“The Stress Effect: Why Smart Leaders Make Dumb Decisions and What to Do About It”, by Henry Thomson, presents compelling analysis into how stress impacts leadership decision-making. What do studies of this nature have to do with private wealth management? Much more than you might think.

Reasoned Decision-Making in Adverse Environments

Stress impacts the brain’s cognitive and emotional intelligence, critical abilities needed to make sound decisions. Understanding how this occurs can be highly applicable to individual investors.

Like most wealth managers, we emphasize common sense such as “stick to your plan”, “think long-term”, and “capitalize on volatility”. While such admonitions are valid, they are much more easily implemented in routine times than in the heat of the moment. As Mike Tyson, former heavyweight champion, once said, “everyone has a plan ‘till they get punched in the mouth”.

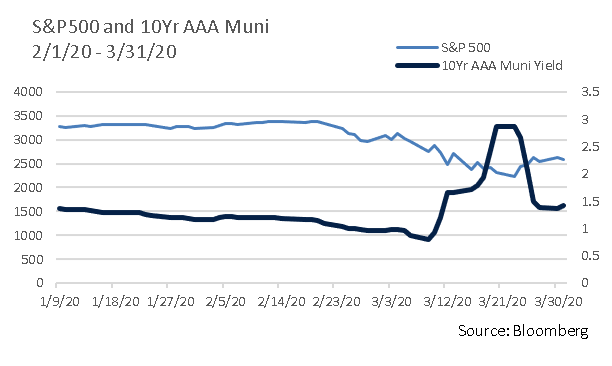

Today’s global healthcare crisis and associated market turbulence certainly qualifies as such a blow. The S&P 500 fell more than 33% in only a month, while the AAA 10Yr municipal curve whipsawed wildly from 0.80% on March 9th all the way up to 2.88% on March 23rd before receding to 1.53% on April 6th.

“The Stress Effect” studies traits associated with both effective and poor decision-making under pressure. While special operations seemingly have little to do with private investment portfolios, there are common threads, including a need to recognize and effectively manage pressure-driven stimuli. This can be challenging, yet doing so is a key ingredient in achieving long-term financial goals. As we help clients navigate today’s challenging times, four recommendations seem particularly worthy of consideration.

Tune In By Tuning Out

McKinsey & Co. recently published crisis guidance for executives that suggests they “take a breath and allow the brain to focus on what’s most relevant”.(1) In our realm, investors are bombarded with “noise”, especially when markets are volatile, much of which is irrelevant to personal financial plans and circumstances. This creates a risk of excessive attention being paid to extraneous information, and alarm-inducing headlines often coincide with times in which selling can be most damaging.

Similarly, investors may benefit from tempering the tendency to follow the herd. Often people find it difficult to go against the grain and, in investing, studies have demonstrated that too much emphasis is placed on “groupthink” rather than personal considerations. Try and tune out the noise and instead zero in on what matters to your family’s long-term plans. As appropriate, revisit and adjust the assumptions that drive your financial plans but think twice about arbitrarily following the crowd.

Small Steps Can Have a Big Impact

Predicting market tops and bottoms is tempting, but arguably a fool’s errand. What may prove far more productive is taking proactive, readily achievable actions concerning matters over which you have control. For example, discuss with your portfolio manager the merits of rebalancing back to asset allocation targets, tax-loss harvesting, or refinancing debt when interest rates fall.

Manage Your Emotional Intelligence

Henry Thomson writes, “when stress increases, cognitive and emotional intelligences are compromised. Perception changes and, in many cases, becomes less accurate.”(2)

Emotional intelligence is an individual’s ability to identify, evaluate and manage their sentiments and those present in the broader environment. Intense stress tends to elevate short-term impulses. Paralysis or panic can be devastating in the military or law enforcement, yet similar risks and tendencies also hinder stress-filled investment decision-making. Our adrenal response is hardwired and cannot be turned off. Nonetheless, in consultation with your advisor, you can take steps aimed at tempering emotions. For example, establishing asset class exposure ranges and stress-testing the impact of negative market scenarios on your financial plans can have a desensitizing effect during turbulent markets.

Recognize Your Biases and Behavioral Tendencies

Everyone’s thought process is influenced by environmental distinctions and personality nuances. We can’t change who we are, but we can try and recognize decision-making biases. Individuals tend to gravitate towards confirming information and under stress often solicit, internalize and act upon information clouded by these biases. For example, those who are instinctively “equity bulls” or “perma-bears” should take this into account when considering investment actions as momentum accelerates in either direction.

Effective decision-making in extreme market conditions does not necessarily mean standing pat. However, a clear assessment of personal needs and goals should drive your thought process, not emotional reactions to stress. At Appleton, we are here to help.

(1) “McKinsey & Company: “Decision-Making in Uncertain Times”, 3/25/20

(2) Henry Thomson: “The Stress Effect: Why Smart Leaders Make Dumb Decisions and What to Do About It”, 2010