In a recent speech concerning risks to the US economy, noted economist Robert Shiller discussed the term “trade war” and how its meaning has evolved over time. During the First World War, Shiller reflected, it had more literal connotations; attacking merchant ships to try to disrupt another country’s access to trade goods. Thankfully, today’s context is much more benign, and when the press refers to a trade war between the US and China, the weapons of choice are tariffs, not torpedoes. That distinction has not made the events of this conflict any less dramatic, of course. Given the importance of this subject to investors, we have made trade war a recurring topic in recent commentaries. We thought our quarterly letter was an excellent opportunity to add context and clarity by delving more deeply into global trade and its connection to the US economy and capital markets.

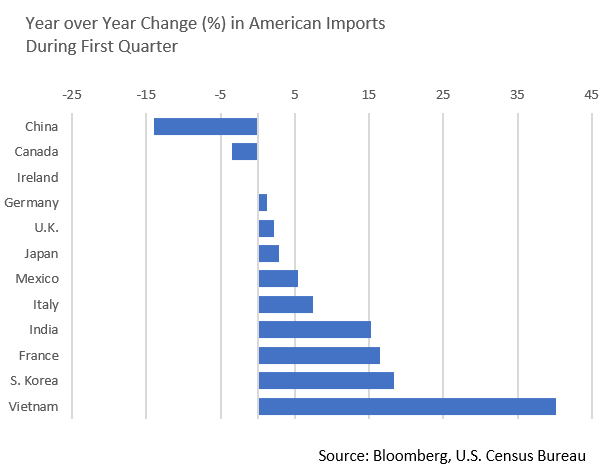

Trade deficits are at the heart of this conflict. Classical economics holds that trade deficits occur when a nation’s public and private spending exceeds public and private savings, rather than from unfair trade terms. In plain English, if a nation “spends” more than it “makes,” then a country has to import more than it exports. This tells us two things; that tariffs are not likely to close a trade deficit, and that unilateral tariffs are a game of whack-a-mole. If tariffs make imports from one country more expensive, purchases are shifted to countries not subject to those levels of tariffs. This is essentially what we’ve observed since the start of the current trade war. The US trade deficit is little changed, and while trade with China has slowed, it has been largely redirected elsewhere, notably Vietnam, Argentina, Chile, and Malaysia. China, meanwhile, has made up for much of their lost US trade by expanding trade with partners such as Canada, the UK, Argentina and Brazil. Arguably the biggest direct impact has been altering long-standing trade patterns, giving us skittish markets and disrupted supply chains.

Tariffs also tend to boost inflation. This is primarily driven by how sensitive consumer demand is to changes in price; the less sensitive, the more of the tariff will be passed on to domestic consumers. Yet surprisingly, inflation has remained muted. This appears to be due to both participants’ negotiating strategies; the Trump Administration made a conscious effort to minimize consumer impact over the first few rounds of Chinese tariffs, while the Chinese have focused their retaliation on goods and sectors to maximize immediate US economic effect. For US consumers, if the deflationary effect of lower Chinese demand for US goods is bigger than the inflationary effect of tariffs being passed along on Chinese imports, then the total impact would indeed be muted inflation. We argue this has been the case – so far. However, the initial round of tariffs that are likely to introduce greater acute consumer impact are just now coming into effect.

Economic forces will only partially influence how the trade war evolves and markets ultimately react. What economic theory tells us, however, is that tariffs alone won’t solve this trade war. They will likely have greater impact on economic growth than trade deficits. The US and China have weathered the slowdown reasonably well to date, and we’ve been pleasantly surprised by the resilience of US consumer spending. Nonetheless, as investors, we’d like to see healthier growth with fewer economic and market headwinds. This would likely contribute to a modest but productive steepening of the yield curve, while bolstering consumer and business confidence. As US and Chinese representatives prepare to once again meet, we are hoping for greater stability in the form of a trade truce whereby both sides refrain from additional tariffs.

Arguably, though, the root of the issue here is how accustomed we’ve grown to discussing trade in military terms. Thinking about it in this way encourages thinking of trade as an adversarial process where every winner requires a loser. This framing doesn’t really work; however convenient the metaphor, tariffs are not torpedoes that can be aimed at one participant while sparing all others. If imposing trade barriers causes mutual harm, reducing them should provide mutual benefit, both to consumers and investors. These benefits are something we’ve perhaps come to take for granted. Trade barriers have progressively fallen since the Second World War, as the global economy has become increasingly interconnected. While there are still trade abuses, we feel needlessly reversing this trend will be harmful for the global economy and markets. And in the meantime, maybe it’s time we drop the trade war metaphor in favor of something a little more cooperative.