Insights and Observations

Economic, Public Policy, and Fed Developments

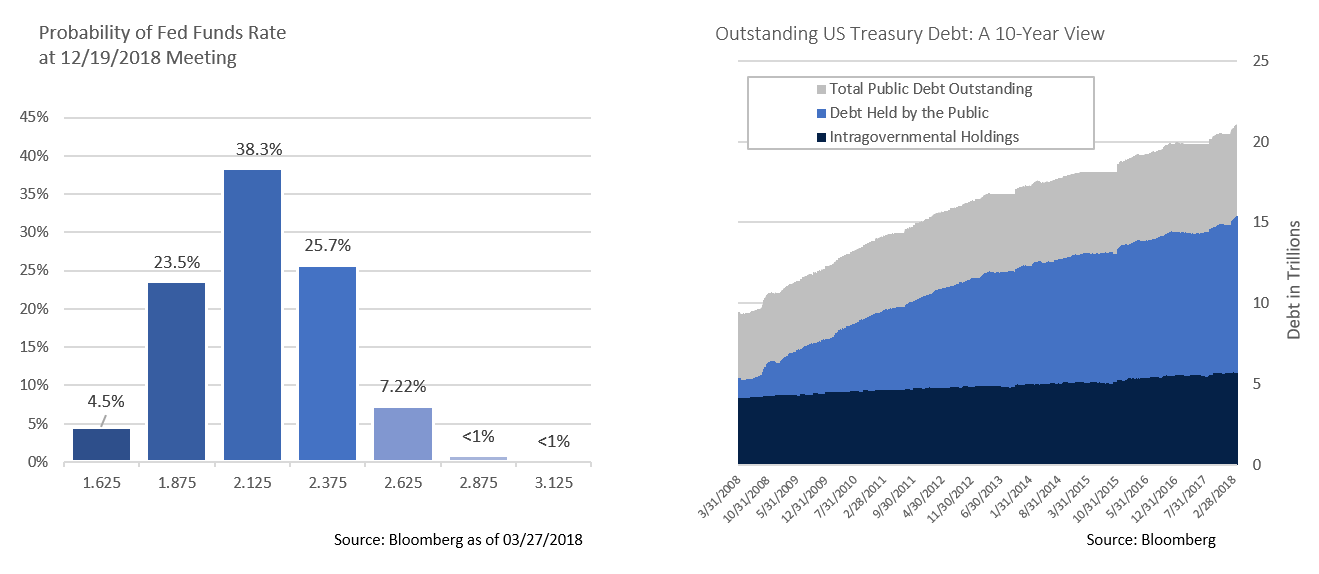

- The recently concluded March Fed meeting bumped up the Fed Funds target rate to 1.50 – 1.75%, with an accelerated pace of increases anticipated. In fact, median Fed Governor’s expectations now call for a Fed Funds rate of 2.10% by the end of 2018, 2.90% by the end of 2019, and 3.40% at year-end 2020. Fed policy will ultimately react to economic developments and forward expectations, both of which are increasingly being influenced by an uncertain public policy environment.

- On that note, President Trump made a hard pivot towards economic populism in March by announcing a series of protective tariffs targeting imported aluminum and steel, as well as broader Chinese trade practices. Although a window for trade negotiation was left open, these tariffs are a sharp departure from the global economic order the US has long championed. They are also likely to result in retaliatory measures beyond what the Chinese have already announced, as well as WTO challenges.

- The US stock market swooned in response to tariff headlines given potential risk to global economic growth. However, we remain optimistic that the ultimate policy impact will be tempered by bilateral negotiation, pressure from Congressional leadership, and the influence of Larry Kudlow, the newly appointed National Economic Council director.

- Along with being considered a “free-trader” at heart, Kudlow is a strong advocate of supply-side economics and has already begun advocating for a second round of tax cuts. Sizable additional deficit-funded tax cuts at this point in the economic cycle would aggravate already swollen budget deficits, increase the risk of inflation, and make accelerated Fed tightening more likely.

