A Few Thoughts and Observations

Economic developments rarely have isolated impact as one factor affects another. A pandemic-influenced spike in inflation was followed in 2022 by rapid Fed Funds rate increases and an inversion of the US Treasury and AAA Municipal yield curves. Alluring short-term yields subsequently fueled a surge in money market fund assets, which totaled $6.85 trillion as of 12/31/24.1

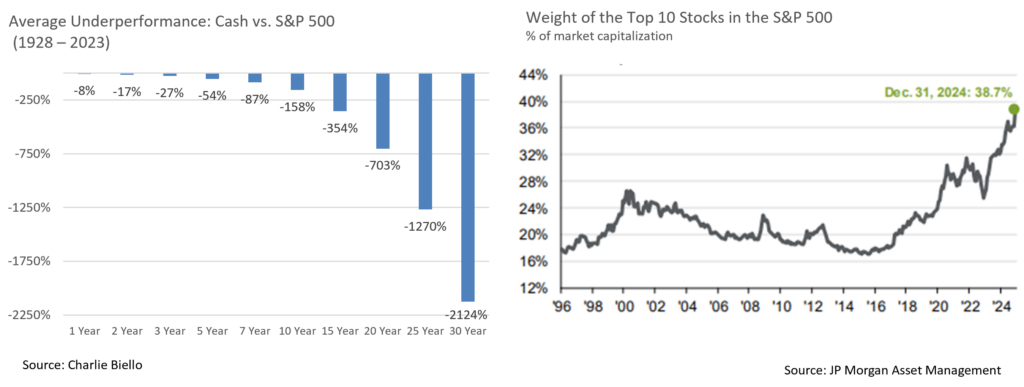

While cash and equivalent holdings can be valuable sources of portfolio liquidity and risk mitigation, too much of a seemingly good thing may ultimately be detrimental to long-term financial health. Fed Funds rate cuts in November and December have already prompted a decline in short-term yields, and for some time we’ve recommended considering extending fixed income duration. For those without a risk or liquidity-based need for a sizeable allocation to money market investments, there may be considerable opportunity cost to holding excess cash.

Nonetheless, asset allocation is only part of the risk equation and moving cash into stocks begs the question of, into what? At Appleton Wealth Management, we emphasize personalization, as what’s right for one family may not be what’s right for another. Today’s markets offer a vivid example of why we feel this way.

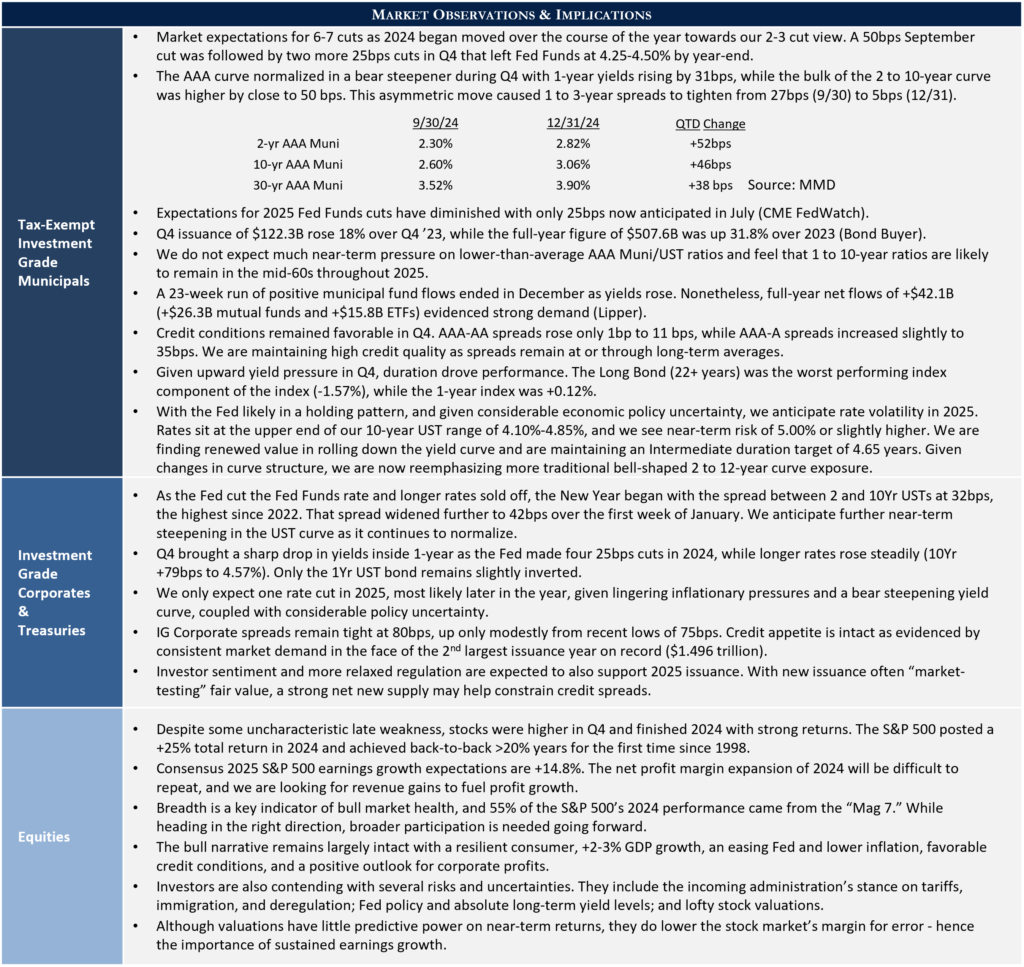

The S&P 500 is often seen as “the stock market,” yet the exposures and risk factors within an S&P 500 Index Fund or ETF may not be well understood. As the accompanying chart reveals, the cap-weighted S&P 500 is currently extremely top-heavy, as the ten largest holdings (primarily large, technology names) account for 38.7% of the entire index’s market capitalization. Asset concentration in a narrow sector or risk factor is just that – a risk – particularly if an investor also has similar exposure through individual stocks or other mutual funds. Nonetheless, the largest S&P 500 companies are enormously successful, high growth businesses, and prudent risk-taking is

essential to the pursuit of compelling long-term returns. In fact, as of 12/31/24, Appleton’s Large Cap Growth composite had a 28.3% weight in the 10 largest S&P 500 names (significant but well below the index concentration).

Our Research team and Wealth Managers are responsible for investing your money in stocks that we feel offer attractive risk-reward profiles, and seek to avoid more speculative, higher risk names. Doing so requires making security specific relative value decisions. When building portfolios, we start by considering your personal goals and risk tolerance, and then draw upon fundamental research rather than simply following market momentum that may be reflected in the largest index holdings.

All stocks are not created equal, and widely cited market valuation metrics demand context. For example, the S&P 500’s forward Price/Earnings Ratio of 21.5x sits well above long-term averages, a reality that has raised analyst concerns. Yet upon removing the Top 10 capitalization names, that ratio drops to a more typical 18.2x.2 Said differently, the “average stock” is trading at valuations well below the largest capitalization names, although arguably for good reason.

There is no simple answer as to when we see value in high flying names and when we don’t, but there are certain characteristics we look for. They include sustainable growth rates, enduring competitive advantages, and seasoned, shareholder friendly management, among others. Our goal is to build high quality portfolios aligned with client objectives while retaining the flexibility to adjust when personal circumstances or market conditions change. The performance and valuation of popular stock indices are useful indicators, but it’s your portfolio that ultimately matters.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.