Insights and Observations

Economic, Public Policy, and Fed Developments

- The Democrats’ sweep of both Georgia Senate seats on January 6th has increased both the likelihood and size of a third COVID-19 stimulus bill. Stimulus negotiations are ongoing, with Biden seeking $1.9 trillion, including aid for state and local governments, continuing unemployment benefits into the Fall, a $15 minimum wage, and an additional $1,400 stimulus check. The GOP has countered with a pared down $618 billion bill omitting most of those features, and with more targeted $1,000 stimulus checks. Despite a “productive” meeting with Republican negotiators, the Democrats are seeking to pass Biden’s proposal via budget reconciliation. With Biden wanting to demonstrate bipartisanship, while also protecting economic growth and appeasing progressive concern he will be too quick to compromise, we see a compromise stimulus bill closer to Biden’s plan than the GOP’s as the likely outcome.

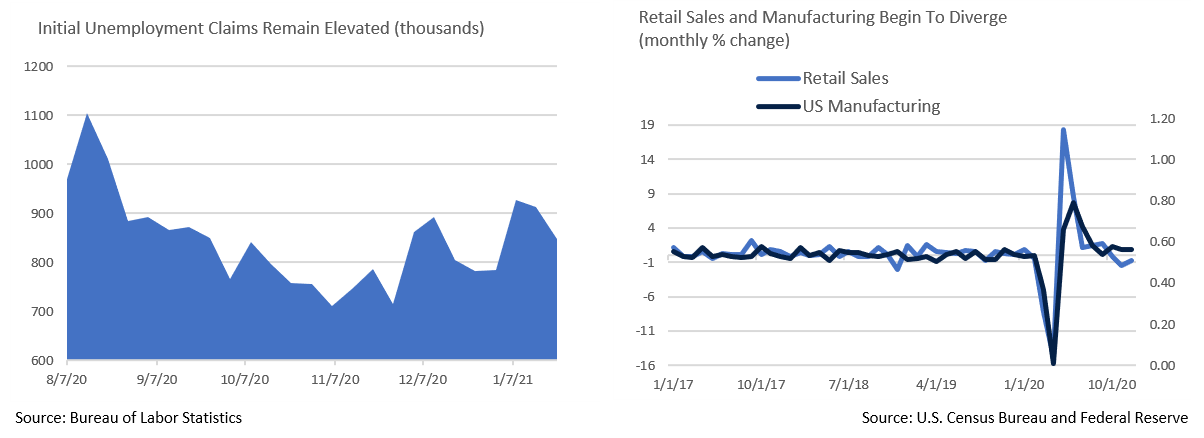

- Unemployment data remains disconcerting; new claims have modestly trended downward over the course of the month from a very high base, falling from 926k the first week of January to 847k the week of the 23rd. Encouragingly, a good number of states reported fewer layoffs in manufacturing, food services, and hospitality. However, the four-week moving average of 868k remains the highest since 1967, as far back as records exist, and is deeply concerning.

- Retail sales disappointed in December, coming in at -0.7% vs. flat expectations, while November was revised downward to -1.4%. Retail sales closed 2020 up 0.6%, the weakest reading in 11 years. Meanwhile, US manufacturing rose more than expected in December at +0.9%, with total industrial production rising the most in five months. Retail weakness and manufacturing strength is not a sustainable combination and leaves us skeptical of a near-term surge in inflation after unprecedented monetary and fiscal stimulus. Demand appears in no danger of exceeding supply anytime soon. Indeed, ISM Manufacturing unexpectedly declined in January, and while evidence of production bottlenecks was at part to blame, large declines in new orders and production are worrying.

- Janet Yellen returns to Washington after being confirmed 84-15 as our first female Secretary of the Treasury. We welcome her confirmation and view it as supportive of the financial markets. Yellen’s tenure at the Federal Reserve revealed her to be generally dovish and highly capable.

- After several Federal Reserve officials spoke openly about scenarios that could lead to a tapering of asset purchases in the first half of January, Chairman Powell aggressively clamped down on speculation, saying it was “not the time to be talking about an exit”. Any discussion of such a move, much less the move itself, would be telegraphed well ahead of time. The Fed is clearly signaling that short term rates will remain on hold until the US economy returns to “full employment” (likely under 4% unemployment), and inflation exceeds the Fed’s 2% mandate on a sustained basis (likely measured by a 12-month trailing average of 2-3%).

