Insights and Observations

Economic, Public Policy, and Fed Developments

- After a delay, the 2020 Presidential Election was eventually called for Democratic candidate Joseph Biden by a comfortable margin, and on November 23rd the GSA began the formal transition process. Meanwhile, although recounts continue, Democrats lost House seats and are projected to hold a razor thin majority. Control of the Senate hinges on two Georgia runoffs in January. Regardless, the margin of control will have been reduced as the Democrats have already picked up at least one seat. All told, a smaller House majority increases the power residing with the Progressive wing of the caucus, while moderate Democrats and Republicans will remain integral in the Senate; this leaves President-elect Biden a tight path to pass legislation. We see substantial tax or healthcare reform as non-starters; although more modest measures like the Affordable Care Act tweaks and prescription drug policy changes may be possible. While it is a perennial source of DC speculation, an infrastructure deal is feasible as the concept enjoys broad bipartisan support.

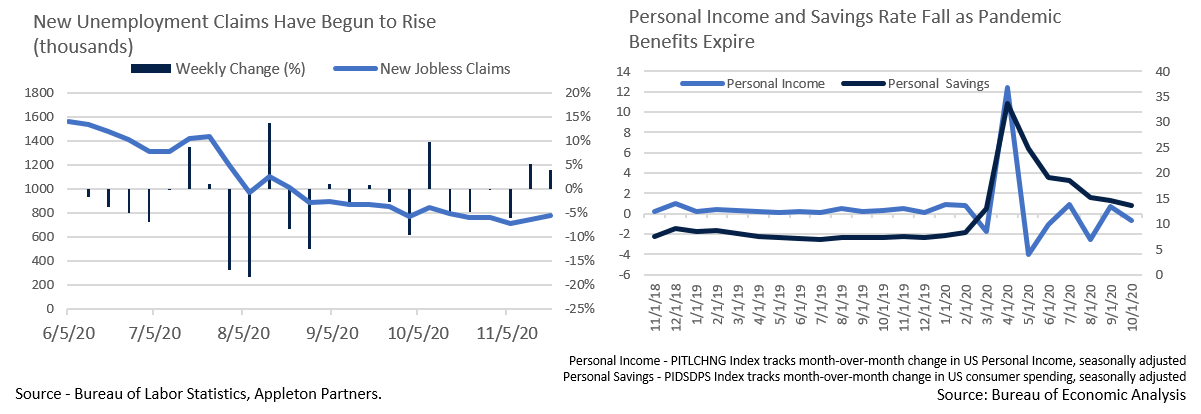

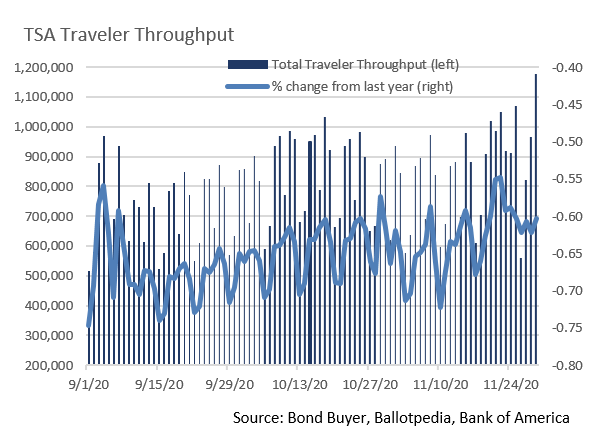

- The COVID-19 pandemic is still with us, and with Thanksgiving travel jumping to 60% of last year’s rate (substantially above recent year-prior comparisons), the third wave is likely to intensify rather than abate in coming weeks. The US economy has adapted well since March, but there is growing evidence that the pandemic is impacting consumer and business behavior. There has been a slight but worrying uptick in initial jobless claims over the past two weeks. Additionally, while the Fed Beige Book survey reported modest to moderate growth, there was a clear slowdown in economic activity in the Midwestern districts where the current surge first became apparent. Much of the country has since followed suit and a broader slowdown likely occurred in late November after the survey period ended. Promising vaccine news offers hope and prompted a November equity rally, although there will likely be considerable economic pain before the US turns the corner.

