“The first six months of the year were, for all the volatility, a period of capital markets strength. It’s far too early to say what the next six will bring, but at a minimum, we see reasons to expect volatility to continue and emphasize the value of sticking to a clear-eyed plan…”

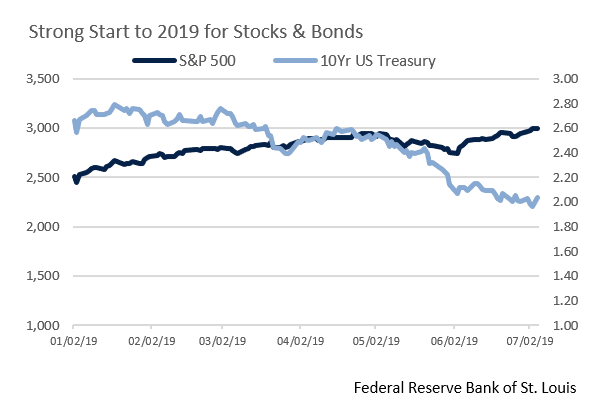

The dog days of summer are a time of tranquility, one for iced tea in the shade and trading your morning newspaper for light beach reading, if only for a week or two. Happily, today’s markets are in sympathy with the traditional summer doldrums. Both the stock and bond markets had banner first halves of the year, and investors reading their second quarter statements can put them down with their minds at ease. The S&P 500 reached all-time highs after the best first half return since 1997, while the Treasury markets saw their strongest January-to-June price performance (i.e. decline in rates) since 2011, and the best outside of Quantitative Easing for any period reported by the St. Louis Fed. In short, it’s July, the sun is shining, and markets appear bright. Of course, just as beaches have lifeguards, as investment advisors our job is to be vigilant to risk, regardless of how calm the day. So, while the first half was positive for equity and bond investors alike, let’s pause and discuss some of the risks we see on the horizon.

Yes, The Trade Drag is Real

Much ink has been devoted to the trade war between the United States and, by now, much of the rest of the world. This war is no longer hypothetical; this month’s Review and Outlook referenced a growing body of evidence that tariffs have already begun to impact importer behavior and are weighing on business investment decisions. Economic consensus confirms that costs are borne by importers and consumers, not foreign countries. The tariffs applied on Chinese imports are already worth roughly a third of a percentage point of GDP growth, a figure that would double if the proposed final round were implemented. This is over and above the impact of tariffs on other trading partners, and we worry that if matters escalate, it could have serious consequences for global growth and domestic consumer demand.

Political Drama on the Horizon?

There are also political risks on our radar. We agree that the Federal Reserve should make an “insurance” cut in rates at the end of this month to address persistently sub-target inflation. However, we feel President Trump’s escalating criticism of the Fed is counter-productive and will make it harder for the Fed to make future cuts, if warranted, for fear of being perceived as capitulating to political pressure. Meanwhile, with partisan tensions flaring on Capitol Hill and the Treasury estimating they will hit the debt ceiling in early October, the stage may be set for political drama equal to January’s shutdown. Finally, with Boris Johnson now the clear frontrunner to replace Theresa May as the UK’s Prime Minister, the risk of a “hard Brexit” has risen significantly, and we believe the markets may be underpricing both the likelihood and severity of the UK exiting the EU without a deal.

High Hopes and Expectations

Ironically, the record high stock market is another source of unease. At present, valuations don’t look particularly stretched, with the S&P 500 finishing the quarter at a forward price-to-earnings ratio of 16.8x (per FactSet), well within historical norms. However, this is based on estimated earnings and is very sensitive to changes in corporate estimates. A decline of slightly more than 15% in earnings expectations would push that ratio over 20x, an extremely stretched valuation. Additionally, we note that for the last several years we’ve been in a “bad news is good news” market. Not by coincidence, the S&P 500 hit record highs the day the Fed hinted they would cut rates for the first time since the Great Recession, which is concerning considering a rate cut indicates the Fed believes the economy needs further stimulus to meet its dual mandate of price stability and full employment. For now, this seemingly odd market response is likely to merely limit upside, but eventually either good news must get good enough or bad news must get bad enough to change the market dynamic, causing at least some investor pain along the way.

Sirius and the Sun

The phrase “dog days” is commonly understood to mean periods of the summer so hot that even dogs become lazy. But, the phrase itself dates to the Roman Empire. To them, it was the time of the year when the “dog star” Sirius would briefly rise before the sun in the morning, and it was considered an ill omen of great concern. Thankfully, the stars don’t have an especially good track record predicting market performance. So, during today’s dog days of bright skies and sunny markets, we remain cautiously optimistic, but not blind to risks on the horizon. Are any of these risks certain to push the economy into recession or cause a market sell-off? Absolutely not. But it would be foolish to assume that they won’t, either, and while the economy is still growing, it remains vulnerable to disruption. The first six months of the year were, for all the volatility, a period of capital markets strength. It’s far too early to say what the next six will bring, but at a minimum, we see reasons to expect volatility to continue and emphasize the value of sticking to a clear-eyed plan, no matter how benign market conditions may appear today.