- There were few surprises in Q4’s GDP report – the initial release came in at 4.0%, slightly below 4.2% consensus. Highlights include Core Personal Consumption Expenditure (PCE) inflation slowing more than expected, from 3.4% to 1.4%, business equipment investment and private residential investment strength, and solid Final Sales to Private Domestic Purchasers growth of +5.6%. Goods consumption declined modestly but was offset by strength in services consumption. Private inventory growth contributed +1.04% to the top-line GDP growth rate, as retail spending and consumption slowed during a period of manufacturing strength. Our base case is further modest GDP deceleration.

From the Trading Desk

Municipal Markets

- The story remains largely the same in the municipal market. Demand is unabated with $13.8 billion of January net mutual fund flows. Supply limitations persist, thereby maintaining technical conditions highly supportive of the market.

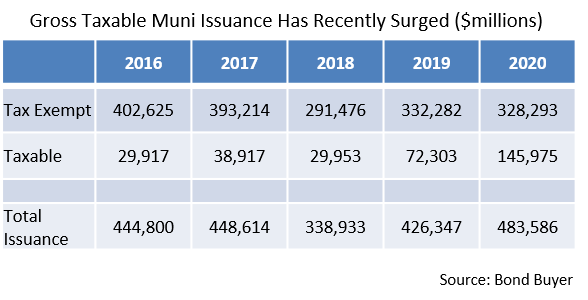

- $24 billion of new debt was issued this past month, a 27% decline vs. $32.7 billion in 2020. Forward issuance expectations have not yet increased, with Bond Buyer 30-day visible supply sitting at a modest $10 billion. However, many market analysts are predicting a surge later in 2021 as municipalities take advantage of low interest rates to finance deferred projects and fortify budgets. Street analysts are generally looking for an increase in new tax-exempt supply relative to 2020. This would be welcomed as we look to deploy client capital.

- As President Biden’s agenda moves ahead there may be a push to bring back tax-exempt advanced refundings. They were eliminated as part of the 2017 Tax Cuts and Jobs Act and heavily influenced last year’s surge in taxable municipal issuance, some of which came at the expense of tax-exempt supply. We favor a reversal of the refunding restriction and feel it is a distinct possibility given very modest budget implications that would need to be factored into a Congressional negotiation process.

- The front-end of the municipal curve has been stable and we do not expect much structural change given the Fed’s commitment to maintaining accommodative monetary policy. A degree of steepening of the longer end of the curve is more likely over the course of 2021.

- The 2Yr AAA muni/UST ratio began February at 100%, whereas a rise in UST yields has contributed to a decline in the 10Yr AAA muni/UST ratio to a tight 65%. We concur with market analysts who recently expressed expectations that ratios will drift up over coming months but likely remain below 100%.

Corporate Bond Markets

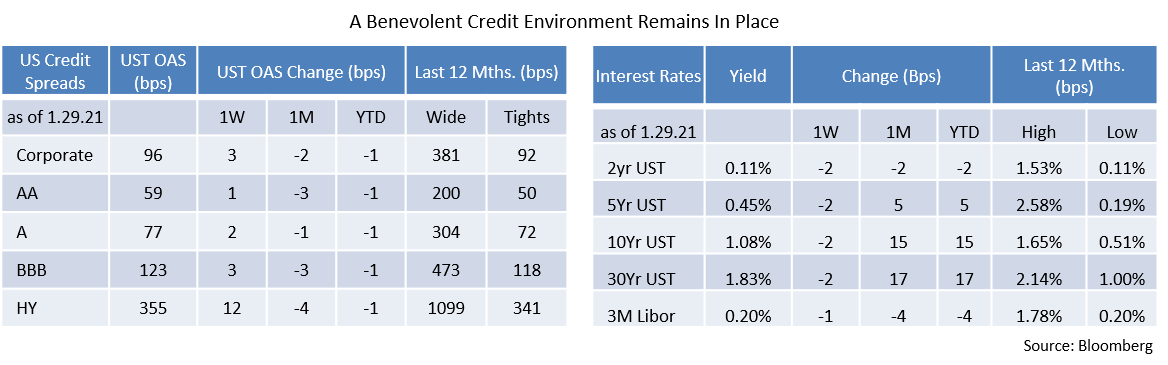

- Investment Grade credit market conditions remain buoyant, with investor risk appetite and demand for income intact. Economic confidence is backed by optimism concerning vaccine distribution and a Federal Reserve firmly committed to recovery and highly supportive of the capital markets.

