Insights and Observations

Economic, Public Policy, and Fed Developments

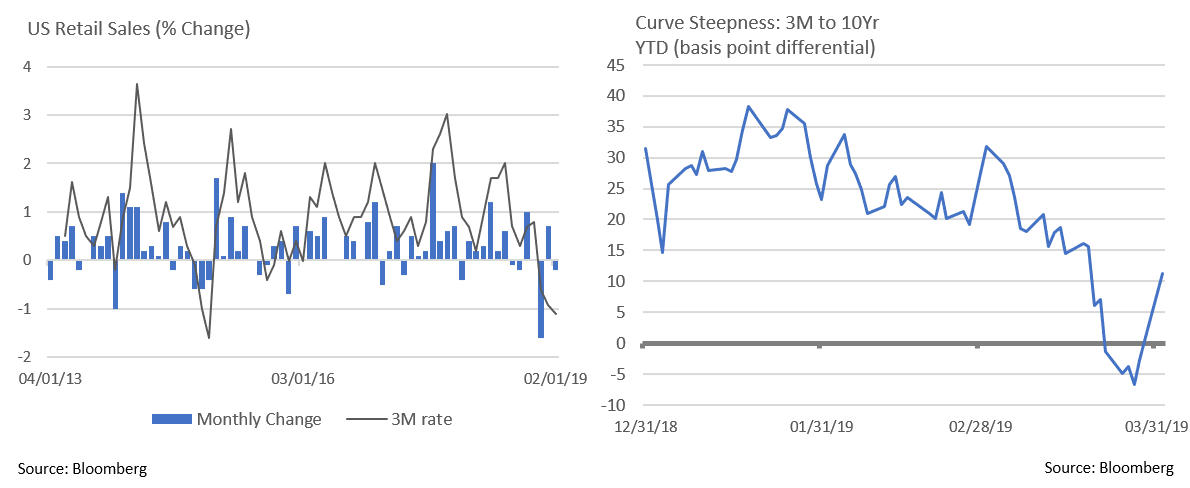

- Evidence of a global slowdown continued to mount in March. A sharp deceleration in retail sales in December was revised further downward and followed by weakness in January and February. Consumer spending restraint is weighing on the economy’s ability to meet the Fed’s 2% inflation target. Core PCE, the Fed’s preferred inflation measure, slowed to 1.8% over the trailing year. The government shutdown likely bears some responsibility, although there was a clear deceleration in Q1 consumer spending.

- Q4 GDP growth was also revised downward from 2.6% to 2.2%, inside our expected 2-2.5% range and in line with the original Bloomberg consensus estimate. This brings full-year growth to 2.9%. With a buildup in inventory, consumer spending weakness, and tepid Fed Beige Book readings, consensus Q1 ’19 estimates have fallen to roughly 1.5%. With tax cut-driven fiscal stimulus wearing off, the US economy seems to be returning to its post-crisis trendline 1.5-2% growth. Absent an unexpected acceleration in inflation, this should keep a lid on interest rates.

- After unexpectedly weak German PMI data spooked the markets, the US Treasury curve inverted in March, with the 10Yr yield dropping below the 3-month for the first time since 2006-07. This is considered an indicator of a forthcoming recession, although we suggest taking this with a grain of salt. The inversion was brief, yields are at much lower absolute levels than previous inversions, and quantitative easing has depressed long-term rates. Nonetheless, the curve reflects market uncertainty, with investors willing to pay a premium to lock in a risk-free rate for longer.

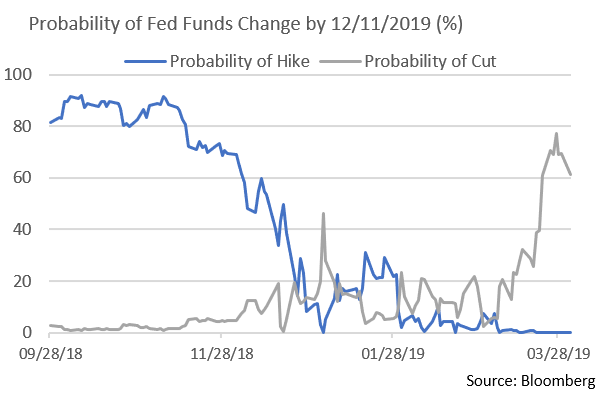

- We have also seen a sharp change in Fed Funds Rate expectations. The likelihood of a Fed Funds cut by year-end increased sharply to 64% as of 3/31, with more than a 22% probability of two or more cuts. This is a radical shift from the end of 2018 when odds of a hike or cut were low and about even.

