Insights and Observations

Economic, Public Policy, and Fed Developments

- As expected, the Federal Reserve hiked short term rates for the first time this cycle at their March meeting. The median dot plot was more hawkish than expected, showing seven hikes vs. the market’s expectation of six, although there is little cost to the Fed setting aggressive expectations. If, as we expect, growth slows into the second half, the Fed may have to choose between fighting inflation and supporting growth. If so, we believe growth will win out. We also note the surprising lack of media attention to the Fed’s balance sheet reduction plans and how this plays out has the potential to surprise the market.

- It bears reiterating in the context of the Fed’s inflation fight that at least three distinct factors explain its rise – a post-pandemic, stimulus fueled demand boom, ongoing Covid supply chain issues, and the Russian attack on Ukraine and resulting commodity supply shocks. Some of these the Fed can address with rate hikes, but others are largely out of their control.

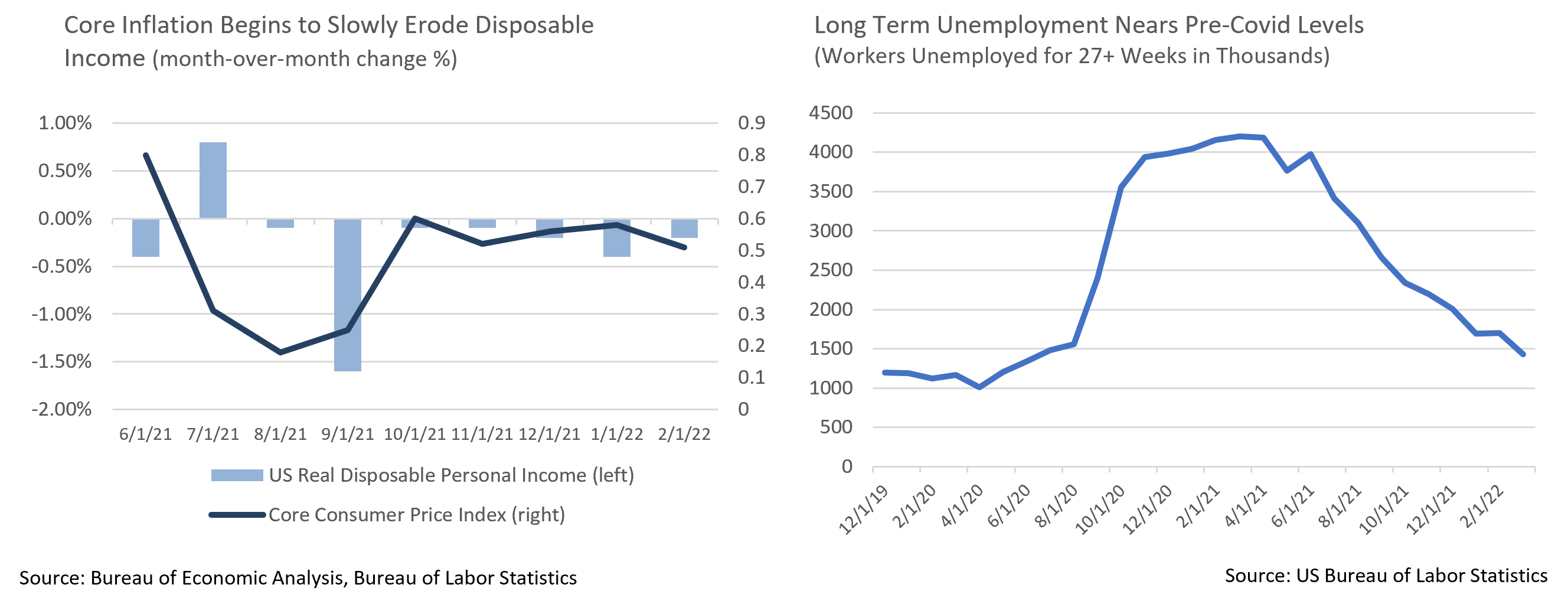

- March brought more evidence inflation had started to slow before full-scale war broke out in Ukraine. The monthly Core CPI series slowed to +0.51% and has been in a modest downtrend for some time. Core Goods Inflation, elevated after Omicron, decelerated from +1.0% to +0.4% month-over-month. Core PPI inflation also slowed to +0.2% in March, the lowest reading since November 2020, and while durable goods orders missed at -2.2% vs. -0.6% expectations, shipments improved at a monthly +0.5% pace. This offered an encouraging sign that supply chains are healing independently of normalizing demand.

