. . . along with Some Fun Facts

Making sense of the economy and markets can be challenging in any era, although today’s environment is proving to be particularly perplexing to many. Context and perspective are critical, as it is all too easy to get lost in the day’s headlines and varying predictions. With apologies to the long running staple of David Letterman’s former “Late Night” show, here is an Appleton “Top 10 List.“

1. Stock market losses have typically been relatively short-lived. Since 1945, there have been 42 DJIA drawdowns of -5 to -10% and 15 declines of -10 to -20%. The average recovery time has been 3 months and 8 months, respectively. (FactSet, Dow Jones)

2. No risk-it, no biscuit! Since the March 2009 market bottom, the S&P 500 has seen 4 declines of 20% or greater (commonly known as bear markets). Nonetheless, the index still returned +16.6% on an annualized basis from 3/9/09 to 3/9/25.

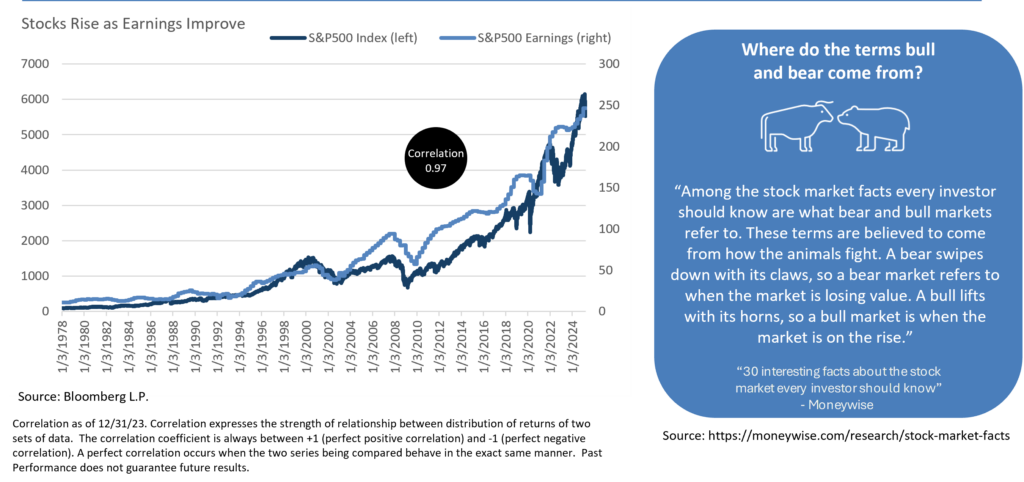

3. Keep an eye on earnings. The S&P 500’s value has demonstrated an exceptionally high 0.97 correlation with S&P 500 earnings growth since 1957. (Invesco, Bloomberg)

4. Profitability growth has stood the test of time. US corporate profits totaled $3.1 trillion in Q3 ’24, nearly double the $1.6 trillion recorded during the same period of 2010. (St. Louis Federal Reserve)

5. Heed the words of Albert Einstein. “Compound interest (e.g. returns) is the eighth wonder of the world. He who understands it, earns it . . . he who doesn’t, pays it.” In other words, time and consistency of savings and investments grows wealth.

