Insights and Observations

Economic, Public Policy, and Fed Developments

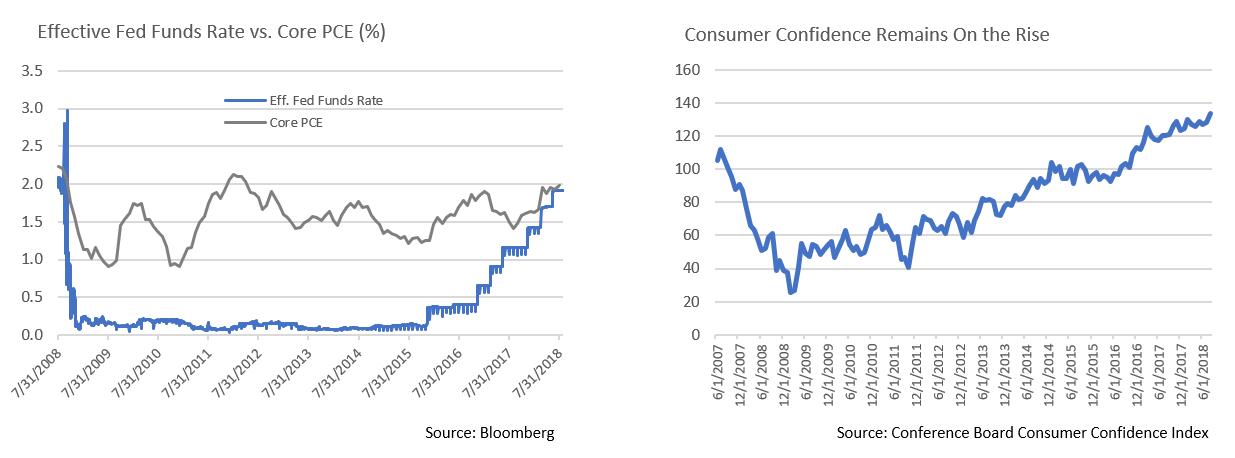

- The economic picture continues to diverge at home and abroad. Domestically, the primary consumer confidence reading surged to 133.4, the highest level in 18 years. This is an exceptionally strong number that supports an expectation of sustained spending in a demand-driven US economy. Global conditions have been much less robust, with weakness in China and many emerging markets.

- Meanwhile, Q2 GDP increased from 4.1% to 4.2% in the first revision. The drag from inventory declines was slightly less than originally reported, though while the adjustment to net trade was positive, it was largely the result of net exports being revised down by less than net imports, hardly an encouraging revision. Despite strong consumer confidence, our Q3 outlook – a modest slowdown from an elevated Q2 to a still healthy Q3 reading – is unchanged.

- Negotiations to revise NAFTA broke down at month end, after a Toronto newspaper leaked off-the-record comments indicating the US would refuse to make concessions to the Canadians. Some form of a deal had looked increasingly likely after the administration had announced the parameters of a potential US-Mexico deal earlier that week. However, with Trump now threatening, over bipartisan opposition, to push for a termination of NAFTA and forge ahead with the bilateral deal with Mexico, the twenty-five-year-old trade agreement’s future has become uncertain. Mexico has indicated they are not interested in pursuing a bilateral deal that excludes Canada, and the power of the President to reverse a Congressionally-approved trade agreement has not yet been tested.

- The setback in NAFTA talks may also have negative implications for trade talks with China. The Trump Administration has indicated they will only turn to China after they have renegotiated NAFTA, delaying any potential resolution. Complicating matters, Trump has indicated he will move forward with an additional $200B of 25% tariffs on Chinese imports with a formal announcement due any day as of present writing, and surprised the markets by mentioning a further $267B in tariffs “ready to go on short notice.” For now, both the US and Chinese have committed to continue discussions.

- The Federal Reserve is widely expected to hike short term interest rates to a range of 2-2.25% on September 26th, with the implied probability of a hike standing at nearly 95% at month end. With the effective Fed Funds Rate at 1.91% and Core PCE inflation at 1.99%, the expected hike would move the “real” overnight rate from modestly negative to modestly positive for the first time since the Great Recession. Indeed, the Fed indicated they may soon drop the word “accommodative” from their assessment of the current policy stance. After more than a decade of stimulus, the return to a normalized short term rate environment is a healthy development and speaks to the strength of the US economy.