- Meanwhile, consumer capacity to spend is beginning to fall; the Commerce Department reported a deeper-than-expected 0.7% decline in personal incomes, mostly on the back of a drop in federal transfer payments as stimulus benefits expired. Consumers made up the difference from savings, as the savings rate declined to 13.3%. This still-high rate may be misleading, as it is the difference between income and consumer spending rather than a direct measure of money set aside and has likely been inflated by high “savings” in the form of surging housing investment. The most vulnerable US workers are least able to adapt to a decline in personal income, and this could have a disproportionate impact on US growth expectations.

- The nomination of Judy Shelton to the Fed Board of Governors unexpectedly collapsed in November after a vote scheduled to occur before AZ Senator-elect Mark Kelly (D) could be sworn in failed when two critical Republican votes were absent due to COVID-19 quarantine restrictions. McConnell could revisit her nomination, although without Kelly’s support her nomination would likely not be approved. Meanwhile, the Senate is moving forward with St. Louis Fed Director of Research Christopher Waller’s nomination. We welcome this development; Waller is a highly credentialled, independent Fed nominee who enjoys bipartisan support; Shelton was neither.

- Another welcome development was Janet Yellen’s nomination as Secretary of the Treasury. Yellen was a well-respected and effective Chairwoman of the Federal Reserve and is a strong addition to Biden’s proposed cabinet. She would be the first woman to hold this role, and the largely warm response to her nomination from moderates of both parties was likely in part relief that a more progressive-aligned pick was not made. While the positive reaction will likely not prevent a contentious nomination hearing, and her time at the Federal Reserve will not necessarily translate into success working with a divided Congress, there is much to like in this pick.

From the Trading Desk

Municipal Markets

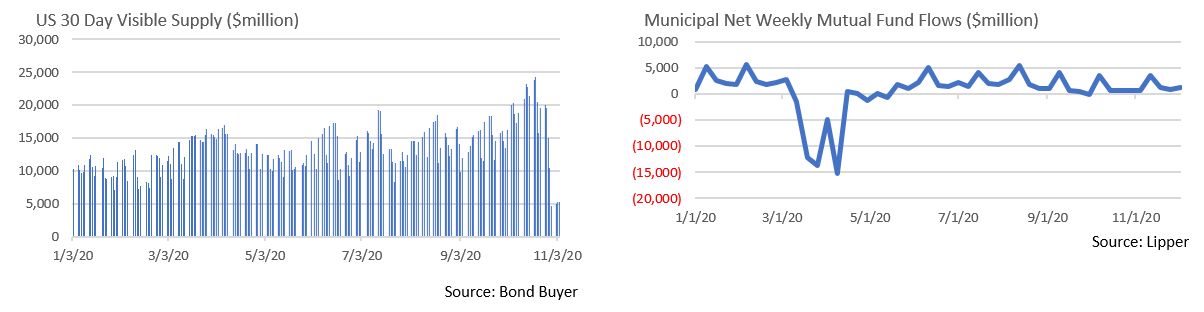

- Demand for municipal bonds remains remarkably strong, pushing yields lower over the course of November. The 5Yr and 10Yr AAA MMD curve yielded 0.23% and 0.73% respectively at month’s end. Mutual fund investors continue to embrace the asset class with YTD net flows now approaching $32 billion despite huge outflows during March and April’s market selloff.

- Favorable technicals are being reinforced by limited new supply. According to The Bond Buyer, November supply of $18.8 billion fell far short of last year’s $47.3 billion. Looking forward, 30-day visible supply is about $11 billion, trailing 2019’s average of $13 billion. Today’s supply and demand imbalance remains supportive of municipal bond prices, creating a performance tailwind for investors.

- Despite low nominal yields, we are finding relative value in municipals, specifically in the 6 to 9-year portion of the curve where there is greater steepness than at shorter maturities. Although the ratio of 10Yr AAA Municipals to Treasuries normalized to 87% by the end of November, this is similar to long-term averages and modestly higher than the 76% level where the year began.