- Consumer spending, a sizable driver of recent inflation, also slowed. Retail sales missed by a tenth at +0.3%, and with a good part of the increase attributable to rising gas prices, the “control group” sales that are part of the GDP calculation actually fell -1.2%. The ability of consumers to spend is waning, and demand had begun to recalibrate to supply in March.

- The Bloomberg Q1 GDP consensus estimate due out at the end of April is expected to slow considerably to a weak annualized rate of +1.5%. We expect the underlying details to be stronger, as a buildup of inventories boosted Q4’s +6.9% figure, effectively borrowing headline growth from the following quarter. Q4’s Private Sales to Domestic Purchasers was a closer-to-trendline +1.7%, and a better indication of underlying demand. We believe the Final Sales number for Q1 will exceed the consensus GDP estimate.

- Two external risks to US economic growth also bear watching. China’s “zero Covid” policy is coming face-to-face with ongoing virus waves, most recently seen through rolling lockdowns in Shanghai. China had initially locked down the city of 26 million but reversed course after a backlash. Their containment strategy has worsened supply issues, most notably when tech hub Shenzhen, a city of nearly 18 million, was locked down on 3/14, impacting Foxconn, Tencent, and Huawei. Meanwhile, Russia’s threat to cut off oil exports to Europe would be a severe problem for Germany in particular, as they import a third of its oil and more than half its natural gas from Russia.

- April’s BLS jobs report was refreshingly boring. Employment was perhaps slightly stronger than expectations, with the prior upwards revisions and a modest (but not worrisome) upside surprise in wages, though we believe this report does nothing to change market expectations of a 0.50% Fed Funds hike in May. A series of strong reports during a tight labor market, and in particular sizable declines in long term unemployment and continued increases in participation rate, means that workers who had dropped out of the workforce are coming back. While inflation remains a risk, let’s not lose sight of the fact that this is a good thing, especially in a supply-constrained economy.

From the Trading Desk

Municipal Markets

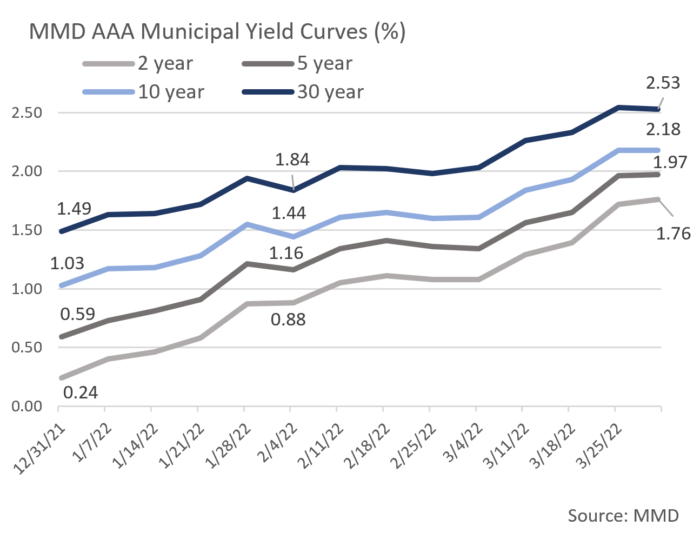

- March accelerated an already difficult quarter in the municipal market as a bear flattening trend continued. The 2Yr AAA curve reached 1.76%, while the 10Yr rose to 2.18%. As discussed in our recent commentary, we feel these levels are attractive on an absolute basis and relative to USTs.

- The 10-Year AAA Muni/UST ratio closed the quarter at 93% while the 2-Year ratio reached 75%. Both metrics are now above long-term averages, historically a positive sign for relative municipal performance.

- Short maturities have already priced in six to seven Fed Fund rate hikes, although we are in the camp that expects 0.50% in May and another 0.25% in July before Fed Fund increases may pause. With this in mind, we are emphasizing the “tails” of our 3 to 12-year buying range in the Intermediate strategy and reducing marginal buying among 5 to 8-year maturities.