From the Trading Desk

Municipal Markets

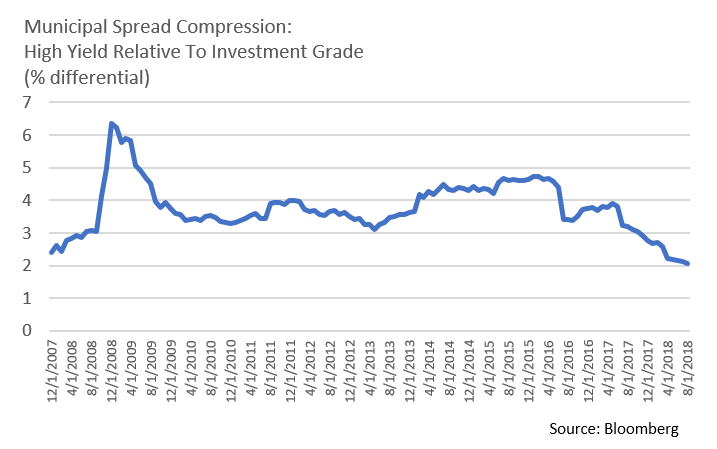

- A long era of accommodative monetary policy, favorable credit conditions, and a thirst for tax-advantaged income have driven yields in the tax-exempt high yield market to record low levels. In fact, the Barclays High Yield Municipal Bond Index yield to worst of 4.74% recorded on 8/31/18 represents the lowest level since the Index’s 1/1/95 inception. The extent to which muni high yield spreads have compressed relative to the investment grade market is also noteworthy. The accompanying chart details the spread between the Barclays Municipal High Yield and Investment Grade indices measured on a yield to worst basis. August ended with a paltry spread of 2.06%, the lowest relative risk premium since 11/30/07, prior to the onset of the Great Recession, a time that also reflected widespread use of 3rd party bond insurance guarantees, a credit backstop that has since largely dissipated.

- In our view, today’s tight high yield spreads introduce a relative value consideration, as advisors and investors assess the adequacy of tax-exempt high yield risk premiums. While nominal tax equivalent high yield coupons may still appear attractive, an extended “risk-on” environment has given investors an opportunity to consider the merits of reallocating a portion of their portfolio into more liquid, higher grade tax-exempt exposure.