Corporate Bond Markets

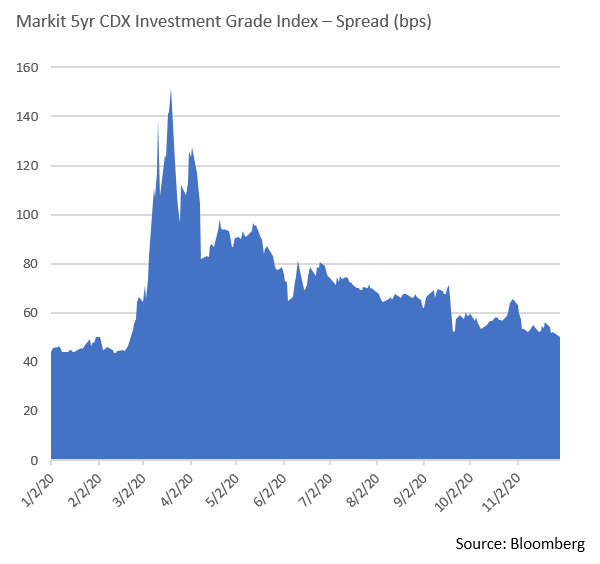

- Market sentiment as measured by the perceived likelihood of corporate defaults has steadily improved over the past several months. The Markit 5yr CDX Investment Grade Index, an equal weighted measure of credit default swaps, has rallied from a peak level of just under 152 bps on March 20th to 50 bps to end November. The market is now approaching the year’s low of 43.75 bps. This is only a singular measure of risk, but one that reflects a belief that credit fundamentals remain intact and corporate prospects look solid over the near term. Broadly speaking, this should be supportive of credit spreads over the course of the next several months, although we remain vigilant in our security specific credit analysis.

- We would be remiss not mentioning supply and demand dynamics in the Investment Grade credit market. Total issuance for November closed in on $90 billion, nearly 30% more than initial estimates, as issuers continue to capitalize on today’s low rate, risk-on environment. Verizon’s $12 billion jumbo deal was the largest of the month and contributed to a sharp increase in BBB supply. There’s been no lack of buyers though, as demand for corporate debt remains robust. November marked the eighth consecutive month of positive Investment Grade Corporate net fund flows at just over $8 billion. December has historically been a very quiet month on the new issue front and estimates are only calling for $25 – $30 billion. However, we anticipate that number being surpassed in the first two weeks and see no reason why new offerings will not continue to be well received and often well oversubscribed.

Public Sector Watch

Credit Comments

The End of the Municipal Liquidity Facility?

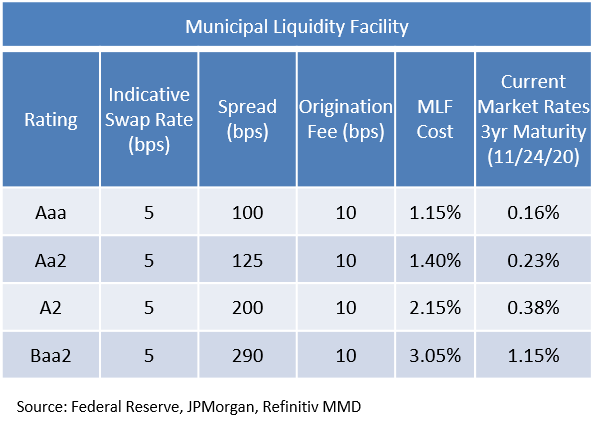

- Treasury Secretary Mnuchin’s decision to allow certain CARES Act emergency facilities to expire at year-end, including the Municipal Liquidity Facility (MLF), generated headlines given the public nature of the decision and a resurgence in COVID-19 cases. Yet the announcement was largely shrugged off by the municipal market. We share the market’s sentiment and believe that for all practical purposes this may not actually be the end of the MLF.

- Markets are functioning well – Fed facilities provided an important market backstop in the spring when conditions were strained. The municipal market has since recovered with interest rates and spreads falling and issuers generally enjoying abundant access to capital.

- Limited Use – Only two issuers have tapped the MLF (State of Illinois and Metropolitan Transportation Authority NY). The MLF’s borrowing costs remain well above market levels, reflecting the program’s “lender-of-last-resort” status.

- Federal Reserve Support Remains Intact – The Fed has other tools that give them an ability to address market dislocation. It also appears that the incoming Treasury Secretary will maintain the authority to restart the MLF. Although available resources may be reduced relative to 2020, capacity would still likely well exceed municipal market needs.

Sectors Levered to Vaccine Rollout

- Although timing and breadth of vaccine distribution remains uncertain, favorable trials have created hopes that our society is moving closer to pre-pandemic conditions.

