Life Transitions and Financial Health

Life is inherently uncertain despite our best efforts to mitigate risk and plan for tomorrow’s eventualities. For many of us, control offers a sense of security, yet the reality is that unexpected events inevitably occur, and personal transitions, however challenging, are sometimes necessary. That’s why Appleton places great emphasis on the human element, as understanding our clients and gaining their trust is critical to helping them adapt to changing circumstances.

According to “The Social Readjustment Rating Scale,” a landmark study of personal stress factors, the loss of a spouse and divorce are the two life events that introduce the greatest personal anxiety.1

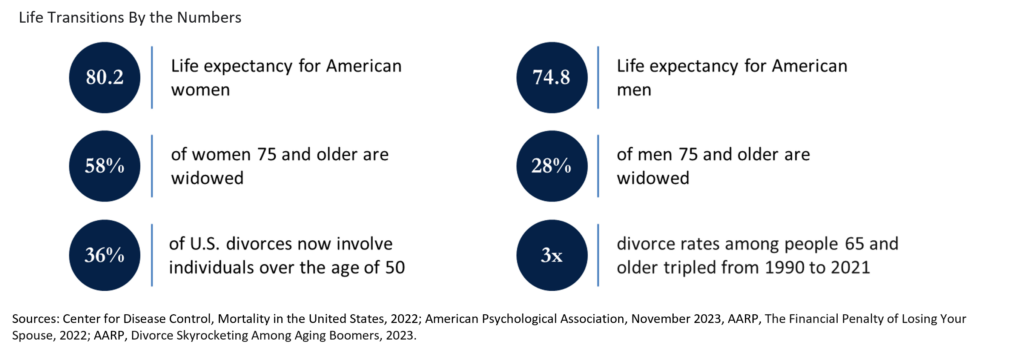

The graying of America has long been chronicled and the implications of this demographic trend far exceeds our capacity to comment in a short letter. Furthermore, a long evident gender life expectancy gap has grown larger as our population ages. Life expectancy for American women reached 80.2 years at the end of 2022, while men live an average of 74.8 years.2 Losing a spouse is not only emotionally difficult, but it also introduces financial planning needs that can be overwhelming to a widow or widower. Life insurance policy claims, retirement planning, budget adjustments, investment decisions, and housing transitions are among the challenges individuals may face.

Divorce introduces a different dynamic, but one that can be equally unsettling. As the population ages, the instances of later-in-life divorces have increased. In fact, a recent study from the American Psychological Association found that 36% of U.S. divorces now involve individuals over the age of 50, double the rate of 20 years ago.3 Dealing with change of this nature often requires decisions concerning tax planning, investment strategy, insurance, beneficiary designations, and other financial matters, a potentially problematic undertaking without the support of an empathetic, knowledgeable advisor.

During the early stages of the pandemic and the relatively brief but very unsettling stock market decline, we published a quarterly letter on the effects of stress on decision-making. Revisiting the subject in terms of major life transitions is also applicable, and we concur with McKinsey & Co.’s advice to “take a deep breath and allow the brain to focus on what’s most relevant” when under extreme stress.4 Paralysis and panic are not atypical reactions, yet what is really needed is a sober assessment of the situation and one’s options, followed by a well thought out response. This is where leaning on an advisor can be valuable.

Helping individuals and their families navigate the many joys of life along with its occasional sorrows requires more than portfolio management acumen, it demands building personal relationships. While no wealth manager can prevent or solve every difficulty clients may face, we can serve as a trusted resource and planning partner. To this end, the importance of personnel continuity should not be overlooked, and the tenure of our Portfolio Managers is one of the attributes we value most.

In good times and more challenging ones, having access to resources who can help you step back and make pragmatic financial decisions is highly recommended. As always, please reach out to your Portfolio Manager as your circumstances change. We also invite you to introduce us to family members or friends for whom we might be able to provide similar planning support.

- Journal of Psychosomatic Research, 1967

- Center for Disease Control, “Mortality in the United States,” 2022

- American Psychological Association, November 2023

- “McKinsey & Company: “Decision-Making in Uncertain Times”, 3/25/20

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.