Outside of a cottage industry of Fed watchers, people do not wait with bated breath for Fed speeches and Policy Minutes releases. Accepting this reality, today’s policy drama may best be envisioned as a plot summary to a gritty film noir drama.

First Act: Mid-December 2018

From an ornate conference room in Washington D.C., Jerome Powell, our protagonist and Chairman of the Federal Reserve, assesses the economy through a fog of murky and conflicting data. He and his team discuss raising rates for the fourth time in 2018 citing high employment, strong consumer spending, and a need for monetary policy normalization. However, slowing inflation, weakening global growth, and a flattening yield curve trouble them. Across town he faces an unexpected adversary in the form of President Trump, the man who appointed him. Having linked the success of his presidency early on to stock market performance, Trump lays the blame for the current sell-off on the shoulders of Powell and the Fed.

Does Powell raise rates at the risk of aggravating markets, or will he pause, possibly setting the stage for an overheated economy?

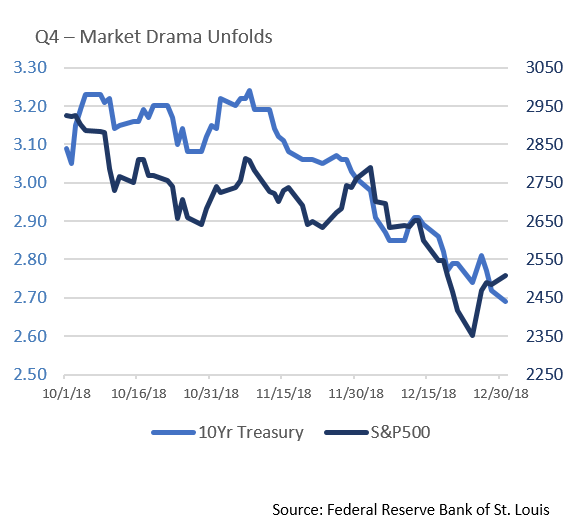

Complicating Powell’s conundrum, equities are on pace for their worst quarter since 2009. Demand for Treasuries pushes yields down as investors flee to “risk off” assets. Political uncertainty is growing, with the US Government approaching yet another shutdown as President Trump demands funding for his politically sensitive border wall.

Second Act: December 19-20 FOMC Meeting

Against this backdrop, and with Federal Funds Futures implying the probability of a hike at only 68% (notable in that the morning before every previous Fed Funds hike in the post-Financial Crisis era the odds were nearly 100%), Powell and his colleagues ultimately decide that economic conditions warrant a higher Federal Funds Rate. Although they signaled a more dovish forward tone by reducing their 2019 “dot plot” forecast from three hikes to two, the market, which had expected no hikes in 2019, trades off.

Third Act: Deciphering Markets & Fed Response

While it is easy to write this off as a mistake, and we believe the Fed is overly optimistic if it thinks the economic fundamentals warrant two hikes in the coming year, let’s put ourselves in Powell’s shoes.

Although the 2019 script is yet unwritten, we agree with the Fed’s assessment that US economic growth, while slowing, remains solid, but this only explains part of the market’s recent story. Powell’s October comments that the Fed Funds Rate was “nowhere close to neutral” contributed to that month’s equity selloff, as did an unexpected spike in Treasury yields, implementation of $200 billion of additional Chinese tariffs, and expiration of a tax break for companies buying corporate bonds for their pension plans.

The housing market has also slowed considerably, although this can just as credibly be explained by the Tax Cut and Jobs Act’s changes to state and local income tax deductibility as underlying US economic health. And, while the stock market slid after the Fed meeting on December 19th, the Fed was hardly the only newsworthy event, as a government shutdown grew from an unlikely risk to near certainty by the Fed meeting’s close on the 20th. The market’s negative reaction to post-meeting press comments reinforced the pain of self-inflicted wounds.

Final Act: Into the New Year

The Fed’s decision to only slightly slow the pace of rate increases is one we find concerning, and indeed, Powell subsequently walked back his comments somewhat in a round table at the start of January. Higher rates will strengthen the dollar, making US exports less competitive at the same time global demand is weakening. Continuing to raise rates during a period of decelerating inflation (the Fed’s preferred gauge dipped below their 2% target in the quarter and on a trailing three-month basis is now a worryingly low 1.1%) risks slowing growth and potentially pushing the US economy into recession. Powell may have been influenced by a desire to demonstrate independence by hiking when President Trump was pressuring him not to. Perhaps, but bowing to non-economic considerations is problematic.

We close by noting that, as in a Greek tragedy where a character’s downfall is often prompted by a flaw in their personality driving them to self-defeating actions, 2018’s market volatility has been heavily influenced by unforced errors on the part of the Federal Reserve and White House (with an assist from the UK and EU). The trade war President Trump initiated at the start of the year has led to repeated sell-offs, yet has thus far not born fruit other than a few changes to NAFTA. Even the Chinese year end “truce” merely represented a 90-day cessation in hostilities rather than an actual breakthrough. Given sustained US growth in the face of a slowing global economy, Fed watchers may recall that former Chairman Greenspan’s speculation concerning whether the US could be an “oasis of prosperity” in the late 1990s was followed by a series of rate cuts. The disconnect in that rate policy relative to this past December’s decision and 2019’s “dot plot” is noteworthy.

We do not believe this is a story destined to end in tragedy, and with a President highly motivated to see sustained strong stock markets, there is growing speculation that a “Trump put” has replaced the former “Yellen put” (see the President’s “great buying opportunity” comments). But, we likely have not seen the last of these tragic flaws, or the volatility that often follows in their wake. We believe the economy still looks good; the question in 2019 will be whether the actions of key decision makers allow it to remain that way.