Insights and Observations

Economic, Public Policy, and Fed Developments

- After several quiet months, trade tensions erupted in early May after President Trump accused the Chinese of “attempting to renegotiate” settled matters and implemented his long-delayed tariff increases on the 9th, the day before the parties had hoped to conclude a deal. China retaliated, extending tariffs which now encompass two-thirds of imports from the US. The conflict subsequently entered a new and dangerous phase with the US blacklisting Huawei (although granting a temporary reprieve), while the Chinese pondered a rare earth export ban and opened an investigation into FedEx. We have long held little hope for more than a symbolic deal, and even that now seems questionable; it is difficult to see how both sides can reach a meaningful agreement without losing face.

- Making matters worse, Trump spooked already-rattled markets by unexpectedly announcing a 5% tariff on all Mexican imports, steadily increasing to 25% by October unless Mexico takes undefined steps to stem the flow of immigrants at the border. As we publish, the White House announced an indefinite suspension of pending tariffs although agreement specifics are lacking. We are concerned that the Mexican tariff threats may impact business confidence beyond the immediate costs imposed, as are Congressional Republicans. Mexico was seen as a winner in the US-China feud as the USMCA agreement should have ensured certainty in cross border trade, but with even negotiated deals no longer offering protection from US tariffs, capital allocation decisions will be riskier. Further, simultaneously fighting trade wars on multiple fronts represents a concerning escalation, and the Administration merely delaying a decision on tariffs on cars from the EU and Japan did little to sooth markets.

- Political uncertainty also ticked up more broadly. Theresa May resigned as British Prime Minister after failing to deliver a Brexit deal, and with Conservative Party members (who favor a “hard” Brexit by more than 2-1) picking the next PM, the risk of a catastrophic no-deal Brexit has increased. At home, the ongoing fight over investigations into the President’s campaign and business dealings ground to an impasse. With the debt ceiling perhaps five months away and partisan rancor worsening, there may be further instability ahead.

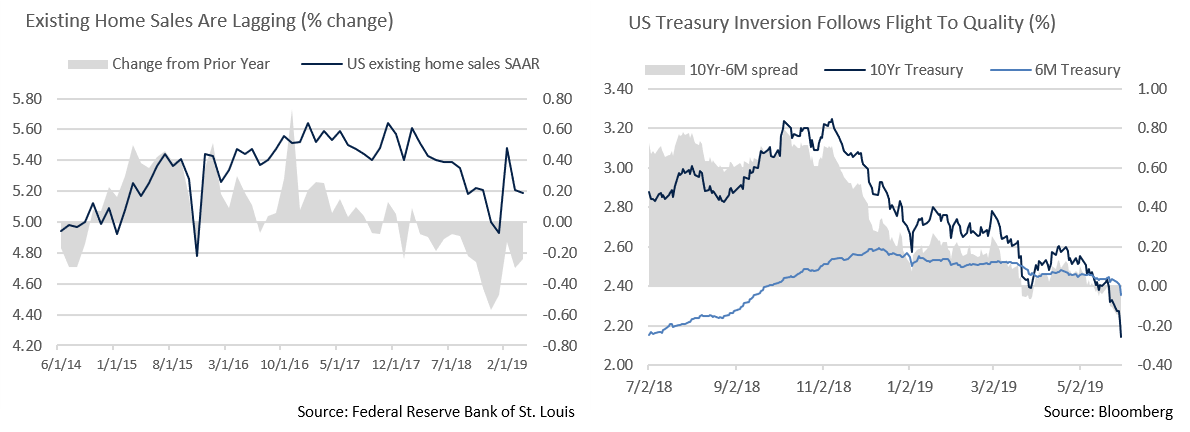

- Unsurprisingly, business confidence is suffering at home and abroad. The US ISM PMI index followed other world economies and dropped at month end to the lowest reading since 2016, missing expectations for a modest increase. US retail sales disappointed as well, with April sales ex-autos and gas dropping 0.2% vs. expectations of +0.3% growth, while housing sales continued what’s now a 14-month unbroken decline in year-over-year growth. With inventory levels high, both factors should weigh on the real economy, and we continue to expect a sharp drop off in Q2 US GDP.

