backdrop that has characterized the municipal market for some time remains intact. Demand is still strong with net municipal fund flows exceeding $31 billion YTD. Through the end of Q1, new tax-exempt issuance of $73 billion is only slightly ahead of relatively low 2020 comparisons. Furthermore, Citibank anticipates flat net new issuance in April, as maturities, calls, and coupon payments are likely to offset new offerings.

- Investment grade municipal demand is also unlikely to be tempered by near-term credit concerns. As the “Public Sector Watch” notes that follow on the next page indicate, most state and local budgets are comfortably exceeding conservative projections and substantial further Federal aid is forthcoming. And with income tax hikes possible, if not likely, demand for tax-exempt income is not likely to wane anytime soon.

Corporate Bond Markets

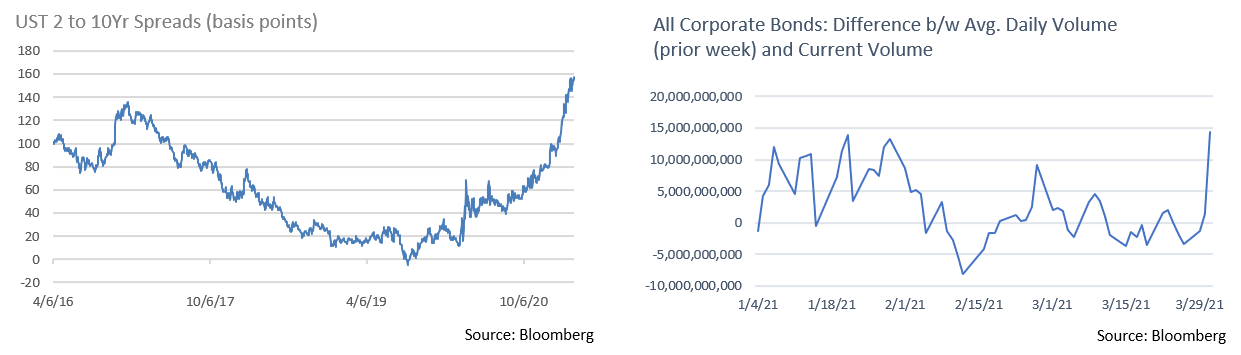

- Curve steepening has been the story of late, with the spread between 2s and 10s on the UST curve reaching 160 basis points at the end of March, a level not seen since the summer of 2015. With the front end of the curve remaining inside of 10 basis points due largely to an accommodative Federal Reserve, bear steepening of Q1 was driven by a spike in the 10Yr from 0.83% to 1.74%.

- Investment grade credit spreads have been in an elongated band throughout 2021. Option-adjusted spreads (OAS) reached cyclical lows at 88 basis points at month’s end. A solid fundamental credit outlook has fueled sustained demand for corporates despite modestly negative recent performance driven by upward rate pressure. We note that after several weeks of sluggish volumes, TRACE reported a $14.3 billion increase in trading activity on the last day of the month, an indication of vibrant market conditions given accompanying spread tightening.

- Investor appetite for corporate bond risk and the income it offers remains high despite the recent move up in the yield curve. The riskiest tier of the High Yield market (CCCs) was the top-performing US fixed-income asset class in Q1 with the Bloomberg Barclays US Corporate High Yield Index returning +3.58%. Below investment grade corporate issuers are capitalizing by issuing bonds at a historic pace. March high yield bond issuance reached a record $59.1 billion, contributing to a new high in quarterly corporate issuance of $148.7 billion.

Public Sector Watch

Credit Comments

An Improving Municipal Sector Outlook

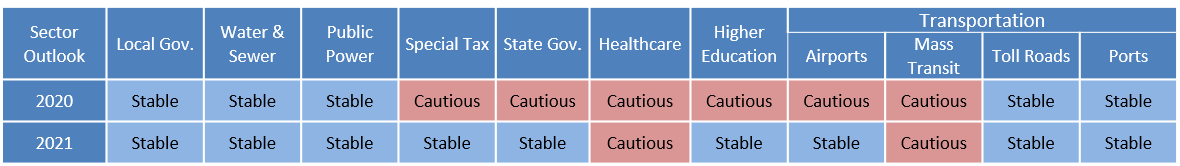

- Slow and steady progress in the fight against COVID-19 has been evident for some time, but with efficient vaccination paired with American Relief Plan (ARP) stimulus, we expect economic activity to accelerate. CNN Business and Moody’s Analytics’ “Back-to-Normal” Index, which measures 37 economic trend factors, saw the US reach 86% on March 23rd, up from an April 2020 low of 60%. The pandemic’s impact on municipal credit has been modest with tax revenue falling only slightly below 2019 levels. We see tax-exempt market tailwinds and are upgrading our outlook on four sectors from “cautious” to “stable”.

States: Budget outperformance paired with generous federal funding has allowed most states to solidify their financial health.

- Many were quick to revise budgets at the beginning of the pandemic, conservatively forecasting steep revenue declines. Fortunately, state revenues have come in far better than anticipated. Of the 30 states that have reported FY 2021 revenue through January, 28 posted positive YoY comparisons.

- States received $195 billion in funding from the ARP. Given an only modest decline in 2020 tax revenues, stimulus funding should more than cover revenue shortfalls. States also enjoy considerable flexibility in the use of Federal aid, such as for growth facilitating investments in infrastructure and job training.

