Capital markets indices long ago became synonymous with “the market”, and changes in value of the DJIA and the S&P 500, the two most prominent US equity benchmarks, have become a staple of the daily business horserace. Yet the nature of index construction and realignment is an arcane topic best understood by tracking error focused portfolio managers and the committees charged with creating and managing each index, not the wider investing public. Nonetheless, indices heavily influence perspectives on risk and return, and hence personal financial planning. With apologies to Otto von Bismarck, unlike laws and sausages, you ought to understand how indices are made.

The Nature and Purpose of Indices

Passive investing has exploded in popularity and now accounts for roughly 45% of all US equity mutual fund assets, up from only 25% a decade ago.(1) What was once largely the domain of institutional investors seeking low cost, defined market exposure has also become a staple of the retail world. Indexing seeks to track representative benchmarks and, in doing so, can help minimize expenses and eliminate the perceived biases and uncertainties associated with active decision-making. This letter’s purpose is not to debate active vs. passive investment approaches (we are active managers), but rather to deepen understanding of the private wealth mindset with which we approach investment decisions.

Personalizing Risk

Indices offer a valuable frame of reference, acting as an asset class proxy and comparative performance assessment tool. Yet, at Appleton Partners we believe our clients’ absolute asset levels are paramount, not relative returns. While we monitor benchmarks and should be held accountable for our long-term performance, the risk our clients assume is very personal – potential permanent loss of capital and/or failure to meet long-term financial goals and liability needs.

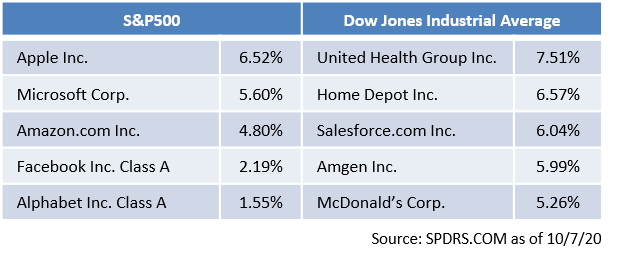

Let’s look at a practical example. Index centric investors often consider an underweight position in a stock as a “bearish” or negative view of that name. For example, Apple represented 6.52% of the S&P 500 as of 10/7, yet to us, a 5% weight in Apple in a client’s portfolio would reflect a positive view of the company’s intrinsic value and growth prospects, not an indication of caution. If we put any of your assets in a stock, we believe in it. While we consider a stock’s weight in the index as part of portfolio construction, it does not drive or supersede our fundamental conviction.

Know What You Own

Committing to customized long-term investment plans ought to be based on an understanding what you own, and equity indices are not created equal. Most, such as the S&P 500, are capitalization weighted, meaning that the largest stocks account for a disproportionate percentage of assets. For example, the top 5 holdings in the S&P 500 – Apple, Microsoft, Amazon, Facebook and Alphabet – comprise nearly 23% of total index capitalization, almost twice the weight of a decade ago. Top heavy to say the least! These same stocks have produced a YTD return of 42%, compared with -3% for the remaining 495 S&P 500 constituents,(2) and thus are the primary reason the index is positive year to date. Capitalization weighted indices are inherently momentum driven, as index replication demands buying more of what is largest and going up in value the fastest. Casting aside the relative merits of these mega cap market leaders, index concentration can have a large, but not always readily apparent, impact on portfolio risk and return.

Other indices, such as the DJIA, are price weighted, indicating that nominal price per share drives the construction methodology. Again, this can introduce momentum characteristics. Corporate actions that have no bearing on actual value, such as stock splits, can also significantly alter the makeup of the underlying index. By contrast, equal weighted indices are just that, equally weighted among constituent names.

Fixed income indices introduce other risk related nuances, as most assign weights to components based on debt outstanding, thereby allocating greater capital to more indebted issuers. Because bonds are traded through dealers, not on an exchange, efficiently replicating desired exposures can be challenging given potentially limited secondary market bond availability. As with equities, we invest in bonds that our credit research and portfolio management teams believe offer good value, not based on index composition.

Index methodology can heavily influence an individual’s exposures when investing in products that track a benchmark, and these distinctions are themselves active investment decisions. Whether these “bets” align well with an investor’s unique needs and objectives is worth considering.

Customized Goals Based on Individual Needs

Quite simply, we feel your primary benchmark should be your financial plan and that’s what we manage towards. Institutional indices play an important role in the market landscape, yet funding your retirement, healthcare or educational needs is a function of capital accumulation, not outpacing index tracking managers. As active managers, we also seek to mitigate risk and preserve capital while targeting appropriate long-term risk adjusted returns. We view relationships in personal terms and the investment strategies developed in consultation with our clients reflect that mindset. So, while we often speak about “the market”, what matters most is how your portfolio works for you.

(1) B of A/Merrill Lynch, March 2019

(2) Goldman Sachs, as of Sept. 11, 2020