Insights and Observations

Economic, Public Policy, and Fed Developments

- Favorable US economic conditions were once again unsettled in June by a resurgence of long-simmering trade tensions and the growing risk of a full-blown trade war. After steel and aluminum tariffs went into effect on June 1st, President Trump announced $50 billion in additional Chinese tariffs. A wave of retaliatory tariffs followed from both sides, and progress towards a trade deal appears to have ceased. Canada, Mexico, and the EU also announced proportional retaliatory action. While the market remains hopeful that these are merely aggressive negotiation tactics, proposed tariffs are now rapidly becoming real ones. A protracted trade war would likely weigh on long-term inflationary expectations through depressed global economic demand despite tariff-driven import price increases, thereby complicating Fed policy direction. Ironically, price and wage inflation was only just beginning to reach the Fed’s long-term target range. May’s core inflation increased to 2.4%, as measured by PPI and 2.2% by CPI. However, while wage growth increased from 2.6% to 2.7%, this was slower than the energy influenced headline inflation. The Fed Funds futures market was little moved by these developments and the most acute inflation risks increasingly appear to be on the downside.

- Similarly, there were few surprises from June’s Fed meeting. The most noteworthy changes were procedural; the Fed dropped their practice, dating to the Bernanke era, of providing forward rate target guidance, and beginning in January will move to a news conference after every Fed meeting. The latter is notable in that by convention the Fed only hikes rates on meetings with accompanying press conferences. These moves should give Chairman Powell a somewhat less transparent, but more flexible platform from which to manage monetary policy.

- Finally, the third revision to Q1 GDP resulted in the growth rate being lowered from 2.2% to 2.0%. This was largely attributable to a decline in consumer spending and a larger than expected reduction in inventories. Meanwhile, PMI data released on July 2nd shows some softening, but remains consistent with healthy economic growth. We had previously expressed concern about a buildup in inventories in the initial release; subsequent revisions have put that worry to rest. Coupled with a highly favorable early July jobs report and strong purchasing manager demand, the potential for a healthy second half remains in place, provided global trade tensions don’t upset the proverbial apple cart.

From the Trading Desk

Municipal Markets

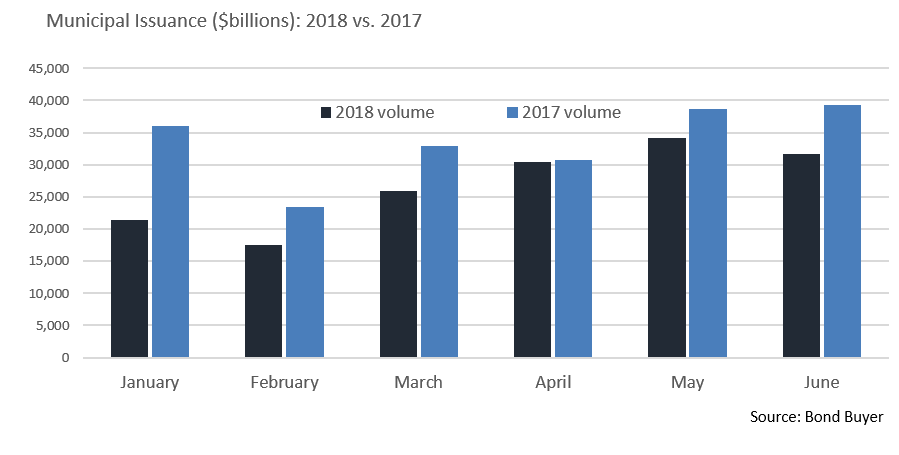

- Municipal supply has continued to underwhelm at just $161.05 billion YTD, about 20% behind the same period of 2017. Investors had been looking for a federal infrastructure plan to increase issuance, but that has received little support and appears to be off the table for now. Although new money debt issuance is up 22% year-to-date, it has not been enough to offset the loss of advanced refunding.