- Investor sentiment reflects what has been one of the largest yield curve moves in many years. Fund outflows of $2 billion over the last week in March raised YTD outflows to $21.9 billion, more than half of which came from longer duration strategies. Deals are still coming to market though and are being reasonably well received. The first week in April brought with it a $13 billion calendar.

- Credit quality in the obligors we like remains very strong, and with yields now much more attractive we are finding compelling investment opportunities to reinvest income and new cash. Q1 performance reflects a broad market repricing, although today’s entry point is quite favorable, particularly for investors in high tax states.

Corporate Bond Markets

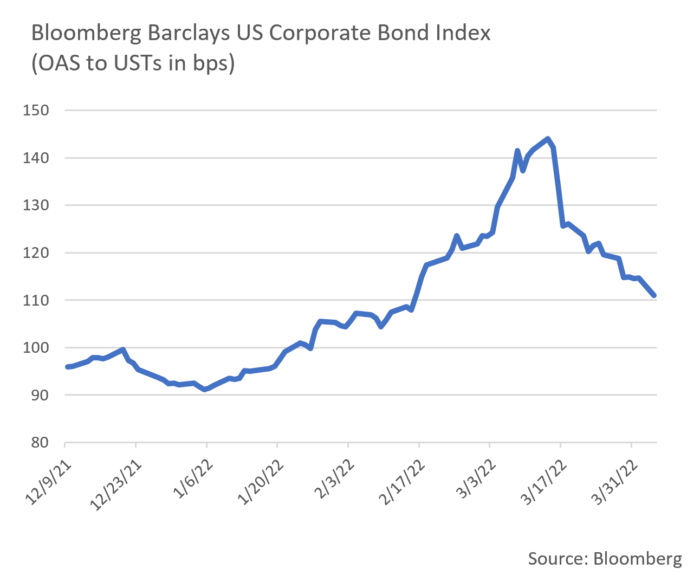

- During the last week in March, $33.3 billion of IG Corporate bond issuance blew through market consensus expectations. This has been a consistent trend over the last several weeks, leading to a total of $229.9 billion for the month. Historically, the primary market tends to be robust in March and this was certainly the case this year. Q1 concluded with the fourth highest monthly total on record, roughly $35 billion more than the $196 billion priced over the same period last year.

- The Fed’s deeply embedded hawkish tone has pushed front-end UST yields to levels not seen since the middle of 2019. Markets have already priced in 6 to 7 Fed Funds rate hikes with the 2Yr UST at 2.47% and the 3Yr UST at 2.63%. We see considerable value in shorter maturities and feel that the pace of Fed rate hikes is likely to slow in the second half of the year and fail to meet current expectations. By contrast, weakening economic expectations, pension and foreign buying have driven down the long bond to 2.43%.

- Lipper Inc. reported $15.7 billion of taxable fixed income fund outflows YTD through 3/28, as sentiment clouds in the face of economic, interest rate, and geopolitical concerns. High yield issues reflected this volatility, closing March with significant losses despite ending the quarter as the top performing US fixed income asset class.

- While widening credit spreads garnered much attention early in March, the corporate markets found their footing later in the month. Spreads ultimately closed about 7bps tighter on the month as strong issuance met unexpectedly firm investor demand in a stabilizing geopolitical environment.

- With Investment Grade spreads about 20bps wider than they were at the start of the year, and factoring in what is now a steep spread curve, corporates currently offer considerably more relative value than they did at the end of 2021.

Public Sector Watch

Credit Comments

Public Power Systems Prepare for New Standards Prompted By Climate Change

- National Oceanic and Atmospheric Administration recently issued their US Spring Outlook, and for the second year in a row, forecasters are predicting prolonged and persistent drought conditions throughout the West. The National Weather Service is also forecasting above-average temperatures across much of the country, a condition that elevates drought and wildfire risks.

