We write following a New Year’s celebration that, like most everything else in 2020, was far from the norm. The COVID-19 pandemic has tested us all in many ways, yet we trust that sunnier days lie ahead. What comes next and what can we learn from these trying times?

Prepare for the Unknown

Policymakers often fight the last crisis rather than anticipating the next one. In fairness, the latter is inherently difficult given life’s many uncertainties. One thing we do know is that this year has shined a spotlight on risk, most notably a need to proactively prepare for it. As advisors, this speaks to several financial planning fundamentals – insurance and medical coverage, legal documentation, and asset allocation strategy.

Insurance may be a mundane element of personal finance yet ensuring adequate medical and liability coverage is in place is integral to managing risk. We cannot prevent future eventualities, but we can put ourselves in a position to mitigate harm. For example, with longevity and acute care costs rising, long-term care insurance warrants careful consideration.

Similarly, trust and estate plans, healthcare proxies and other legal documentation can help insulate us from adverse effects of difficult situations. Working with advisors to implement legal safeguards that address your needs and reflect your wishes is recommended.

Your Life – Your Portfolio

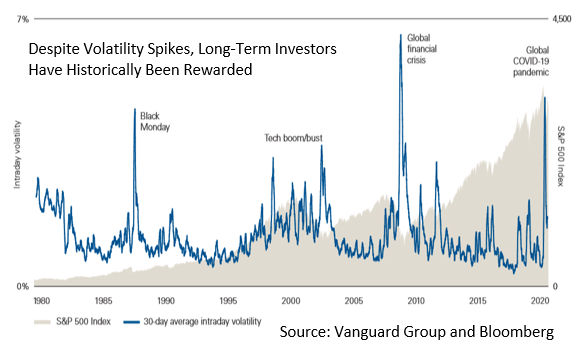

Appleton is a strong proponent of personalized asset allocation strategy. Investment products often emphasize track records, and while such history is highly relevant, each client’s outcome relative to their objectives is what matters most. As 2020 once again illustrated (see accompanying market notes), avoiding behavioral pitfalls brought on by market turbulence is an important element in achieving asset accumulation goals. Spikes in volatility have at times been severe, although they tend to be relatively brief and have historically not overly compromised long-term returns. Whether in the form of “Black Swan” events or more typical shifts in the economic cycle, a good defense against market downturns lies in staying true to a personalized, risk-aware asset allocation strategy.

Wealth management plans also ought to account for personal needs such as income, funding liabilities, and longevity. For example, a year ago very few anticipated millions of job losses. Portfolio management, like insurance, cannot prevent such occurrences, but aligning investment strategies with your circumstances can help mitigate harm.

Address the Knowledge Gap

Financial literacy is a multi-generational challenge and an impetus to more effectively handling routine and unforeseen financial situations. Managing budgets, debt or retirement plans does not require capital markets expertise, rather an ability to understand and act upon personal financial matters. As Champlain College’s Center for Financial Literacy recently emphasized, “financial literacy is linked to positive outcomes like wealth accumulation, stock market participation and smart retirement planning.”(1)

Our society has pushed retirement and other financial responsibilities to the individual despite inadequate financial education. According to a 2019 study by the FINRA Investor Education Foundation, only 17% of Americans ages 18-34 were able to correctly answer 4 of 5 basic questions in a financial literacy quiz. Transitioning to an independent professional life or receiving an inheritance can expose those unequipped to handle financial matters. That is why we encourage clients to bring family members into the planning process and seek professional advice when needed.

Resilience, Adaptability and Community

Sarah Ban Breathnach, a best-selling author, stated, “success in life is not how well we execute plan A, it’s how smoothly we cope with plan B.” Our pandemic experience has been an unexpected test of personal and organizational resilience. No one anticipated navigating a predominantly remote work environment from March through the present, nor the ensuing disruption to our children’s education, our family lives, and community.

Trust is a foundation of resilience. Families, friends, colleagues, and community create a valuable support system when dealing with adversity. While pandemic and recession have frayed our nerves, the strength we draw from each other can be an effective anecdote. Like so many others, the Appleton team has adapted well, working together and with our clients and partners. Doing so has helped bridge the constraints of distance and dislocation.

As the Economist emphasized, “we are hardwired to anticipate the future. . . Imagining a positive outcome is a popular technique to build resilience and confidence.”(2) We too look ahead to 2021 with optimism. This past challenging year has reinforced the virtues of adaptability, perseverance, and trust, as well as the need to take prudent steps today to mitigate tomorrow’s risks.

Our collective well-being is fortified by helping one another. How many times have you heard that “we’re all in this together?” Despite its overuse in TV advertising, there is truth to that sentiment. December’s Review and Outlook discussed the difficulties faced by non-profits and referenced the CARES Act’s charitable giving benefits. Individual generosity makes a big difference, and we strongly encourage community engagement.

At Appleton, we are grateful to serve you and your family and wish everyone a happy and healthy New Year.

(1) www.champlain.edu

(2) The Economist, 11/27/20