- The trade picture remains murky. Trade talks between Trump and Xi were delayed until “at least April.” The Wall Street Journal reports that talks are in their final stages; however, Bloomberg suggests growing concern about Chinese attempts to walk back concessions. Trump wants to keep tariffs in place until there is evidence China is complying with terms. An overhang of trade uncertainty remains, despite markets pricing in a reasonably favorable outcome. Should that not prove to be the case, we could see considerable market turbulence.

- Auto tariffs could soon push China negotiations to the sidelines. In late March it was confirmed that a Commerce Department study concluded that the auto industry was critical for national security, giving Trump until May to impose tariffs of up to 25%. Trump is likely using tariff threats as a negotiating tactic, but as most trading partners have refused to budge, their imposition remains a real threat. The potential impact on US jobs and consumers is significant; the Alliance of Automobile Manufacturers has estimated a 25% tariff would cause price increases of $2,000 – $7,000 on imported cars, and other analysts have predicted major US job losses should the conflict escalate.

From the Trading Desk

Municipal Markets

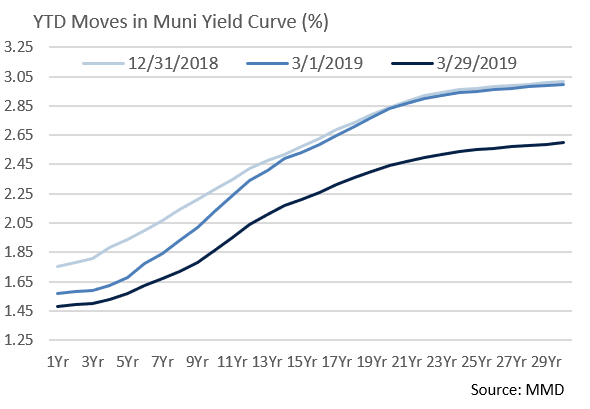

- The beat goes on in the municipal markets as strong demand continues to push down yields and spreads, while new issues typically remain oversubscribed. Net YTD municipal mutual fund flows of $22.5 billion over 12 consecutive positive weeks demonstrates sustained retail appetite for tax-advantaged income, with roughly equal allocations going into Intermediate and Long strategies.

- The absence of advanced refundings contributed to a 6% decline in issuance for March 2019 vs. the same month last year. However, Q1 comparisons relative to 2018 are up more than 14%, given that the first quarter of 2018 saw low issuance precipitated by 2017’s tax reform. While issuance remains healthy and has demonstrated breadth across the quality spectrum, robust demand for new municipal offerings continues to create challenges sourcing desired bonds.

- The impact of SALT limitations should backstop tax-exempt demand in high tax states, many of which are home to large numbers of high-income investors. While the 10 Year muni/treasury ratio of 77.2% (as of 4/2) is low relative to historic averages, a dovish Fed coupled with favorable municipal technical factors have created a positive tax-exempt environment. Recent municipal market performance reflects these strong fundamentals with the Bloomberg Barclays Managed Money Short/Intermediate Bond Index posting 2.38% and 4.92% total returns over the YTD and 1 year periods ended 3/31.

Taxable Markets

- The Fed continued to emphasize patience concerning future rate hikes and is “in no rush” to make policy changes. Release of the January FOMC meeting minutes in March reconfirmed market expectations of no near-term interest rate hikes. This dovish policy was soon followed by the Fed’s “Dot Plot” which forecast no rate increases in 2019 (December’s plot targeted two), and only one in 2020. The clear change in tone led to a rapid flight to quality, further compressing Treasury yields and generating strong demand for other investment grade credits.

- The news of the month was Treasury curve inversion, as 3 months to 10 years inverted slightly, with both maturities converging around a 2.46% level. A Fed Funds rate of +/- 2.40% has held the very short end steady. By contrast, 2Yr-30Yr yields ended the month lower by 30-35 basis points, creating a disconcerting flattening. More specifically, the 1Yr Treasury ended the month at 2.39%, exactly in line with the 10Yr. The market is signaling that the 0.25% rate hike in December may have been premature and the probability of a rate cut went from nearly zero to just over 60% during the month of March. The next FOMC rate decision will be announced on 05/01/19 . . . stay tuned.