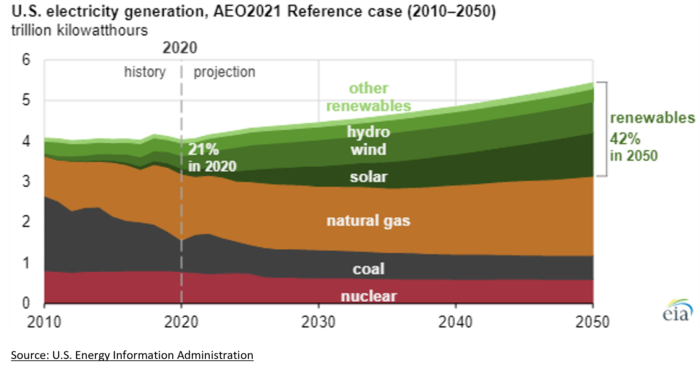

- According to climate researchers, 42% of the severity of recent drought conditions can be attributed to human influenced higher temperatures. This has spurred regulators to accelerate the push towards renewable energy and climate-resilient power generating infrastructure.

- Non-renewable resources, including coal and natural gas still account for over 60% of 2021’s total generation output, with renewable energy representing 20% and nuclear power 19%.

- State and Federal Government Renewable Portfolio Standards (RPS) are driving much of this push. These standards, some of which are voluntary and others mandatory, specify a baseline of renewable electric power. Most such targets are currently at least 40%, with many increasing to 100% by the years 2030 to 2050.

- Achieving these goals while maintaining reliability requires a massive and expensive infrastructure investment. However, most power utilities should be able to mitigate these cost pressures through autonomous rate setting authority and by passing on rising expenses to customers. However, affordability is an issue in some markets.

- Support from the Biden Administration is a positive for the economics of power utilities with $65 billion already awarded for enhanced grid resiliency. These funds will facilitate the integration of renewable energy and support energy related technologies. We anticipate sustained federal aid in coming years as a long-term push towards a carbon free electric system proceeds.

- Utility systems with strong credit profiles are in an advantageous position to absorb growing costs. The essential nature of their services leads to highly resilient revenues, as demonstrated throughout the pandemic. Power generating utilities enjoyed a median fixed charge coverage ratio of 1.95x in FY ‘20, as well as median adjusted cash on hand of 263 days, both of which we consider favorable metrics for revenue bond issuers.

- We see Public Power as a defensive, yet dynamic sector with an ability to evolve along with energy production requirements. Our Credit Research team favors issuers with sizeable existing renewable energy production capacity, and/or those investing aggressively to expand renewable resources, provided management is demonstrating efficient transition planning. Credit approval of issuers with lower renewable exposure requires a strong and reliable service base, consistently high debt service coverage levels, ample liquidity, and a manageable debt burden.

Growth in State and Local Government Tax Collection Slows But Remains Positive

- Of the thirty-nine states that have reported through February, median revenues increased by 5% vs. the same period of 2021, modest growth following a strong prior year. We expect nominal sustained growth over the remainder of 2022 with commodity producing states likely to fare better than others. This contrasts with 2021 when states dependent on high wage earners and capital gains led and commodity producing states lagged.

- Despite decelerating growth, state credit conditions remain quite strong. According to a NCSL survey conducted in December and January, twenty-five states expect to exceed their forecasted revenues for FY 2022, with another seventeen on track to meet their general fund revenue projections. No participating states indicated that they are unlikely to meet their 2022 revenue forecast.

- This underscores the current strength of state finances, as they are awash with cash from outperforming budgets and federal aid. Appleton is closely monitoring how states are utilizing CARES Act and ARP Act funding, as imprudent budget decisions based on unsustainable windfalls could cause future structural imbalances.