- For these reasons, we are less inclined to dismiss May’s yield curve inversion in the same manner we did March’s. The sharp deterioration in trade talks with China and the significant disruption to cross-border supply chains Mexican tariffs would impose could have a long-term impact on growth, and we believe the likelihood of recession in the next 18 months has risen. Fed Funds futures now place odds of a rate cut by September at more than 92%, and we believe the Fed will have to bow to economic reality and cut rates. Powell acknowledged this on June 4th, noting the Fed was monitoring the implications of economic and trade developments, and opening the door to the potential for cuts if matters worsen. As has recently been the norm, the equity markets responded positively.

From the Trading Desk

Municipal Markets

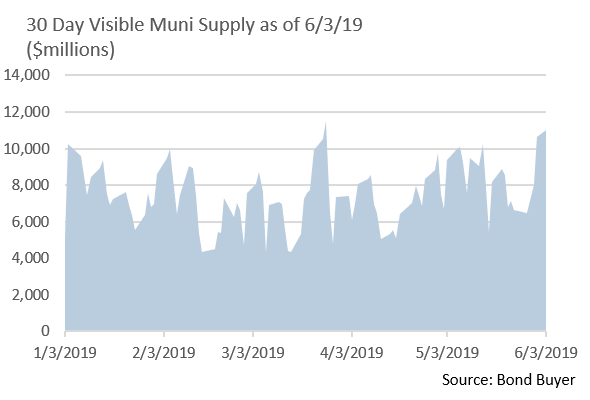

- Municipal technical factors remain supportive with strong demand showing no signs of abating amid recently volatile markets for equities and other risk assets. Municipal mutual funds have seen 21 consecutive weeks of inflows, bringing the YTD total to over $37 billion. For reference, this YTD net inflow is more than 3 times larger than the cumulative high of 2018 and double that of 2017. As for supply, through the end of May, issuance of $132 billion is up only 1% vs. the same period of last year. May’s monthly figure fell short of 2018’s comparable period by 17%.

- We have commented on several occasions on how sustained demand coupled with limited supply, while positive for performance, has made finding municipal inventory challenging. It is worth noting though that 30-day visible supply is up to $11 billion, the highest it has been since March. This is a welcome development as we look to put client assets to work.

- May closed with a flight to quality, and yields across the muni curve fell along with Treasuries and are now down 10 to 25 basis points over the course of Q2. The 10-year muni/treasury ratio stood at 78.5% as of June 3rd after hovering in the low 70s for the early part of May. Despite strong municipal performance, the ratio moved up given the very sharp recent decline in US Treasury yields. We expect the muni/treasury ratio to recede a bit as we approach summer months that have traditionally been characterized by negative net issuance.

Taxable Markets

- In the face of renewed volatility and a late month risk-off trade, the US Treasury Curve experienced a significant flattening and inversion (10Yr relative to 3 and 6-month bills) for the second time this year. Maturities from 2 to 30 years moved between 34 to 40 basis points. While the very front end of the Treasury curve remained anchored, 10Yr yields sank to a YTD low of 2.13% at month’s end, a response to global growth concerns, another round of trade fears, and dovish Fed response expectations.

