While investment markets, unlike novels, have no natural beginning or end, we feel clear parallels can be drawn, most notably the importance of focusing on the broader narrative rather than whatever short-term story is currently in vogue.

First published in 1979, Italo Calvino’s novel “If On A Winter’s Night A Traveler” is a whimsical tale told through alternating chapters of one’s experience reading Calvino’s novel, and the actual text of the novel itself. A series of printing errors, forgeries, lost manuscripts, and various other surprises conspire to interrupt the reader at critical points in the story, each time returning the reader to the start of an entirely new text. Over time, the story gradually becomes the reader’s search for the novel, rather than the series of incomplete tales initially presented as the story. The experience is jarring, confusing, and disorienting, or in other words something an investor looking back at the first half of 2018 might find oddly familiar.

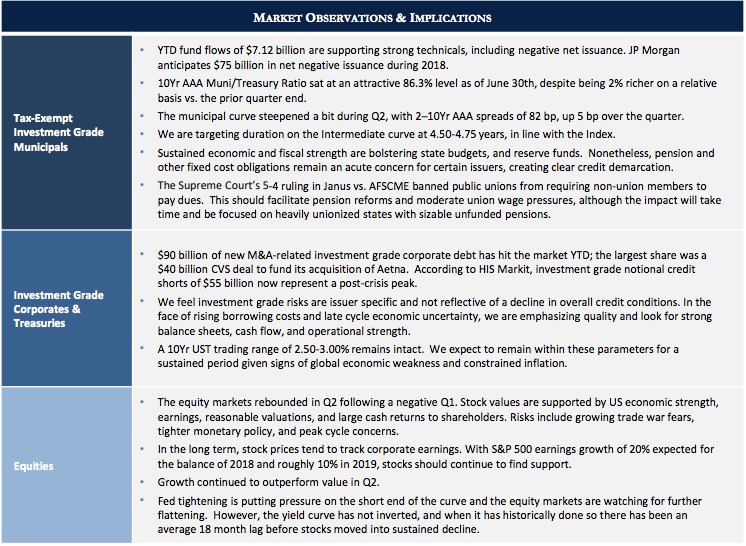

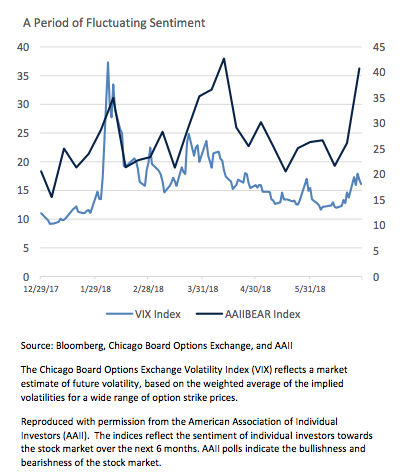

From January’s fears of an intentional devaluation of the dollar, to February’s inflation scare, to March’s announcement of steel and aluminum tariffs, to a resurgence in inflation worries in April, followed by nervousness about a flattening yield curve and trade wars returning to the forefront in May and June, the market has struggled to hold onto a consistent theme for more than a few weeks. Meanwhile, although the 10Yr Treasury yield spiked at the start of the year, both interest rates and US stocks have since spent the first half of 2018 trading sideways, unable to find a clear direction. So, when the micro-narrative seems jarring, confusing, and disorienting, taking a step back and looking at the larger story can sometimes provide a clearer picture.

For the most part, a ten-thousand-foot view reveals a US economy that’s in pretty good shape. There is evidence that GDP growth has slowed somewhat since the strong fourth quarter of 2017, although with manufacturing surveys showing strong business confidence, inventories unusually low, and hiring still strong, there are good reasons to expect very strong Q2 GDP growth and a solid Q3. Despite unemployment touching 40-yearlows, wage pressures remain contained, and aggregate inflation measures may have slowed over the past two months. US corporate earnings are still growing at a rapid clip, and increasingly the US economy is outpacing most of the world.

Nonetheless, the market’s continually shifting narrative reveals skittish investor sentiment. We are now entering the ninth year of economic recovery, the third longest in modern history. The fact that the source of fear rarely stays the same for more than a few weeks matters less than that the market is not only constantly afraid, but appears to be desperately looking for something to be afraid of. This is probably healthy. An old industry saying is that the surest sign of an impending recession is when no one is worried about an impending recession. Any of the themes from the first half of the year certainly could manifest themselves in a sustained equity market correction. In particular, we suspect we will be discussing trade concerns in our upcoming monthly “Review and Outlook” commentaries (and if you do not currently receive these and would like to, please let us know and we would be happy to add you to our distribution). Investors have every right to be nervous.

At the same time, a period of consolidation after two years of strong equity market performance gives underlying earnings time to support valuations, while interest rates remaining in a trading range after an abrupt rise offers investors time to digest and reposition portfolios. Supply and demand imbalances remain a source of support in the Municipal market, and sustained balance sheet strength coupled with relatively weak issuance is backstopping Investment Grade Corporate credit. Investors should be skittish, but they should also allow themselves to remain cautiously optimistic. In Calvino’s novel, the reader eventually, with the assistance of a second reader met along the way, is successful in tracking down the manuscript of the novel, and the novel concludes as the reader finishes the original story. While investment markets, unlike novels, have no natural beginning or end, we feel clear parallels can be drawn, most notably the importance of focusing on the broader narrative rather than whatever short-term story is currently in vogue. While the market’s attention and investor emotions will continue to be drawn to risk after risk in rapid succession, concerns to which the Appleton team will remain vigilant, in our opinion the broader story remains favorable. Despite the market’s jagged nerves, there’s a fair amount of cause to stay optimistic given the fundamental backdrop that supports today’s equity and debt markets.