Insights and Observations

Economic, Public Policy, and Fed Developments

- October was dominated by the on again, off again announcement of a surprise “phase one” trade deal on the 11th. Markets initially rallied as President Trump touted an agreement halting the next round of tariffs in return for a $50B agricultural purchase commitment and intellectual property protections that appeared to include enforcement mechanisms. This proved premature, however, as the Chinese noted that further negotiations were needed and that the planned purchases were not feasible unless existing tariffs were also rolled back. While we welcome a halt to further escalation and renewed attention to IP protections, the move to a phased approach is itself a concession from the Administration’s prior all-or-nothing stance and suggests that many of the issues slated for later phases may be too thorny for negotiators. According to Bloomberg News, Chinese officials privately agree, noting that structural changes to the Chinese economy sought by US negotiators may not be solvable before the end of Trump’s first term and would require a full rollback of US tariffs, an unlikely concession. Against this backdrop and the weight of slowing global growth, exports and imports slumped to nearly two-year lows.

- The Federal Reserve had a busy month as well. Stressing that this was not a new round of quantitative easing, Chairman Powell introduced a new bond-buying “reserve management” program at the start of the month to ease turmoil in the repo markets. Then, as expected, the Fed lowered the Fed Funds Rate by a further 25 basis points. The accompanying statement replaced language saying they would “act as appropriate to sustain the expansion” with a more muted pledge to monitor the economic outlook. The implicit message was rates are likely on hold unless the economic outlook deteriorates further, although measured in conjunction with the reserve management program, the Fed remains reasonably dovish. The market implied probability of a December cut was little changed, falling from 26% to 22%.

- Economic indicators have generally been weak. US Retail sales for September missed badly, down 0.3% vs expectations of a 0.3% gain, although ex-gas and auto sales, the month was flat. While the decline in auto sales (-0.9%) came after a strong August (1.9%) and was negatively impacted by the GM strike, month-over-month volume notably increased, implying the drop was impacted by discounting and/or consumers choosing lower cost vehicles, potentially troubling trends in a consumer dependent economy.

- Elsewhere, the Fed Beige Book described growth as slowing to a “slight to moderate pace”, while consumer confidence softened off relatively high levels. Industrial production and durable goods orders missed, evidencing further contraction in the manufacturing side of the economy.

- The most encouraging news of the month came after it ended, when on 11/1 the jobs report came in at a considerably better than expected 128k – expectations were for 85k. While nominally the third weakest of the year, it was impacted by 41.6k in job losses largely due to the GM strike and 20k in temporary US Census contracts concluding. While hiring continues at a slower pace than 2018, the unexpected resiliency of the labor market is encouraging at a time when consumer spending is critical to sustaining the economic expansion. Equities rose on the news, and a modest miss on a still-contracting ISM Manufacturing number later that day did not dampen enthusiasm.

From the Trading Desk

Municipal Markets

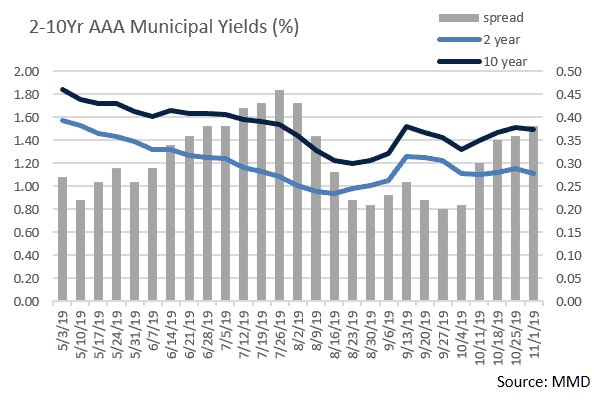

- The municipal curve steepened during October with the spread between AAA 2s and 10s increasing to 30 basis points, 10 basis points wider than the beginning of the month. This followed a similar steepening of the Treasury curve as the Fed cut short rates, while the longer end was influenced by modest improvement in trade and economic sentiment. A steeper municipal curve is welcome as it now offers a bit more value for adding duration. In aggregate, our heaviest exposure remains in the 6 to 10-year portion of the curve.

- We continue to see very strong demand for municipals from mutual fund investors with 43 consecutive weeks of positive net cashflow. $75.1 billion of net assets have flowed into municipal funds year-to-date, the highest level since data began being reported in 1992. A desire for tax-advantaged income and skepticism concerning equities amid an aging bull market have helped keep municipals in favor.

- Supply picked up considerably over the second half of the year after lagging through Q2. As of the end of October, year-to-date issuance reached $330.3 billion, nearly matching $338.9 billion for all of 2018. October 2019 issuance of $52.2 billion is 43% greater than the prior year’s monthly figure. This phenomenon has been heavily impacted by a surge in taxable municipal offerings, as today’s highly compressed yield environment has made taxable advance refundings of tax-exempt bonds economical.