- Along with consistent foreign buying, retail demand for corporate credit has not changed, with January posting $26.6 billion of net cash flow into mutual funds. Investment grade spreads remain tight, closing the month just 1 bp wider than where we ended 2020.

- The search for income is perhaps most evident in the High Yield market with lower quality names outperforming on the month. High Yield issuers have taken note and brought $52 billion of new debt to market in January, the 3rd largest month of issuance on record. Low UST yields and a largely “risk on” environment have enabled high yield spreads to reach historic lows. Yields on the lower quality CCC bucket tightened by 21bps points in January and the overall High Yield index touched a record low of 4.10% before closing the month at 4.31%.

- While we are encouraged by the sustained strength of the corporate credit markets and do not see demand significantly diminishing anytime soon, the risk premium is rather low. Staying up in credit quality is advisable.

Public Sector Watch

Credit Comments

Income-Tax Reliant States Report Impressive Budget Performance

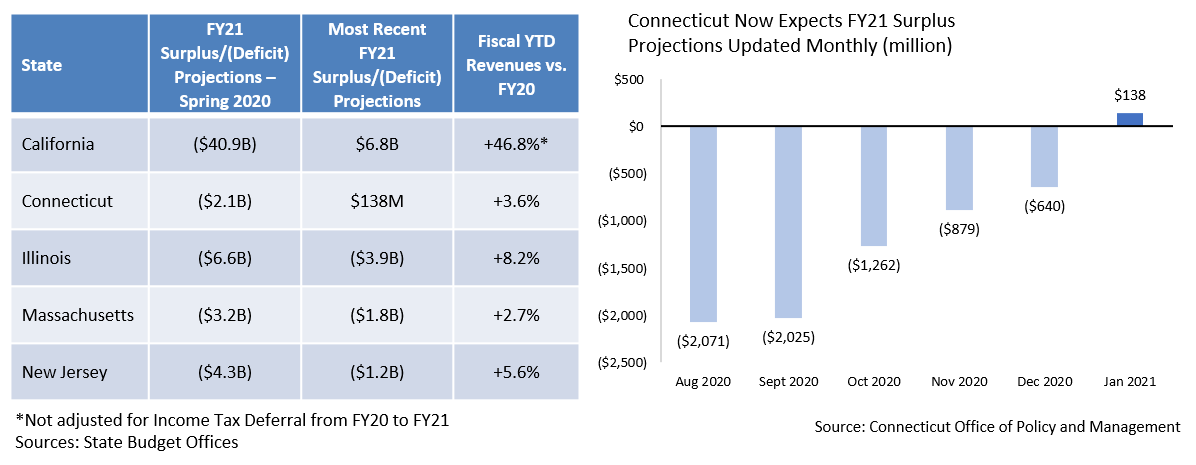

- While we have previously highlighted widespread brighter-than-expected state tax revenue trends, states with high wage populations and personal income tax dependent budgets are enjoying even more favorable tailwinds than the overall State sector.

- Early in the COVID crisis, Connecticut’s Office of Policy and Management (OPM) projected a $2.1 billion deficit for the fiscal year ending June 30, 2021. As health regulations eased and the economy gradually emerged from spring lockdowns, the OPM has steadily improved its forecast. As of January 2021, the State was on pace to produce a $138 million surplus. This would allow Connecticut to refrain from tapping its reserves, safeguarding a Rainy-Day Fund that sits at $3.5 billion, a very healthy 17.9% of annual expenses.

- Connecticut is not alone, as white-collar jobs have been relatively insulated from losses experienced in retail, travel and leisure, and food services. As a result, personal income tax collections have remained steady, far outpacing once predicted catastrophic declines.

