The Era of Big Government Is Not Over

As the calendar moves deeper into summer, we reflect upon a tumultuous quarter. The words “unprecedented,” “challenging” and “difficult” seemed to be featured in every television commercial, let alone market commentary. COVID-19 unleashed a severe economic contraction and prompted the largest, most aggressive Federal response ever undertaken.

On April 9th, Federal Reserve Chairman Jerome Powell declared that the U.S. central bank was committed to “forcefully, pro-actively, and aggressively” helping the country recover, and that there were “no limits” to the money the Fed could deploy. The Fed has subsequently reinforced its steadfast support. The incredible Q2 rally in equities and other risk assets was bolstered by the breadth and potency of government intervention, although the eventual implications of these prescriptions remain unknown.

Awash in Stimulus and Liquidity

Cumulative monetary and fiscal stimulus may ultimately reach $11-12T, or 47% of GDP.1 Federal spending through the CARES Act and other programs has provided badly needed income replacement, reduced job losses, and helped maintain the viability of countless small businesses. Central bank facilities also now offer a direct or implied backstop to the short-term funding, corporate credit, asset-backed, and municipal markets. In asset classes such as corporate bonds, the Fed has only recently begun to deploy significant amounts of capital, although its availability has emboldened investors and ignited risk appetite.

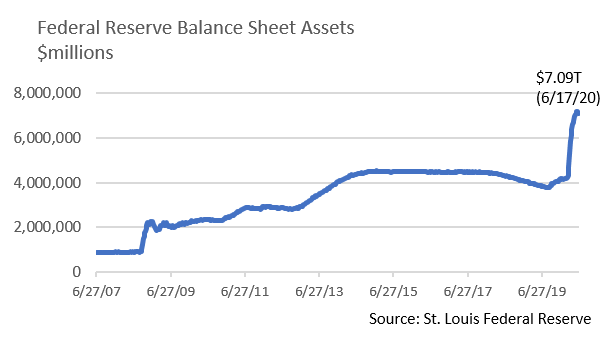

The US deficit will likely reach $3.7T in FY 2020, nearly 4 times greater than projected before COVID-19.2 By comparison, during the Financial Crisis annual US deficits peaked at about $1.4T. The Fed’s balance sheet, a proxy for the scale and scope of monetary operations, already exceeds $7T and may reach $10T by the end of 2021, up from less than $4T in Q4 2019.

A New Paradigm?

Traditional economics supports deficit spending when aggregate demand is lacking but cautions that runaway deficits risk pushing up interest rates, crowding out private investment, and eventually inducing inflation. Economists have also long warned that excessive liquidity risks undue speculation and even financial bubbles. Yet budget hawks who once bemoaned vastly smaller US deficits are quiet given the current urgency of large-scale Federal support, and almost by default, a new concept, Modern Monetary Theory (MMT), has emerged. MMT argues that countries that control their own currencies face no inherent spending or budget constraints because they can print money. Inflation is the primary risk should money supply growth far exceed economic capacity. Taxation is a tool to pull money out of circulation to fight inflation, although in practice raising taxes would be politically challenging.

Twenty-four years after President Clinton declared “the era of big government is over,” we have come full circle. The intersection between public policy and the capital markets is now arguably more pronounced than at any time since WWII. So, what advice can we offer clients?

Stick to Fundamentals

Moral hazard is a condition in which one takes on greater risk because someone else is assuming the potential costs. Although Fed liquidity and credit support is a powerful stabilizing force, it runs the risk of inflating asset values, particularly with bond markets seemingly healthy.

At Appleton, we look at credit analysis and equity research on a security specific basis independently of potential external support or market intervention. For example, the possibility of Fed bond buying should not displace assessment of an issuer’s underlying creditworthiness. Our focus on quality will not change and across asset classes we invest when a security’s price suggests fundamental value, not based on an anticipated external backstop.

Avoid What You Do Not Understand

With Fed Funds likely anchored at 0 – 0.25% well into 20223, savers face paltry returns. This can lead to misguided decisions, such as reported by the WSJ on June 1 relative to large losses incurred by retail investors in leveraged Exchange Traded Notes (ETNs). ETNs are structured products that track the value of an underlying asset while using derivatives that amplify gains or losses. Complex products have long been marketed as opportunities to enhance income and total return, yet absent a thorough understanding of an instrument and its risks, we advise staying away.

Focus on What You Can Control

Macroeconomic forecasting is inherently uncertain, and today’s environment is no exception. How this age of no limits ultimately plays out will be fascinating. Opinions abound and there are no clear answers. Nonetheless, we are optimists and believe in our ability to find attractive investments in ever changing markets. Proprietary analysis drives our investment process and we also emphasize fundamentals in personal financial planning. We recommend clients focus less on economic and market projections and more on their family’s financial needs and circumstances. Revisit goals, time horizon and risk tolerance. Because committing to a well-structured, long-term asset allocation plan offers the best means of navigating uncharted waters.

Morgan Stanley Wealth Mgt., 6/15/20 2. CBO, as reported by Roll Call, 6/8/20

Federal Reserve minutes dated 6/10/20