Insights and Observations

Economic, Public Policy, and Fed Developments

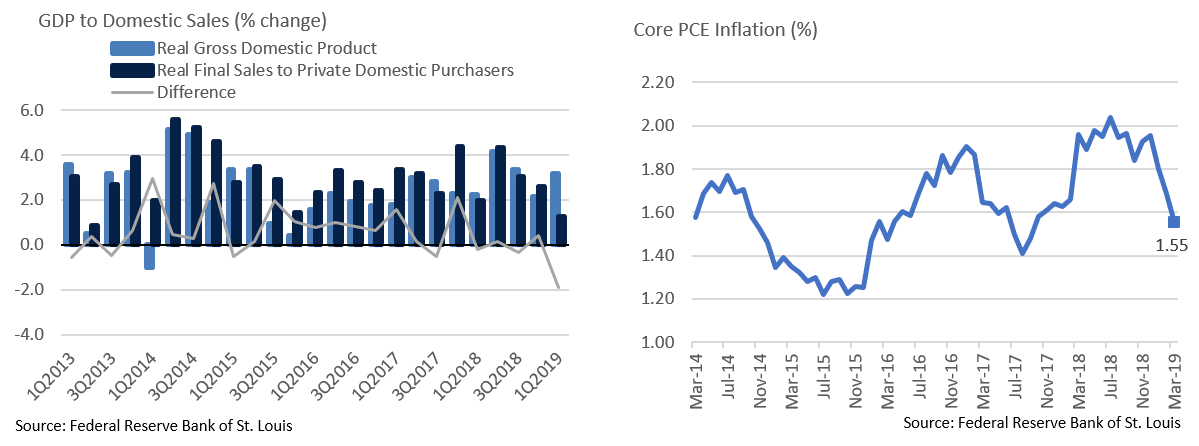

- After a soft January and February, March’s economic data demonstrated evidence of economic firming. The jobs report was unremarkable, but a welcome rebound after prior weakness, with average hourly earnings showing a modest increase. Inflation disappointed though, despite a Bureau of Labor Statistics report suggesting a monthly drop in real wages due to a 0.4% increase in CPI. The Fed’s preferred Core PCE index came in flat in March and was only up 1.55% year-over-year. This is flirting with the 1.5% threshold that the Fed has indicated might potentially warrant rate cuts. However, we feel that a sizable spike in productivity in April should give the Fed cover to remain patient unless inflation continues to weaken.

- While Q1 GDP growth of 3.2% handily beat estimates (the Bloomberg median was 2.3%), the report itself was not encouraging. Growth was primarily driven by an unexpected narrowing in the trade deficit, as well as an increase in inventories. Tariffs are likely behind both factors, as firms rushed to build inventory given supply-chain disruption risks ahead of what was then expected March 1st tariff increases. Underlying demand was weak – consumption expenditures increased 1.2% (durable goods expenditures fell 5.3%), while final sales to private domestic purchasers only increased 1.3%. Although these effects are likely to unwind in Q2, this was about as weak a GDP report as a 3.2% headline rate can be, and all else equal, we expect Q2 growth to decelerate to at or below the recent 2-2.5% trendline.

- At the start of May, Pres. Trump threatened to implement long-delayed tariff increases on China from 10% to 25%, spooking global markets and casting further doubt on the progress of negotiations; we remain bearish the likelihood of a substantial deal, and believe this uncertainty could continue to weigh on global trade and domestic growth.

- Herman Cain and Steven Moore both recently withdrew their nominations to the board of the Federal Reserve. Cain, a former pizza magnate and 2012 presidential candidate known for his short-lived 9-9-9 tax proposal, had drawn scrutiny for his role heading a pro-Trump super PAC and for the sexual harassment allegations that ended his presidential campaign. Moore, a Heritage Foundation fellow and early Trump supporter, had his candidacy falter due to tax and child support issues and published remarks in the early 2000s criticizing gender pay equality. While we consider both withdrawals to be a short term positive for Fed governance, longer term Trump’s decision to appoint two avowed loyalists in the first place is a disconcerting attack on the Fed’s independence, as is their nominations collapsing over personal issues rather than widely perceived lack of qualifications for the Fed board.