- On a brighter note, economic fundamentals still look solid. Despite a banner headline number of 313k new jobs, February’s report was of the “goldilocks” variety, revealing “strong-but-not-too-strong” growth. Average hourly earnings moderated, and the combined January and February increases imply a sustainable 2.6% annualized growth rate. Workforce participation increased to 63%, adding credence to former Chairwoman Yellen’s belief in labor market slack despite low unemployment. • February’s personal consumption report came in flat, and a revised Q4 GDP increase from 2.5% to 2.9% was largely due to rising business inventories. Although a late 2017 surge in consumer spending concerned inflation hawks, it looks seasonal in nature. Furthermore, with modest personal consumption growth, there is less likelihood of inflation being driven materially higher. We believe inflation should remain at or below trendline, at least for the immediate future, although policy risks are rising.

From the Trading Desk

Municipal Markets

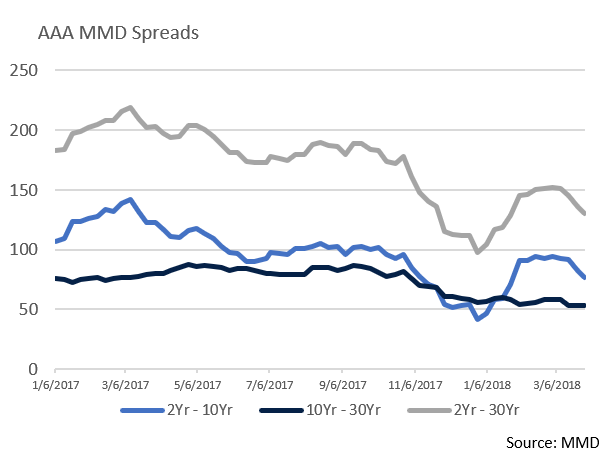

- The muni curve flattened during the month of March, with the short end rising 14bps as measured by 2Yrs, while the 10Yr fell 2bps to 2.42%. As a result, the 2Yr to 10Yr muni curve compressed from 93bps to 77bps. While we do not see the Treasury or muni curves inverting, and feel the economy largely remains on track, recent flattening has raised a few alarm bells given that inverted yield curves have often historically preceded recession.

- Over the first quarter, municipal issuance dropped by a third from the prior year. Q1 2018 issuance of $60.5 billion significantly trailed last year’s level of $86.3 billion. Looking forward, 30-day visible supply is hovering just above the 12- month trailing average according to the Bond Buyer, which is hopeful that supply will soon increase and help foster more efficient price discovery.

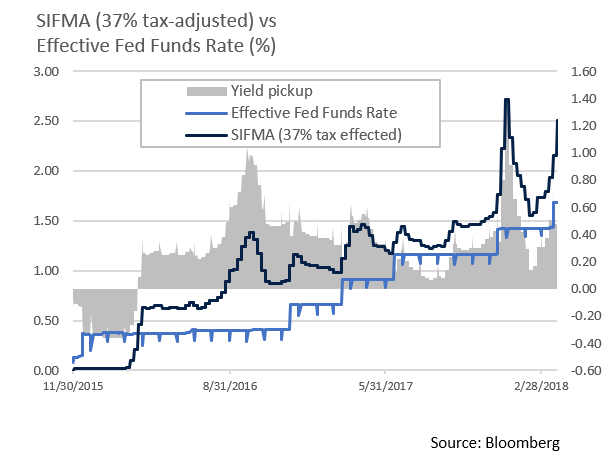

- On the ultra short end of the tax-exempt market a trend worth noting is the sharp increase in high quality cash alternative yields. The SEC’s post-Financial Crisis money market reforms announced in 2014 and made effective in October 2016 produced considerable change in investor behavior. The moves to requiring institutional prime and tax-exempt money market funds to price with floating NAVs rather than fixed $1.00/share values, and allowing for temporary liquidity restrictions during times of extreme volatility, prompted sizable institutional tax-exempt money market fund outflows, thereby constraining a significant buyer of Variable Rate Demand Notes (“VRDNs”). VRDN clearing rates increased accordingly, rising from near zero in early 2016 to a 37% tax-adjusted level of 2.51% as of 3/28/18.