- Despite minimal apparent angst in DC, the annual federal deficit is now projected at close to $900 billion. The result is record levels of Treasury bond issuance. To date, demand is easily absorbing this supply, in part due to a premium available on US debt relative to many other developed market sovereign issuers. We caution that this may not stay the case as the deficit balloons. Should investor appetite diminish, significant pressure would be applied on the long end of the curve.

Public Sector Watch

Credit Comments

Volatile Oil Prices Require Conservative Budgeting

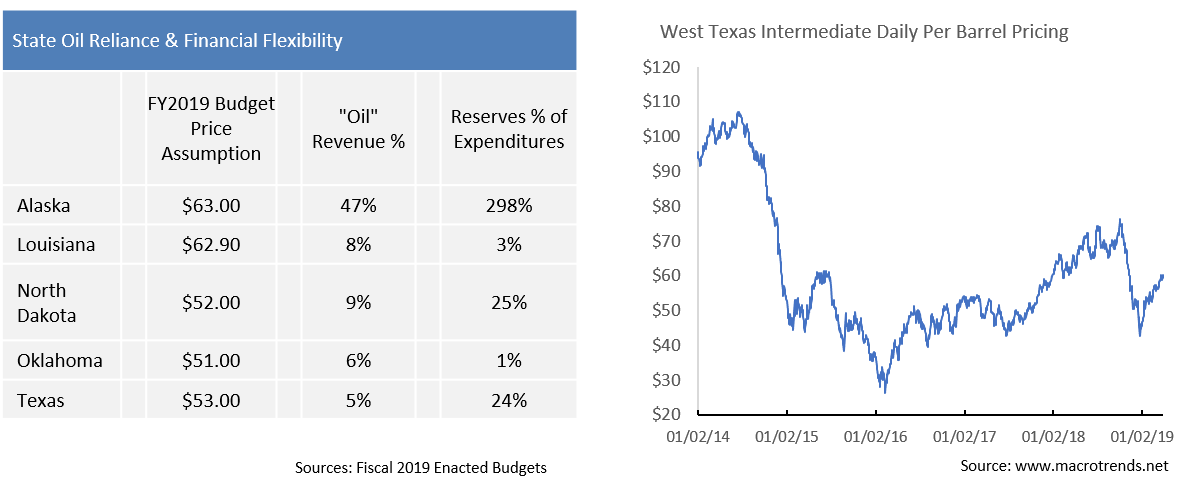

- Oil-producing states benefited in 2018 from rising oil prices, leading to higher severance taxes and expansion in energy-related economic activity. However, Q4 2018 saw sharp declines in energy, at least temporarily dampening tax collections.

- West Texas Intermediate averaged $65.19 per barrel in 2018 vs. $50.87 in 2017. Prices increased to a near-term high of $76.41 in October 2018, but slid to $42.53 before year-end on excess supply and global economic growth fears.

- With oil-producing state credits, we focus on three primary factors: 1) budgeted energy price assumptions; 2) reliance on oil-related revenues; and 3) available reserves. The market often requires greater spread compensation for those with lower reserves (Louisiana) or a high reliance on oil-related revenues (Alaska).

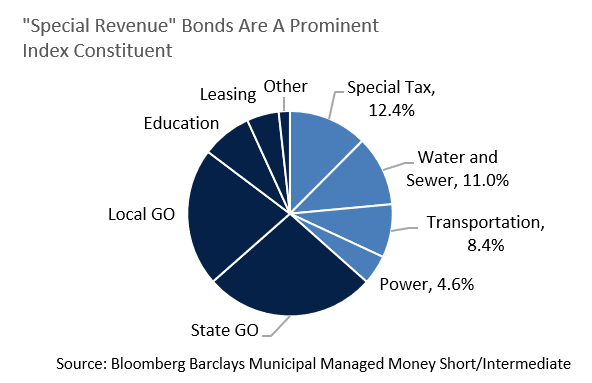

“Special Revenue” Bonds: Not So Special?