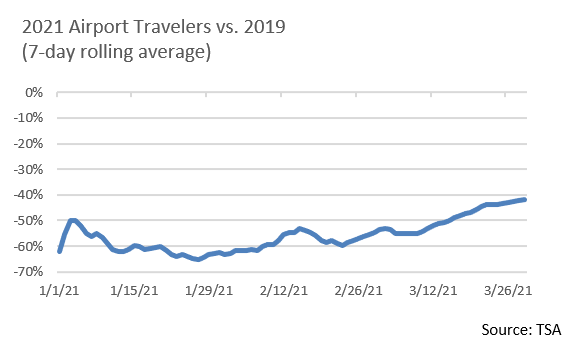

Airports: As vaccination levels accelerate, Americans are demonstrating a greater willingness to travel.

- Airlines have reported solid growth in bookings, a leading indicator of airport throughput. Strong bookings for late spring and summer have encouraged airlines to add back flights and service new destinations, thereby supporting enplanements.

- ARP funding will provide airports with an additional $8 billion through 2024. These resources will be particularly beneficial for large international gateway airports that have suffered from foreign travel constraints.

Higher Education: Colleges and universities should benefit from pandemic relief funding and an anticipated stabilization of state aid.

- The CARES Act, the Consolidated Appropriations Act, and ARP, have provided $77 billion, or 12% of sector revenues.

- Improving budget trends have allowed states to reallocate funds to higher education. Public universities generate an average of 25% of their revenue from state appropriation.

- Vaccine penetration has also increased the likelihood of more students returning to campus this fall, a development that would increase tuition and auxiliary revenue. These revenue sources account for 75% and 50% of private and public universities’ revenue based on median reported revenue.

Special Tax: This sector is closely correlated with consumer sentiment and economic vitality given its cyclicality and reliance on spending. Economy reopening, stimulus checks, and extended unemployment benefits are all expected to benefit the sector.

- Special taxes far exceed earlier projections. Q4 Census Bureau data indicates that state sales tax revenues have declined by only $5.4 billion, or -1.6% YoY.

- Consumer spending continues to rebound. Personal consumption expenditures (PCE) remain slightly below pre-pandemic levels due to a lagging services sector, although spending on goods has been bolstered by online purchases.

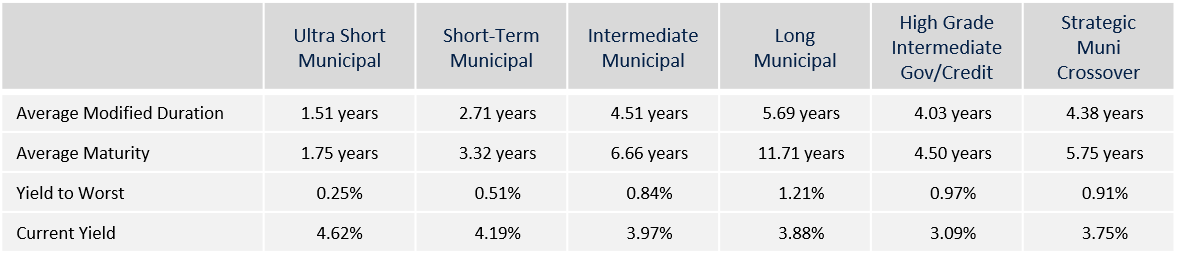

Strategy Overview

Composite Portfolio Positioning as of 3/31/21

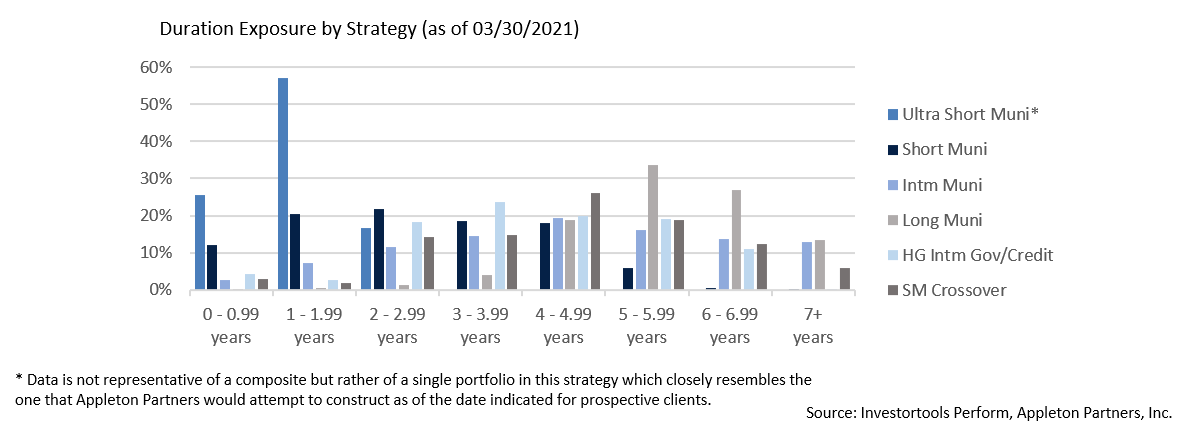

Duration Exposure by Strategy as of 3/31/21

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.