- Investor appetite for munis remains healthy, creating strong technical support. Municipal mutual funds added over $7 billion in net new cash over the first half of the year. In the near term, demand should remain robust due to cash coming from July municipal interest payments and maturities. Recent offerings have typically been significantly oversubscribed. Although banks have reduced their municipal holdings, in large part due to regulatory concerns relating to liquidity risk management, a technical supply/demand imbalance remains intact and is supportive of secondary market pricing.

- Although the 10-year AAA Muni/Treasury Ratio fell 2% points from March 31st, the ratio ended the quarter at an attractive level of 86.3%.

Taxable Markets

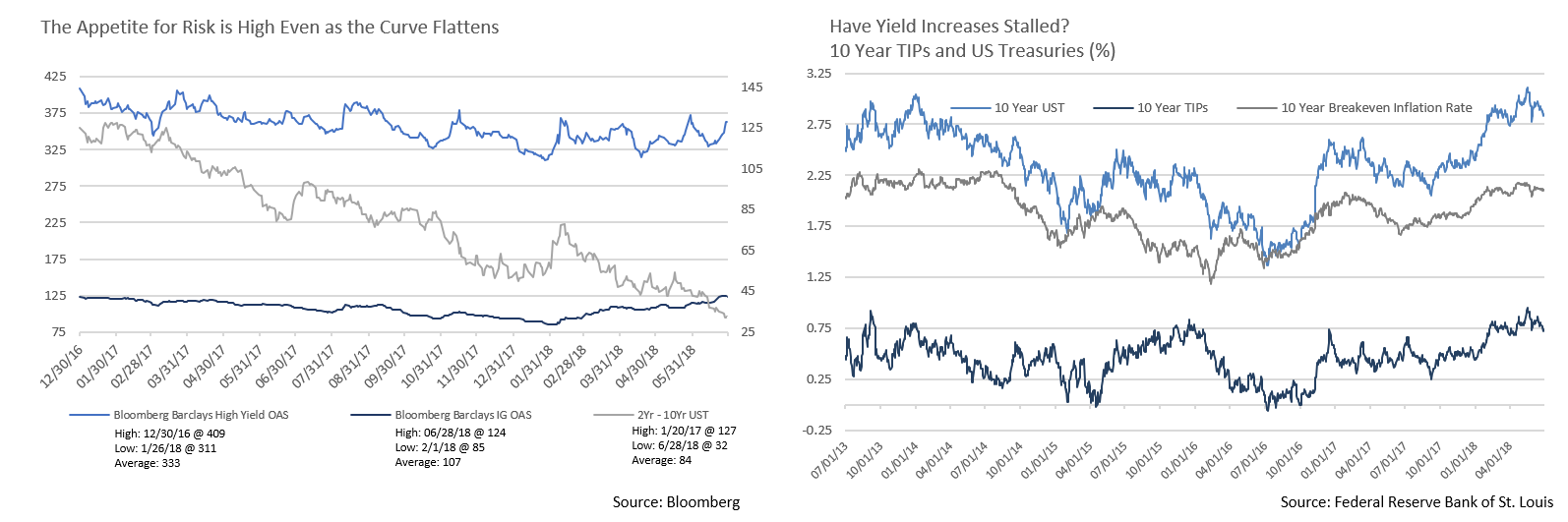

- Amid a long cycle of positive economic fundamentals and tight credit spreads, investment grade corporate debt is facing some modest headwinds. A surge in late cycle M&A deals has fueled otherwise lukewarm supply, contributing to modest spread widening. With $90 billion of new M&A-related Investment Grade corporate debt hitting the market year-todate, the largest of which was the $40 billion CVS deal to fund its acquisition of Aetna, short-sellers have taken aim. According to HIS Markit, Investment Grade notional credit shorts of $55 billion now represent a post-crisis peak. Additionally, rising interest rates are slowly increasing the cost of financing at a time when gross investment grade corporate leverage is close to all-time highs. Nonetheless, we feel these concerns are case specific and see positive fundamentals in the names we own. Strong balance sheets and still favorable economic conditions continue to backstop credit standing.