- As per the accompanying chart, the SIFMA Municipal Swap Index, a 7-day high grade market index comprised of tax-exempt VRDN reset rates, now maintains a considerable tax adjusted yield advantage over Fed Funds, offering HNW investors a potentially attractive, high quality, liquid cash alternative.

Corporate Markets

- The investment grade new issue market is beginning to turn from a sellers’ to a buyers’ market as new issue concessions are on the rise. Despite a 30% decline in new debt issuance for Q1 ‘18 relative to the same time period in 2017, investors are demanding more of an incentive to buy corporate bonds. This trend is most evident as one moves down the credit spectrum. Over the past few years, the cost of issuing debt has been very low and issuers have taken advantage. However, many companies have arguably gone too far and leverage is once again becoming a concern. The ratings agencies have taken note, and the amount of BBB-rated bonds in the secondary markets now accounts for nearly 50% of the overall IG credit space.

- Given this more challenging backdrop, investment grade spreads have recently widened and lower rated bonds have fared worse than higher rated issues. We feel that maintaining our strong preference for higher rated, more liquid investment grade bonds will prove to be prudent over the long term.

Public Sector Watch

Credit Comments

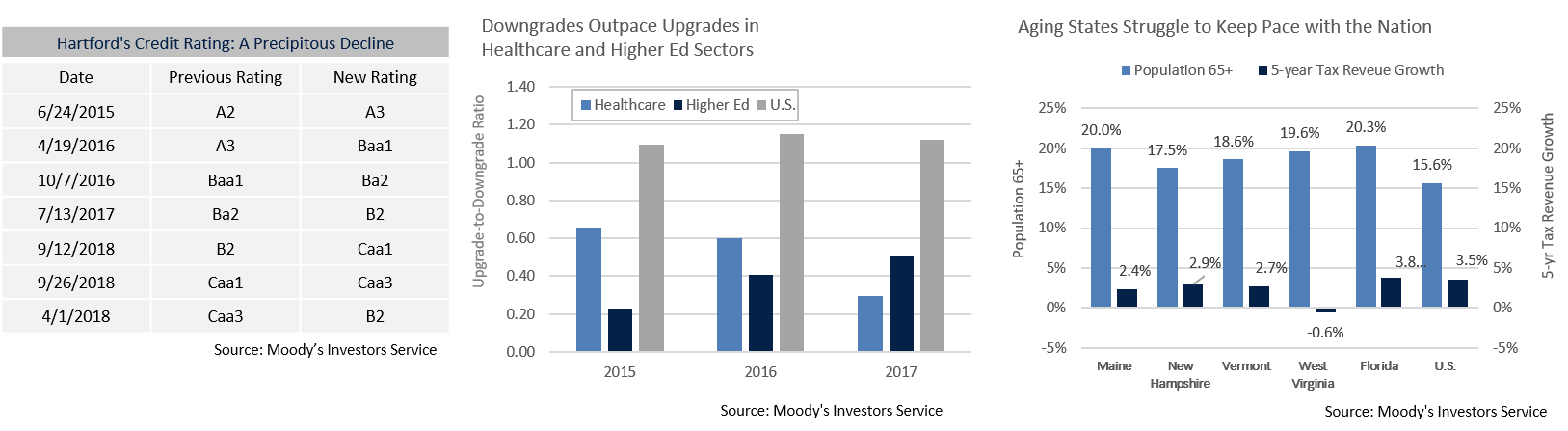

- The State of Connecticut will cover Hartford’s annual debt service on more than $550 million of outstanding bonds as part of a recently approved rescue package. This is not the first time that Connecticut, or other states, has stepped in to provide financial support for a major city. In 2002, the State backed deficit financing bonds for the City of Waterbury, subject to supervision of budgets, contracts and capital improvements. Although Connecticut’s support may be viewed as a “bailout,” potentially creating an incentive for other struggling cities to ask for the same, we feel allowing Hartford to go bankrupt would have been worse, given the likelihood of negative reverberations on many other Connecticut municipalities.

- These events highlight the importance of rigorous independent credit analysis. As recently as September 2016, Hartford was rated “A+“ by Standard & Poor’s, a credit score far from the City’s subsequent brush with insolvency in the Fall of 2017. We have not purchased City of Hartford GOs in any client accounts for several years.