- The usually staid world of Variable Rate Demand Notes (VRDNs) has recently experienced tremendous yield volatility.Yields began Q3 at the year’s low of 1.2%, although low rates are not unusual for early July due to large maturities and interest payments. Upon spiking to 1.6% in late September, VRDN yields temporarily equaled 15-year AAA municipals given what was then a very flat yield curve. As quickly as VRDN rates climbed late in Q3, they fell even faster in October, dropping an average of 10 basis points a week to finish the month at 1.12%. Despite sizeable October municipal issuance, much was taxable and mutual fund demand for VRDNs has been high as managers scramble to stay fully invested.

Taxable Markets

- As we moved into the final week of October, Investment Grade Corporate issuance was looking like it was going to fall far short of expectations. The $39.5 billion issued during the first three weeks of the month was less than half the market’s $85 billion expectation, a development that tightened already lean supply. Although a surge over the last week of October resulted in $28.8 billion coming to market, bringing the month’s total to $69 billion, this was still the quietest October since 2014. A lack of bank issuance and corporate earnings blackouts has constrained supply, providing further impetus for corporate credit spreads to remain in rally mode.

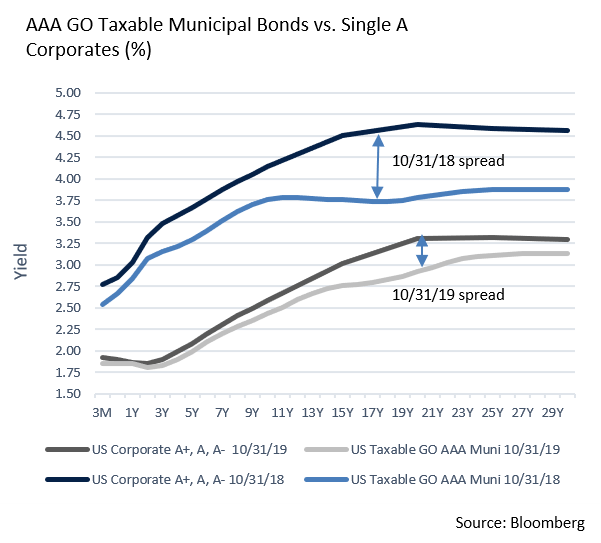

- Interestingly, we saw a substantial increase in Taxable Municipal issuance and yields on some deals have been close to the levels at which Single A corporate bonds are trading. The accompanying chart comparing Single A corporate bonds to AAA Taxable GO bonds reveals that the spread between the two asset classes has narrowed over the last year. This has prompted crossover buyers to consider Taxable Municipals as a viable complement to Corporates.

Public Sector Watch

Credit Comments

Sleepy Off-Cycle Election Still Important for Municipal Market

Bond Authorizations

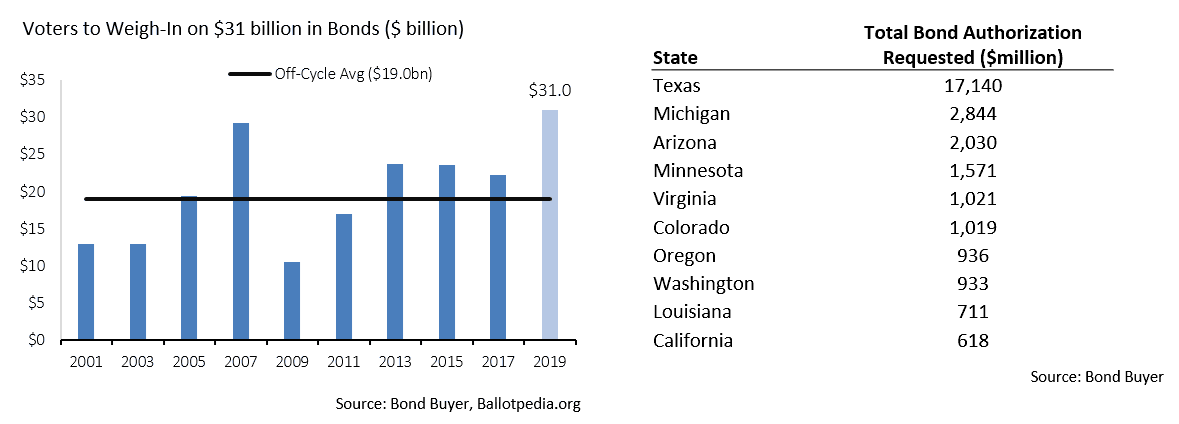

- On November 5th voters were asked to approve $31 billion in municipal bond authorizations. In addition, Louisiana voters will opine on $711 million of bonds on November 16th. Compared to previous off-cycle elections these are substantial levels, as the average off-year figure since 2000 is only $19 billion.

- 75% of bond authorizations sought during off-years since 2000 have been approved by voters. We anticipate another largely positive voter response, which would result in modest new municipal supply over the next few years. Local governments continue to work through deferred capital expenditures and are looking to take advantage of historically low borrowing costs.

