Insights and Observations

Economic, Public Policy, and Fed Developments

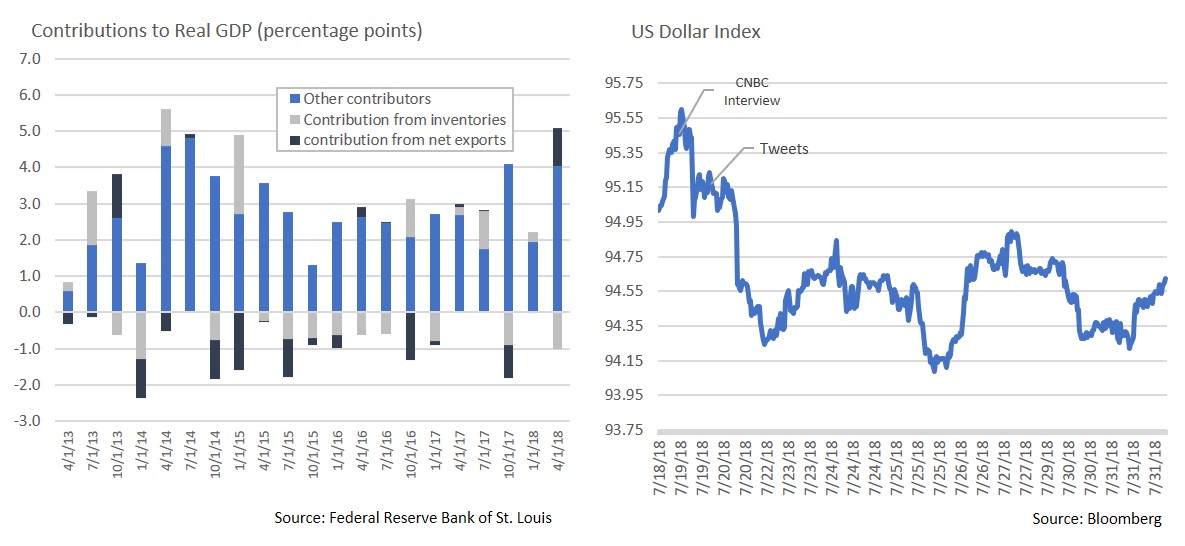

- While the Q2 GDP release came in slightly below expectations at 4.1%, it was a strong report and represented the highest quarterly growth rate since Q3 2014. Beneath the surface, there was both cause for optimism and caution. A surge in net exports contributed more than 1% to the growth rate, although this was largely a function of fast-tracked trade activity as firms tried to get ahead of retaliatory tariffs. Q3 GDP should slow as a result, with the net export contribution largely a wash over the two quarters. On the other hand, a decline in inventories subtracted roughly 1%, and solid final sales to domestic private purchasers of 4.3% point to sustained domestic demand. While the net trade impact was expected, this was not. We expect GDP growth to cool a bit in Q3, although the fall off should be less dramatic than previously feared.

- The inflation picture remains muddled, but likely still muted. While PMI released at the start of July was slightly lower than expectations at 0.2% for both headline and core (bringing year-over-year to 3.4 and 2.7% respectively), the Fed’s preferred measure, the PCE deflator, came in light at 0.1% (vs 0.2% expected). Encouragingly, personal income and consumption both rose 0.4%, and the savings rate was unchanged at 6.8%. This was a good report, as it confirmed healthy, modest inflation, along with solid spending and savings.

- The Trump Administration continues to send mixed messages on trade. At the start of the month President Trump directed his administration to prepare for $200B in additional 10% tariffs (a move China threatened to challenge in the WTO), before announcing another proposed $500B in tariffs. With roughly $130B in US goods shipped to China and $506B in Chinese goods exported to the US, we are approaching the point where further tariffs would be ineffective, making alternative forms of retaliation necessary. The Qualcomm and NXP merger being blocked by Chinese regulators may represent an example. Tensions moderated towards the end of the month with both sides committing to talks, only to see the US reiterate plans to move forward with $200B of tariffs, prompting Chinese ire. Meanwhile, in earlier meetings with European Commission President Juncker and Italian PM Conti, Trump soothed the market with assurances of continued trade negotiation. It remains difficult to get a clear read on where the Administration stands, although overall trade tensions seem to be escalating.