- A source of near-term uncertainty removed from the markets in March was Brexit, as the EU agreed to extend the deadline to October 31st, while allowing the UK to leave in June if the House of Commons manages to pass a deal before that time. Nonetheless, the longer-term outlook is little changed. We find it hard to picture a deal that will pass British Parliament that the EU is simultaneously willing to accept and feel the most likely outcomes remain Theresa May’s “soft Brexit” withdrawal deal, the UK reversing its Article 50 EU withdrawal provision, or a hard Brexit, loosely in that order. Global markets are currently pricing in something along the lines of May’s previously rejected “soft Brexit” proposal, and would likely respond very favorably to no Brexit, whereas the UK crashing out of the EU without a deal risks shocking equity and currency markets.

From the Trading Desk

Municipal Markets

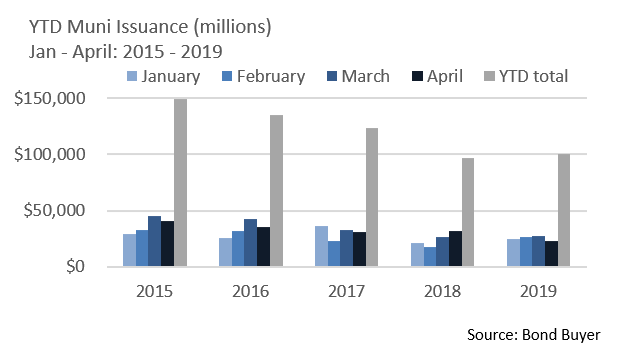

- The tax-exempt markets are enjoying a prolonged period of favorable supply-demand dynamics and tight credit spreads, with the 10Yr Muni/Treasury ratio reaching 74.4% as of the end of April, down from 84.8% as recently as year-end 2018 and low 90s averages over the prior decade. Municipals have been in high demand due to a confluence of factors, none of which we see dissipating anytime soon.

- 2017’s tax reform imposed a $10,000 state and local tax (SALT) deduction limitation, fueling a surge in retail buying, particularly from high tax states. Municipal mutual funds have seen almost $30 billion of net flows YTD (1) and positive cash flow for 16 consecutive weeks. (2) Reversal of the SALT caps appears politically unpalatable given how integral tax reform is to the Trump Administration’s fortunes.

- Primary market supply continues to be constrained by restrictions on advance-refunded debt introduced in 2017’s tax reform. Citigroup has projected $385 billion of new issuance in 2019, a total now unlikely to be reached as it would require more than $8 billion to be issued each week through year-end. April’s $22.6 billion volume was the weakest YTD and was lower by 28% vs. the same month of 2018. (3)

- JPM recently projected $63 billion of net negative municipal issuance for 2019 at large, although the negative year-end total may end up being even larger. Sustained demand for tax-advantaged income, which shows no signs of ebbing, coupled with constrained supply, should keep muni/UST ratios in their current range. While today’s ratio seems low, the 10Yr ratio spent most of the 1990s in the 70s.

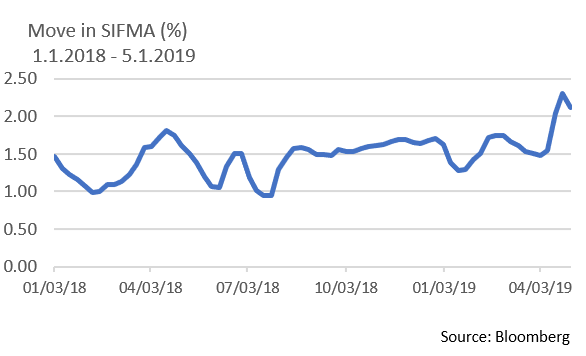

- The short-term tax-exempt markets have simultaneously been jolted by tax liability-driven selling of variable rate demand notes (VRDNs). VRDN inventories are currently high, pushing the SIFMA index yield sharply higher to 2.12% (as of 5/1/19). While tax season often causes a bump in SIFMA yields, this season’s change has been extreme. Given SIFMA’s jump, one needs to go out to 2033 to find equivalent AAA muni yields. Although we feel a SIFMA reversion is inevitable as demand from crossover buyers builds, for now, VRDNs may represent an attractive, high quality, short-term option for many investors looking at the shorter ends of the muni curve.