- The 1st Circuit Court of Appeals affirmed a federal judge’s prior ruling in Puerto Rico’s restructuring, asserting that while issuers of “special revenue” bonds may pay debt service during bankruptcy, they are not obligated to do so.

- “Special revenue” debt promises repayment solely from revenues generated by a specific entity associated with the bonds, such as utilities, transportation systems or dedicated excise taxes, rather than general purpose taxes. Based on historical precedent and limited case law, the municipal market has long assumed that Special Revenue debt was exempt from automatic stay provisions of bankruptcy, providing protection against interruptions in principal and interest payments, so long as the financial health of the system, project or revenue source allowed for it.

- Assuming the ruling stands, we see potential impact:

- A narrowing gap between the “parent” issuer rating and Special Revenue debt, particularly when the latter is rated significantly higher

- In deteriorating credit situations, a narrowing of the gap in credit spreads between a municipality’s GO debt and Special Revenue bonds

- A reluctance of municipalities to issue Special Revenue bonds, as borrowing cost efficiencies may diminish.

- Despite these implications, we feel the initial impact on the municipal market will be modest and that future changes in issuer and investor behavior will largely be limited to distressed or credit-challenged entities. In such situations, concern among bondholders that a government will attempt to “tap” or “break” special revenue pledges may heighten, threatening “guilt by association”.

- The ruling also reinforces our longstanding belief in the need for diligent credit analysis of an issuer’s fundamentals, including the financial health of related entities.

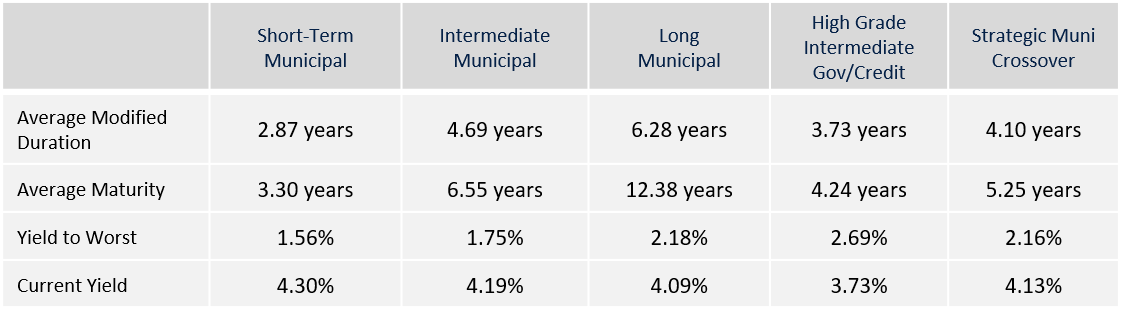

Strategy Overview

Portfolio Positioning as of 3/31/2019

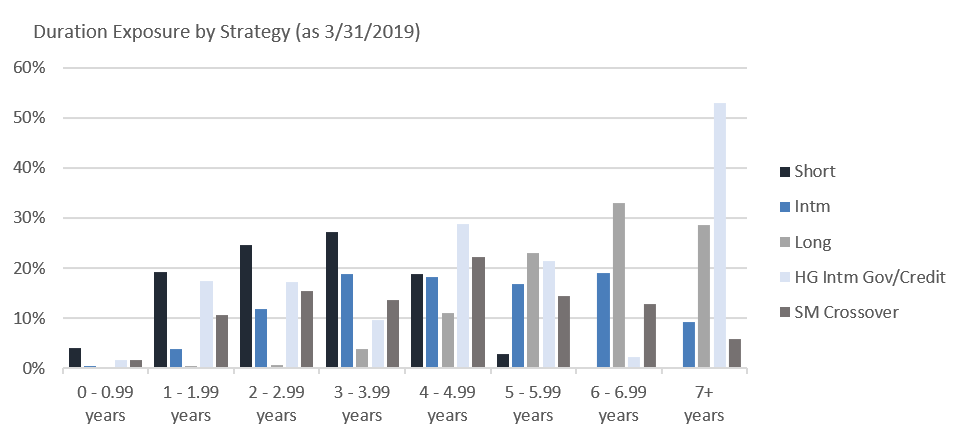

Duration Exposure by Strategy as of 3/31/2019

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.