Policy Referendums

- Colorado – Voters will assess a measure that could improve the State’s fiscal flexibility and revenue collections. Proposition CC would allow the State to retain revenue beyond the Taxpayer Bill of Rights (TABOR) limits and dedicate it to K-12 and higher education, and transportation. Revenues beyond the constitutional limit are currently refunded to local governments and taxpayers. Colorado maintains a solid credit profile, although passage of the ballot initiative would be positive as it would create a greater ability to benefit from favorable demographic and economic trends.

- Texas – Anti-tax sentiment will once again be tested in the Lone Star State where voters will decide whether to open the door to a possible future personal income tax. Proposition 4 would ban individual income taxes (which aren’t currently levied) and require a two-thirds majority in both houses of the legislature and a voter majority to lift that ban. A healthy economy has sustained Texas’ credit profile without personal income taxes, yet approval of this measure would tie the hands of future legislatures should a need to restructure revenue sources materialize.

Local Finance Officers See Revenue Weakness on Horizon

- Softening credit conditions in the local government sector were reported by The National League of Cities in their annual Fall survey of local finance officers. For the first time in seven years, cities are anticipating an inflation-adjusted decline in revenue for fiscal 2019. This comes on the heels of a meager 0.6% increase in 2018 and points to a multi-year trend of decelerating revenue.

- Although responses may be conservatively biased, the survey “takes the temperature” of the muni market and is valuable in flagging potential trends before they materialize in audited figures. Property tax assessments, the life-blood of local government budgets, often lag housing market conditions by 1-2 years. Audited financials are also not published until up to six months after fiscal year end. Our research process seeks intelligence drawn from a variety of sources as we look to identify credit trends before they are widely recognized and priced into the market.

- Although most local finance officers assert in survey responses that fiscal conditions remain healthy following years of strong tax revenues and balance sheet repair, we are focused on differentiating those that think they are financially healthy from those that truly are.

Strategy Overview

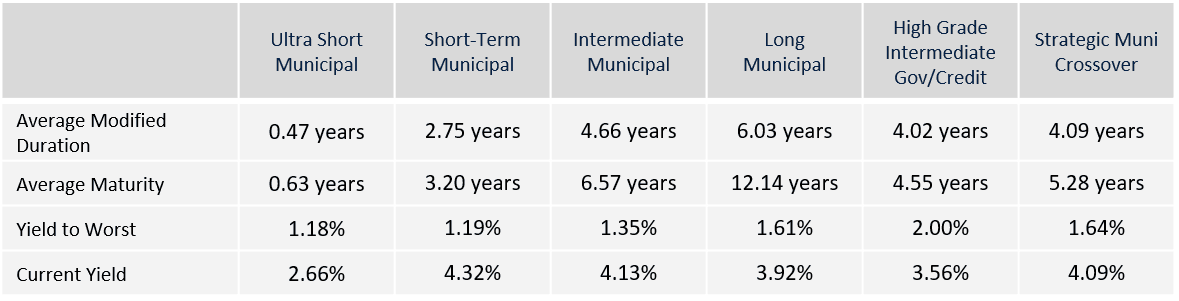

Portfolio Positioning as of 10/31/19

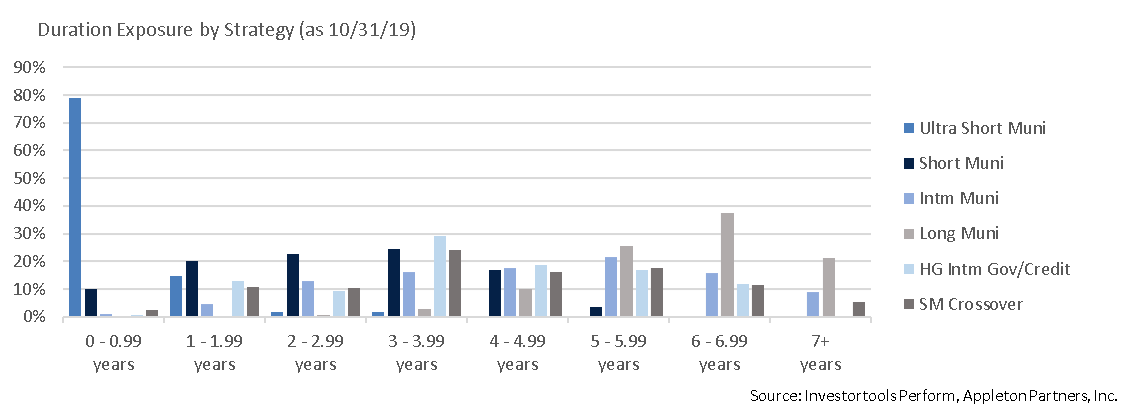

Duration Exposure by Strategy as of 10/31/19

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.