- The rally in Treasury Inflation Protection Securities (TIPS) towards the end of 2017 and into 2018 has cooled as we closed the second quarter. Inflationary expectations going into this year had risen, with the Fed’s 2% target seen by many traders as likely to be met or exceeded. However, despite a US economy that remains on strong footing, it is hard to find evidence of a troubling acceleration of inflation, particularly as global economic conditions slow. The recent rally in US Treasuries may be a signal that we have seen a temporary top of rates and waning inflationary pressures.

Public Sector Watch

Credit Comments

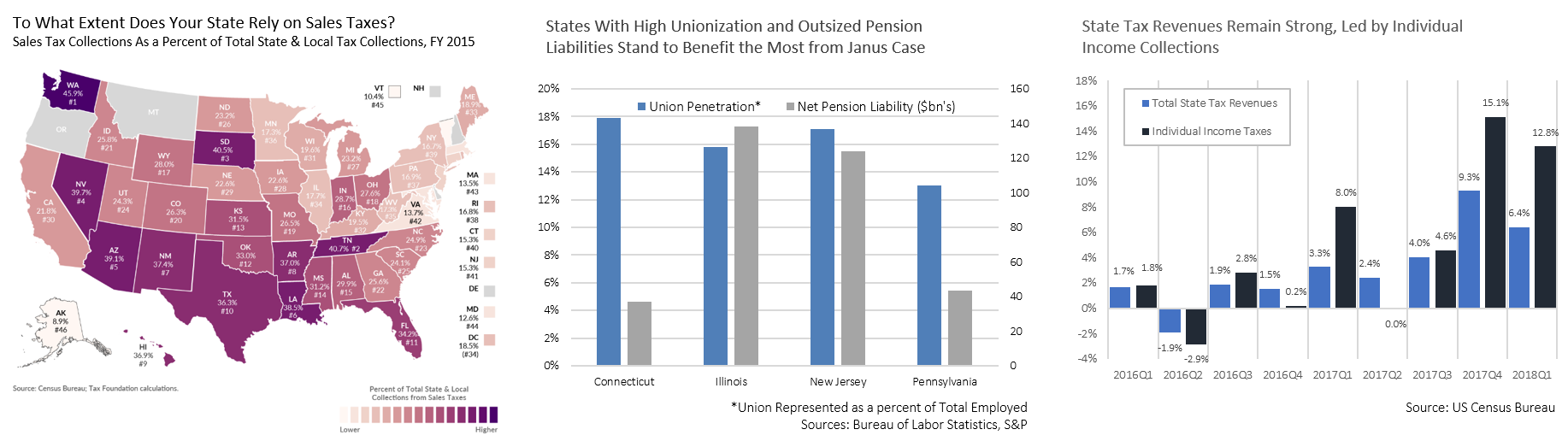

- The Supreme Court boosted municipal sentiment with two recent high profile rulings. In South Dakota v. Wayfair, the Court gave states the authority to require online retailers to collect sales taxes regardless of physical presence in a given market. The ruling is a net positive for state and local governments, as it broadens their tax base and should lead to modest incremental revenues. The Government Accountability Office estimates that the inability to levy taxes on merchants outside state borders resulted in a loss of between $8.5 billion and $13.4 billion in 2017, roughly 2-4% of total state and local sales tax receipts. While the aggregate “lost revenue” may seem modest, the impact on states heavily reliant on sales taxes will likely be meaningful.

- On June 27th, the Supreme Court subsequently voted 5-4 in the Janus v. American Federation of State, County, and Municipal Employees (AFSCME) case that non-member government employees have a constitutional right to decline to pay union dues. This politically sensitive ruling could hinder union membership and revenue, thereby reducing collective bargaining clout. While 28 “right to work” states have already banned agency fees, the 22 states that have not are characterized by relatively high union membership. From a credit research standpoint, we view the ruling as a positive for state and local governments, particularly those with substantial public union penetration and outsized pension liabilities. Budget implications are favorable given the longterm potential for increased negotiating leverage over union wages and retirement benefits. However, we note that political dynamics, including the willingness to take an adversarial stance against unions, and certain legal limitations, remain factors that will influence the ultimate impact on state finances.