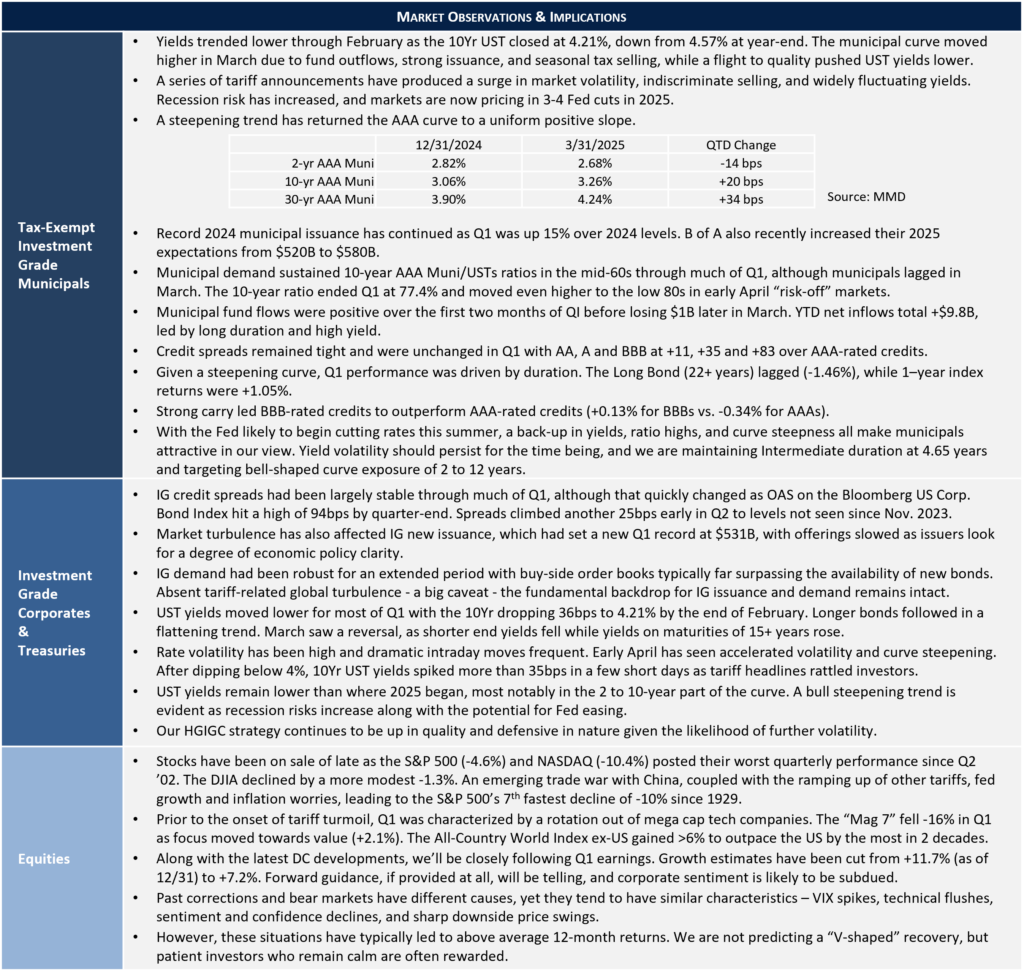

6. Income matters and it’s currently healthy. The yield-to-worst on the Bloomberg Managed Money Short/Intermediate 1-10 Year Index of 3.02% comfortably outpaces its 10-year average of 1.80%. Furthermore, a 4.26% yield-to-worst on the Bloomberg Intermediate US Govt/Credit Index far exceeds the 10-year average of 2.60% (as of 3/31/25).

7. The private markets boom is facing challenges. Liquidity for private equity limited partners is at its lowest level since the 2008 global financial crisis, with 2024 distributions to investors accounting for only 11% of the market value of investments. (Bain & Co., 3/17/25)

8. Encourage family members to start saving as early as possible. Investor 1 begins making $50 biweekly investments at age 25. Over 40 years, they invest $52,000 of their own money and at age 65 have a balance of $128,276. Investor 2 begins investing $100 biweekly at age 40, putting in $65,000 of their own money and at age 65 has a balance of $110, 514. By simply beginning investments earlier, you can take advantage of compound interest helping your money earn more. (RBC Global Asset Management)*

9. Financial advice is likely to become an increasingly acute need. Cerulli Associates recently projected that $124 trillion of US wealth will be transferred by 2048, $105 trillion to heirs. (Cerulli Associates, “The Great Wealth Transfer,” 12/4/24)

10. Help wanted. Referrals are welcome! The wealth management industry could face a shortage of 90,000 to 110,000 financial advisors by 2034. (McKinsey & Co., February 2025)

*This example is for illustrative purposes only and not indicative of any investment. Account value in this example assumes a 4% annual return.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.