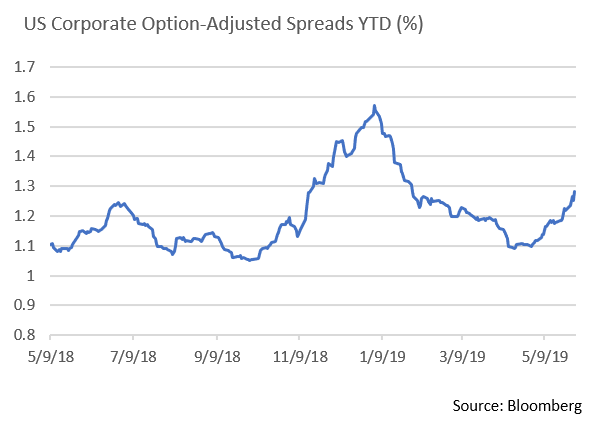

- Investor tolerance for risk assets appears to be weakening as the global economic and political picture becomes cloudier. On an OAS basis, US High Grade bond spreads widened 11 basis points in May to 122 and investors pulled money out of Investment Grade bond funds for the first time in 16 weeks. Signs of risk aversion after a long period of credit strength is having its effects on the new issue market, as issuers are finding it more challenging to offer debt. Lower-tiered BBB debt issuers are perhaps most impacted with the primary market place requiring higher concessions to get deals done. Of the roughly $485 billion in YTD Investment Grade issuance (ex-EM), 36% has been in the BBB rating category, a credit tier that now accounts for more than 50% of the total Investment Grade market. The implication we see is that a longstanding benign corporate credit environment is showing signs of strain. Although corporate credit conditions are still largely favorable, we continue to emphasize liquid, higher grade issues in our taxable and crossover portfolios.

Public Sector Watch

Credit Comments

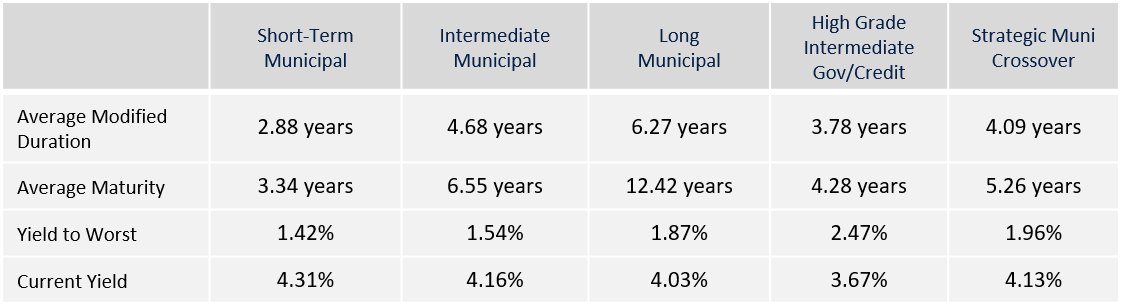

Illinois Sends Graduated Income Tax to Voters

- Illinois’ Legislature approved a measure that, subject to voter approval in November 2020, would do away with a constitutionally-mandated flat tax and open the door for a progressive graduated income tax. The current flat rate of 4.95% would be replaced with a tiered structure ranging from 4.70% to 7.99%.

- Legislative approval was a political win for first-term Governor J.B. Pritzker who campaigned on the idea as a means of enhancing revenue collection. The Governor estimates that if the tax structure is implemented, it could produce $3.4 billion in annual incremental revenue.

- According to Moody’s, all but 11 of 43 states with individual income taxes have progressive structures. Depending on the scale in rates, graduated income taxes can be a boon to state coffers in good times, as wealthier citizens typically represent an outsized portion of tax collections. However, such reliance may heighten downturns as it introduces elevated revenue volatility. In fact, states with the greatest dependence on high earners for income tax revenue saw the largest swings in annual revenue changes from 1999 through 2018 according to Moody’s and the National Association of State Budget Officers. This is evident in Illinois’ projections, as the State estimates that 97% of taxpayers will see minimal difference given that those making over $250,000 will bear the brunt of the change.

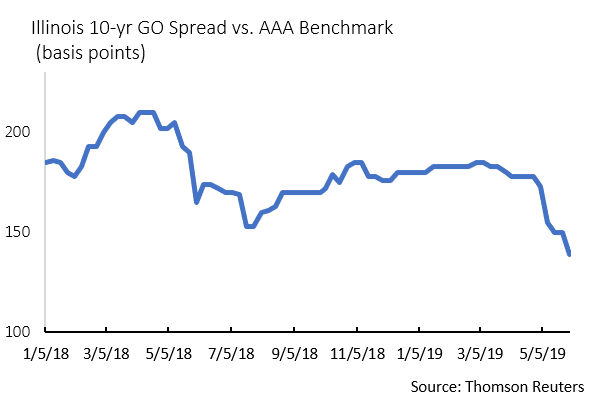

- Illinois’ legislative approval and strong April tax collections have received a favorable reaction in the bond market. Since the beginning of the year 10-year Illinois GO Bonds have tightened by 40 basis points. While recent news is positive, we caution that a large bill backlog, out-year budget gaps, and Illinois’ most pressing challenge, a $134 billion unfunded pension liability, remain in place. These challenges are central to our continuing to avoid the State’s GO debt.