- Q1 ‘18 state tax revenues remained strong, increasing 6.4% from the same period a year ago, down from even higher 9.5% growth in Q4 ‘17. Individual income taxes led the way, rising 12.8% and outpacing corporate income, sales and use, and property taxes. Sustained economic growth and a surge in tax collection in energy states from rising oil prices have buffeted state coffers. Revenue composition differs widely state to state, and we look at the breadth and sustainability of each state’s revenue base, along with budget policy discipline in making credit assessments. Broadly speaking, public sector credit quality remains favorable, with “high tax” states initially benefiting from tax reform and sales tax reliant states looking to add on-line retail revenue given the South Dakota vs. Wayfair SCOTUS ruling.

Strategy Overview

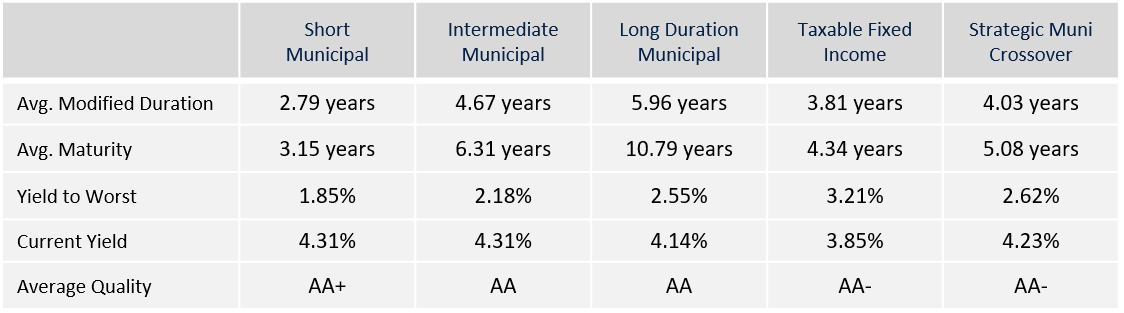

Portfolio Positioning as of 6/30/2018

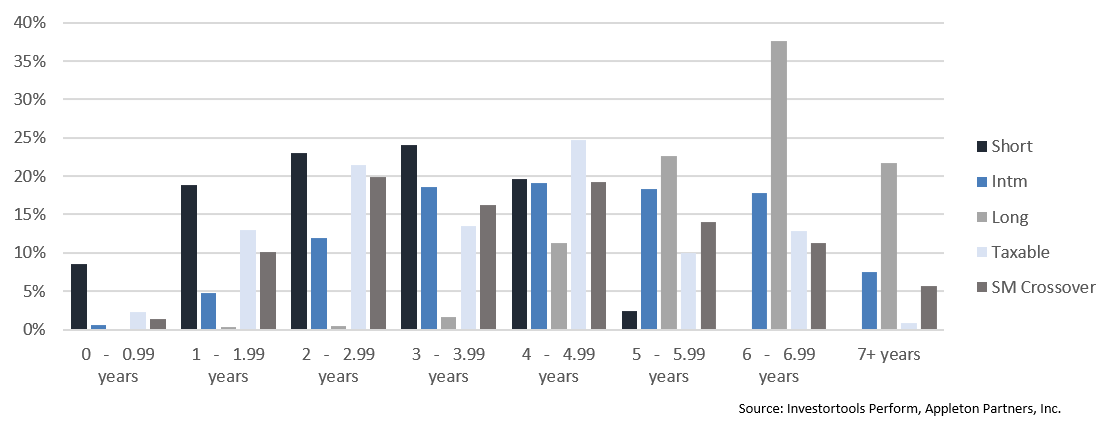

Duration Exposure by Strategy as of 6/30/2018

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.