Strategy Overview

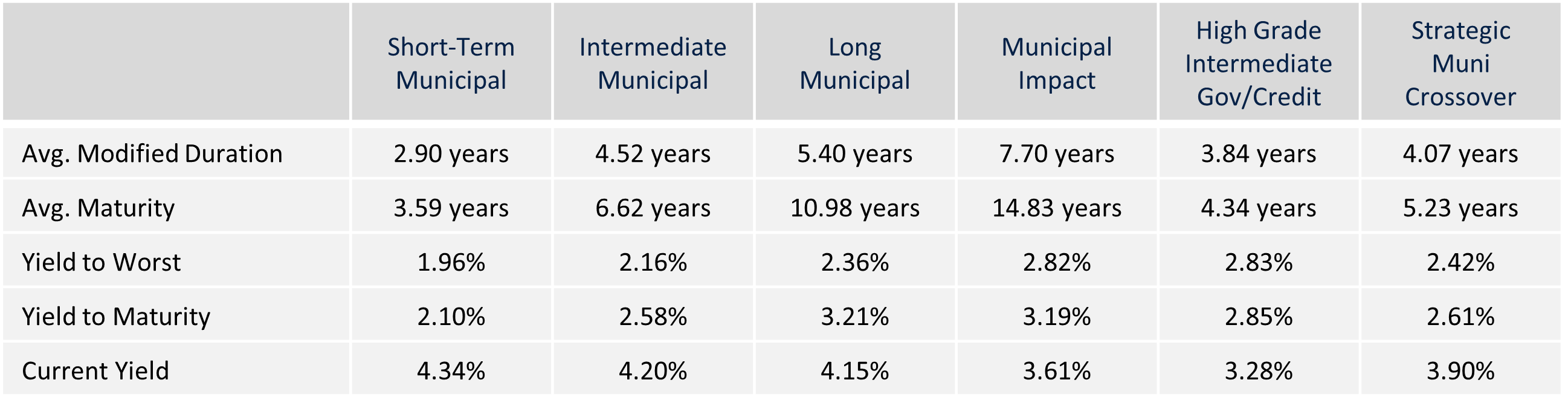

Composite Portfolio Positioning as of 3/31/22

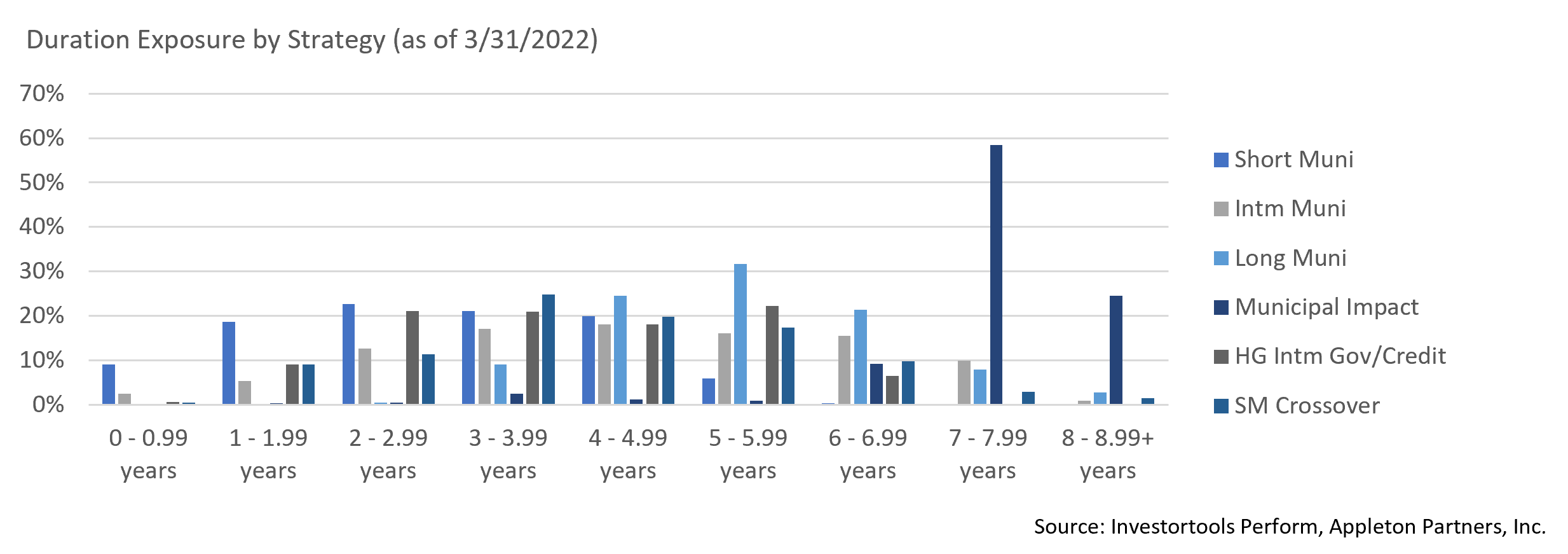

Duration Exposure by Strategy as of 3/31/22

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.