- On a brighter note, for every 2017 downgrade, Moody’s upgraded 1.12 tax-exempt issuers, marking the third consecutive year that upgrades outpaced downgrades. Nonetheless, pockets of public finance weakness remain, perhaps most notably within the Higher Education and Healthcare sectors. These are two sectors we see as battling headwinds, and accordingly, our bond exposure has been highly selective. The rating agencies have also taken notice, as Higher Education’s 2017 downgrade-to upgrade ratio was 1.9x, while Healthcare fared even worse at 3.4x. We believe trends in both sectors continue to warrant a conservative approach.

- Demographics must be taken into account when evaluating public debt given the impact on an issuer’s long-term revenue base and liabilities. According to a recent Moody’s report, the service demands associated with aging populations are increasingly putting pressure on state budgets. The four oldest states – Maine, New Hampshire, Vermont and West Virginia – all underperformed the nation over the past five years as measured by population growth, employment growth, tax revenues, and GDP. Florida, the fifth oldest state, bucked those trends as their older population is offset by an expanding younger population and immigration of financially secure retirees.

Strategy Overview

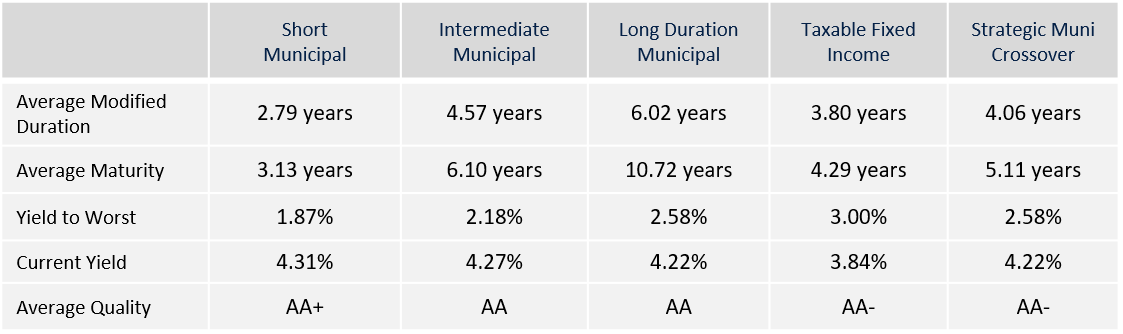

Portfolio Positioning as of 3/30/2018

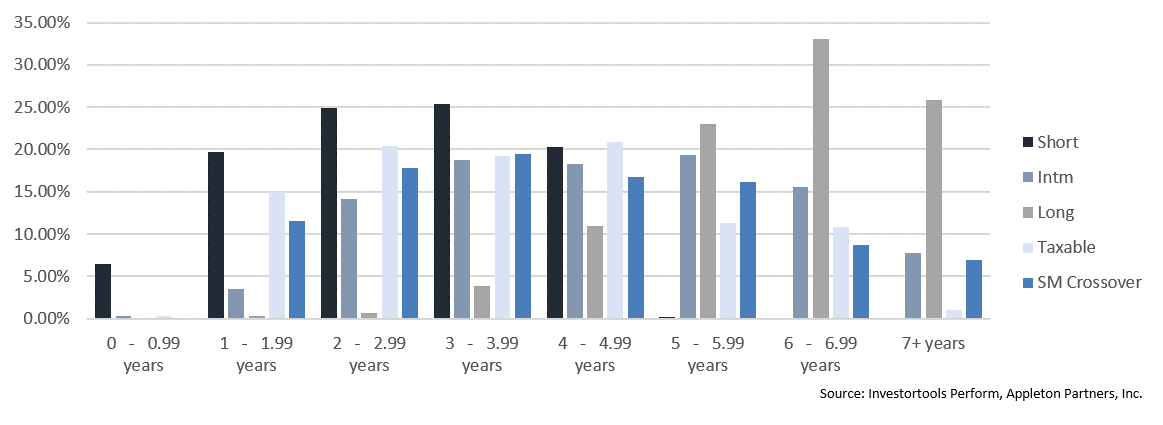

Duration Exposure by Strategy as of 3/30/2018

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.