1. Credit Sights

2. Investment Company Institute

3. Bond Buyer, 4/30/19

Taxable Markets

- The Federal Reserve Bank theoretically has four ways of controlling monetary policy. The most talked about is the discount rate, or the rate the Fed charges on short-term lending. The others include buying and selling US debt in the open market, adjusting bank reserve requirements, and payment of interest on excess bank reserves held at the Fed. Lowering the discount rate or interest on excess reserves motivate banks to lend rather than hold Fed reserves. In recent years, banks have felt a need (due to Basel III and Dodd-Frank regulation) to maintain large amounts of high-quality excess reserves, including Treasuries, to meet liquidity requirements.

- Treasuries are not officially designated as “cash equivalents” and there has been talk at the Fed about changing the liquidity designation of Treasuries in the event of a “rapid liquidity event.” If that were to occur, the Fed could repurchase US Treasuries through a Repo Agreement. This would give banks an incentive to buy short treasuries as opposed to holding excess reserves or accessing the discount window when there is a need for cash. Should the Fed change policy in this manner, it would likely reduce excess reserves at the Fed and allow those monies to be invested in the marketplace. This would be expansionary and could push up rates, particularly in the currently flat 2 to 5-year portion of the Treasury yield curve.

Public Sector Watch

Credit Comments

California’s April Tax Data Eases Wealthy Departure Concern

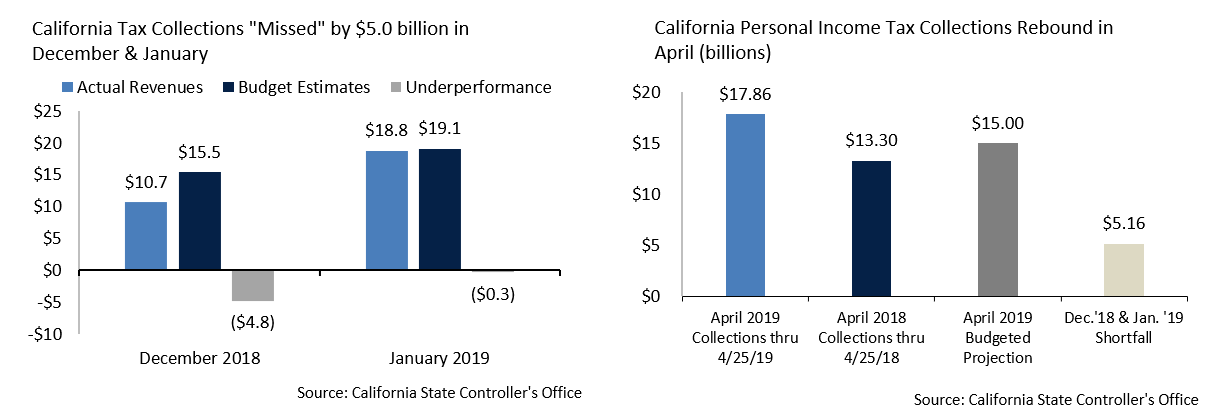

- As we highlighted in March, several “high tax” states experienced significant underperformance in personal income tax collections in December and January. Some observers of the trend raised the specter of troubling outmigration of the wealthy driven by recent tax law changes.

- We felt differently and pointed to factors suggesting this was a timing issue, not a structural trend. Those included strong YTD collections through November, weak Q4 equity markets likely impacting capital gains tax revenue, and a lack of incentive to prepay state and local taxes due to the SALT deduction cap. Our view was that April tax collections would make up for the slack experienced in December and January.

- It appears this may be the case. Although most states will not report April collections until mid-to-late May, California offers an ability to track personal income taxes (PITs) daily. Through April 25th, the State’s receipt of $17.9 billion in PITs compared favorably to $13.3 billion collected through the same day last year and a $15.0 billion budget projection. At the current rate, California is likely to make a sizable dent in December and January’s $5.0 billion miss.

