Hall of Fame catcher and noted baseball sage Yogi Berra famously quipped, ‘It ain’t over till it’s over.’ His aphorism is usually taken as a never-say-die rallying cry for underdogs and longshots, but it’s also good advice when you’re riding the highs of a winning streak.

Baseball is an autumn tradition here in Boston. This city’s storied affair with the sport hasn’t always been a pretty one, most famously for an 86-year-long World Series dry spell we finally broke in 2004. The past decade and a half has been a little kinder to us, however, and this year may be no exception. Despite a rocky September, the 2018 Red Sox led the major leagues with a franchise-record 108 wins. While most of the city has been focused on this record, we at Appleton have been concentrating on a slightly different one. On August 22nd, the S&P 500 broke the previous record for the longest stock market rally in history, rising without a 20% correction from its lows of March 9th, 2009. Over the nine and a half years following that low, the stock market has risen nearly 430%. This recovery hasn’t always been pretty either, but a scan of the economy today shows plenty of evidence of strength, though not without cause for concern.

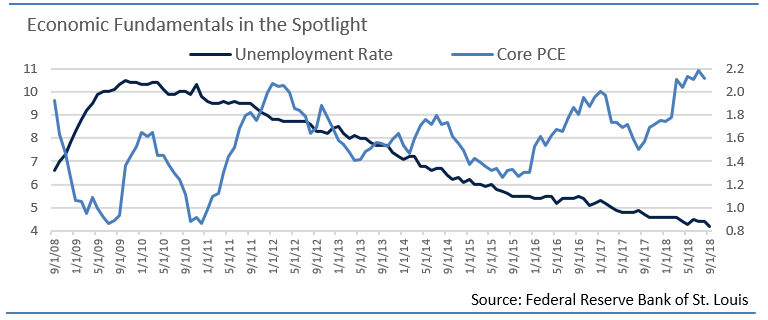

For much of this bull market the recovery saw stock gains outpacing economic fundamentals. Notably, inflation remained stubbornly weak despite unprecedented Federal Reserve stimulus, while wages for American households stagnated. In the past year, however, both have shown signs of improvement. In August, average hourly earnings growth jumped to a robust annualized 2.9%, a rate not seen since June of 2009. Unemployment is now testing generational lows; September’s rate of 3.7% represents the lowest reading since 1969. The surge we are seeing in labor demand is also reflected in survey-based measures of consumer and business sentiment, which are generally at or near cyclical highs. Meanwhile, GDP growth surged in the second quarter to the highest reading since 2014.

Finally, while in 2017 the stock market’s rise was largely driven by the so-called FANG stocks (Facebook, Apple, Netflix, and Google), this year’s strong performance has shown much greater market breadth. We also think it’s symbolically fitting that this bull market broke the previous bull market record the same quarter that the Federal Reserve hiked its overnight rate to a level above the inflation rate. This brings the so-called “real” interest rate, adjusted to account for inflation, to positive territory for the first time since the Fed slashed rates to zero during the Great Recession. The current recovery may have started a little slowly, but it seems to have finally found its legs.

However, just as the best major league sluggers are more likely to end a plate appearance called out as safely on base, even a robust, growing economy will also show pockets of weakness. As we suspected at the time of our last letter, simmering trade tensions did indeed dominate headlines for the past several months. Today, only the most optimistic market commentators would deny that we’re in a full-blown trade war. While the market was able to shrug it off, at least through early October, its effects are visible in the economy; part of the surge in last quarter’s GDP was US firms rushing to get ahead of retaliatory tariffs. With those now in place, the trade deficit widened in August and September to near-record levels as demand for US goods slowed. A successful resolution of the NAFTA trade talks did take a major trade risk off the table, however, as the 25-year-old trade agreement was renamed the USMCA but otherwise left largely unchanged.

Domestically, while inflation remains right at the Fed’s target when measured year-over-year, there has been a slowdown in month-over-month readings, which if continued should soon begin to pull the yearly readings down as well. Survey-based measures of economic sentiment are fairly consistently near cyclical highs; they are also fairly consistently just off those highs. Emerging market economies continue to rumble as the dollar strengthens, echoing the 1997 Asian crisis. And, of course, it’s been a rocky year in the bond markets; while spreads have hung in well and generally have tightened since December, interest rates spiked at the start of the year and then ground up slowly all third quarter, before spiking again in early October. While yields are currently at the top of a trading range we believe will hold, the speed at which they moved spooked equity markets.

Still, as Hall of Fame catcher and noted baseball sage Yogi Berra famously quipped, “It ain’t over till it’s over.” His aphorism is usually taken as a never-say-die rallying cry for underdogs and longshots, but it’s also good advice when you’re riding the highs of a winning streak. While Bostonians certainly know a thing or two about snatching defeat from the jaws of victory – just mention the name Bill Buckner to anyone who grew up here – it’s wrong to expect any particular winning streak to end just because it’s gone on for a long time. Yes, there are things we are concerned about in today’s economy and markets, but it’s a rare quarter where that hasn’t been the case, and it’s hard to ignore the economy’s demonstrated strength and resilience. Periods of strong performance and low volatility can lead to complacency, and now more than ever it’s important to remain disciplined and stick to an investment plan. But, these can also be the periods where it’s the most fruitful to be an investor. We’re still in a record breaking bull market. One day, it’ll end, as all rallies do. But there’s no sure way to know when that is, so until that day comes, well, it ain’t over till it’s over.