- While widespread vaccination would be positive across-the board, certain tax-exempt sectors that have lagged during the market recovery would likely see the most significant fundamental improvements. Higher education, healthcare, and airports are prime examples. We have maintained selective exposure in these sectors supported by proprietary stress-testing and foresee additional near-term opportunities consistent with our conservative credit profile.

- The higher education sector faced considerable pandemic challenges including a decrease in student demand, reduced room and board revenues, and rising expenses associated with remote learning and safety protocols. Universities will likely benefit from pent up demand as many students deferred enrollment until Fall 2021. International enrollment should also begin to move towards past levels as travel restrictions ease.

- Similarly, operating margins in the healthcare sector have also narrowed. Hospitals had to delay more profitable elective surgeries to accommodate a surge in COVID-19 patients at the same time expenses were rising. Widespread vaccination should facilitate greater normalization of healthcare operations.

- The airport sector experienced extreme revenue drops, with TSA passenger volume declining by as much as 96% in April. Despite this deceleration, Appleton-approved airport authority bonds possessed an average of more than 18 months of balance sheet liquidity, giving us confidence in their long-term financial viability. More recently we have seen a modest uptick in passenger travel, a trend that should continue as confidence increases.

Strategy Overview

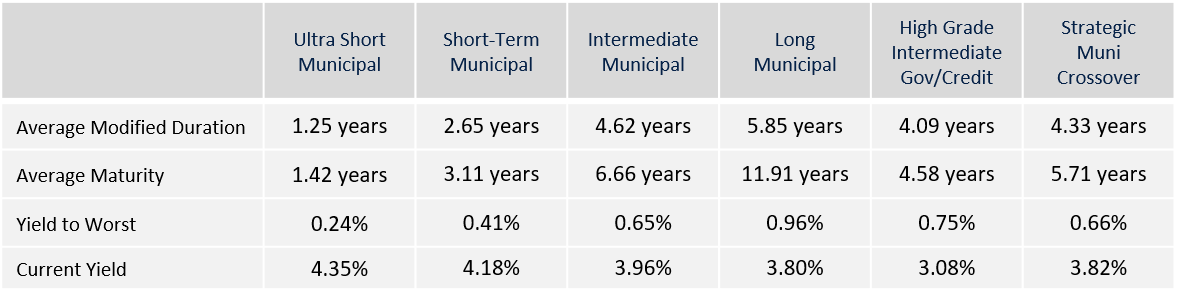

Composite Portfolio Positioning as of 11/30/20

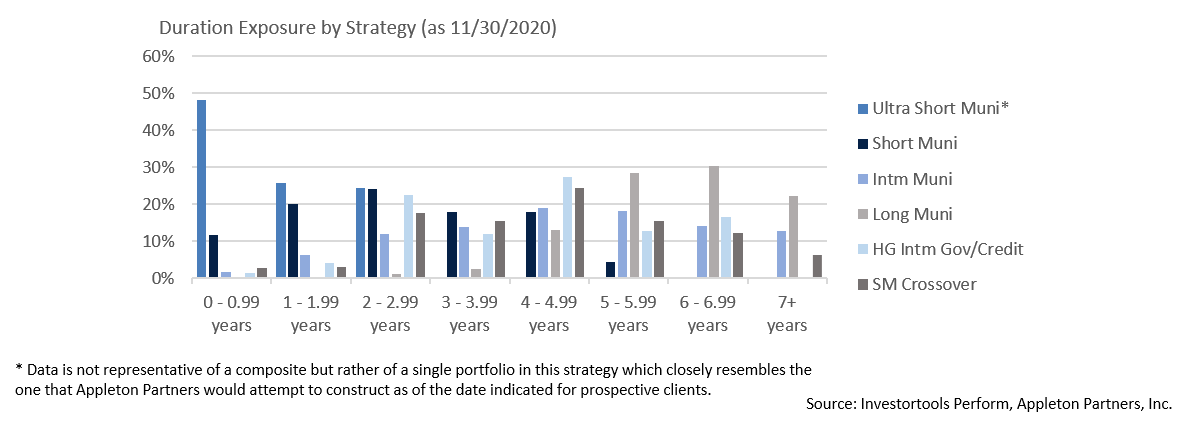

Duration Exposure by Strategy as of 11/30/20

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.