Taxable Markets

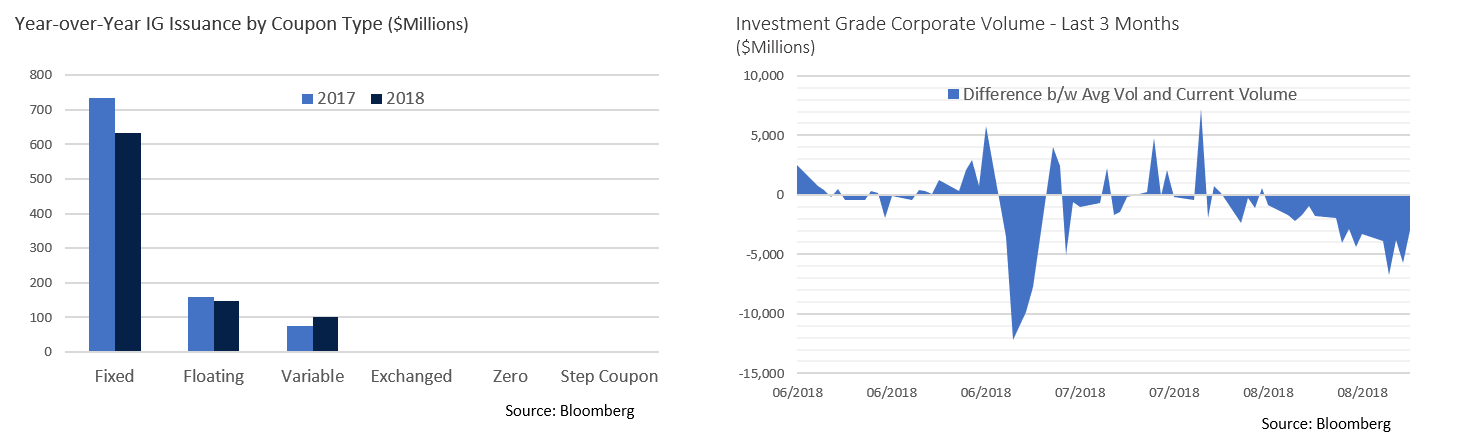

- A sea of red ink at the Federal level is exacerbating US Treasury yield curve fears. As we move into the second half of 2018, the level of outstanding marketable US Treasury debt has climbed to a record level of $15.566 trillion, more than $1 trillion greater than the Treasury had outstanding as recently as the end of 2017. The year-to-date 2018 increase is roughly equal to recession easing issuance during all of 2011. The additional debt is in part needed to offset revenue lost by the Trump tax cut package. An additional $500 billion is expected to be raised by the end of 2018.

- Treasury issuance has been focused on the shorter end of the curve, with the heaviest distribution out to five years. Funding the Treasury’s needs will continue to put pressure on rates at the front end of the yield curve, contributing to the flattening that has given market watchers so much consternation. This supply dynamic is compounded by the Fed’s ongoing efforts to normalize monetary policy, in part by steadily nudging up short-term rates. The market has long demonstrated a willingness and ability to accommodate US debt needs, although the longer term funding cost is something that must be closely watched.

Public Sector Watch

Credit Comments

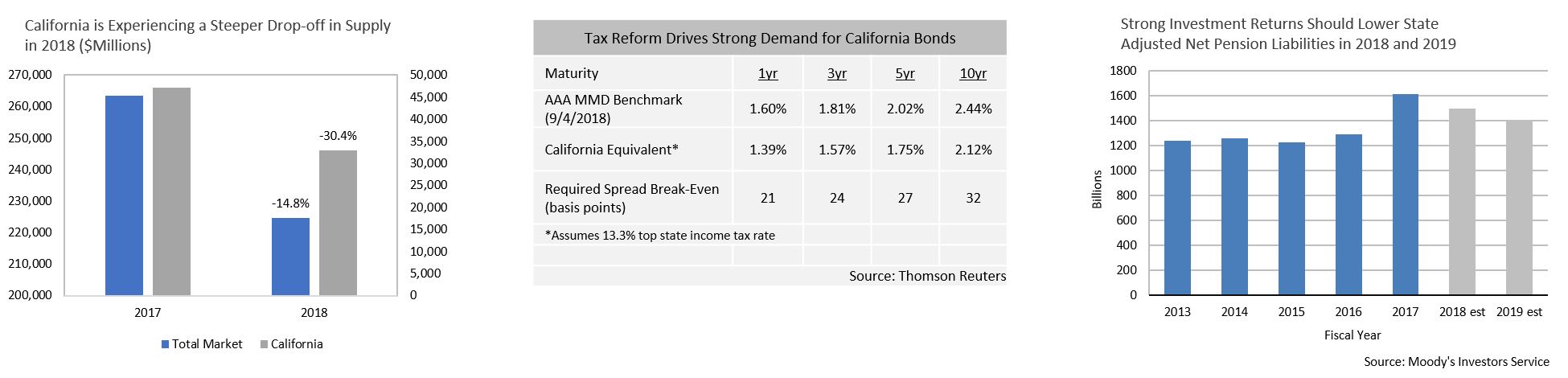

- Early returns for some of the country’s largest public pensions are running ahead of assumptions through the fiscal year ended June 30th, narrowing the gap between assets and promised future benefits. The California Public Employees Retirement System (CalPERS) announced an 8.6% return for fiscal 2018, besting the plan’s 7.0% target and boosting the funded ratio from 68% to 71%. The second largest U.S. pension plan, California State Teachers Retirement System (CalSTRS), posted a healthy 9.0% return over the same period. Investment returns remain an important ingredient in stabilizing pension fund health. As participating governments struggle to make necessary contributions, investment performance can provide temporary relief. Our tax-exempt research focuses on identifying issuers with adequate current pension funding, and a strong commitment and ability to meet the future benefits promised to retirees.