- It bears emphasizing that revenue performance is only one factor we consider in evaluating a state’s credit profile. New Jersey and Illinois, two states highlighted in the accompanying table, are not Appleton approved bond issuers due to their longstanding structural credit challenges. However, for most other states, revenue trends have exceeded expectations, allowing for greater fiscal flexibility than once anticipated.

A Preliminary Look at Biden’s $1.9 Trillion Stimulus Proposal

- On January 14th President Biden unveiled a $1.9 trillion American Rescue Plan (ARP), an opening salvo in what promises to be extended Congressional negotiations aimed at supporting the economy and expediting national vaccine rollout. It remains to be seen whether a smaller stimulus program can gain a degree of bipartisan approval, or if the Democrats use budget reconciliation to implement their policy proposals. Regardless of how it ultimately plays out, noteworthy provisions could impact the municipal market.

- State & Local Governments – $350 billion in direct aid as well as $70 billion to help administer vaccines. With tax revenues showing surprising resilience, aid of this magnitude would more than meet the need of most municipalities. Tax revenues would also be supported by direct individual payments and enhanced unemployment benefits.

- Education – $130 billion for K-12 to help more schools open safely, and $35 billion for higher education with preference given to public institutions.

- Transportation – $20 billion for public transit. New York MTA stands to be a big beneficiary, funds that would supplement $4 billion provided to the nation’s largest transit system as part of the $900 billion package passed in December.

Strategy Overview

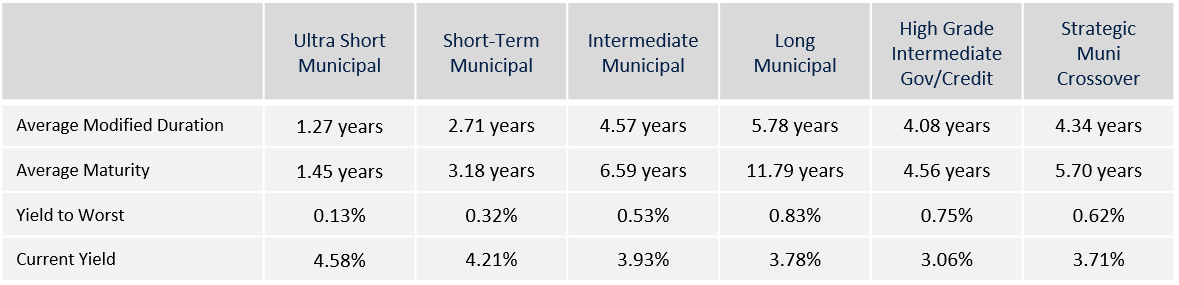

Composite Portfolio Positioning as of 1/31/2021

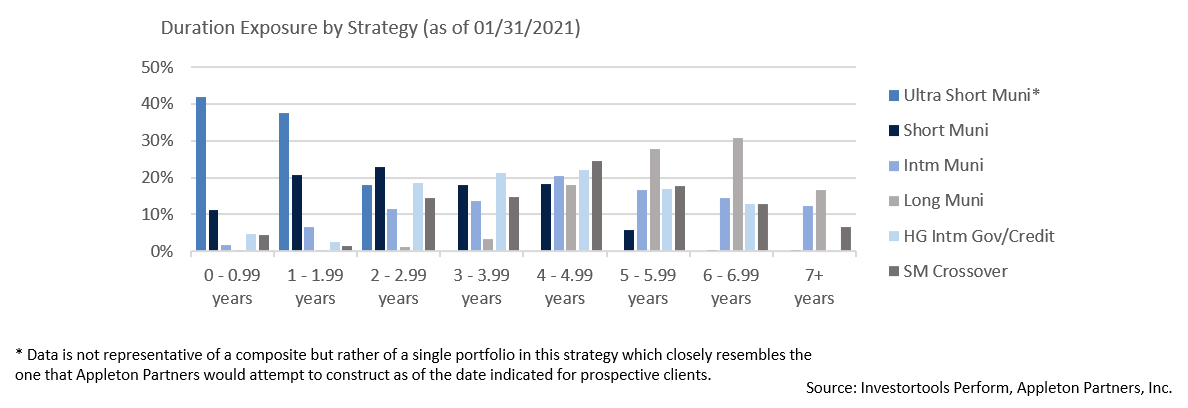

Duration Exposure by Strategy as of 1/31/2021

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.