Even the most casual of observers are likely aware of the inflation debate roiling the capital markets, one that has seemingly accelerated with each economic report. Those who recall the 1970s may have a different perspective than others whose sole experience has been benign inflation. This letter’s intent is not to dissect CPI, PPI, or money supply growth; instead, we discuss investor implications should problematic inflation materialize.

Why Fear Inflation?

Sustained price acceleration risks creating financial hardships, including imposing a regressive burden on those of lesser financial means given their propensity to spend a high percentage of income. Inflation may also penalize savers and those on fixed incomes due to its corrosive effect on the future value of assets. Rising price expectations also typically pushes up the cost of capital, thereby hindering capital spending. How this ultimately plays out is yet unknown, although the Federal Reserve on June 16th raised its inflation expectations and accelerated the time frame of initial anticipated rate hikes to 2023.

Making Sense of Price Volatility

In economics certainty is only obtained in hindsight; nonetheless, distinctions between healthy reflation and troublesome inflation are worth noting. The former is indicative of economic recovery marked by a resurgence in demand and has been a policy objective for more than a decade. May’s Core CPI reading surged at a greater than 5% annualized YoY rate, although the Fed’s revised headline inflation expectation for 2021 is currently a more modest +3.4%. Recent price increases have so far been led by a rebound in transportation costs, supply chain disruptions, and comparisons with cyclically low 2020 levels. Price volatility that reflects pandemic recovery is a good thing, although inflation hawks point to factors such as large public deficits, highly accommodative monetary policy, and wage pressures in raising alarms.

Troublesome inflation is generally characterized by excessive money supply relative to economic output, or aggregate demand significantly exceeding supply, imbalances that can snowball if not contained. By contrast, deflation is a feared economic regime associated with sustained price declines and anemic economic conditions. Falling prices harms those with fixed rate debt and other future liabilities, while also creating capital investment disincentives. Avoiding these risks is at the root of fiscal and monetary stimulus and factors into the Fed’s willingness to let inflation run above their longstanding 2% annual target after years of sub-optimally low levels.

Transience vs. Sustainability: The Great Debate

The extent to which price pressures persist is an open question. The White House and Federal Reserve are in the transient camp in which we also reside, with Treasury Secretary Yellen stating on June 6th that “We have in recent months seen some inflation. . . But I personally believe that this represents transitory factors.” These sentiments were echoed by Fed Chairman Powell during June 22nd Congressional testimony. Reading the inflation tea leaves is inherently speculative, as magnitude, nature, and duration are usually not evident in real time. For the sake of argument, let’s accept that inflation could be a risk. If so, how might this impact asset allocation strategy?

Portfolio Strategy Considerations

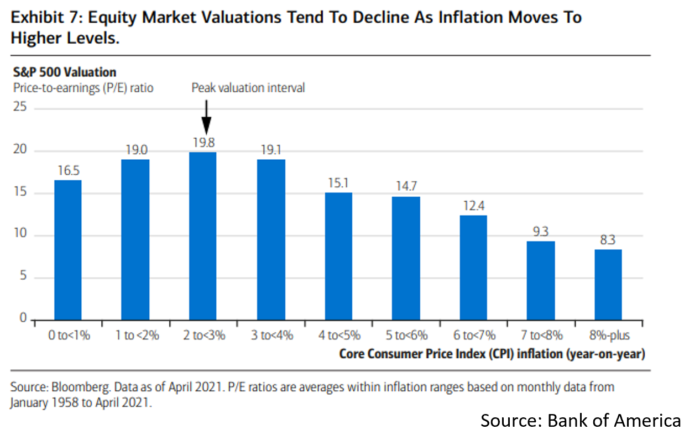

Equities have been one of the better long-term inflation hedges. Although sharp increases in inflationary expectations can compress valuation multiples, equities have generally navigated price increases well. Modest inflation has historically been associated with healthy price-earnings ratios, whereas deflation presents more serious challenges. That is a contributing factor in the Fed’s prioritization of economic growth relative to inflation risk.

Sector and individual stock performance in differing price environments is a topic unto itself, although cyclicals, strong growth franchises, and other companies with an ability to pass along cost increases typically fare better than those with longer duration cash flows and greater input cost sensitivity.

Real estate is a tangible asset with both income-producing and appreciation-oriented characteristics. Inflation erodes the present value of future cash flows and hedging against this with REITs can be advantageous given their tendency to benefit from rising rents and property values. REITs pass through income, and a rising stream of dividends coupled with potential capital appreciation has offered considerable value during inflationary periods.

Commodities, another “real asset,” can add value in an inflationary environment as commodity prices have historically tended to increase as overall prices rise. Furthermore, commodities offer diversification benefits given a relatively low correlation to the broader equity and bond markets.

Floating rate investments, or variable rate bonds, adjust interest payments based on a reference benchmark such as Fed Funds. As price pressures across the economy rise those rates are likely to move up, thereby increasing income streams that help offset or reduce inflationary impact.

Financial Planning Implications

Armchair economists may enjoy prognostication although we recommend instead focusing on more personal matters. Investing is ultimately about reaching your long-term savings goals and funding future liabilities. Real returns net of inflation and taxes builds wealth, and should inflation rise, portfolio performance must at least keep pace to maintain the purchasing power of savings. Refining asset class exposures in consultation with your portfolio manager could be warranted as market conditions evolve. On the liability side of the balance sheet, in a rising rate environment consider converting variable rate debt to fixed obligations as a means of managing your interest burden. At Appleton, we do not believe in cookie cutter solutions and emphasize sticking with investment and financial planning strategies built around your needs and risk parameters.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.