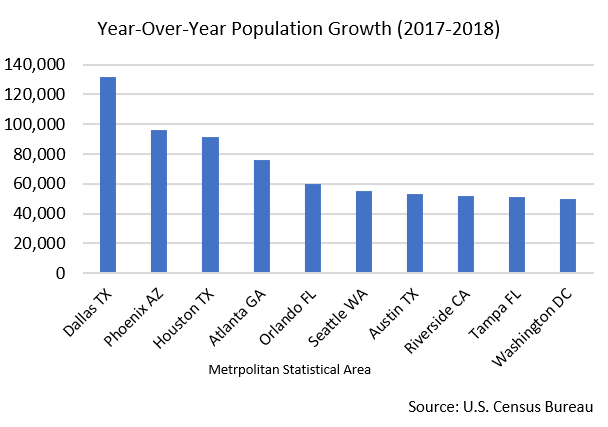

Census Data Highlights Ongoing Popularity of Texas

- U.S. Census Bureau data released in mid-April shows that the Dallas-Fort Worth-Arlington metropolitan area had the largest nominal population gain for the third consecutive year. The area added 130,000 residents for the fiscal year ended June 30, 2018, as a low cost of living continues to attract employers and residents.

- Other Texas markets are also benefiting from the State’s business-friendly environment. The Houston and Austin metro markets were also among the nation’s top 10 fastest growing for 2018, and Houston joined Dallas as the only two markets to have added 1 million residents since 2010.

- Our research and investment efforts continue to emphasize large, well-established issuers, as well as those experiencing favorable population growth and demographics.

Strategy Overview

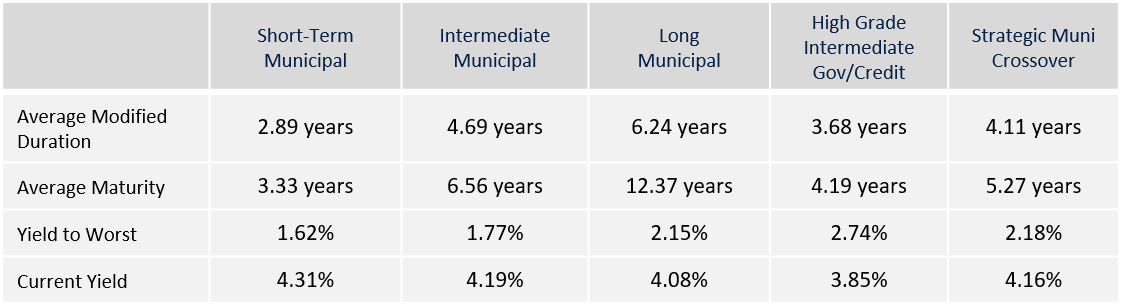

Portfolio Positioning as of 4/30/19

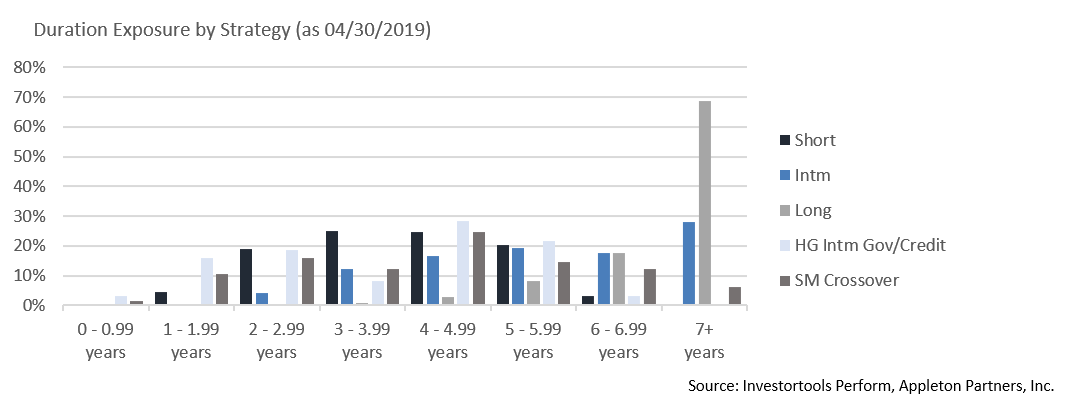

Duration Exposure by Strategy as of 4/30/19

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.