- Connecticut, Maryland, New Jersey and New York sued the Trump Administration over the $10,000 state and local tax deduction cap, implemented as part of the 2018 Tax Cuts and Jobs Act. The States argue the measure unfairly targets traditionally Democrat-led states and “hobbles their sovereign authority to make policy decisions without federal interference.” Successful invalidation of the deduction cap through the courts appears unlikely. Attempts to circumvent the SALT deduction cap through charitable donations or employer-paid payroll tax have also stalled. The state and local governments most impacted by tax reform may ultimately need to adjust their taxing mechanisms, as current tax policy could be constrained by pressure brought to bear by the impact of recent Federal tax reform. These are developments we feel require sustained research scrutiny.

- California’s Supreme Court ruled that Proposition 9, a proposed measure to split the state into three distinct governments, will not be on the November ballot as it could cause serious harm and disruption to the State’s ability to provide essential services. Billionaire Tim Draper sponsored the bill, arguing that California’s distinct regional cultures, prosperity and political bents would benefit from being separated into Northern California, California and Southern California. Even if voters had approved the measure, it would have required State ratification and an act of Congress. However short-lived, Proposition 9 highlights the potential impact of voter-driven ballot measures on state budgets and governance.

Strategy Overview

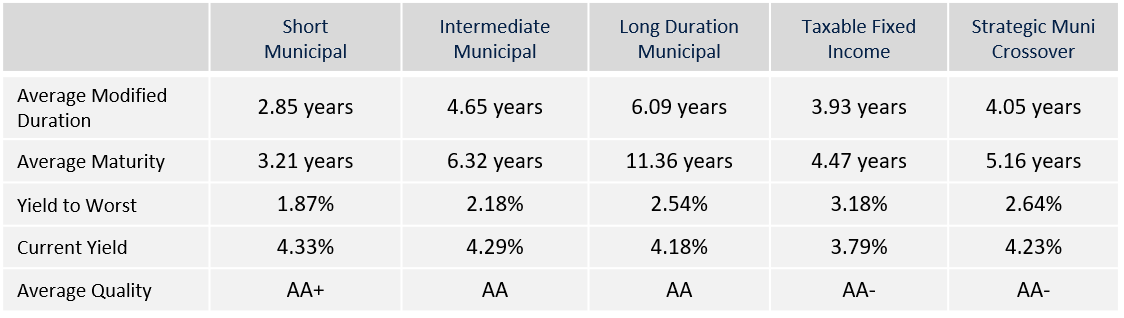

Portfolio Positioning as of 8/31/2018

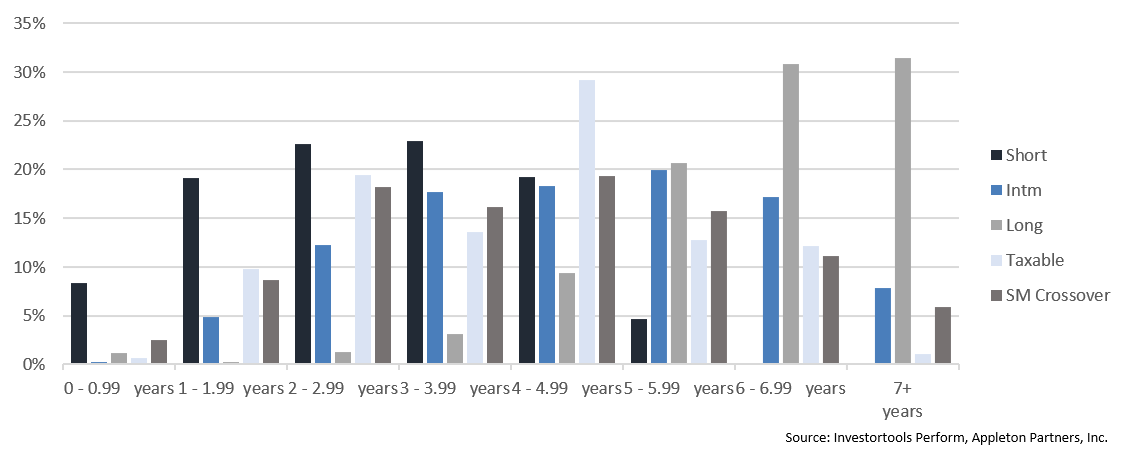

Duration Exposure by Strategy as of 8/31/2018

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.