- Breaking from decades of White House tradition, President Trump guardedly criticized the Federal Reserve for raising interest rates in an interview with CNBC, before more openly attacking the Fed over Twitter the next day. The President argued that Fed policies are strengthening the dollar and taking away a US competitive advantage as the euro and yuan weaken. The dollar dropped sharply on the news, an indication of acute market sensitivity to today’s political news cycle, before recovering somewhat in subsequent days.

From the Trading Desk

Municipal Markets

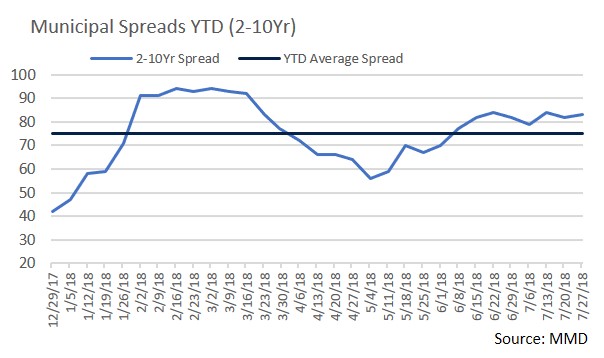

- At the end of July, the 2 to 10 year spread on the muni curve stood at 84 basis points, significantly steeper than the beginning of the year’s 42 basis point level, but consistent with the beginning of the month. The 2Yr yield increased to a high of 1.87% in the Spring, before prices rallied and drove yields down to 1.61% at the end of July. The 10Yr muni started the year at 1.98% before climbing to 2.45%, with most of the move occurring in Q1. While the financial media and many investors fret over the possibility of the Treasury curve inverting given a historic association with subsequent recession, the muni curve remains much steeper and has never inverted. We do not expect that to change and see healthy tax-exempt market conditions marked by strong investment grade credit quality.

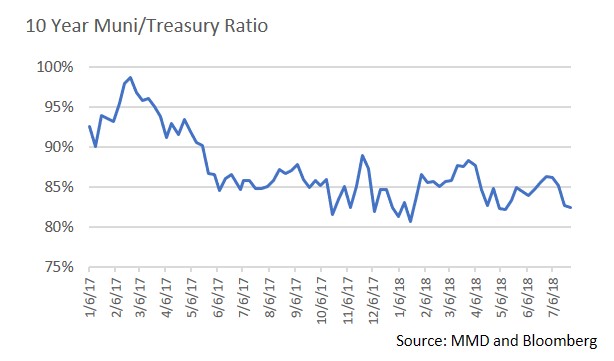

- The ratio of 10Yr munis to Treasuries ended July at 82.8%, below the 52 week average of 84.9% and down more than 3% from the beginning of the month. The trend lower has been driven by strong muni demand coupled with limited supply. Federal tax reform has impacted both sides of the equation by limiting investors’ ability to deduct State and Local taxes, and removing issuers’ flexibility to issue advance refunding bonds. While munis and Treasuries often largely move in synch, favorable muni technicals have driven down the Muni/Treasury ratio to its current level. Nonetheless, we are finding tax-exempt investment grade value.