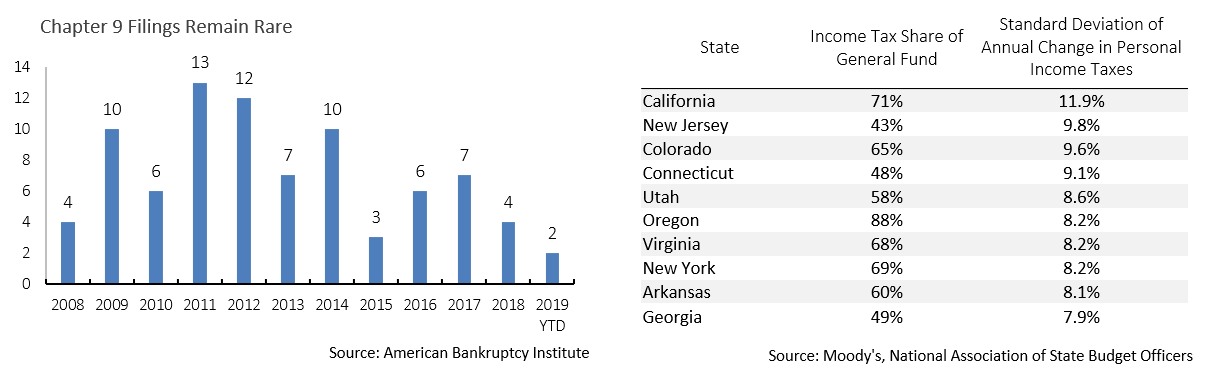

The First Municipal Chapter 9 Filing Since 2015

- Perla, AR filed for Chapter 9 bankruptcy this past month, the first municipality to file since 2015 and only the second Chapter 9 filing of any kind this year.

- Located 40 miles southwest of Little Rock, Perla is facing a lawsuit filed by the neighboring town of Malvern, which claims Perla hasn’t paid more than $250,000 for water services it provided. The town of 245 (according to 2018 U.S. Census Bureau data) indicated that its past due payments and accruing interest far outweigh Perla’s annual budget of around $94,000. Perla listed Malvern as its only unsecured creditor and has no outstanding public debt.

- We see Perla’s challenges as stemming from an isolated legal fight, not widespread local government credit pressure. The rarity of municipal bankruptcy filings reflects stable-to-improving financial health among most local governments. Nonetheless, this development supports our preference for large, well-established entities that benefit from economic breadth and diverse revenue sources. Larger cities are not immune to lawsuits, although they are more likely to have the resources to weather such events with minimal credit impact.

Strategy Overview

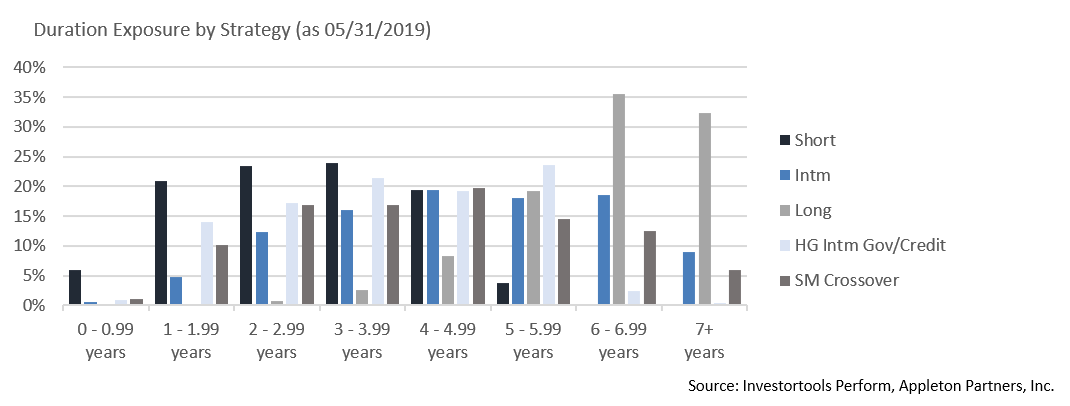

Portfolio Positioning as of 5/31/19

Duration Exposure by Strategy as of 5/31/19

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.