Taxable Markets

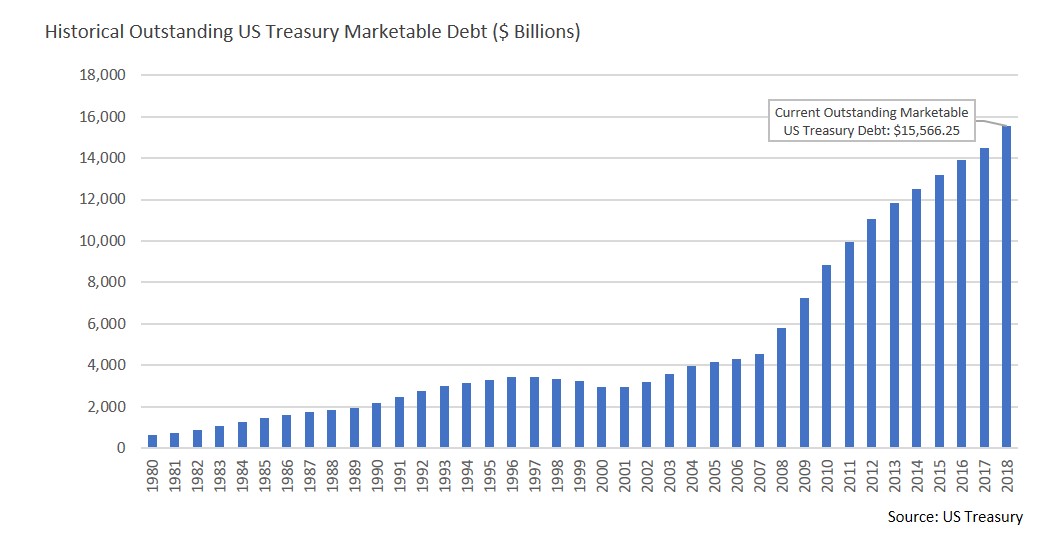

- A sea of red ink at the Federal level is exacerbating US Treasury yield curve fears. As we move into the second half of 2018, the level of outstanding marketable US Treasury debt has climbed to a record level of $15.566 trillion, more than $1 trillion greater than the Treasury had outstanding as recently as the end of 2017. The year-to-date 2018 increase is roughly equal to recession easing issuance during all of 2011. The additional debt is in part needed to offset revenue lost by the Trump tax cut package. An additional $500 billion is expected to be raised by the end of 2018.

- Treasury issuance has been focused on the shorter end of the curve, with the heaviest distribution out to five years. Funding the Treasury’s needs will continue to put pressure on rates at the front end of the yield curve, contributing to the flattening that has given market watchers so much consternation. This supply dynamic is compounded by the Fed’s ongoing efforts to normalize monetary policy, in part by steadily nudging up short-term rates. The market has long demonstrated a willingness and ability to accommodate US debt needs, although the longer term funding cost is something that must be closely watched.

Public Sector Watch

Credit Comments

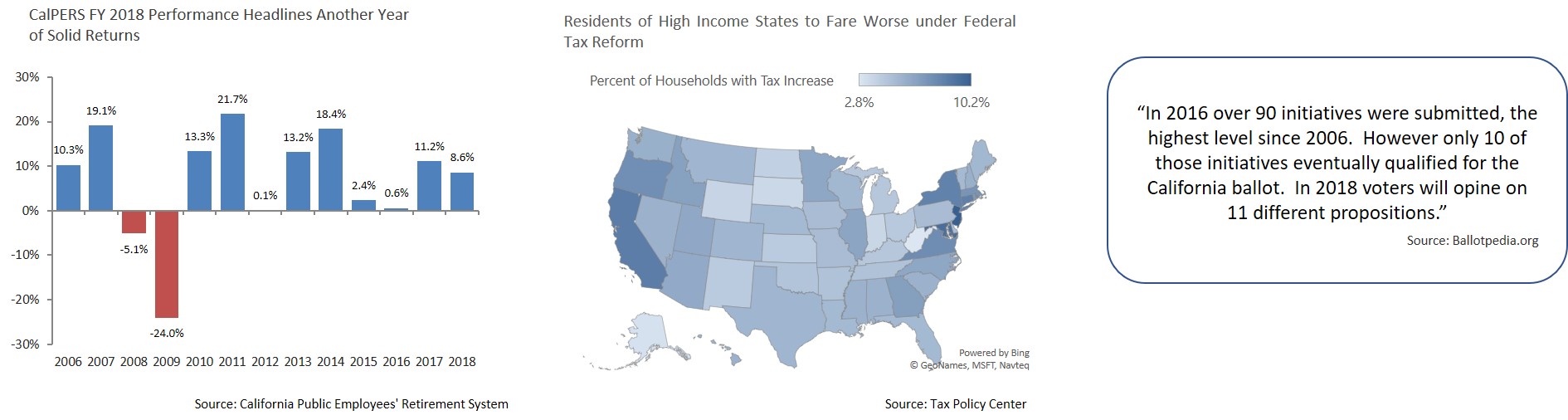

- Early returns for some of the country’s largest public pensions are running ahead of assumptions through the fiscal year ended June 30th, narrowing the gap between assets and promised future benefits. The California Public Employees Retirement System (CalPERS) announced an 8.6% return for fiscal 2018, besting the plan’s 7.0% target and boosting the funded ratio from 68% to 71%. The second largest U.S. pension plan, California State Teachers Retirement System (CalSTRS), posted a healthy 9.0% return over the same period. Investment returns remain an important ingredient in stabilizing pension fund health. As participating governments struggle to make necessary contributions, investment performance can provide temporary relief. Our tax-exempt research focuses on identifying issuers with adequate current pension funding, and a strong commitment and ability to meet the future benefits promised to retirees.

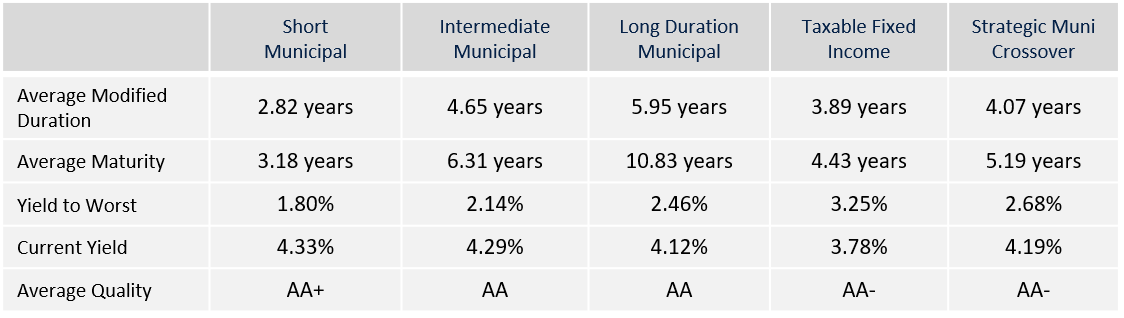

- Connecticut, Maryland, New Jersey and New York sued the Trump Administration over the $10,000 state and local tax deduction cap, implemented as part of the 2018 Tax Cuts and Jobs Act. The States argue the measure unfairly targets traditionally Democrat-led states and “hobbles their sovereign authority to make policy decisions without federal interference.” Successful invalidation of the deduction cap through the courts appears unlikely. Attempts to circumvent the SALT deduction cap through charitable donations or employer-paid payroll tax have also stalled. The state and local governments most impacted by tax reform may ultimately need to adjust their taxing mechanisms, as current tax policy could be constrained by pressure brought to bear by the impact of recent Federal tax reform. These are developments we feel require sustained research scrutiny.

- California’s Supreme Court ruled that Proposition 9, a proposed measure to split the state into three distinct governments, will not be on the November ballot as it could cause serious harm and disruption to the State’s ability to provide essential services. Billionaire Tim Draper sponsored the bill, arguing that California’s distinct regional cultures, prosperity and political bents would benefit from being separated into Northern California, California and Southern California. Even if voters had approved the measure, it would have required State ratification and an act of Congress. However short-lived, Proposition 9 highlights the potential impact of voter-driven ballot measures on state budgets and governance.

Strategy Overview

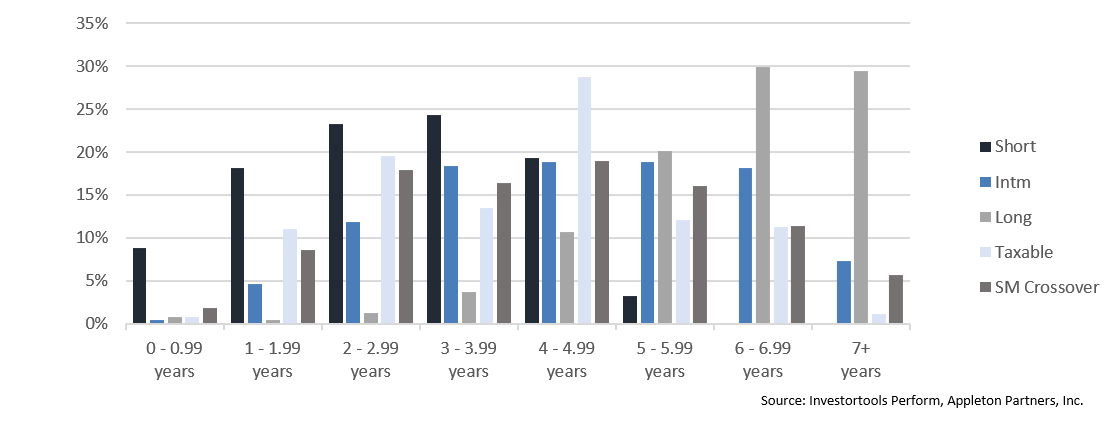

Portfolio Positioning as of 7/31/2018

Duration Exposure by Strategy as of 7/31/2018

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.